Understanding Resolv’s USR and stUSR: Delta-Neutral Yield-Bearing Stablecoins

Stablecoin innovation is accelerating, and Resolv’s USR ecosystem is drawing serious attention for its unique blend of risk management and yield generation. In a market increasingly wary of fiat-backed stablecoins and opaque collateral, Resolv USR stablecoin offers a data-driven alternative: a crypto-native, delta-neutral model that delivers both price stability and passive income opportunities.

Delta-Neutral Architecture: How USR Maintains Its $1 Peg

At the core of Resolv’s design is its delta-neutral strategy. Unlike traditional stablecoins that rely on cash reserves or overcollateralized loans, USR is fully backed by on-chain ETH, staked ETH (stETH), and BTC. To maintain the $1 peg, Resolv simultaneously holds spot positions in these assets while taking offsetting short positions in perpetual futures contracts. This approach neutralizes exposure to price swings in crypto markets, if ETH or BTC prices move sharply, gains or losses in one position are counterbalanced by the other.

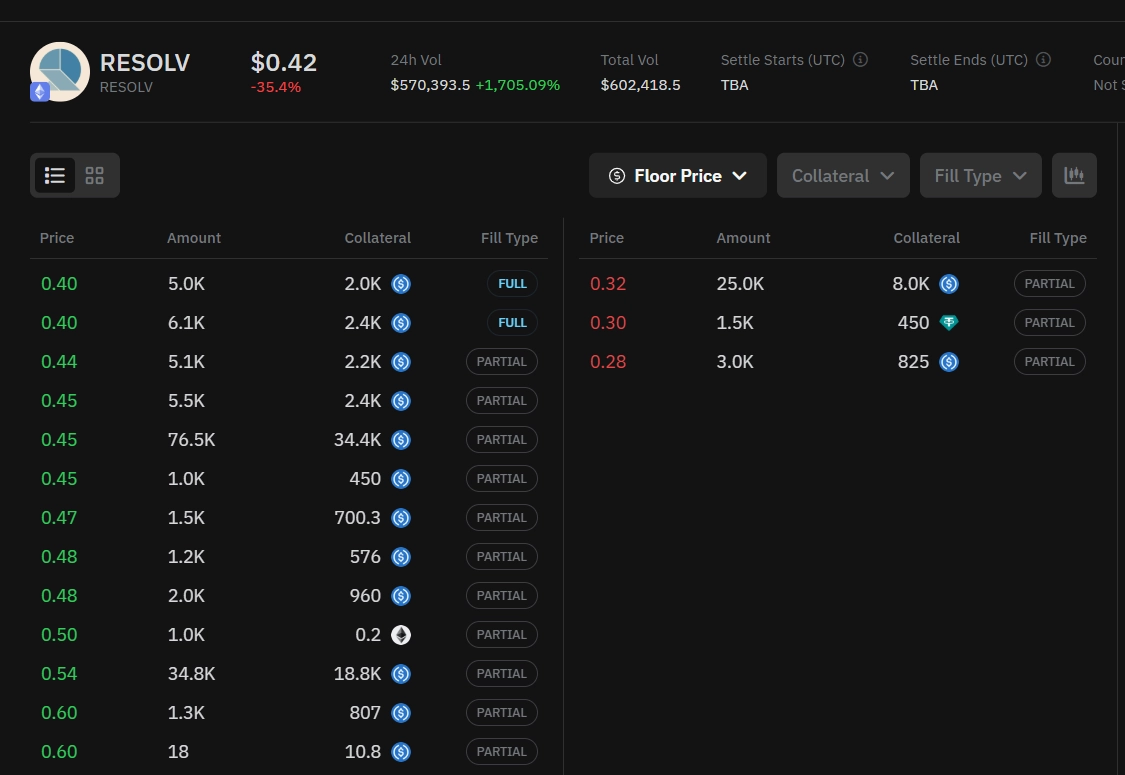

This isn’t just theoretical. As of September 19,2025, USR is trading at $0.999822, with a 24-hour high of $1.001 and a low of $0.998576, a tight range that demonstrates real-world peg stability even during volatile market conditions.

