How RWA-Backed Yield-Bearing Stablecoins Like USST and USDY Are Redefining DeFi Yields in 2024

In 2024, the decentralized finance (DeFi) sector is undergoing a seismic shift, propelled by the explosive growth of RWA-backed stablecoins. Unlike their traditional counterparts, these new stablecoins generate yield by integrating real-world assets like U. S. Treasury bonds directly into blockchain protocols. As investors search for more predictable DeFi yield strategies, tokens such as USST and USDY have become the poster children for “stablecoin 2.0” – blending TradFi reliability with on-chain transparency.

From Fiat-Backed to Yield-Bearing: The Stablecoin Evolution

The landscape has evolved rapidly since the first fiat-backed stablecoins emerged. According to CoinGecko’s RWA Report 2024, the market cap of fiat-backed stablecoins climbed 5% from $128.2B to $133.6B by February 1, reflecting renewed confidence in digital dollars. But while tokens like USDT and USDC provide stability, they don’t offer passive income, a major drawback as global rates rise.

This gap set the stage for RWA-backed yield-bearing stablecoins. By tying their value to tokenized real-world assets (RWA), these coins deliver both price stability and regular yield, a game-changer for DeFi users seeking sustainable returns without excessive risk.

USDY (Ondo US Dollar Yield) Price & Yield Prediction: 2026-2031

Professional forecast for USDY based on RWA adoption, DeFi integration, and evolving yield strategies.

| Year | Minimum Price | Average Price | Maximum Price | Projected Annualized Yield (%) | Key Market Scenario |

|---|---|---|---|---|---|

| 2026 | $1.06 | $1.10 | $1.15 | 4.7 – 6.5 | Stable growth; RWA adoption accelerates |

| 2027 | $1.05 | $1.11 | $1.18 | 4.5 – 6.3 | Increased competition, moderate DeFi expansion |

| 2028 | $1.04 | $1.12 | $1.21 | 4.2 – 6.1 | Regulatory clarity; institutional inflows |

| 2029 | $1.03 | $1.13 | $1.25 | 4.0 – 6.0 | Mainstream institutional adoption |

| 2030 | $1.02 | $1.14 | $1.28 | 3.8 – 5.8 | Yield compression as RWA market matures |

| 2031 | $1.01 | $1.15 | $1.32 | 3.5 – 5.6 | Widespread global adoption; competition drives innovation |

Price Prediction Summary

USDY is expected to maintain its peg near $1.10, with modest price appreciation potential due to growing DeFi and RWA adoption. The minimum price scenario reflects regulatory or market shocks, while the maximum price scenario considers bullish DeFi expansion and increasing demand for compliant, yield-bearing stablecoins. Projected yields are expected to gradually decline as the RWA-backed stablecoin sector matures and competition intensifies, but USDY will likely remain a leading choice for stable DeFi yield.

