2025 Yield-Bearing Stablecoins Watchlist: reUSD deUSD yUSD fxUSD USDe APYs and Risks

In the dynamic world of DeFi, yield-bearing stablecoins stand out as a compelling option for investors chasing passive income in 2025. With the total market cap hitting $7.19 billion and daily volume at $56.18 million, these rebasing stables like reUSD, deUSD, yUSD, fxUSD, and USDe provide enough liquidity for treasury strategies, yet remain vigilant against the dominance of USDT and USDC. Recent depegging incidents remind us that higher yields come with sharper edges, demanding a balanced assessment of APYs and risks.

These tokens generate returns through diverse mechanisms, from delta-neutral trades to protocol revenues, but regulatory hurdles like the GENIUS Act’s restrictions on U. S. retail access add layers of complexity. As a portfolio strategist, I advocate starting with thorough due diligence, prioritizing protocols with transparent backing and audited contracts to safeguard capital while capturing yields.

reUSD: Reliable Yields from Reinsurance Strategies

Leading our 2025 watchlist, reUSD from Resupply USD currently trades at $0.9895, reflecting a minor 24h dip from its high of $0.9905. This yield-bearing stable offers a baseline APY of 6-12%, sourced from delta-neutral ETH basis trades or short-term U. S. Treasury bills. Its reinsurance-backed model appeals to those seeking real-world yield ties, making it a staple for diversified DeFi portfolios.

Yet, balance requires acknowledging the caveats. reUSD restricts U. S. persons, mandating KYC/AML checks, which aligns with broader regulatory pressures but limits accessibility. On Avalanche blockchain, it inherits smart contract risks, though its focus on market-neutral strategies mitigates volatility exposure. For investors outside restricted zones, reUSD embodies the sweet spot of yield and relative stability in the yield bearing stablecoins 2025 space.

Yield generation here hinges on disciplined execution; any basis trade disruptions could trim returns, but the Treasury fallback provides a safety net.

deUSD: A Stark Reminder of Depeg Risks

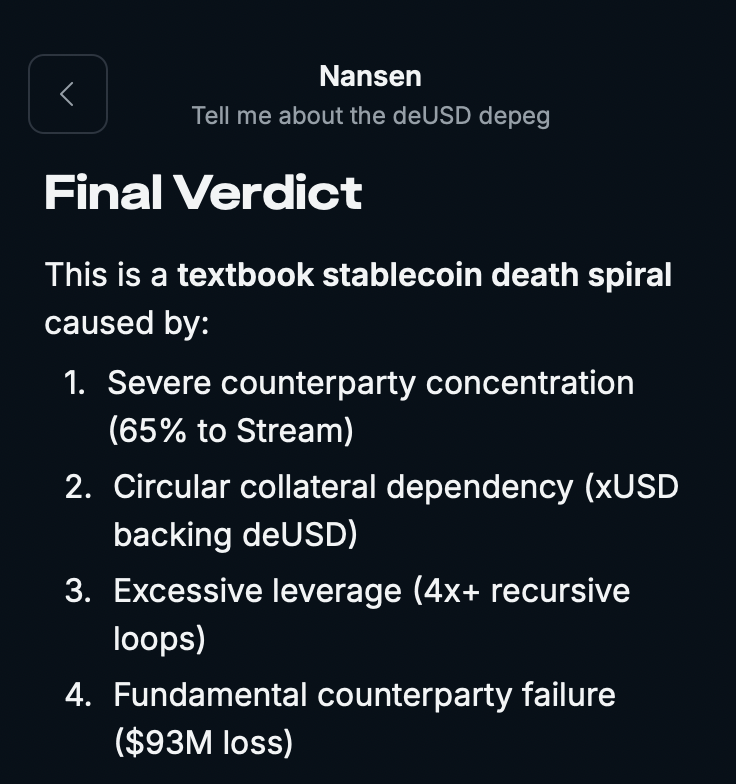

Elixir’s deUSD has captured attention for all the wrong reasons lately. Following a catastrophic depegging on November 6,2025, where it plunged to around $0.015 amid a $93 million loss at Stream Finance, its yield proposition hangs in uncertainty. Previously bolstered by DeFi collateral, the token now grapples with undercollateralization and halted redemptions, eroding trust in its deUSD yield potential.

This episode highlights collateral risks in yield-bearing designs. Mass withdrawals triggered a liquidity crisis, underscoring how interconnected DeFi protocols can amplify shocks. While it aimed to deliver competitive APYs through lending and staking, the fallout serves as a cautionary tale: always scrutinize reserve transparency and stress-test scenarios before allocating funds. In my view, deUSD demands a wide berth until redemption mechanisms stabilize and audits confirm solvency.

YieldFi’s yUSD presents fluctuating APYs, recently sliding to 8.73% amid market turbulence. Its sensitivity to conditions like collateral exposure to depegged assets such as USDX, coupled with reported outflows, flags liquidity concerns. For yUSD passive income seekers, it’s viable for short-term plays but warrants monitoring for sustained peg maintenance.