From Stability to Yield: Staking USR for stUSR

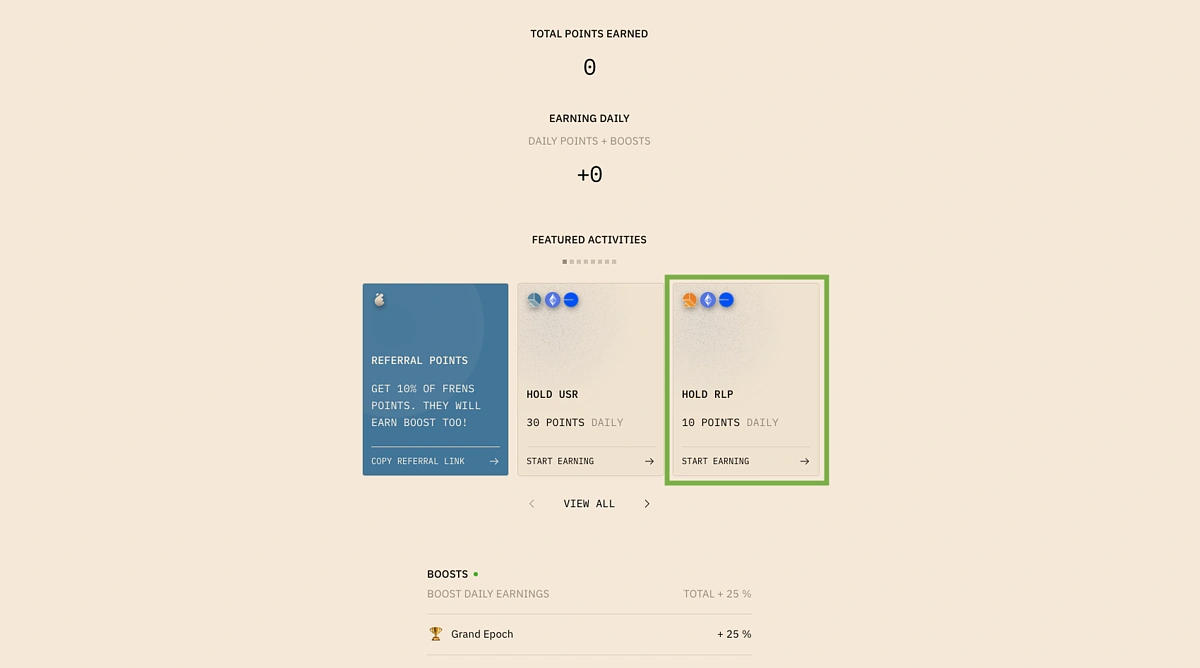

The real magic happens when users stake their USR. By converting USR into stUSR yield stablecoin, holders unlock daily rewards sourced from two primary revenue streams:

- ETH staking rewards: As Resolv’s treasury includes staked ETH (stETH), it captures protocol-level staking yields.

- Perpetual funding rates: The protocol’s short perpetual positions may earn positive funding payments from traders betting against the prevailing trend.

This dual-yield engine powers competitive returns, recently cited around 6-10% APR depending on market conditions, without requiring users to manage complex DeFi strategies themselves. Rewards are distributed daily and auto-compound into your stUSR balance, making this an attractive set-and-forget option for passive income seekers.

Risk Tranching with RLP: The Insurance Layer Explained

No yield opportunity comes without risk, but Resolv’s architecture is built for resilience. The protocol employs a risk-tranching mechanism via the Resolv Liquidity Pool (RLP). Here’s how it works:

- RLP acts as insurance: It absorbs systemic risks like extreme volatility or unexpected counterparty events that could threaten the peg.

