Best Fixed Yield Opportunities for Stablecoins on Pendle Finance

In the fast-evolving landscape of decentralized finance, Pendle Finance has emerged as a cornerstone for stablecoin investors seeking predictable, fixed yield opportunities. With over $3 billion in total value locked and nearly a third of all yield-bearing stablecoins flowing through its protocol, Pendle stands at the forefront of DeFi’s fixed income revolution. For those aiming to maximize passive income with minimal exposure to volatility, understanding the best current stablecoin yields on Pendle is essential.

Pendle’s Fixed Yield Model: How Principal Tokens Work

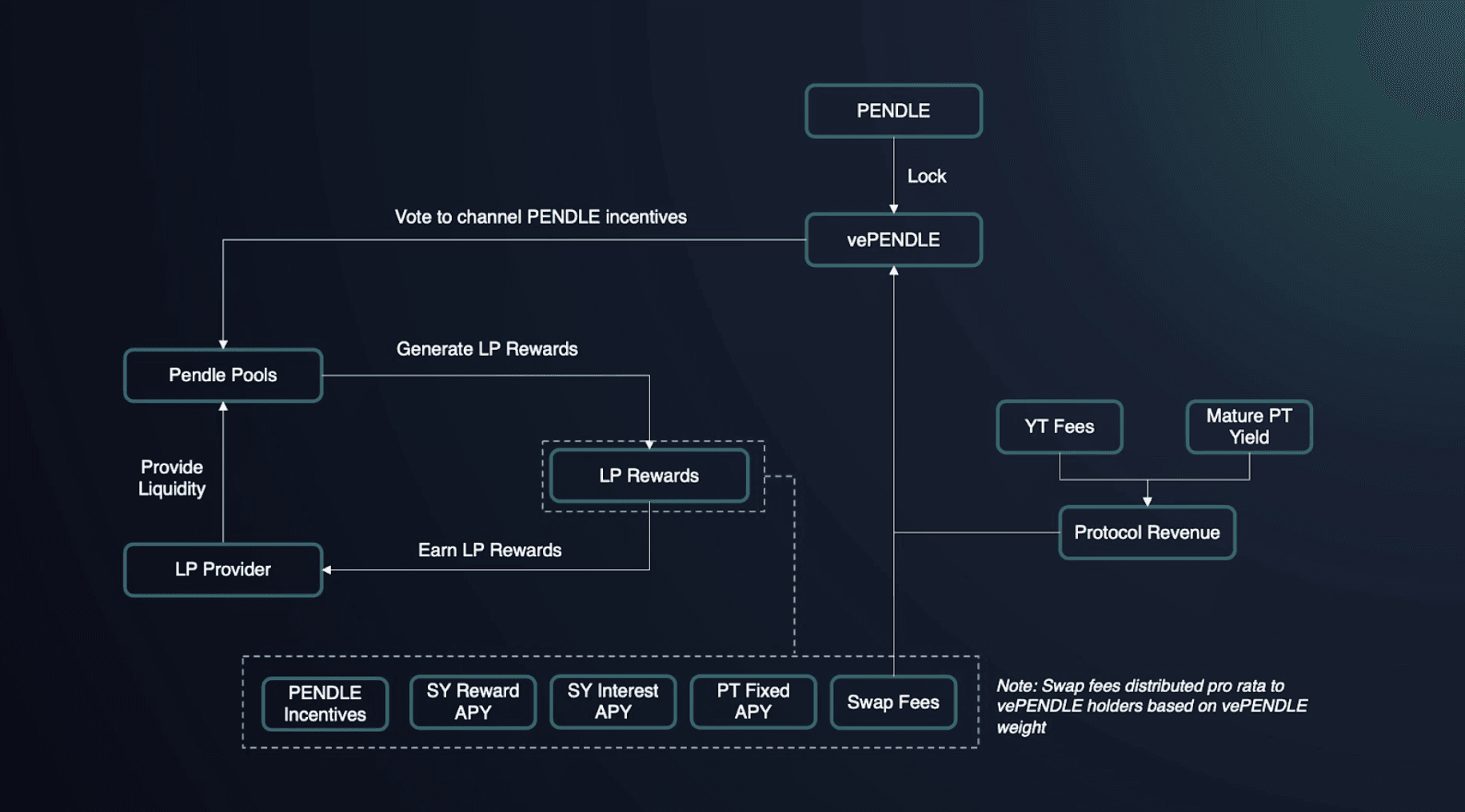

At its core, Pendle enables users to split yield-bearing assets into two distinct parts: Principal Tokens (PTs), which represent the underlying asset and mature at par value, and Yield Tokens (YTs), which entitle holders to the variable yield generated until maturity. By purchasing PTs at a discount today, investors can lock in a fixed return for a specified period, effectively creating an on-chain equivalent of a zero-coupon bond.

This approach is especially compelling for stablecoin holders who prioritize capital preservation alongside steady returns. The market prices of PTs on Pendle directly determine the implied annual percentage yield (APY) available to investors. Let’s examine the two most attractive and current opportunities.

The Top Fixed Yield Stablecoin Opportunities on Pendle

Top Fixed Yield Stablecoin Opportunities on Pendle

-

PT-aUSDC (Aave USDC) – Matures 29 Oct 2025: Earn a fixed APY of approximately 9.03% by locking in your USDC with this Principal Token on Pendle Finance. This opportunity allows investors to secure predictable stablecoin yields until late October 2025, making it ideal for those seeking reliable passive income with minimal volatility. Stablecoin: USDCMaturity: 29 Oct 2025Platform: Pendle Finance

-

PT-AIDaUSDT (Aave USDT) – Matures 26 Sep 2024: This Principal Token offers a fixed APY of around 8.7% on USDT. By purchasing PT-AIDaUSDT, users can lock in stable returns with low risk exposure until September 2024, making it a compelling choice for short- to medium-term DeFi investors. Stablecoin: USDTMaturity: 26 Sep 2024Platform: Pendle Finance