Key Factors Affecting USDY Price

- Adoption of RWA-backed stablecoins within DeFi and TradFi ecosystems

- Regulatory clarity around tokenized Treasuries and yield-bearing stablecoins

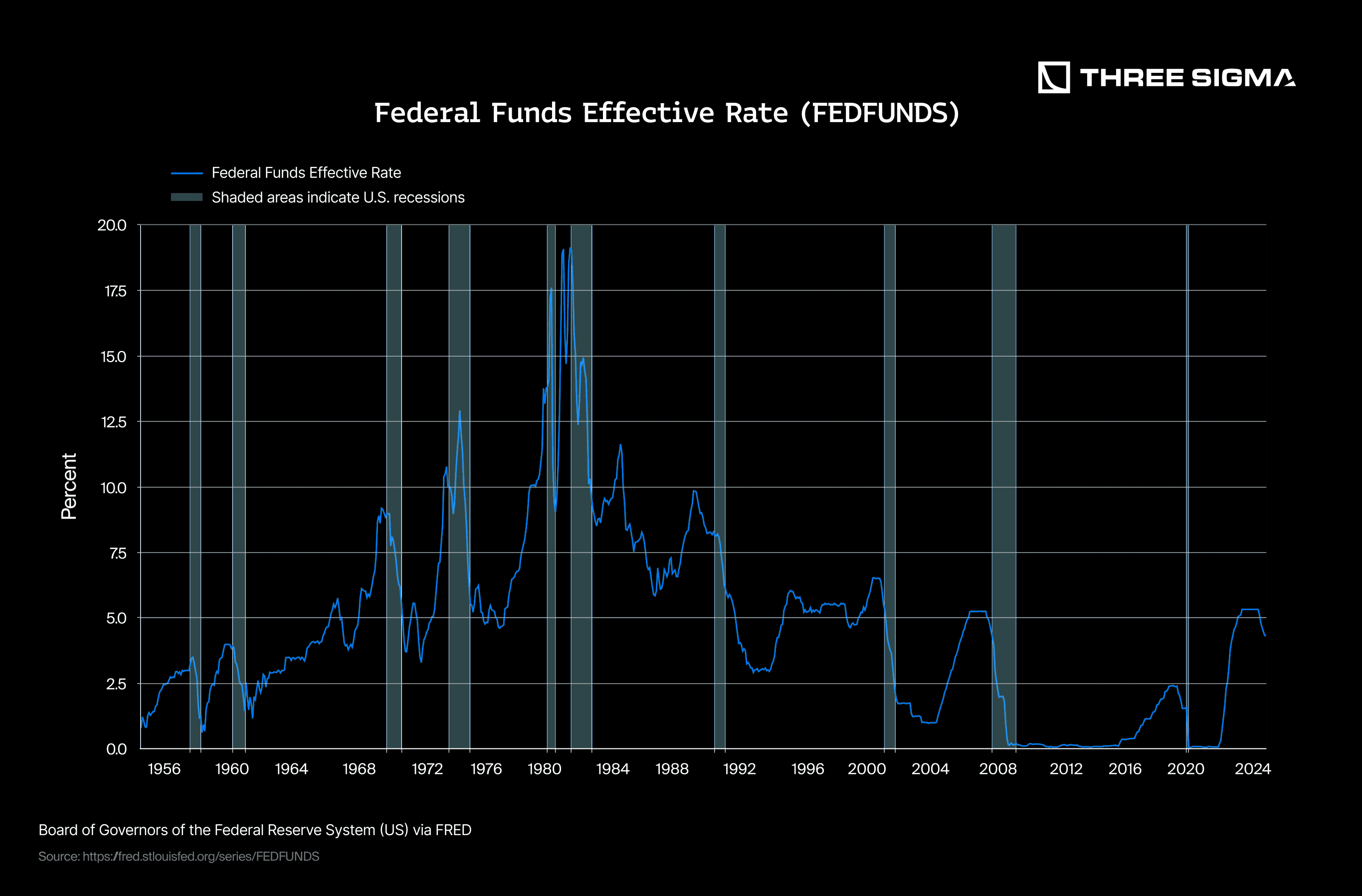

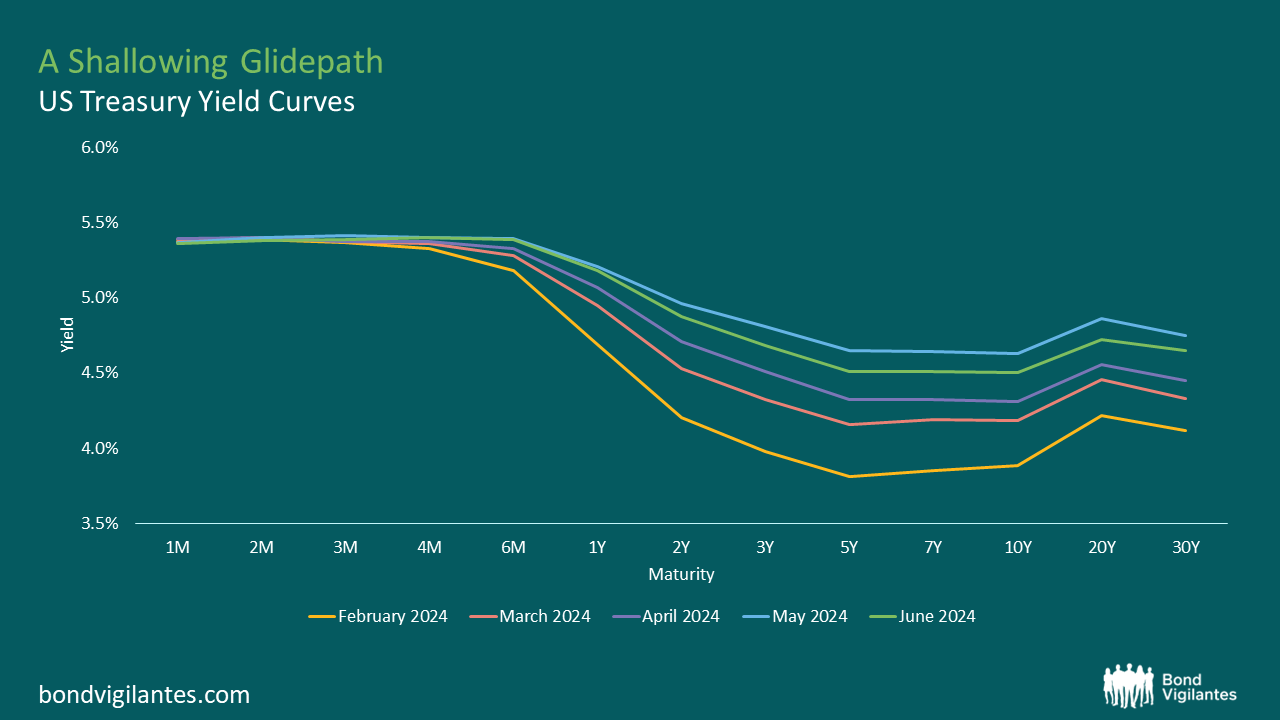

- Interest rate trends and U.S. Treasury yields

- Technology improvements and cross-chain integrations

- Competition from other stablecoin and RWA protocols

