Top Yield-Bearing Stablecoins by TVL and Risk: 2024 Analysis

The yield-bearing stablecoin sector has undergone a remarkable transformation in 2024, emerging as a key pillar of decentralized finance (DeFi) and passive income generation. As of May 2025, the total value locked (TVL) in yield-generating stablecoins reached $11 billion, representing 4.5% of the overall stablecoin market. This surge reflects not only growing investor appetite for steady returns but also increasing sophistication in risk management and protocol design. In this analysis, we examine the top yield-bearing stablecoins by TVL and risk profile, with a focus on five standouts: sDAI, USDe, aUSDC, crvUSD, and eUSD.

Stablecoin Market Dynamics: Context for 2024’s Yield Leaders

Stablecoins have become the backbone of DeFi liquidity and cross-chain capital flows. The three largest USD-pegged coins, USDT ($114.4B), USDC ($33.3B), and DAI ($5.3B): now account for 94% of all stablecoin market capitalization (CoinGecko). Yet, innovation is accelerating fastest in the yield-bearing segment, where protocols layer on interest accrual or rebasing mechanisms atop traditional stability guarantees.

Protocols like Pendle have captured about 30% of all yield-bearing stablecoin TVL by enabling users to tokenize and trade future yields on assets such as sDAI and USDe (Cointelegraph). Ethereum remains the dominant network for these experiments, hosting over $124 billion in stablecoin TVL, more than half the global total.

Key insight: The best-performing yield stables combine robust collateralization with innovative mechanisms to deliver competitive APYs while minimizing systemic risk.

Top Yield-Bearing Stablecoins by TVL and Risk Profile

Top 5 Yield-Bearing Stablecoins Explained

-

sDAI (Savings DAI by MakerDAO): sDAI represents DAI deposited into MakerDAO’s DAI Savings Rate (DSR) module, allowing holders to passively earn yield generated from protocol revenue and real-world asset investments. Key features: Direct integration with MakerDAO, transparent on-chain mechanics, and yields that fluctuate based on protocol governance. sDAI is fully backed by DAI, which itself is overcollateralized by crypto and real-world assets.

