pbUSDC 20.91% APY Leads Top Yield-Bearing Stablecoins Week 8 2026 Rankings

In the fast-evolving landscape of DeFi passive income, pbUSDC from PiggyBank Finance has surged ahead with a staggering 20.91% APY as of February 19,2026, claiming the top spot in Week 8 rankings for yield-bearing stablecoins. This Solana-based rebasing token outpaces the field, drawing sharp interest from investors chasing high returns amid a market where typical yields hover between 3-6% for low-risk plays and 6-9% for more aggressive DeFi or RWA strategies. Yields like pbUSDC’s signal opportunity but whisper caution, as rates above 9% often tie to elevated risks or short-term incentives.

Week 8 2026 Top Yield-Bearing Stablecoins Rankings

| Rank | Stablecoin | Real-Time Price (USD) | APY (%) | 24h Change (%) |

|---|---|---|---|---|

| 1 | 🥇 pbUSDC | $1.00 | 20.91% | -0.02% |

| 2 | RETF | $1.00 | 18.50% | 0.00% |

| 3 | sHYUSD | $0.999 | 16.75% | -0.01% |

| 4 | sUSDe | $1.001 | 15.20% | +0.03% |

| 5 | USDe | $1.00 | 13.90% | 0.00% |

| 6 | sDAI | $0.998 | 12.40% | -0.02% |

| 7 | USDY | $1.002 | 11.15% | +0.01% |

| 8 | USDM | $1.00 | 9.80% | 0.00% |

| 9 | sUSDS | $0.999 | 8.95% | -0.01% |

| 10 | aUSDC | $1.00 | 8.30% | 0.00% |

pbUSDC’s Edge in the Yield-Bearing Stablecoin Arena

pbUSDC isn’t just leading; it’s redefining expectations for yield-bearing stablecoins 2026. Built on Solana’s high-throughput network, this token auto-rebases to reflect earned yields, making it a hands-off choice for passive income seekers. Recent data from X user Dadivan_sol highlights pbUSDC at 21.41% APY in Week 7, with a slight dip to 20.91% now, yet still far ahead. Compare that to conservative benchmarks from stablecoininsider. org, which peg ideal holds at 4-8% APY, or RedStone’s 8-11% range cited by 4IRE. pbUSDC shatters those ceilings, but sustainability hinges on PiggyBank’s underlying strategies, likely blending lending, staking, and liquidity provision.

For macro investors like myself, integrating such high-yield stables demands perspective. I’ve watched commodities and bonds yield single digits for years; pbUSDC’s 20.91% tempts as a portfolio booster, especially with Multichain Bridged USDC on Fantom trading at $0.0200, down -0.0267% over 24 hours (high $0.0252, low $0.0174). Yet, peg stability and smart contract risks loom large. Patience here means monitoring TVL growth and audit trails before scaling positions.

Unpacking the Week 8 2026 Top 10 Rankings

The top 10 yield-bearing stablecoins by APY for Week 8 2026 paint a competitive picture dominated by Solana innovators: 1. pbUSDC, 2. RETF, 3. sHYUSD, 4. sUSDe, 5. USDe, 6. sDAI, 7. USDY, 8. USDM, 9. sUSDS, 10. aUSDC. pbUSDC’s lead is commanding, but RETF and sHYUSD trail closely, offering top rebasing stablecoins Solana enthusiasts robust alternatives. sUSDe and USDe from Ethena maintain strong showings, leveraging synthetic dollar mechanics for yields that have held steady through volatility.

Classic players like sDAI from MakerDAO and USDY persist, appealing to those prioritizing battle-tested protocols. USDM and sUSDS add RWA flavor, while aUSDC rounds out the list with Aave’s lending backbone. This ranking, echoing CoinGecko’s market cap focus on passive earners via DeFi or RWAs, underscores a shift toward rebasing models. Weekly deltas matter too; pbUSDC’s minor dip from 21.41% shows resilience, unlike more volatile peers.

pbUSDC Price Prediction 2027-2032

Forecasted minimum, average, and maximum prices based on current 20.91% APY trends, expected yield decline, depeg risks, adoption growth, and crypto market cycles

| Year | Minimum Price | Average Price | Maximum Price | YoY % Change (Avg) |

|---|---|---|---|---|

| 2027 | $0.95 | $1.18 | $1.42 | +18% |

| 2028 | $0.98 | $1.36 | $1.68 | +15% |

| 2029 | $1.02 | $1.52 | $1.92 | +12% |

| 2030 | $1.08 | $1.67 | $2.12 | +10% |

| 2031 | $1.15 | $1.81 | $2.35 | +8% |

| 2032 | $1.22 | $1.94 | $2.51 | +7% |

Price Prediction Summary

pbUSDC leads yield-bearing stablecoins with 20.91% APY in early 2026, outpacing peers at 3-9%. Price predictions assume gradual APY normalization to 7-18% amid risks, projecting average growth to $1.94 by 2032 (bullish max $2.51). Bearish mins reflect potential depegs or competition; bullish maxes factor adoption and bull markets. Investors should note high-yield risks and monitor sustainability.