- Dynamically adjusted APY: To incentivize adequate liquidity during turbulent periods, RLP yields automatically rise when fewer providers participate, rewarding those willing to underwrite risk when it matters most.

- User choice: You can decide whether to simply hold USR (for pure stability), stake for stUSR (to earn yield), or provide RLP liquidity (for higher but riskier returns).

Key Differences: USR, stUSR, and RLP Explained

-

USR: Delta-Neutral StablecoinMaintains a $1 US Dollar peg (current price: $0.999822) using a delta-neutral strategy with ETH, stETH, and BTC collateral. No direct yield, but offers stability without fiat backing.

-

stUSR: Yield-Bearing VariantStake USR to receive stUSR and earn daily yield from protocol revenue (ETH staking rewards and perpetual funding rates). Auto-compounding, no lock-up, and passive income for holders.

-

RLP: Protocol Insurance LayerRLP absorbs systemic and market risks to protect USR stability. Holders earn higher, dynamic yields as compensation for risk, especially during market stress.

Current Market Data and Price Outlook for USR

The numbers don’t lie: as of today’s update ($0.999822 for USR, 24h high at $1.001), Resolv’s delta-neutral engine is delivering on its promise of capital efficiency and stability without relying on legacy banking rails or excessive overcollateralization. This makes it a compelling choice for DeFi investors seeking both security and steady returns in an uncertain macro environment.

stUSR (Resolv) Price & Yield Prediction Table (2026-2031)

Forecasting stUSR Minimum, Average, and Maximum Prices Based on Delta-Neutral Yield Model and Market Factors

| Year | Minimum Price | Average Price | Maximum Price | Estimated APR Range (%) | Key Market Scenario |

|---|---|---|---|---|---|

| 2026 | $0.9975 | $1.00 | $1.0020 | 5.8% – 7.5% | ETH staking rates stabilize; moderate DeFi adoption |

| 2027 | $0.9970 | $1.00 | $1.0030 | 5.5% – 8.2% | Increased stUSR adoption; mild regulatory headwinds |

| 2028 | $0.9965 | $1.00 | $1.0040 | 5.0% – 8.5% | Peak crypto cycle; ETH upgrades boost yields |

| 2029 | $0.9960 | $1.00 | $1.0050 | 4.8% – 9.0% | Global stablecoin acceptance rises; competition intensifies |

| 2030 | $0.9955 | $1.00 | $1.0060 | 4.5% – 9.5% | Institutional DeFi integration; regulatory clarity increases |

| 2031 | $0.9950 | $1.00 | $1.0070 | 4.2% – 10.0% | Mature DeFi markets; stUSR seen as core yield-bearing stablecoin |

Price Prediction Summary

stUSR is projected to maintain its $1.00 peg with minimal deviation, reflecting the robustness of its delta-neutral architecture. The minimum price predictions suggest rare and minor depegs during system stress, while maximums reflect brief positive slippage in high demand periods. The estimated APR range is expected to narrow as ETH staking rates and funding conditions evolve, but may expand during periods of high market volatility or protocol innovation. Overall, stUSR is likely to remain a stable, yield-bearing asset with competitive returns through 2031.

