How STBL’s Dual-Token Model Is Changing Yield-Bearing Stablecoins

Stablecoins have long been the backbone of decentralized finance (DeFi), offering users a reliable store of value and a gateway to digital asset markets. However, as demand for passive income and real-world asset (RWA) integration intensifies, new models are emerging to address the limitations of traditional stablecoins. The STBL protocol is at the forefront of this evolution with its dual-token system, which is reshaping how investors interact with yield-bearing stablecoins.

What Makes STBL’s Dual-Token Model Unique?

The core innovation behind STBL lies in its ability to separate principal from yield. Unlike conventional stablecoins that combine both in a single token, STBL introduces two distinct assets:

- USST: An overcollateralized stablecoin backed by tokenized U. S. Treasury Bills and other RWAs. USST is designed for seamless DeFi composability and can be freely used or transferred while maintaining its 1: 1 peg.

- YLD: A non-fungible token (NFT) representing the right to claim yield generated by the underlying collateral. YLD accrues interest independently, allowing users to capture passive income even if they put their USST to work elsewhere.

This architecture means that when you deposit yield-generating RWAs into the protocol, you receive both USST for liquidity and YLD for ongoing yield – effectively unbundling capital utility from income generation. For a technical breakdown, see CoinMarketCap’s overview.

Current Market Performance: STBL Price Update

The market has taken notice of this innovative approach. As of now, STBL trades at $0.3270, reflecting a 24-hour change of -0.1726%. The price has ranged between $0.3267 and $0.4226 over the last day, underscoring both volatility and active engagement from DeFi participants seeking exposure to yield-bearing stablecoin strategies.

STBL (STBL) Price Prediction 2026-2031

Professional forecast based on current RWA yields, market adoption trends, and STBL’s dual-token model innovation.

| Year | Minimum Price | Average Price | Maximum Price | Year-over-Year % Change (Avg) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $0.28 | $0.39 | $0.60 | +19% | Adoption grows as DeFi integrates more RWA protocols; volatility remains due to regulatory uncertainty. |

| 2027 | $0.33 | $0.47 | $0.78 | +21% | Bullish sentiment as institutional RWA participation rises; potential for new competitors to emerge. |

| 2028 | $0.41 | $0.56 | $1.05 | +19% | Regulatory clarity boosts confidence; STBL expands integrations with DeFi and CeFi platforms. |

| 2029 | $0.48 | $0.65 | $1.32 | +16% | Yield innovation attracts conservative capital; market cycles drive periods of higher volatility. |

| 2030 | $0.53 | $0.74 | $1.55 | +14% | Mainstream adoption of tokenized RWAs; STBL governance matures, increasing protocol stability. |

| 2031 | $0.61 | $0.82 | $1.82 | +11% | Mature RWA DeFi sector; STBL competes with leading yield protocols and expands globally. |

Price Prediction Summary

STBL is positioned for significant growth as its dual-token model addresses key DeFi challenges by separating liquidity and yield. Over the next six years, price appreciation is expected to be steady but volatile, driven by adoption of real-world asset yield strategies, regulatory progress, and the evolving DeFi landscape. While STBL could face competition and market downturns, its innovative approach and governance utility support a bullish long-term trajectory.