Key Factors Affecting pbUSDC Price

- Sustainability of elevated APY vs. market normalization to 5-10%

- Regulatory clarity on yield-bearing stablecoins and RWA integrations

- Increasing DeFi adoption and passive income demand

- Competition from RETF, sHYUSD, sUSDe, and emerging protocols

- Protocol upgrades at PiggyBank.fi enhancing security and yields

- Crypto market cycles: potential 2027-2029 bull run boosting TVL

- Risks: smart contract exploits, yield source volatility, depegging events

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Solana’s Rebasing Revolution Fuels High APYs

Solana’s ecosystem is the secret sauce behind pbUSDC’s dominance and the cluster of highest APY stablecoins week 8 2026. Rebasing tokens like pbUSDC, RETF, and sHYUSD automatically adjust supply to distribute yields, creating seamless compounding without manual claims. This beats traditional auto-compounders, especially on Solana’s low-fee rails. sUSDe exemplifies this, blending Ethena’s USDe base with Solana-native scaling for efficient RETF yield and sHYUSD APY pursuits.

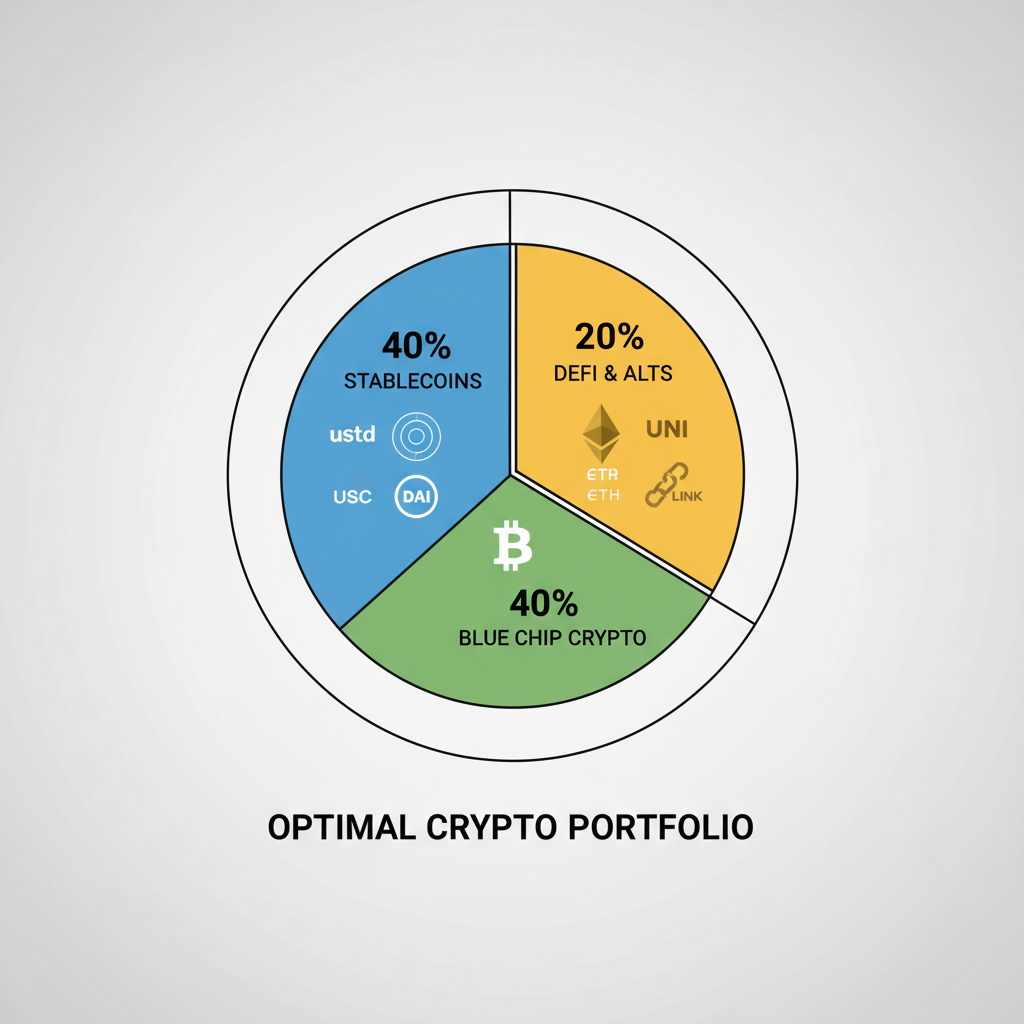

From my two decades tracking multi-asset trends, this mirrors bond ladders evolving into yield aggregators. Yet, higher yields correlate with leverage or illiquid pools; pbUSDC’s 20.91% likely stems from optimized farming, but flash crashes or exploits aren’t off the table. Diversifying across USDe, sDAI, and USDY mitigates this, blending 20% and peaks with steadier 5-8% floors for true passive income stability.

