How YieldFi’s yUSD and vyUSD Are Redefining Stablecoin Yield Strategies in 2025

Stablecoin yield strategies have come a long way from the days of simple lending and farming. In 2025, YieldFi’s yUSD and vyUSD are making serious waves by turning stablecoin passive income into a science, not just a gamble. If you’re searching for reliable DeFi passive income strategies that don’t force you to chase every new token or farm, this is where things get interesting.

yUSD’s Meteoric Growth: From $10M to $140M Supply

The numbers don’t lie: since April 2025, yUSD supply has rocketed from $10 million to $140 million, and total value locked (TVL) is up 14x. That’s not just impressive growth – it’s a sign of increasing trust in YieldFi’s approach to stablecoin yield. What’s fueling this surge? It’s the combination of competitive APYs, transparent on-chain management, and the comfort of knowing your principal remains pegged to the dollar.

YieldFi yUSD (yUSD) Price Prediction 2026-2031

Professional forecast based on current market adoption, DeFi trends, and stablecoin innovation

| Year | Minimum Price | Average Price | Maximum Price | Year-over-Year Change (Avg) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $1.08 | $1.13 | $1.23 | +1.8% | Stable demand; yUSD yield strategies see steady adoption, but competition from other yield-bearing stablecoins grows. |

| 2027 | $1.07 | $1.15 | $1.26 | +1.8% | Regulatory clarity boosts institutional DeFi use; vyUSD/yUSD integration with more platforms increases utility. |

| 2028 | $1.05 | $1.17 | $1.30 | +1.7% | YieldFi launches advanced AI-driven allocation; minor volatility as DeFi market matures and macro rates fluctuate. |

| 2029 | $1.04 | $1.19 | $1.32 | +1.7% | Stablecoin sector faces increased regulation; yUSD benefits from robust compliance and transparency. |

| 2030 | $1.03 | $1.21 | $1.36 | +1.7% | DeFi mainstreams into traditional finance; yUSD becomes a preferred yield-bearing stablecoin for on-chain savings. |

| 2031 | $1.02 | $1.23 | $1.41 | +1.7% | Competition intensifies, but yUSD’s reputation and track record secure consistent demand and stable yield flows. |

Price Prediction Summary

YieldFi yUSD is expected to maintain a stable, slightly appreciating price profile, reflecting its dollar-pegged design and embedded yield accrual. As DeFi matures and institutional adoption grows, yUSD could see increased demand, especially if it maintains its technological edge and regulatory compliance. Maximum prices reflect periods of high demand and aggressive yield optimization, while minimum prices account for market corrections or regulatory headwinds.

Key Factors Affecting YieldFi yUSD Price

- Sustained growth of DeFi and on-chain asset management.

- YieldFi’s ability to maintain competitive, risk-adjusted yields.

- Integration with major DeFi protocols and cross-chain platforms.

- Stablecoin regulatory developments globally.

- Advancements in yield strategy automation (e.g., AI-driven strategies).

- Emergence of new competitors offering higher yields or unique features.

- Macro interest rate environment impacting DeFi yields.

- Adoption by institutional and retail investors.

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

As of September 29,2025, YieldFi yToken (yUSD) is trading at $1.11. This price stability, even as supply expands rapidly, shows that the platform’s risk controls and market-neutral strategies are working as intended.

How YieldFi yUSD Delivers Risk-Managed Stablecoin APY

What sets yUSD apart from other yield-bearing stablecoins? It leverages a diversified portfolio of market-neutral strategies – think zero-coupon bonds like Pendle PT tokens, blue-chip protocol vaults (Morpho and Silo), and private credit vaults through Midas. Each allocation is actively managed with strict limits per protocol for real diversification.

This isn’t just theoretical. You can track every move on-chain, with daily compounding rewards vesting via ERC-4626 mechanics. The result: yields that are both predictable and competitive – often in the 15-20% APY range for vyUSD holders, according to platform data.