1. PT-aUSDC (Aave USDC) – 29 Oct 2025:

- Fixed APY: 9.03%

- Maturity: October 29,2025

- Stablecoin: USDC via Aave

This opportunity allows USDC holders to lock in an impressive 9.03% fixed APY, one of the most competitive yields available for blue-chip stablecoins across DeFi as of May 2025. By acquiring PT-aUSDC tokens on Pendle’s marketplace at their current discounted rate, investors are guaranteed to receive $1 per token at maturity regardless of future interest rate movements or market volatility.

2. PT-AIDaUSDT (Aave USDT) – 26 Sep 2024:

- Fixed APY: 8.7%

- Maturity: September 26,2024

- Stablecoin: USDT via Aave

The PT-AIDaUSDT market offers DeFi participants access to a robust 8.7% fixed APY, maturing just over three months from now. This short-dated position is ideal for those who prefer lower duration risk or want flexibility to rotate capital later in the year while still capturing above-market yields on their stablecoins.

Navigating Market Context: Why Fixed Yields Matter Now

The appeal of these opportunities is heightened by ongoing macroeconomic uncertainty and fluctuating variable rates elsewhere in DeFi. As lending protocols adjust rates dynamically based on supply-demand imbalances or protocol incentives, fixed yields provide much-needed stability, especially for those managing larger portfolios or seeking reliable cash flows.

Pendle’s transparent AMM-based pricing ensures that these rates reflect real-time market consensus; if demand for fixed returns rises or macro conditions shift further, implied yields may tighten quickly. That’s why it’s crucial for investors to monitor markets closely and act decisively when attractive discounts appear.

Tactical Considerations: Maturity Dates and Portfolio Fit

Selecting between these two leading options depends largely on your investment horizon and liquidity needs. If you value higher certainty over a longer term, and can commit capital until late October next year, PT-aUSDC offers both duration premium and exposure to one of DeFi’s most trusted stablecoins. Meanwhile, if you favor shorter lockups with near-term access to funds but still want above-average returns, PT-AIDaUSDT is an excellent fit through late September.