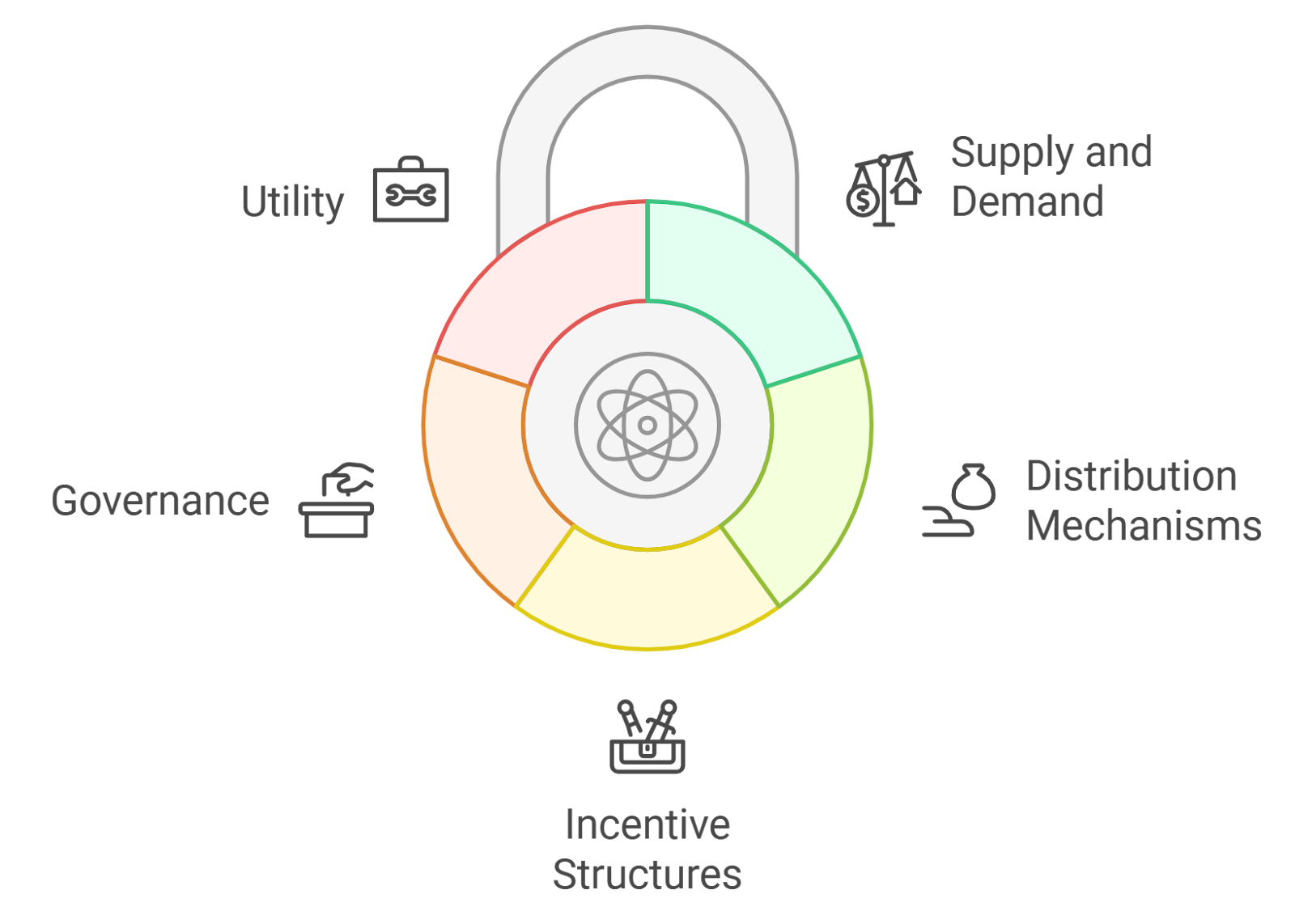

Key Factors Affecting stUSR Price

- Delta-neutral strategy effectiveness at maintaining the $1.00 peg

- ETH staking yield trends and protocol upgrades (e.g., Ethereum roadmap)

- Crypto market cycles influencing DeFi adoption and demand for yield-bearing stablecoins

- Regulatory developments impacting stablecoin frameworks and DeFi protocols

- Competition from other yield-bearing stablecoins and CeFi alternatives

- Adoption by institutional players and integration with major DeFi platforms

- Liquidity and systemic risk management by RLP (Resolv Liquidity Pool)

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

If you’re looking to diversify away from centralized stablecoins, or want an easy way to earn crypto-native yield without active management, Resolv’s dual-token model deserves your attention as we head into Q4 2025.