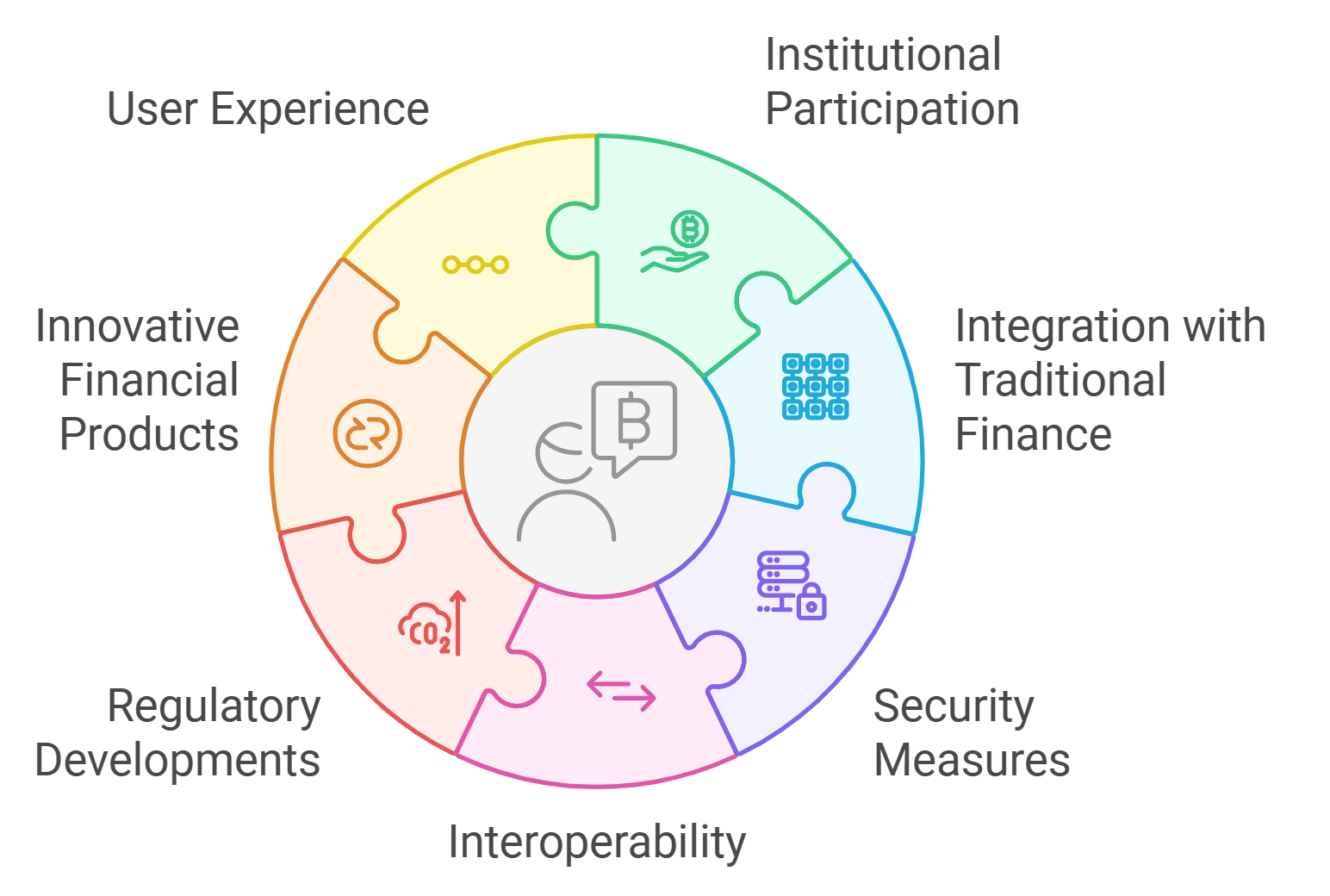

Key Factors Affecting STBL Price

- Adoption of real-world asset (RWA) tokenization in DeFi and CeFi ecosystems

- Market acceptance and liquidity of USST and YLD tokens

- Regulatory developments impacting stablecoins and RWA protocols

- Innovations in yield strategies and risk management

- Competition from other RWA-backed stablecoin and yield protocols

- Macro-economic factors influencing RWA yields (e.g., U.S. Treasury rates)

- STBL governance enhancements and community participation

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

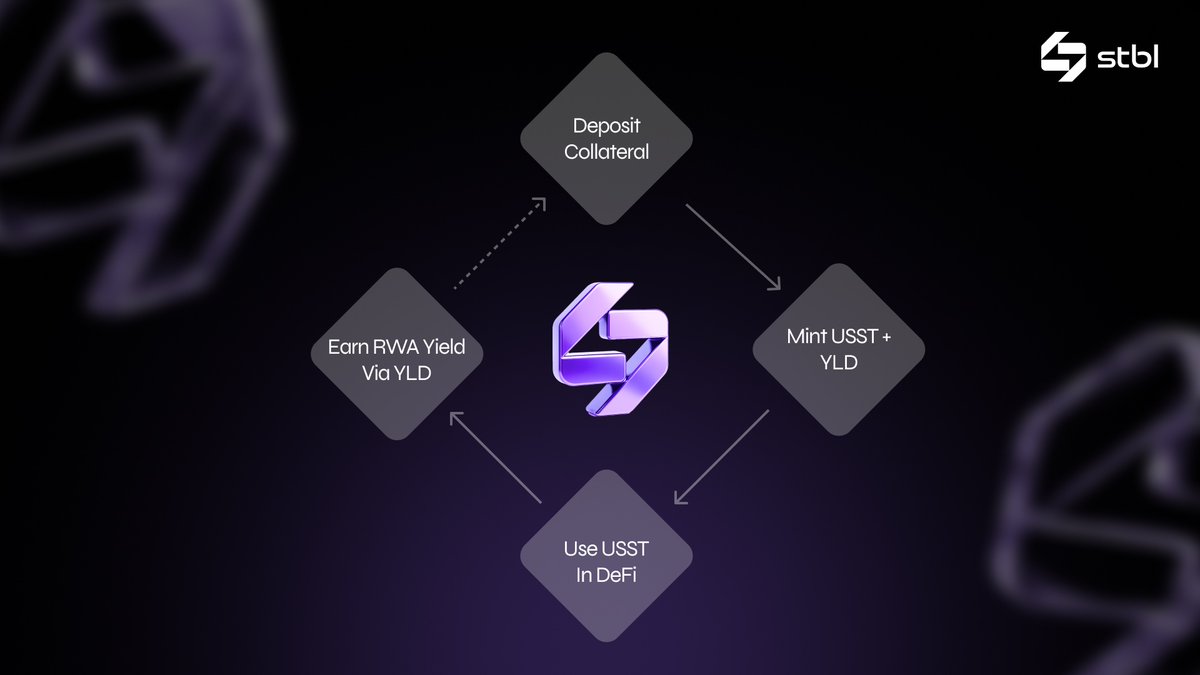

The Mechanics: How USST and YLD Work Together

The process begins when users deposit eligible RWAs – such as tokenized U. S. Treasuries – into the protocol. In return, they mint USST (the liquid stablecoin) and receive YLD (the NFT capturing future yields). This split enables several advantages:

- Liquidity: Users can deploy or transfer their USST across DeFi platforms without interrupting their yield stream.