Contrast this with f(x) Protocol’s fxUSD, averaging 9.8% since inception via protocol revenue shares. This makes it a strong contender in the fxUSD risks debate, though lower liquidity versus majors could snag trades, and smart contract vulnerabilities loom in DeFi’s wild west. Interest rate shifts might nudge its price pre-maturity, rewarding yield curve savvy investors. Both tokens shine for those comfortable with moderate volatility, fitting neatly into hybrid portfolios blending stables with blue-chips.

reUSD Price Prediction 2026-2031

Yield-Bearing Stablecoin Peg Stability Outlook Amid DeFi Trends, Regulatory Risks, and Market Volatility

| Year | Minimum Price | Average Price | Maximum Price | YoY % Change (Avg from Prev) |

|---|---|---|---|---|

| 2026 | $0.97 | $0.995 | $1.02 | +0.5% |

| 2027 | $0.98 | $0.998 | $1.025 | +0.3% |

| 2028 | $0.985 | $1.000 | $1.030 | +0.2% |

| 2029 | $0.990 | $1.002 | $1.035 | +0.2% |

| 2030 | $0.995 | $1.005 | $1.040 | +0.3% |

| 2031 | $0.997 | $1.008 | $1.045 | +0.3% |

Price Prediction Summary

reUSD is forecasted to steadily recover toward its $1.00 peg, with average prices improving from $0.995 in 2026 to $1.008 by 2031. Minimums reflect bearish scenarios like regulatory crackdowns or depegging events, while maximums capture bullish DeFi adoption and yield premiums. Overall outlook is cautiously optimistic with tightening ranges indicating maturing stability.

Key Factors Affecting reUSD Price

- Regulatory Developments: GENIUS Act restrictions and global policies on yield-bearing stablecoins could pressure peg stability.

- DeFi Adoption Trends: Growth in Avalanche ecosystem and DeFi treasuries may drive demand and premium pricing.

- Competition from Peers: Rivalry with USDe, fxUSD, and traditional stablecoins like USDT/USDC impacts market share.

- Risk Management: Mitigation of smart contract vulnerabilities and collateral risks through audits and tech upgrades.

- Macroeconomic Factors: Interest rate shifts affecting basis trade yields and overall crypto market cycles.

- Market Cap Expansion: YBS sector growth from $7.19B could support reUSD liquidity if adoption accelerates.

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Across these, smart contract audits and on-chain transparency emerge as non-negotiables. As we dissect USDe next, remember: yields entice, but resilience endures.

Read more on post-depeg safest options at stablecoinflows.com analysis.

USDe: Ethena’s Resilient Synthetic Bet

Ethena’s USDe rounds out our watchlist, holding its peg through collateralized stablecoins and hedged cash-and-carry trades amid trade war swings. While exact APY figures fluctuate with funding rates, it positions itself as a USDe watchlist essential for those eyeing rebasing stables DeFi without fiat backing. This synthetic approach delivers yields from derivatives markets, appealing to yield hunters comfortable with basis trade intricacies.

Resilience defines USDe’s story so far, but don’t overlook the shadows. Its non-1: 1 fiat collateral introduces basis risk if perpetual futures diverge sharply from spot prices. Transparency lags with sparse reserve proofs and audits, fostering skepticism in a field scarred by depegs. Market volatility tested it recently, yet it endured; still, overreliance on hedging strategies could falter in prolonged bear phases. I rate USDe higher for experienced DeFi navigators, pairing it with traditional stables to buffer synthetic exposures.

2025 Yield-Bearing Stablecoins Watchlist: APYs, Backing Mechanisms, and Key Risks

| Stablecoin | APY | Backing Mechanism | Key Risks |

|---|---|---|---|

| reUSD | 6-12% | Delta-neutral ETH basis trades or short-term U.S. Treasury bills | Regulatory restrictions (not for U.S. persons; KYC/AML required), underlying asset/strategy risks, smart contract/platform risks (Avalanche blockchain) |

| deUSD | Uncertain (post-depeg) | DeFi collateral | Depegging to ~$0.015 (Nov 6, 2025), $93M collateral losses (Stream Finance), liquidity crisis & halted redemptions |

| yUSD | 8.73% (recent drop of 4.7%) | DeFi yields (YieldFi yToken) | Market volatility & APY fluctuations, collateral exposure (e.g., depegged assets like USDX), liquidity concerns & outflows |

| fxUSD | 9.8% (avg since launch) | Protocol revenue (f(x) Protocol) | Lower market liquidity, smart contract vulnerabilities, interest rate movements & yield curve sensitivity |

| USDe | Funding rate-based | Collateralized stablecoins + hedged cash-and-carry trades | Market volatility, synthetic nature (not 1:1 fiat-backed), transparency & audit concerns |

Zooming out, these five tokens illustrate the spectrum of opportunity and peril in yield-bearing stablecoins. reUSD’s reinsurance tilt offers tangible anchors at $0.9895, while deUSD’s implosion warns of collateral fragility. yUSD and fxUSD tempt with protocol-driven returns but demand liquidity vigilance, and USDe thrives on derivatives prowess yet courts opacity critiques.

Diversification remains my cornerstone advice. Allocate modestly across 2-3 from this list, never exceeding 10-15% of a stablecoin sleeve. Monitor TVL shifts and peg deviations weekly; tools like on-chain dashboards reveal stress signals early. For passive income chasers, blend with blue-chip yielders to temper DeFi’s tempests.

Regulatory winds, from GENIUS Act curbs to global scrutiny, further shape accessibility. Non-U. S. investors gain edges here, but evolving rules could reshape the landscape. Stay attuned via protocol discords and analytics platforms. Check deeper USDe insights here.

Ultimately, these yield bearing stablecoins 2025 reward the prepared. reUSD shines for reliability, fxUSD for revenue shares, yet all underscore that yield extracts a vigilance tax. Build portfolios that yield without yielding to fear, balancing APY allure against depeg demons for enduring gains.