Transparency is another pillar of the Resolv USR stablecoin system. All collateral and position data are verifiable on-chain, giving users real-time insight into the protocol’s health. Unlike black-box stablecoins that rely on opaque attestations, Resolv’s open architecture means anyone can audit reserves and track the delta-neutral hedges in action. For those who value trustless, crypto-native solutions, this level of visibility is a major advantage.

Yield Without Compromise: Who Should Use stUSR?

stUSR yield stablecoin sits at the intersection of stability and passive income. It’s especially compelling for three types of DeFi users:

- Risk-averse savers: Those who want exposure to crypto yields but without directional bets on ETH or BTC prices.

- Diversifiers: DeFi veterans looking to hedge against real-world asset risk embedded in fiat-backed stables.

- Yield maximizers: Investors seeking daily compounding rewards with minimal active management required.

With no lock-up periods for staking or unstaking, stUSR offers flexibility rare among high-yield DeFi protocols. The auto-compounding feature further boosts effective returns over time, letting your capital work harder while you sleep.

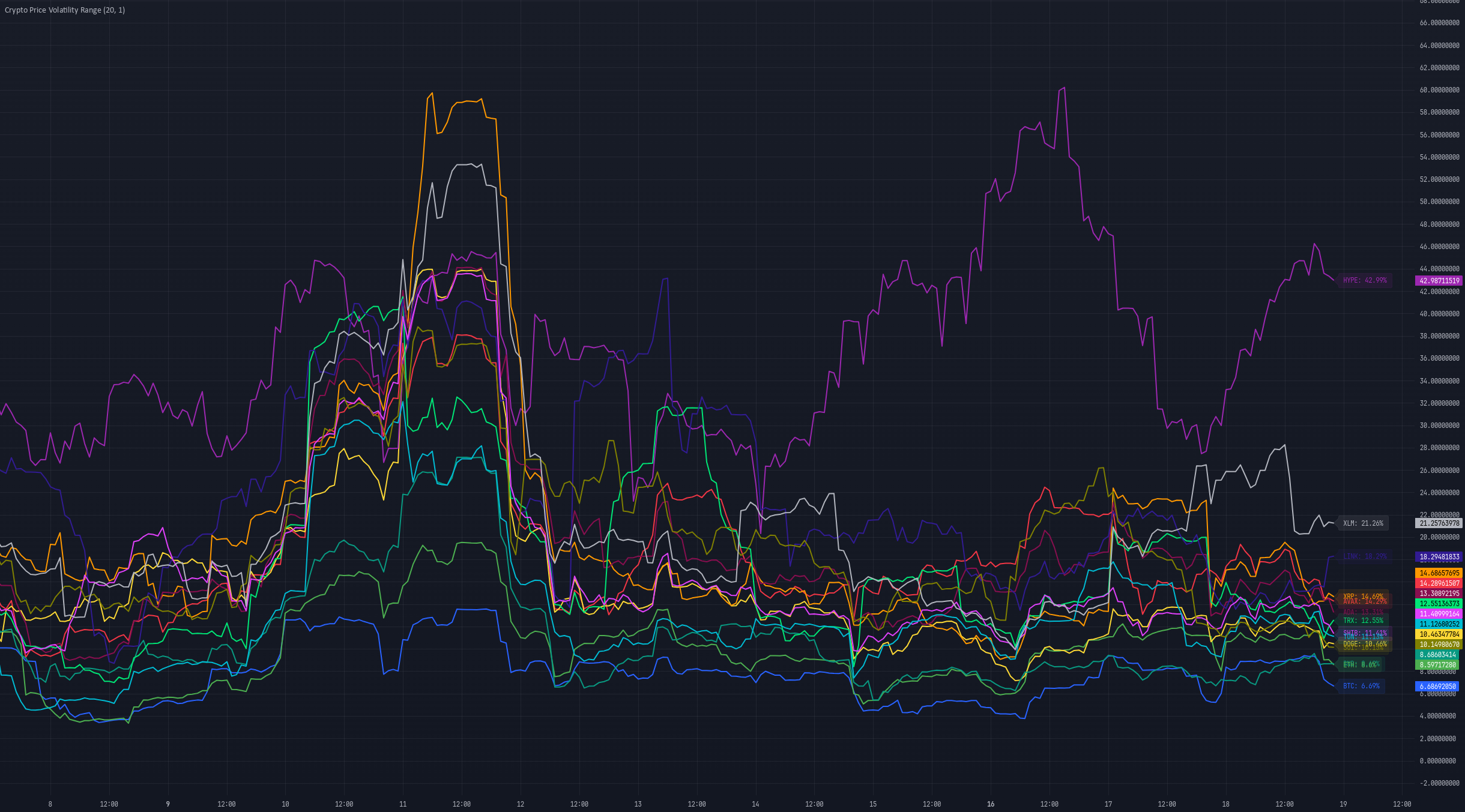

Risks and Considerations: What to Watch

No protocol is risk-free. While Resolv’s delta-neutral approach is robust against spot market swings, it still faces challenges such as:

- Perpetual futures liquidity: Sufficient depth is needed for effective hedging; thin markets could introduce slippage or funding volatility.

- Smart contract risk: As with any DeFi protocol, bugs or exploits remain a consideration despite audits and open-source code.

- Peg stress scenarios: Extreme market dislocations could test the limits of the delta-neutral model, though RLP acts as a first line of defense in such cases.

The key takeaway: always size your exposure based on your own risk tolerance and keep an eye on protocol metrics as they evolve. The transparent design makes due diligence straightforward for those willing to dig in.

Pros and Cons of Delta-Neutral Yield-Bearing Stablecoins

-

Stable Dollar Peg: USR maintains a tight peg to the US dollar, with a current price of $0.9998 (as of September 19, 2025), showcasing effective stability.

