Red Flags When Chasing High-Yield Stablecoins: What to Watch For

High-yield stablecoins are lighting up the DeFi landscape, promising juicy returns with the reassurance of a dollar peg. But let’s get real: not all that glitters in crypto is gold. As the market races ahead, so do the risks, especially for those chasing double-digit APYs without a safety net. Today’s savvy investor needs more than hype; you need a sharp eye for red flags that could turn your yield dreams into a cautionary tale.

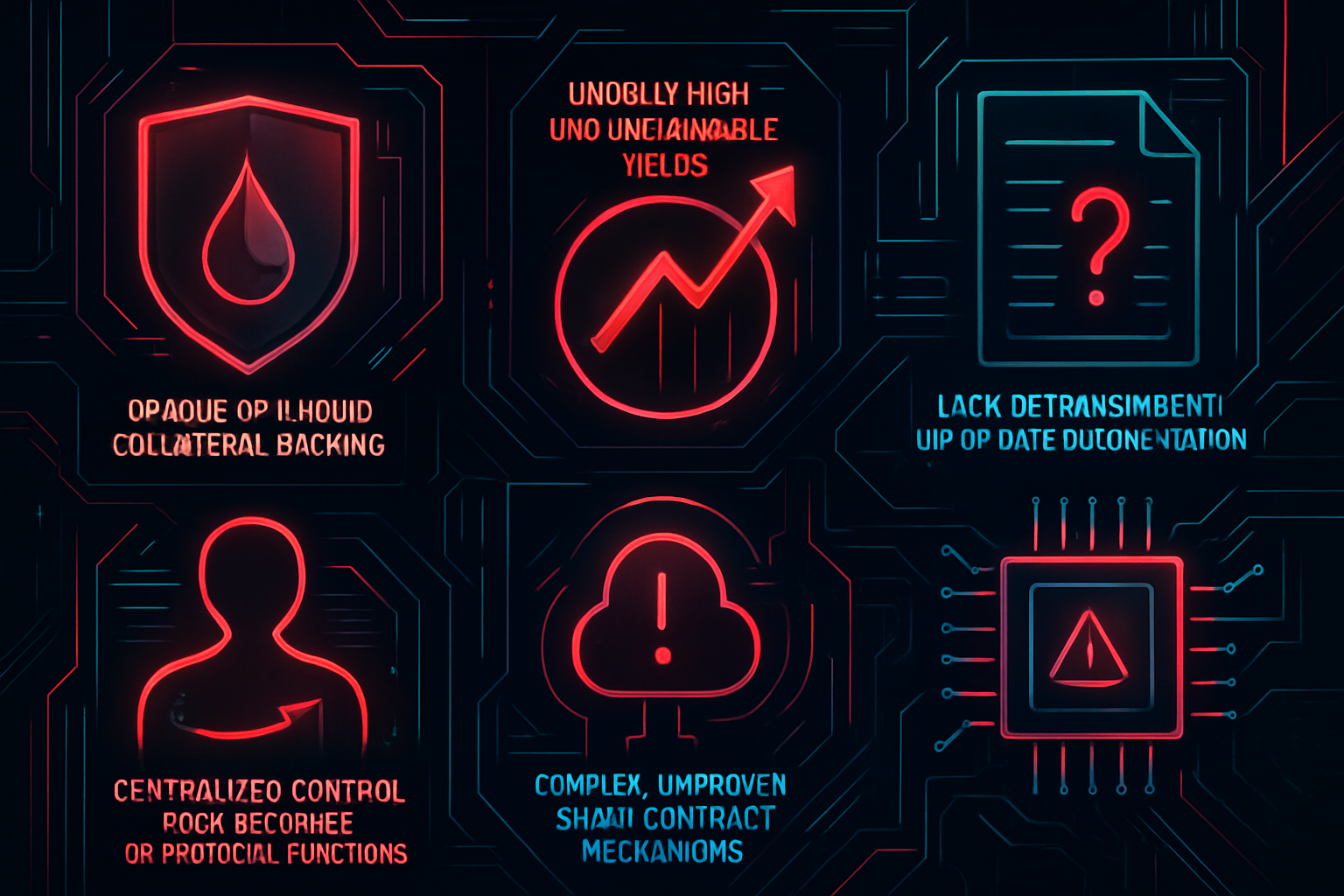

Spotting Trouble: The Top 5 Red Flags in High-Yield Stablecoins

Let’s break down the most critical warning signs every DeFi user should watch for before locking up capital in yield-bearing stablecoins. These aren’t just minor details, they’re fundamental to protecting your stack and maximizing sustainable returns.