YieldFi yUSD (yUSD) Price Prediction 2026-2031

Comprehensive outlook based on current DeFi adoption, Total Value Locked (TVL) growth, and evolving stablecoin yield strategies.

| Year | Minimum Price (Bearish) | Average Price (Base Case) | Maximum Price (Bullish) | % Change (Avg YoY) | Key Market Scenario |

|---|---|---|---|---|---|

| 2026 | $1.07 | $1.13 | $1.25 | +1.8% | Stabilized DeFi yields; moderate expansion |

| 2027 | $1.05 | $1.15 | $1.32 | +1.8% | Regulatory clarity; DeFi integrations deepen |

| 2028 | $1.03 | $1.17 | $1.40 | +1.7% | Broader institutional adoption; new use cases |

| 2029 | $1.02 | $1.18 | $1.47 | +0.9% | YieldFi ecosystem matures; competitive pressure increases |

| 2030 | $1.01 | $1.19 | $1.54 | +0.8% | Stablecoin market saturates; focus on utility |

| 2031 | $1.00 | $1.19 | $1.60 | 0% | YieldFi maintains leadership; stable yields |

Price Prediction Summary

YieldFi yUSD (yUSD) is expected to maintain a stable price trajectory with moderate appreciation above its nominal peg, reflecting accrued yield and increasing DeFi adoption. The minimum price scenario assumes heightened competition or regulatory hurdles, while the maximum scenario considers aggressive adoption of YieldFi’s yield strategies and persistent innovation. Average prices suggest a steady, incremental growth, positioning yUSD as a reliable yield-bearing stablecoin for both retail and institutional DeFi participants.

Key Factors Affecting YieldFi yUSD Price

- Sustained growth in Total Value Locked (TVL) and user adoption of YieldFi products

- Integration with major DeFi platforms and new yield strategies

- Regulatory developments impacting stablecoin issuance and DeFi protocols

- Competition from other yield-bearing stablecoins and new DeFi protocols

- Technological advancements in yield optimization and risk management

- Potential for further airdrops, reward programs, and community incentives

- Market cycles and risk appetite in the broader cryptocurrency ecosystem

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

If you’re tired of chasing fleeting APYs or worrying about rug pulls, yUSD offers a breath of fresh air: real yields from real market activity, not just inflationary token incentives.

vyUSD: Enhanced Yield Meets DeFi Automation

vyUSD takes things up a notch for those willing to get more active. By holding vyUSD or using it in supported strategies (like lending or synthetic asset creation), users can tap into higher yields plus bonus multipliers through the YieldFi Points program. This means vyUSD isn’t just about earning more yield – it also opens doors to exclusive rewards and future airdrops.

The best part? You don’t need to be an expert DeFi strategist. YieldFi abstracts away complex multi-chain farming into simple ownership of one token. Whether you’re staking yUSD directly or deploying vyUSD in partner protocols like Hemi (details here), everything is automated for you, but fully transparent on-chain if you want to dig deeper.

The Power of On-Chain Yield Tracking and Transparency

This year has been all about transparency and control for stablecoin investors. With yUSD and vyUSD, every strategy allocation is visible on-chain, no black boxes or hidden risks. This gives investors confidence that their funds aren’t being funneled into high-risk gambles behind the scenes.

YieldFi yUSD (yUSD) Price Prediction 2026-2031

Professional Forecast for YieldFi’s yUSD Stablecoin Based on Market, Technology, and Adoption Trends

| Year | Minimum Price | Average Price | Maximum Price | % Change (Avg YoY) | Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $1.08 | $1.13 | $1.22 | +1.8% | Stable yield and growing DeFi adoption; minor volatility from liquidity shifts |

| 2027 | $1.07 | $1.16 | $1.25 | +2.7% | YieldFi expansion, more integrations, but stablecoins face minor regulatory scrutiny |

| 2028 | $1.06 | $1.18 | $1.28 | +1.7% | Matured yield strategies; competition from new protocols keeps yields competitive |

| 2029 | $1.05 | $1.21 | $1.32 | +2.5% | Potential regulatory clarity boosts stablecoin trust and institutional adoption |

| 2030 | $1.04 | $1.23 | $1.35 | +1.7% | Further DeFi mainstreaming; yUSD benefits from robust risk management |

| 2031 | $1.03 | $1.26 | $1.39 | +2.4% | Peak adoption, possible innovations in delta-neutral strategies and cross-chain integrations |