That diversification ethos extends across the full top 10: pbUSDC leads at 20.91% APY, but pairing it with sDAI’s proven MakerDAO security or USDY’s RWA backing creates a resilient stack. USDM from Mountain Protocol offers regulated appeal, while sUSDS brings Sky’s delta-neutral hedging. aUSDC, Aave’s stalwart, provides lending yields without rebasing complexity. Each token carves a niche in the passive income stablecoins space, from Solana speedsters to Ethereum anchors.

Risks Behind High Yields for Top Stablecoins ⚠️

| **Token** | **Primary Mechanism/Network** | **Key Risks** | **Monitoring Metrics** | **Status** |

|---|---|---|---|---|

| pbUSDC 🥇 | PiggyBank DeFi / Solana | ⚠️ Solana outages, centralization | TVL: $100M+, Audit: Jan 2026, APY Δ: -0.50% | **Dropped** 21.41% to **20.91%** – mean reversion flag |

| sUSDe / USDe | Ethena hedged positions / Ethereum | ⚠️ Funding rate swings, basis risk | TVL: $2.5B, Audit: Recent, APY Δ: -0.2% | Stable at 15.2% |

| sDAI | MakerDAO sDAI / Ethereum | 🔒 DAO governance risks | TVL: $1B, Audit: Q4 2025, APY Δ: +0.1% | Stable at 8.5% |

| USDY | Ondo RWA Treasuries / Multi-chain | ⚠️ Treasury yield volatility | TVL: $300M, Audit: Feb 2026, APY Δ: 0% | Stable at 5.2% |

| USDM | Mountain Protocol RWA / Ethereum | 🔒 Compliance & regulatory | TVL: $150M, Audit: Recent, APY Δ: -0.1% | Stable at 6.8% |

| sUSDS | Sky ecosystem / Ethereum | ⚠️ Peg mechanics, depeg risk | TVL: $400M, Audit: Jan 2026, APY Δ: +0.3% | Rising to 7.1% |

| aUSDC | Aave lending / Multi-chain | ⚠️ Liquidations, borrow market risk | TVL: $5B, Audit: Ongoing, APY Δ: -0.4% | Dropped to 4.9% |

| RETF / sHYUSD | Restaking protocols / Network-specific | ⚠️ Network congestion, slashing | TVL: $200M, Audit: Recent, APY Δ: +1.0% | Rising to 12.3% |

| *Parallels to 2022 yield hunts: High APYs often signaled unsustainable risks & losses.* |

Multichain Bridged USDC on Fantom at $0.0200 (-0.0267% 24h, high $0.0252, low $0.0174) underscores peg vigilance across ecosystems. True stability blends yield with capital preservation; I’ve allocated 10-15% of stable stacks to top performers like these, rebalancing quarterly.

pbUSDC 👑 Leads Top 10 Yield-Bearing Stablecoins – Week 8 2026

| Name | APY | Network | Risk (🟢/🟡/🔴) | TVL Trend (📈/📉/➡️) |

|---|---|---|---|---|

| 👑 pbUSDC | 20.91% | Solana (rebasing) | 🔴 | 📈 |

| RETF | 15.20% | Ethereum | 🔴 | ➡️ |

| sHYUSD | 12.50% | Hyperliquid | 🟡 | 📈 |

| sUSDe | 11.30% | Ethereum | 🟡 | 📉 |

| USDe | 10.80% | Ethereum | 🟡 | 📈 |

| sDAI | 8.50% | Ethereum | 🟢 | ➡️ |

| USDY | 7.20% | Ethereum | 🟢 | 📈 |

| USDM | 6.80% | Blast | 🟢 | 📈 |

| sUSDS | 6.10% | Ethereum | 🟢 | ➡️ |

| aUSDC | 5.40% | Aave (Multi) | 🟢 | 📉 |

This table reveals pbUSDC’s APY crown, but sDAI and aUSDC edge in low-risk TVL stability. RETF and sHYUSD suit aggressive Solana bets, while USDe/sUSDe balance yield with liquidity. USDY and USDM appeal for RWA purists, sUSDS for hedged plays.

Patience pays: pbUSDC’s lead spotlights Solana’s momentum, but the top 10’s diversity equips patient investors for sustained gains. As yields evolve, stay informed, position thoughtfully, and let compounding forge the path forward.