-

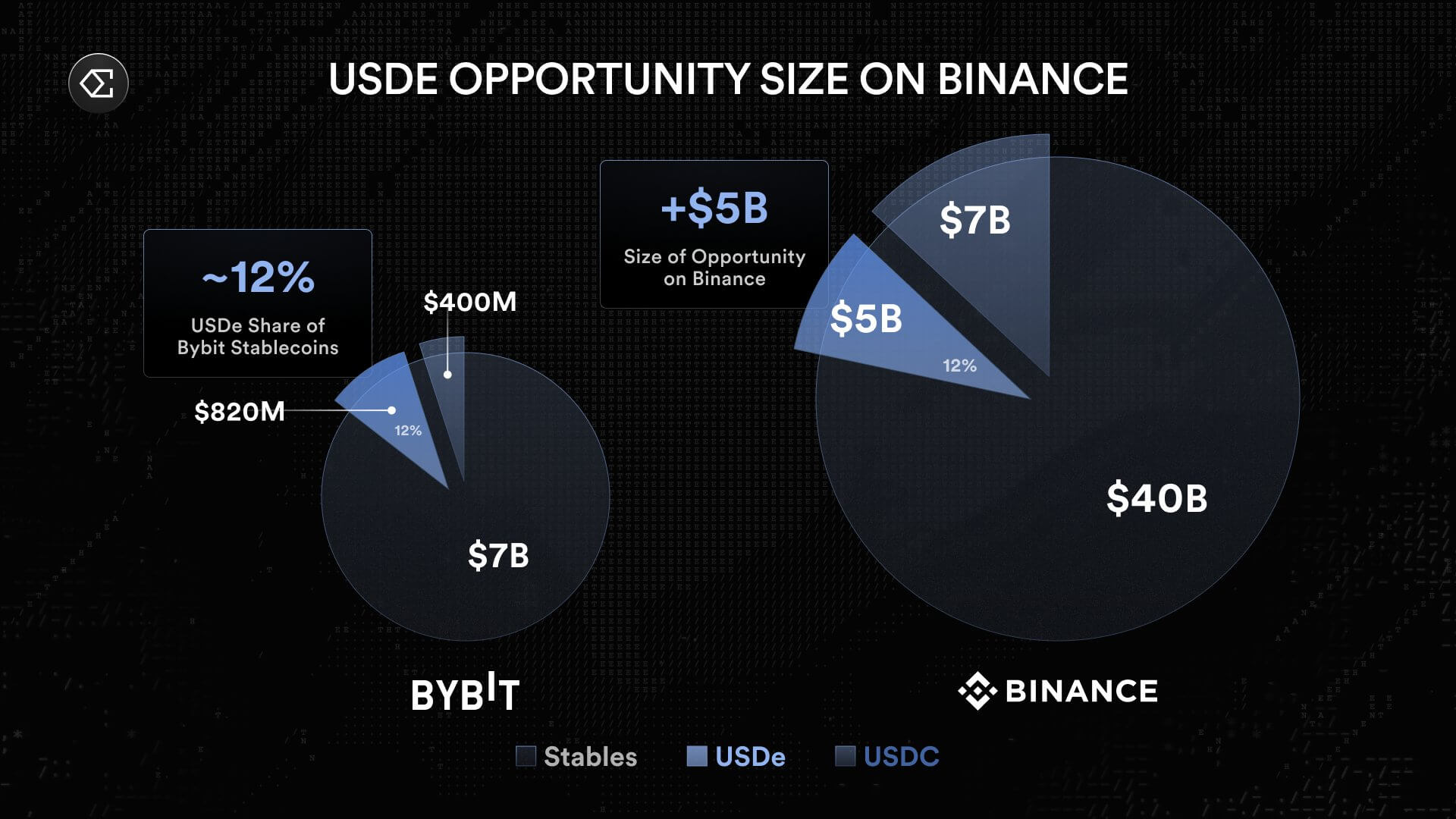

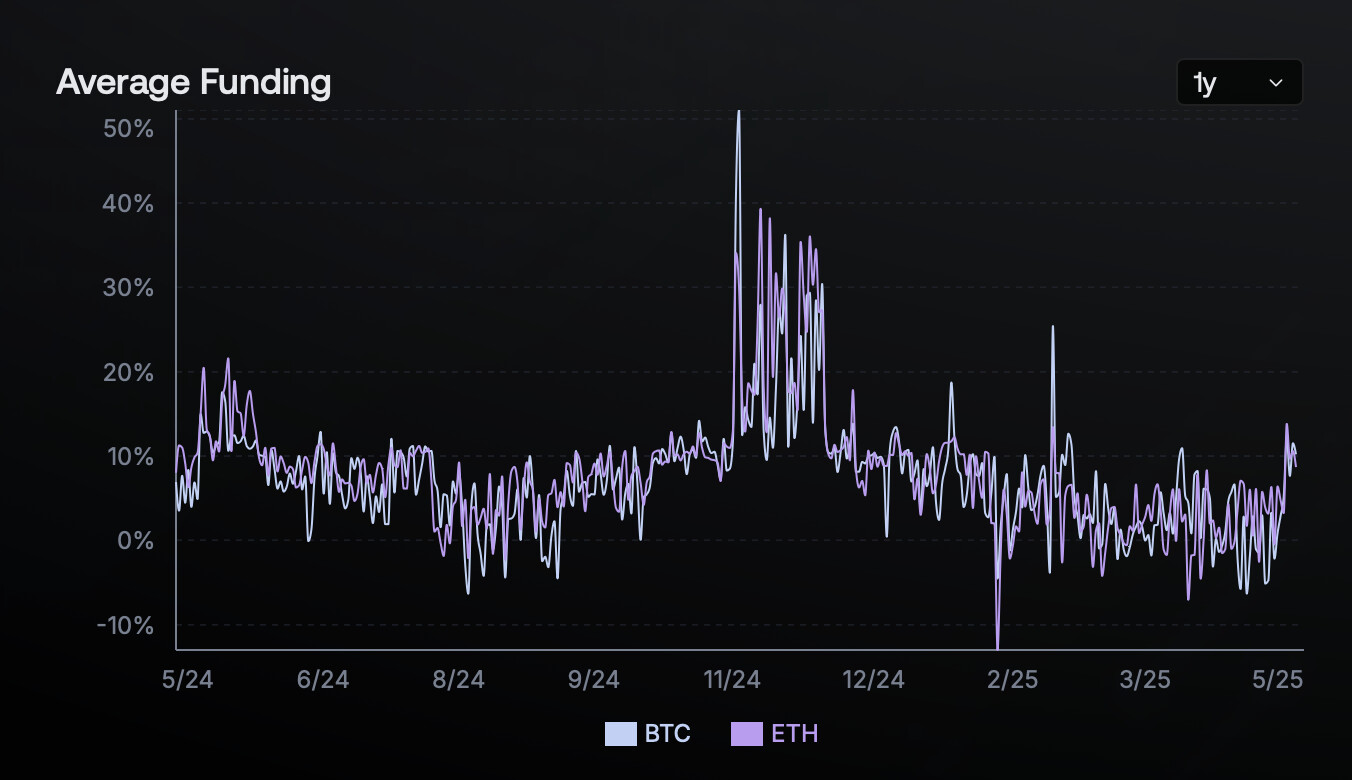

USDe (Ethena USDe): USDe is a synthetic stablecoin issued by Ethena Labs, designed to maintain its peg through a delta-neutral strategy involving staked Ethereum and short futures contracts. Key features: High on-chain yields (often among the highest in DeFi), innovative risk-mitigation mechanisms, and rapid TVL growth. However, its complex hedging introduces unique risks during volatile markets.