-

Yield Generation: Staking USR to receive stUSR allows holders to earn daily passive income from ETH staking rewards and perpetual futures funding rates.

-

On-Chain Transparency: All collateral backing USR is verifiable on-chain, enabling users to independently audit reserves and protocol activity.

-

Delta-Neutral Risk Management: The protocol neutralizes exposure to ETH and BTC price swings by balancing spot and perpetual futures positions, reducing volatility risks.

-

No Fiat or RWA Exposure: USR is fully crypto-backed, avoiding risks tied to real-world assets, banks, or fiat custodians.

-

Systemic Risk Concentration: The protocol’s reliance on perpetual futures and liquidity pools (RLP) introduces risks if extreme market events disrupt funding or liquidity.

-

Smart Contract & Oracle Risks: As with all DeFi protocols, USR and stUSR are exposed to potential smart contract bugs and oracle manipulation vulnerabilities.

-

Yield Volatility: stUSR yields depend on underlying market conditions and funding rates, which can fluctuate significantly over time.

-

Complexity for Users: The dual-token (USR/stUSR) and RLP insurance system may be challenging for newcomers to fully understand and manage.

Why Resolv’s Delta-Neutral Model Matters Now

The broader stablecoin sector is at an inflection point. Regulatory scrutiny around fiat reserves has never been higher, while users demand more resilient alternatives that don’t depend on banks or centralized custodians. By leveraging crypto-native assets and sophisticated hedging strategies, Resolv delivers a compelling answer, one that balances capital efficiency with robust risk management.

This isn’t just theory: today’s peg performance ($0.999822 for USR) proves out the model even amid market noise. For investors hunting for sustainable yield without sacrificing transparency or composability, Resolv’s approach stands out from both legacy stables and overengineered algorithmic options.

If you’re ready to explore next-generation stablecoins that actually pay you to hold them, while keeping risk tranching fully transparent, Resolv USR and stUSR are worth adding to your watchlist this cycle.