Top 5 Red Flags for High-Yield Stablecoin Investors

-

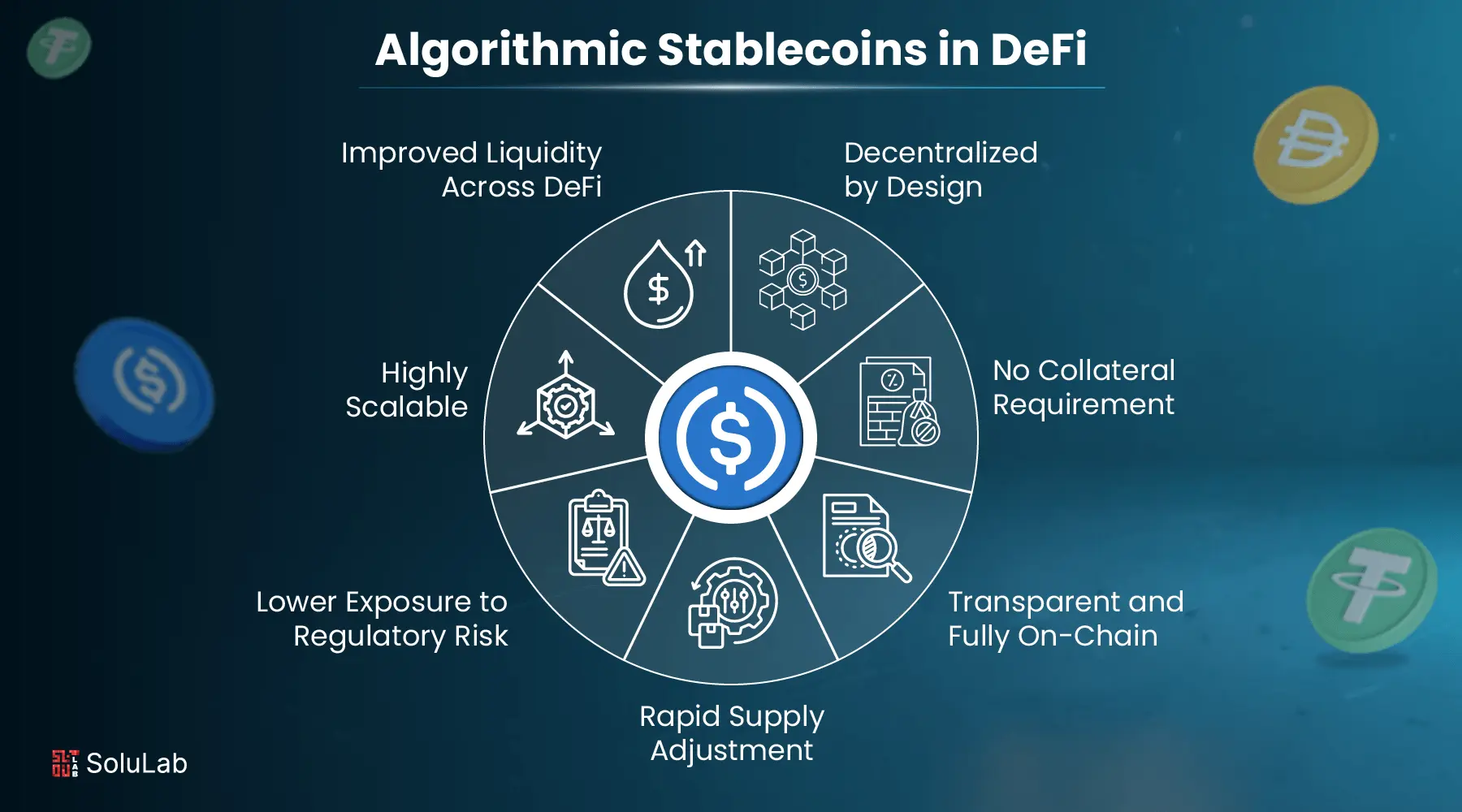

Opaque or Illiquid Collateral Backing: Beware of stablecoins that do not clearly disclose or frequently update details about their collateral reserves. Examples like Tether (USDT) have faced scrutiny for holding risky or unclear assets, raising concerns about their ability to maintain a stable value during market stress.

-

Unusually High and Unsustainable Yields: If a stablecoin platform advertises yields that seem too good to be true, they probably are. High returns often signal risky underlying strategies or unsustainable reward mechanisms, as seen in several failed DeFi protocols.

-

Lack of Transparent, Up-to-Date Audits or Documentation: Reliable stablecoin projects provide regular, third-party audits and clear documentation. Platforms that avoid or delay publishing audits may be hiding vulnerabilities or mismanagement.

-

Centralized Control Over Reserves or Protocol Functions: Centralized decision-making increases the risk of mismanagement, censorship, or sudden changes. Look for protocols with decentralized governance and clear checks and balances to protect user funds.

-

Complex, Unproven Smart Contract Mechanisms: Complicated or experimental smart contracts are more prone to bugs and exploits. Without extensive audits and a proven track record, these mechanisms can expose investors to significant technical risk.

1. Opaque or Illiquid Collateral Backing

The first and most glaring red flag? Opaque or illiquid collateral backing. If you can’t easily verify what’s backing a stablecoin, or if those assets are hard to liquidate during market stress, your risk skyrockets. Remember Tether’s infamous reserve drama? When transparency is lacking, you’re left guessing whether your investment is actually safe. And if redemption requests surge, illiquid treasuries can trigger liquidity crunches that break the peg and leave holders stranded. For a deep dive into how reserve quality impacts stability, check out this analysis from Coinlive: The Risks of Stablecoins: Hidden Concerns Behind the Halo.

2. Unusually High and Unsustainable Yields

If it sounds too good to be true, it probably is! Unusually high yields: especially those far above prevailing DeFi rates, can be a siren song luring investors into unsustainable models or outright Ponzi schemes. Platforms offering sky-high APYs often rely on aggressive token emissions or leverage risky strategies that collapse when new inflows dry up. Always ask: Where does this yield actually come from? If there’s no clear answer, consider it a flashing red light.

3. Lack of Transparent, Up-to-Date Audits or Documentation

No audit, no peace! Lack of transparent, up-to-date audits or documentation means you’re flying blind. Audits are your only window into protocol security and reserve integrity, but not all audits are created equal. Look for recent reports from reputable firms (not just one-off reviews), ongoing bug bounty programs, and open-source codebases with active community scrutiny. If this info isn’t front-and-center on their docs page, or worse, doesn’t exist at all, it’s time to walk away.