- Transparency: Yield accrual is separated from principal value, making returns auditable and less susceptible to opaque accounting practices.

- User choice: Investors can sell or trade YLD tokens independently if they wish to realize future interest upfront or rebalance risk.

This model solves a persistent issue in passive income DeFi stablecoins: balancing capital efficiency with transparent yield distribution.

The inclusion of a governance token (also called STBL) further decentralizes control over collateral onboarding and protocol parameters, giving power users an active role in shaping the ecosystem’s future (learn more here). By leveraging institutional-grade assets instead of algorithmic mechanisms or unsustainable subsidies, STBL aims for both stability and real-world relevance.

By decoupling yield from liquidity, STBL’s architecture positions itself as a prototype for the stablecoin 2.0 model. This approach is already influencing the broader DeFi landscape, where protocols are racing to integrate real-world assets and provide more granular control over passive income streams. The composability of USST means users can engage in lending, trading, or liquidity provision without sacrificing their right to future yield, a significant leap from legacy stablecoins that force users to choose between utility and returns.

Comparing STBL With Traditional Stablecoins

Traditional stablecoins like USDT or USDC are typically backed by cash equivalents but do not offer direct access to underlying yields. In contrast, STBL’s model allows holders of YLD to claim interest generated by overcollateralized RWAs such as U. S. Treasuries, assets that have historically been reserved for institutional investors. This democratization of yield is one of the most talked-about innovations in DeFi today.

Key Differences: STBL vs. Traditional Stablecoins

-

Dual-Token Architecture: STBL employs a unique system with two main tokens: USST (the stablecoin) and YLD (the yield token), separating liquidity from yield. Traditional stablecoins like USDT or USDC combine both functions in a single token.

-

Backed by Yield-Bearing Real-World Assets (RWAs): USST is overcollateralized with real-world assets such as tokenized U.S. Treasury Bills, providing transparent, auditable backing. Most traditional stablecoins are backed by cash equivalents or bank reserves, often with less transparency.

-

Decoupling of Yield and Principal: With STBL, users receive USST for liquidity and a separate YLD NFT to accrue interest. This allows users to spend or deploy stablecoins while still earning yield—a feature not available in conventional stablecoins.

-

Composability Across DeFi: USST is designed to be fully composable and easily integrated across DeFi platforms, enabling broader utility. Traditional stablecoins may face limitations or restrictions in certain DeFi protocols.

-

Governance Participation: STBL introduces a dedicated governance token (STBL), empowering holders to vote on protocol changes, collateral onboarding, and yield parameters. Most traditional stablecoins offer limited or no governance rights to users.

-

Market Transparency and Auditing: The STBL protocol emphasizes transparent, on-chain auditing of collateral and yields, contrasting with the often opaque reserve disclosures of traditional stablecoins.

For DeFi participants who prioritize transparency and sustainable yield sources, the protocol’s reliance on audited contracts and real interest (rather than inflationary token subsidies) is a major draw. This structure mitigates risks associated with opaque backing or algorithmic instability seen in previous generations of stablecoins.

Risks and Considerations

No protocol is without its challenges. While USST YLD explained offers compelling advantages, users should be aware of certain risks:

- RWA Custody: The system relies on secure custody and transparent tokenization of real-world assets. Regulatory shifts or custodial failures could impact collateral value.

- Smart Contract Risk: As with all DeFi protocols, bugs or exploits remain a concern despite audits.

- Market Volatility: Although designed for stability, secondary market fluctuations in YLD pricing may affect realized yields for sellers before maturity.

This underscores the importance of due diligence when pursuing passive income through DeFi stablecoins, especially those integrating off-chain components.

What’s Next for Yield-Bearing Stablecoins?

The launch of over $1 billion in USST supply demonstrates robust demand for real-world asset backed stablecoin products (source). As more protocols adopt dual-token frameworks and regulatory clarity improves, expect further innovation around how yield is distributed and governed within DeFi ecosystems.

The current STBL price at $0.3270, while reflecting immediate market dynamics, also hints at the ongoing process of price discovery as users assess risk-reward profiles unique to this new breed of digital assets. For those seeking exposure to RWA-driven yields without locking up capital indefinitely, models like STBL’s dual-token system could become foundational pillars in next-generation decentralized finance.