Top Yield-Bearing Stablecoins in 2025: TVL, Supply, APR, and Airdrop Potential Compared

Yield-bearing stablecoins have become a cornerstone of DeFi in 2025, offering both passive income and capital preservation in an increasingly volatile macro environment. With total circulation reaching $11 billion and accounting for 4.5% of the stablecoin market, these assets are no longer a niche play, they’re a primary destination for risk-conscious yield seekers and DeFi power users alike. This year’s top contenders each bring unique mechanisms, risk profiles, and growth stories. Below, we break down the five leading yield-bearing stablecoins by TVL, supply growth, APRs, and airdrop potential to help you navigate this dynamic sector.

Stablecoin TVL Rankings: Who’s Dominating Onchain Yield?

In 2025, TVL (Total Value Locked) has become a key metric for evaluating stablecoin adoption and trust within DeFi protocols. Here’s how the top five stack up:

Top 5 Yield-Bearing Stablecoins by TVL & Growth (2025)

-

sDAI (Savings DAI): sDAI is MakerDAO’s yield-bearing version of DAI, allowing users to earn the DSR (DAI Savings Rate) while holding a stablecoin fully backed by decentralized collateral. In 2025, sDAI remains a leading choice for risk-averse DeFi users seeking steady returns and robust supply growth, with integration across major protocols and a history of strong security.