- Institutional demand for compliant, transparent DeFi products

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

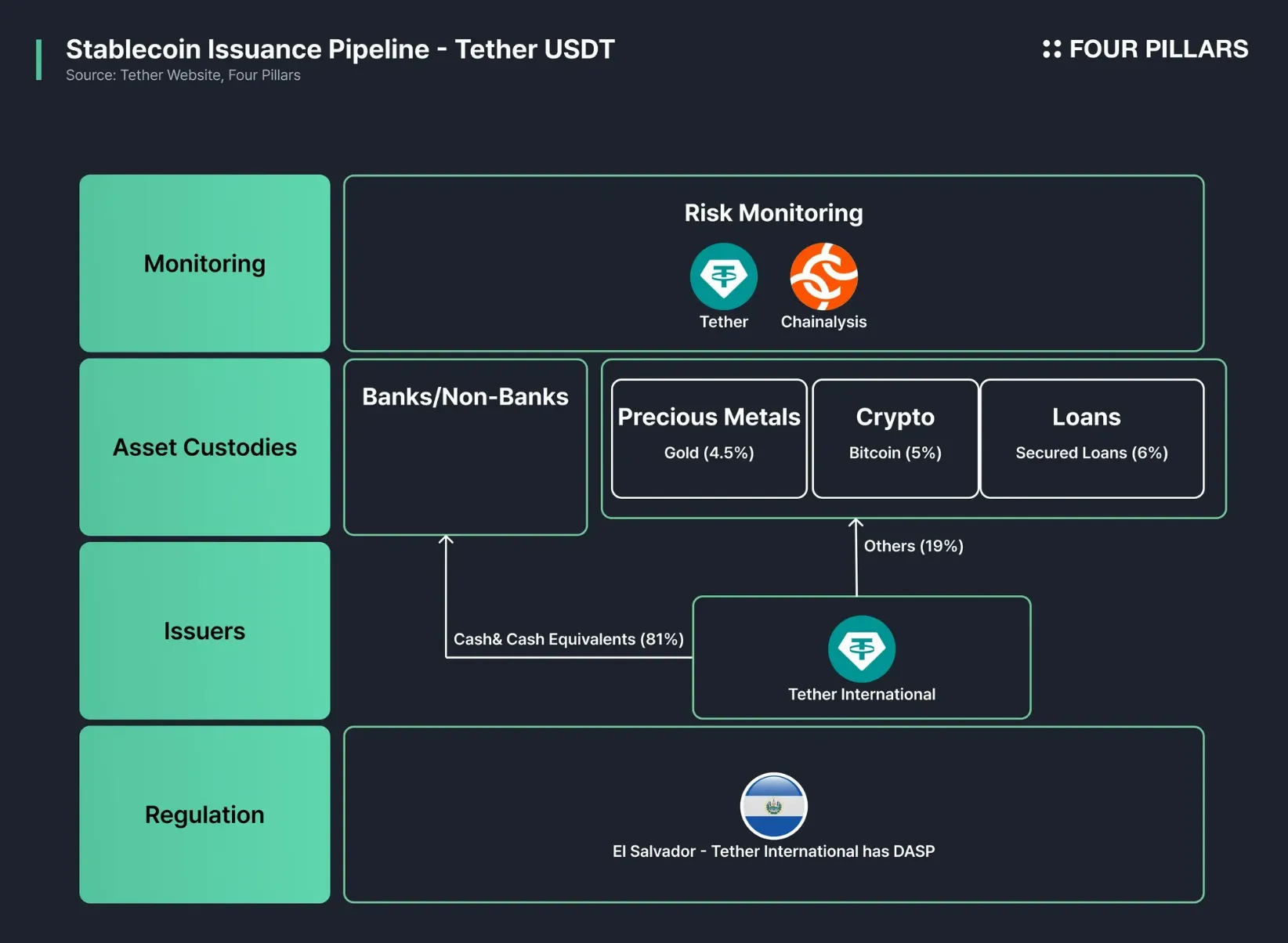

USST: Unpacking a Dual-Token Yield System

USST, launched by the STBL protocol, exemplifies innovation in stablecoin mechanics. Users mint USST by depositing approved on-chain RWA tokens such as USDY, OUSG, or BUIDL as collateral. What sets USST apart is its dual-token architecture: upon minting, users receive both USST (a fully collateralized stablecoin) and YLD (an NFT representing rights to future yield).

This separation of liquidity (via USST) from yield ownership (via YLD) empowers users with unprecedented flexibility in managing cash flow and passive income streams. Transparency is paramount; all assets and ledgers are verifiable on-chain through open protocols (details here). For investors wary of opaque reserves or off-chain risks, this model offers clarity and security.