Price Prediction Summary

yUSD is expected to maintain a stable value with gradual appreciation due to sustained yield accrual and increased DeFi adoption. While designed to track the US dollar, yUSD’s price may trade at a premium during periods of high demand for yield-bearing stablecoins, especially if DeFi yields remain attractive relative to TradFi. Regulatory clarity and further integration into major DeFi platforms could provide additional upside, while competition and unforeseen regulatory headwinds remain key downside risks.

Key Factors Affecting YieldFi yUSD Price

- Sustained growth in DeFi TVL and integration of yUSD/vyUSD in major protocols

- YieldFi’s ability to maintain attractive, market-neutral yields via diversified strategies

- Potential for regulatory changes affecting stablecoins and DeFi protocols

- Adoption by institutional and retail investors seeking stable, on-chain yield

- Competition from other yield-bearing stablecoins and new DeFi primitives

- Technological improvements in yield management and risk controls

- Market sentiment and overall crypto market cycles

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

If you’re looking for risk-managed stablecoin APY with daily compounding, while still keeping things simple, both tokens deserve your attention as part of any modern DeFi yield portfolio.

One of the most attractive features for yield hunters in 2025 is the way YieldFi’s ecosystem rewards loyalty and diversification. The YieldFi Points program, for example, lets you rack up points simply by holding yUSD or vyUSD, participating in campaigns, or supplying assets to lending markets. These points are more than just a gamification layer – they translate into multipliers on your yields, eligibility for future community rewards, and even potential airdrops. For DeFi users who want to maximize every dollar while minimizing risk, it’s a compelling reason to stick around.

Top Benefits of Using yUSD and vyUSD for DeFi Passive Income

-

Stable, Predictable Yields with Dollar Peg: Both yUSD and vyUSD are designed to maintain a stable value (with yUSD currently priced at $1.11), letting users earn passive income without worrying about crypto market volatility.

-

Diversified, Market-Neutral Strategies: YieldFi employs a mix of strategies—including Pendle PT tokens, Morpho and Silo vaults, and Midas private credit vaults—to generate yield, reducing risk through diversification.

-

High APY Potential: Staking yUSD can offer up to 893% APY (as of September 2025), while vyUSD provides enhanced yields (typically 15-20% APY) with daily compounding, making them attractive for maximizing returns.

-

Seamless DeFi Integration: yUSD and vyUSD are supported across major DeFi platforms like Hemi, enabling lending, synthetic asset creation, and yield optimization for a broader range of strategies.

-

Automated, Hands-Off Yield Generation: Both tokens abstract away complex yield farming processes, letting users earn diversified, automated, and transparent returns with a single token—no active management required.

-

YieldFi Points Program Rewards: By holding or staking yUSD and vyUSD, users earn YieldFi Points, unlocking access to multipliers, airdrops, and future platform rewards—boosting overall passive income.

-

Rapidly Growing Ecosystem and Liquidity: yUSD’s total value locked has surged 14x since April 2025, with supply growing from $10M to $140M, ensuring deep liquidity and a thriving user base.

And let’s not overlook the flexibility. With multi-chain integrations rolling out across platforms like Hemi, users can bring in USDC or USDT from any major chain and seamlessly convert to yUSD. This means you’re not locked into one ecosystem or forced to bridge assets manually – everything flows through one unified interface that puts user experience first. Read more about how Hemi and YieldFi are collaborating here.