-

aUSDC (Aave Interest-Bearing USDC): aUSDC is the tokenized representation of USDC supplied to Aave, a leading decentralized lending protocol. Key features: Earns variable interest from borrowers, benefits from Aave’s robust risk controls and liquidity, and is redeemable 1:1 for USDC plus accrued interest. aUSDC is widely used in DeFi for passive yield with relatively low risk.

-

crvUSD (Curve’s Yield-Bearing Stablecoin): crvUSD is Curve Finance’s native stablecoin, designed for efficient on-chain trading and yield generation. Key features: Backed by a collateralized debt position, crvUSD can be deposited into Curve pools to earn trading fees and protocol incentives. Its innovative soft-liquidation mechanism helps maintain stability during market swings.

-

eUSD (Lybra Finance eUSD): eUSD is a yield-bearing stablecoin issued by Lybra Finance, backed by liquid staking derivatives such as stETH. Key features: Holders accrue yield from underlying staking rewards, and the protocol is designed to maintain a 1:1 USD peg. eUSD offers exposure to both stablecoin stability and Ethereum staking yields, but carries risks tied to the underlying staking assets.

sDAI (Savings DAI by MakerDAO): As an upgraded wrapper around MakerDAO’s DAI Savings Rate (DSR), sDAI allows users to earn protocol-native yields without manual staking or withdrawal friction. In 2024, sDAI’s APY fluctuated between 3.5-8%, driven by demand for DAI borrowing and broader DeFi rates. Its risk profile is relatively conservative since yields are sourced from Maker’s overcollateralized vaults and protocol fees rather than external lending or leverage.

USDe (Ethena USDe): Ethena’s USDe is at the forefront of algorithmic yield generation via delta-neutral strategies combining staked ETH returns with perpetual futures hedges. In early 2024, it offered double-digit APYs, sometimes exceeding 18%: but this comes with complexity: sudden market volatility or liquidity crunches can challenge its hedging system. For investors seeking outsized returns but willing to accept higher smart contract and strategy risks, USDe has been a magnet for capital inflows.

aUSDC (Aave Interest-Bearing USDC): aUSDC represents deposited USDC on Aave V3 that accrues lending interest automatically. While yields are generally lower than more experimental protocols, averaging around 2-5% APY, the underlying risks are also more transparent: primarily counterparty exposure to Aave smart contracts and potential liquidity mismatches during market stress events.

The Rise of Programmable Yield: crvUSD and eUSD Explained

crvUSD (Curve’s Yield-Bearing Stablecoin): Curve’s crvUSD introduces a new paradigm where users mint stablecoins against volatile crypto collateral while earning native protocol incentives through liquidity provision or governance participation. Its stability mechanism relies on an innovative “soft liquidation” model rather than hard liquidations, a feature designed to reduce systemic shocks during price swings but still subject to smart contract vulnerabilities.

eUSD (Lybra Finance eUSD): Lybra Finance’s eUSD leverages staked Ether derivatives as backing collateral to offer holders both price stability and an ongoing ETH-based yield stream. Its APY has ranged from approximately 6-8%, appealing to those who want exposure to ETH staking rewards without direct validator management overhead.

Navigating Yields vs Risk in DeFi Stablecoins

The diversity among these five leading yield-bearing stablecoins highlights an important truth: No two protocols manage risk or reward identically.

- sDAI prioritizes transparency and conservatism via MakerDAO’s time-tested architecture.

- USDe pushes boundaries with complex hedging for higher yields, but greater tail risks.

- aUSDC offers blue-chip reliability at modest rates suitable for conservative allocations.

- crvUSD experiments with novel liquidation mechanics that may dampen volatility impacts, but require careful monitoring as adoption scales up.

- eUSD bridges ETH staking economics into dollar-denominated passive income streams, a compelling hybrid model gaining traction among DeFi power users.