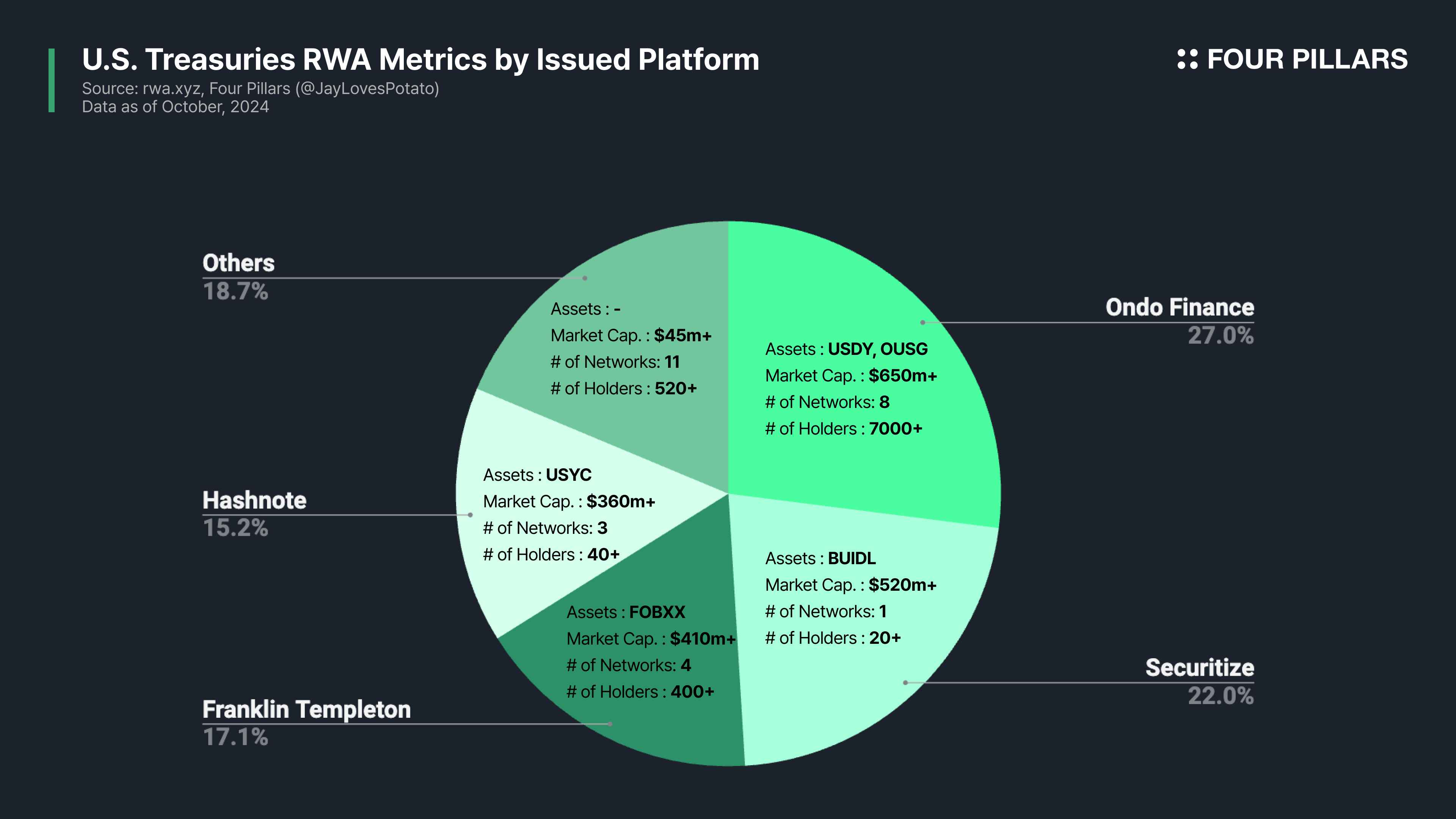

USDY: Bringing Treasury Yields On-Chain at $1.09

USDY, issued by Ondo Finance, has become synonymous with compliant DeFi yields in 2024-2025. Each USDY token is backed 1: 1 by short-duration U. S. Treasuries held via regulated custodians, allowing holders to tap into annualized yields between 4.8% and 6.8%. As of October 2025, USDY trades at exactly $1.09, reflecting both accrued interest and robust demand among institutional and retail users alike.

The market size for tokenized U. S. Treasuries soared to $5 billion by March 2025 (source). This surge illustrates how USDY’s model bridges TradFi’s safety net with DeFi’s composability, making it a preferred vehicle for those seeking predictable returns without sacrificing blockchain-native benefits.

USDY (Ondo US Dollar Yield) Price Prediction 2026-2031

Professional outlook based on RWA integration, DeFi adoption, and market trends (2025 baseline: $1.09)

| Year | Minimum Price | Average Price | Maximum Price | Yearly % Change (Avg) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $1.05 | $1.11 | $1.16 | +1.8% | Continued RWA adoption, stable U.S. rates, modest growth in DeFi demand |

| 2027 | $1.03 | $1.12 | $1.18 | +0.9% | Potential rate cuts moderate yield, but DeFi institutionalization offsets downside |

| 2028 | $1.01 | $1.13 | $1.21 | +0.9% | Increased global adoption, competition from other RWA stablecoins, regulatory clarity improves |

| 2029 | $1.00 | $1.14 | $1.24 | +0.9% | Stablecoin technology matures, on-chain treasury products proliferate, new integrations |

| 2030 | $0.99 | $1.16 | $1.27 | +1.8% | Bullish DeFi cycle, higher on-chain treasury yields, institutional allocations rise |

| 2031 | $0.98 | $1.17 | $1.30 | +0.9% | Peak RWA integration, possible new regulatory frameworks, mature DeFi infrastructure |

Price Prediction Summary

USDY is expected to maintain a stable price profile slightly above $1.00 due to its yield-bearing nature and U.S. Treasury backing. Average prices show steady, modest growth reflecting ongoing RWA adoption in DeFi and increased demand for compliant yield products. Price volatility remains low, with min/max ranges reflecting regulatory and market cycle risks. The bullish scenario sees USDY trading at a premium in high-demand DeFi cycles, while bearish scenarios price closer to $1.00 if yields compress or competition intensifies.

Key Factors Affecting USDY Price

- U.S. Treasury yield environment (interest rate changes)

- Growth of RWA-backed assets and DeFi adoption

- Regulatory developments in the U.S. and globally

- Competition from other yield-bearing stablecoins and RWA protocols

- Institutional adoption and integration with TradFi infrastructure

- Technology improvements for on-chain transparency and compliance

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

The Institutional Magnetism of Yield-Bearing Stablecoins

The impact of RWA-backed coins like USST and USDY goes beyond individual investors, they’re acting as magnets for institutional capital seeking regulatory clarity and risk-adjusted returns within crypto markets.

- Stable Yields: With annualized yields ranging from 4.8% to 6.8%, these products rival or exceed many traditional fixed-income offerings while retaining digital asset flexibility.

- Transparency: On-chain verification reduces counterparty risk, addressing one of the main hurdles facing institutional adoption in DeFi.