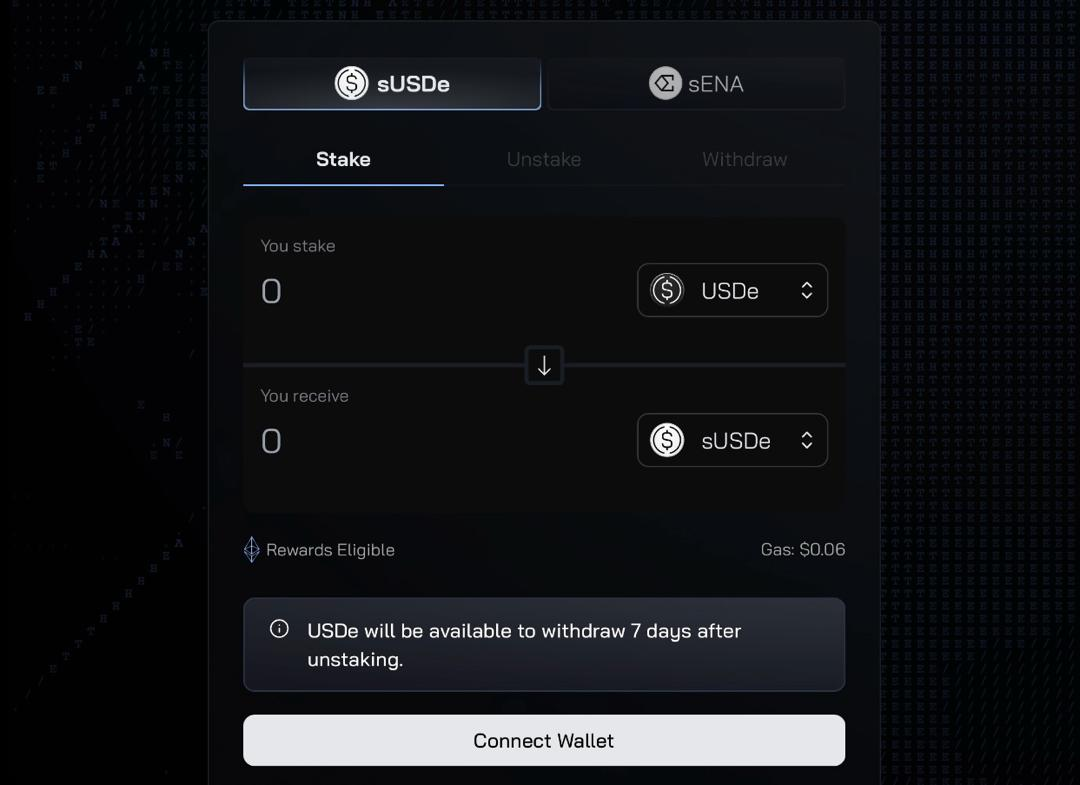

How to Get Started with yUSD and vyUSD in 2025

Getting exposure to these innovative stablecoin strategies is refreshingly straightforward:

Once you have your tokens, you can choose between passive holding (and earning) or deploying them into active strategies for even higher returns. The best part? You always maintain full control over your funds – no lockups or obscure withdrawal windows.

Travis’ Tip: “Diversify across both yUSD and vyUSD if you want a blend of liquidity, steady APY, and upside from platform incentives. Don’t put all your eggs in one basket. ”

If you’re still on the fence about whether these new stablecoins fit your portfolio, just look at the numbers: yUSD is trading at $1.11 as of September 29,2025, with TVL up 14x since April. That’s a clear signal that both retail users and bigger DeFi players see real value here.

Staying Ahead in the Stablecoin Yield Game

The stablecoin yield landscape is evolving fast – but with transparency, automation, and real market-neutral returns at its core, YieldFi is setting itself apart from short-lived farms or opaque protocols. For anyone serious about building sustainable DeFi passive income strategies in 2025, tracking on-chain yield data and sticking with risk-managed products like yUSD and vyUSD could be the edge you need.

The bottom line? Whether you’re new to DeFi or looking for an upgrade from legacy stablecoin solutions, YieldFi’s approach offers a practical path forward. Stay curious, keep diversifying – and let smart automation do the heavy lifting while your dollars work harder behind the scenes.