-

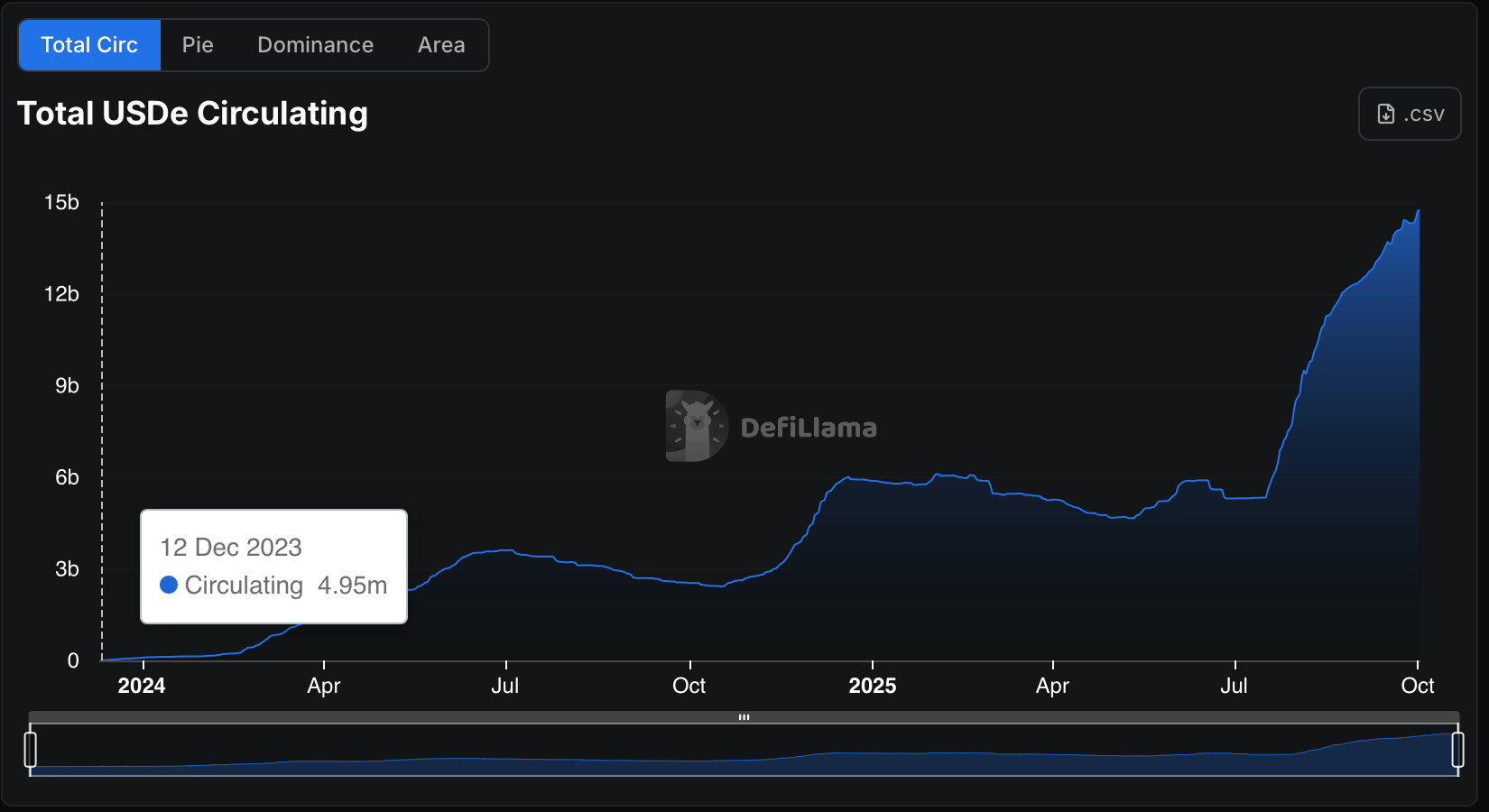

USDe (Ethena USDe): Ethena’s USDe has seen explosive growth in 2025, with its staked version (sUSDe) reaching a TVL of approximately $10 billion. It utilizes delta-neutral strategies to generate high yields (up to 18% APY in 2024) without direct market exposure. USDe’s rapid adoption and innovative mechanism make it a standout among yield-bearing stablecoins.

-

aUSDC (Aave V3 USDC): aUSDC represents USDC supplied to Aave V3, the leading DeFi lending protocol by TVL in 2025. Users earn competitive yields (Aave V3’s USDC APY reached 4.67%) and benefit from Aave’s strong safety rating and deep liquidity. aUSDC is widely used as collateral and for passive income strategies across DeFi.

-

PYUSD (PayPal USD with DeFi integrations): PYUSD, issued by PayPal, has expanded into DeFi protocols, allowing users to earn yield through integrations with lending and liquidity platforms. Its strong brand, regulatory compliance, and growing supply position it as a trusted stablecoin for both retail and institutional DeFi participants in 2025.

-

crvUSD (Curve’s native stablecoin): crvUSD, launched by Curve Finance, leverages the protocol’s deep liquidity and incentivized pools. In 2025, crvUSD supply and TVL have grown steadily, with users earning yields from trading fees and CRV rewards. Its design aims for stability and capital efficiency, making it a core asset in DeFi yield strategies.

sDAI (Savings DAI) remains an anchor for conservative yield strategies. Built on MakerDAO’s robust infrastructure, sDAI offers automatic rebasing from protocol revenue, making it an attractive choice for those prioritizing transparency and decentralization. While its TVL growth has been steady rather than explosive, this reflects its appeal as a low-risk option amid more experimental alternatives.

USDe (Ethena USDe), on the other hand, has seen meteoric adoption thanks to its innovative delta-neutral hedging mechanism. By combining staked Ethereum yields with short futures positions, Ethena delivers high onchain APYs without direct market exposure, catapulting its TVL to near $10 billion as of October 2025 (source). This rapid ascent is attracting not only yield farmers but also institutional allocators seeking scalable passive income.

aUSDC (Aave V3 USDC) leads among lending protocol stables with high safety ratings and a proven track record. The protocol’s upgrades have improved capital efficiency while maintaining rigorous risk controls, resulting in sustained inflows from both retail users and DAOs managing treasury reserves.

PYUSD, PayPal’s stablecoin now integrated across major DeFi platforms via bridges and liquidity pools, is quietly becoming a favorite among TradFi entrants looking for regulatory clarity. Its supply growth reflects increasing confidence from both fintech partners and crypto-native users seeking seamless fiat onramps paired with competitive yields.

crvUSD, Curve’s native stablecoin launched with advanced peg stability modules and deep native liquidity incentives. It has carved out a niche among sophisticated LPs who want exposure to trading fees without sacrificing price stability or composability within Curve’s ecosystem.

APR Comparison: Chasing Yields Without Chasing Risk

The hunt for yield is as fierce as ever, but so is the scrutiny around sustainability. Let’s compare current APRs across these five leaders:

APR Comparison of Top Yield-Bearing Stablecoins in 2025

| Stablecoin | Estimated APR Range | Platform/Integration Notes |

|---|---|---|

| sDAI (Savings DAI) | 4–6% | MakerDAO; widely integrated in DeFi, considered low risk |

| USDe (Ethena USDe) | ~18% | Ethena; high yield via delta-neutral strategies, rapid TVL growth |

| aUSDC (Aave V3 USDC) | 4–5% | Aave V3; top safety rating, leading DeFi lending protocol |

| PYUSD (PayPal USD) | 3–6% (varies) | Yield depends on DeFi integrations; growing adoption |

| crvUSD (Curve USD) | 8–12% | Curve; boosted by trading fees and CRV rewards, DeFi native |

sDAI typically offers yields in the 4-6% range, modest but reliable thanks to MakerDAO’s conservative asset management. For those prioritizing capital preservation over maximum returns, sDAI remains hard to beat.