- Ecosystem Growth: The total value locked (TVL) in yield-bearing stablecoins exploded from $660 million in August 2023 to $10.8 billion by May 2025 (see analysis) – a clear indicator that demand is surging across all segments.

This influx signals not just a passing trend but a structural evolution towards safer and more attractive DeFi passive income solutions.

As we look toward the future, the momentum behind yield-bearing stablecoins 2024 is poised to accelerate. The convergence of real world asset crypto and decentralized finance is no longer a theoretical promise, it’s an active, rapidly scaling reality. Protocols are racing to expand collateral options, improve on-chain transparency, and integrate with broader financial infrastructure. For investors, this means a growing menu of DeFi yield strategies that balance risk and reward more intelligently than ever before.

Navigating Risks: What to Watch With RWA-Backed Stablecoins

Despite their advantages, RWA-backed stablecoins are not without unique risks. Regulatory scrutiny remains high, especially as these tokens gain traction among traditional investors. Counterparty risk, while reduced through on-chain verification, still exists in the custody and management of underlying assets like Treasuries. Additionally, liquidity can fluctuate during periods of market stress or if redemptions spike suddenly.

Key Risks and Best Practices for USST & USDY Investors

-

Smart Contract and Protocol Risks: Both USST and USDY rely on complex smart contracts and DeFi protocols, which may contain vulnerabilities or bugs. Even with audits, exploits or unintended behaviors can result in loss of funds.

-

Regulatory and Compliance Uncertainty: RWA-backed stablecoins like USDY are exposed to evolving regulatory frameworks, especially due to their connection with U.S. Treasuries and securities laws. Sudden regulatory changes could impact yield, access, or even force redemptions.

-

Collateral and Liquidity Risks: The value and liquidity of the real-world assets (e.g., U.S. Treasuries) backing these stablecoins are critical. Market disruptions or illiquidity in the underlying assets may affect redemption or price stability, as seen with USDY trading at $1.09 (as of latest data).

-

Counterparty and Custodial Risks: RWA-backed stablecoins depend on trusted custodians and issuers (e.g., Ondo Finance for USDY). Failure, mismanagement, or fraud at the issuer or custodian level could jeopardize users’ funds.

-

Yield Sustainability and Market Conditions: The yields offered (4.8%–6.8% APY) are linked to traditional markets, particularly U.S. Treasury rates. Falling rates or macroeconomic shifts could reduce yields or affect the attractiveness of these stablecoins.

-

Best Practice: Diversify Across Protocols and Assets – Avoid concentrating your portfolio in a single stablecoin or protocol. Spread exposure across multiple RWA-backed stablecoins and DeFi platforms to mitigate protocol-specific risks.

-

Best Practice: Monitor On-Chain Transparency and Audits – Prioritize platforms like STBL protocol (for USST), which offer on-chain, verifiable asset ledgers and regular third-party audits. This enhances trust and reduces information asymmetry.

-

Best Practice: Stay Informed on Regulatory Developments – Regularly follow updates from stablecoin issuers, industry news, and regulatory bodies to anticipate changes that could impact your investments.

Staying informed about protocol updates, collateral changes, and evolving regulations is essential for anyone considering exposure to these assets. Platforms like Stable Coin Alerts help investors monitor developments in real time so they can adjust positions proactively.

Expanding Use Cases: Beyond Passive Income

The utility of RWA-backed stablecoins now extends far beyond simple yield generation. USST’s dual-token system enables innovative DeFi applications such as composable lending, structured products, and even NFT-based yield rights trading. Meanwhile, USDY’s compliance-first approach sets a template for cross-border payments and institutional treasury management within crypto rails.

Expect further integrations with staking programs, automated portfolio managers, and cross-chain bridges, each unlocking new layers of value for both retail users and institutions. These innovations reinforce the thesis that stablecoin 2.0 will underpin the next phase of DeFi adoption.

The Bottom Line: Sustainable Yields Meet On-Chain Trust

With USDY holding steady at $1.09, its robust pricing signals market confidence in both its collateral base and future prospects. As protocols refine their models and regulators provide clearer frameworks, RWA-backed stablecoins like USST and USDY are set to become foundational building blocks for global digital finance.

The explosive rise from $660 million to $10.8 billion TVL in less than two years underscores a paradigm shift: investors now demand both stability and passive income from their digital dollars (read more). For those seeking reliable returns without sacrificing transparency or composability, yield-bearing stablecoins represent one of 2024’s most compelling opportunities.