Investors evaluating these stablecoins must weigh not only the headline yield but also the underlying mechanisms, sources of risk, and protocol maturity. For example, sDAI’s reliance on MakerDAO’s overcollateralized vaults offers a degree of predictability absent in algorithmic or delta-neutral systems like USDe. Conversely, USDe’s ability to generate outsized returns is tied to the efficiency and resilience of its hedging strategies, when market conditions are benign, returns can be exceptional, but stress events may expose users to losses not seen in more traditional models.

aUSDC remains a favorite among institutional and conservative DeFi participants. Its yields are typically lower than those found in more experimental protocols, but Aave’s track record for security and liquidity means users face less exposure to black swan events. This makes aUSDC an ideal core holding for those prioritizing capital preservation over aggressive yield chasing.

crvUSD and eUSD both reflect the next phase of programmable stablecoins, where yield is not just a byproduct of lending, but an integral part of the protocol’s design. crvUSD’s soft liquidation process is particularly noteworthy: rather than forcibly liquidating collateral during volatility spikes (which can cascade into broader DeFi instability), Curve attempts gradual unwinding, smoothing out user experience at the potential cost of slightly higher systemic complexity. This innovation could set new standards for risk management if widely adopted.

eUSD, meanwhile, exemplifies the convergence between ETH staking derivatives and dollar-denominated stability. By allowing users to tap into ETH staking rewards without direct validator participation or exposure to price swings, eUSD offers an elegant solution for those seeking both passive income and minimal operational overhead.

Top 5 Yield-Bearing Stablecoins: Risks & Yields (2024)

-

sDAI (Savings DAI by MakerDAO): Yield Range: 3.5% – 8% APY (varies by DSR adjustments). Key Risks: Exposure to MakerDAO governance changes, DAI collateralization risks, and potential protocol upgrades. Generally considered low-risk due to overcollateralization and long track record.

-

USDe (Ethena USDe): Yield Range: 8% – 18% APY (notably high in 2024). Key Risks: Employs delta-neutral hedging strategies with staked ETH and short futures. Risks include strategy complexity, market volatility, and smart contract vulnerabilities. Rapid growth has increased scrutiny.

-

aUSDC (Aave Interest-Bearing USDC): Yield Range: 2% – 6% APY (dependent on Aave market conditions). Key Risks: Relies on Aave protocol security and USDC solvency. Risks include smart contract exploits, liquidation events, and USDC depegging. Generally considered low-to-moderate risk.

-

crvUSD (Curve’s Yield-Bearing Stablecoin): Yield Range: 5% – 12% APY (varies by Curve pool incentives). Key Risks: Exposed to Curve protocol risks, including smart contract vulnerabilities and potential liquidity crunches. Yield is often boosted by CRV incentives, which can fluctuate.

-

eUSD (Lybra Finance eUSD): Yield Range: 5% – 8% APY (from LSD-backed strategies). Key Risks: Backed by liquid staking derivatives (LSDs), so exposed to staking protocol risks and LSD depegging. Additional risks from Lybra protocol smart contracts and governance.

Key Considerations Before Allocating Capital

The temptation to chase high APYs is perennial in DeFi, but prudent investors should consider several factors before committing funds:

- Protocol Audits: Review recent security audits and bug bounty programs for each protocol. Even blue-chip projects can fall victim to exploits.

- Collateral Quality: Assess what backs each stablecoin, overcollateralized crypto assets (sDAI), algorithmic hedging (USDe), or staked ETH (eUSD): and how quickly these assets can be liquidated during stress.

- Redemption Liquidity: Ensure there is sufficient on-chain liquidity to exit positions without significant slippage during turbulent markets.

- Ecosystem Integration: Stablecoins with deep integrations across lending pools, DEXs, and payment rails (like sDAI or aUSDC) typically offer greater flexibility for active portfolio management.

The yield-bearing stablecoin sector isn’t static; it evolves with every upgrade in smart contract infrastructure and every new risk event that tests protocol resilience. Staying informed about audit results, governance changes, and shifting market dynamics is essential for anyone seeking sustainable returns from this asset class.

Which yield-bearing stablecoin do you consider safest for long-term holding?

With yield-bearing stablecoins gaining popularity and billions in total value locked, choosing the safest option is crucial for long-term investors. Based on the top 5 stablecoins by TVL and risk profile, which do you trust most for holding over the long run?

Final Thoughts: Balancing Innovation With Prudence

The rapid TVL growth in leading protocols like sDAI and USDe underscores both investor optimism and the need for careful risk calibration. As more capital flows into programmable yield models like crvUSD and eUSD, and as blue-chip options like aUSDC continue steady expansion, the landscape will reward those who blend curiosity with caution. Diversification across different stablecoin mechanisms remains one of the most effective tools available for navigating this emergent corner of DeFi.