USDe stands out with eye-popping APYs hovering around 18%, driven by its delta-neutral strategy that harvests staking rewards while hedging out ETH volatility (source). However, investors should be mindful that such strategies rely on derivatives markets functioning smoothly, a factor worth monitoring as volumes grow.

aUSDC continues to offer competitive rates in the 4-5% range on Aave V3, especially appealing given Aave’s reputation for security and transparency (source). These rates are often boosted through liquidity mining or cross-protocol integrations.

PYUSD yields fluctuate between 3-6%, depending largely on which DeFi integrations or reward programs are active at any given time. As more platforms race to onboard PYUSD liquidity pools post-integration, expect further competition, and thus potentially higher rewards, in coming quarters.

crvUSD rounds out our list with dynamic APRs ranging from 8% up to 12%, fueled by Curve gauge incentives plus organic trading fees within deep liquidity pools. Its composability ensures that power users can stack additional rewards via veCRV boosts or third-party vaults, making it one of the most flexible options available today.

Airdrop Potential and Community Incentives

Airdrops remain an integral part of yield-bearing stablecoin ecosystems, not just as marketing tools but as mechanisms for broadening community ownership:

Pendle Finance set the tone earlier this year with substantial community distributions tied to yield tokenization activity (source). While neither MakerDAO nor PayPal have confirmed imminent sDAI or PYUSD drops respectively, both protocols continue experimenting with incentive structures aimed at rewarding long-term holders rather than short-term mercenaries.

USDe’s explosive growth has prompted speculation about future community rewards. Ethena’s team has hinted at ongoing incentive programs, especially as sUSDe’s TVL approaches $10 billion. While no formal airdrop schedule has been released, active participation in governance or liquidity provision could enhance eligibility for any future token distributions. Similarly, Curve’s crvUSD ecosystem maintains a robust tradition of rewarding engaged users via veCRV boosts and periodic incentive campaigns, making active LPs and stakers prime candidates for upcoming drops.

aUSDC users benefit from Aave’s established safety incentives and occasional liquidity mining campaigns. While major airdrops are less frequent here, Aave governance continues to explore new reward models to retain market share amid rising competition from novel stablecoin protocols. PYUSD, as a bridge between TradFi and DeFi, could see innovative reward mechanisms emerge as PayPal experiments with onchain engagement strategies, though these are likely to be more regulatory-friendly than the wild-west drops of early DeFi cycles.

Key Considerations: Risk, Regulation, and Real-World Adoption

As yields climb across the sector, risk management becomes paramount. sDAI stands out for its conservative approach: it is fully backed by MakerDAO’s diversified collateral set and benefits from transparent onchain governance. For investors prioritizing stability over headline APYs, sDAI remains the gold standard among yield-bearing stablecoins.

USDe’s delta-neutral strategy is innovative but comes with its own set of risks, including dependence on derivatives market liquidity and the complexity of rebalancing positions during periods of extreme volatility. This makes USDe attractive for sophisticated users comfortable with advanced DeFi mechanics but perhaps less suitable for those seeking set-and-forget solutions.

aUSDC continues to offer a compelling balance between yield and security due to Aave V3’s proven risk controls and deep liquidity pools. For institutions and DAOs with large treasuries, aUSDC remains one of the most trusted options in the space.

PYUSD, while still finding its footing in DeFi, offers regulatory clarity that will appeal to traditional finance participants entering crypto yield markets for the first time. Its integration into blue-chip protocols signals growing acceptance, and potentially lower counterparty risk, compared to more experimental stablecoins.

crvUSD, meanwhile, is best suited for power users who can actively manage positions within Curve’s gauge system or combine crvUSD exposure with other DeFi strategies to amplify returns. However, this flexibility comes with added complexity; users must remain vigilant about protocol updates and incentive changes.

Looking Ahead: Yield-Bearing Stablecoins as Portfolio Pillars

The rapid ascent of yield-bearing stablecoins in 2025 is not just a fleeting trend, it reflects structural shifts in both crypto-native and institutional portfolio construction. With regulatory clarity improving after February 2025’s securities framework announcement (source), adoption barriers are falling fast. Conservative investors now have credible options like sDAI or PYUSD; those willing to embrace more complexity (and potential upside) can look toward USDe or crvUSD.

The next phase will likely see further convergence between traditional finance infrastructure and DeFi innovation, with protocols racing to offer both higher yields and greater transparency around risk management. As always, due diligence remains critical: scrutinize each protocol’s collateral composition, audit history, incentive structure, and governance before deploying significant capital.

If you’re building a diversified crypto portfolio this year, or simply seeking passive income without excessive exposure to market swings, these five stablecoins represent the sector’s best blend of safety, scalability, competitive APRs, and evolving community rewards. Stay alert for new integrations and protocol updates that could shift the landscape further as we close out 2025.