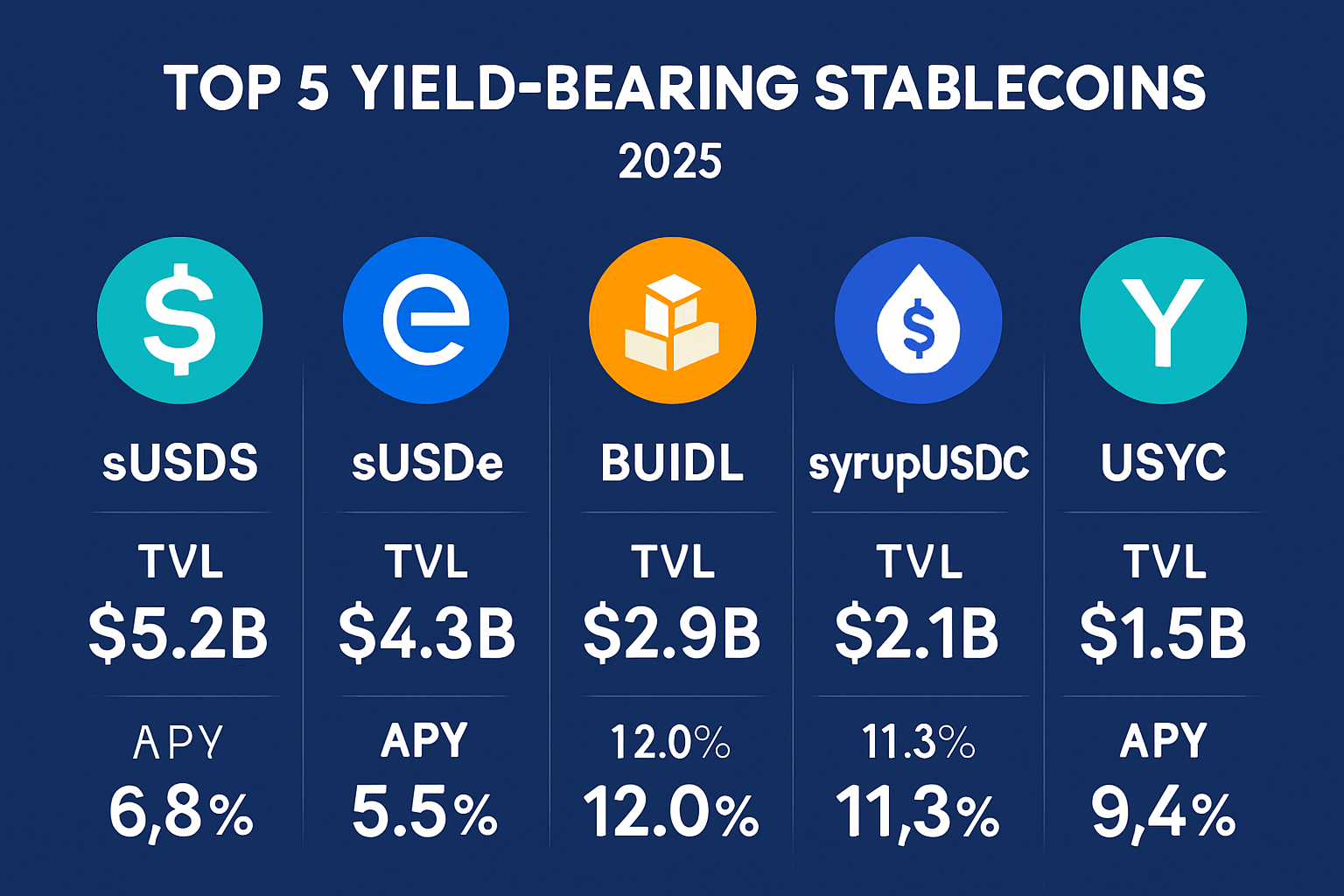

2025 Top 5 Yield-Bearing Stablecoins by TVL: sUSDS sUSDe BUIDL syrupUSDC USYC APY Comparison

In the dynamic landscape of 2025 DeFi, yield-bearing stablecoins stand out as essential tools for generating passive income without sacrificing principal stability. These rebasing assets automatically accrue yields, turning idle capital into productive holdings backed by treasuries, lending protocols, and sophisticated strategies. Our analysis spotlights the top 5 yield-bearing stablecoins by TVL 2025: sUSDe, sUSDS, syrupUSDC, BUIDL, and USYC. With TVLs reflecting institutional trust and APYs offering competitive returns, they redefine low-risk yield farming for crypto investors.

Market data underscores this shift. USD stablecoin issuers parked roughly $155 billion in T-bills by late October 2025, per S and P Global, powering yields that outpace traditional savings. Yet, as Federal Reserve research highlights, these flows influence short-term Treasury rates, blending crypto innovation with global finance. Yield-bearing stablecoins like sUSDS and sUSDe lead by TVL, while syrupUSDC shines in returns, alongside BUIDL’s tokenized treasuries and USYC’s specialized approach.

How Yield Mechanisms Define Top Performers

Each stablecoin’s yield source shapes its risk-return profile. sUSDe, a staked version of Ethena’s USDe, derives APY from delta-neutral strategies involving perpetuals and funding rates. Current data pegs its APY at 5.23% amid yield compression that halved TVL earlier this year, yet its $50.05 billion TVL signals resilience. sUSDS from Sky Lending markets borrower repayments into a steady 4.5% APY across $36.01 billion locked, ideal for conservative stacking. syrupUSDC taps Maple Finance’s institutional credit pools for a robust 7.07% APY on $27.4 billion TVL, prioritizing premium lending over speculation.

Stablecoin issuers held about $155 billion in T-bills by the end of October 2025 (S and P Global).

BUIDL, BlackRock’s on-chain treasury fund, mirrors money market yields through direct T-bill exposure, appealing to institutions seeking regulatory clarity. USYC complements this with focused yield optimization, often blending real-world assets for enhanced returns among the best rebasing stables 2025. These mechanisms balance accessibility with sustainability, though risks like funding rate flips or credit defaults loom, echoing Bank Policy Institute warnings on systemic parallels to 2008 money funds.

TVL and APY Face-Off: Data-Driven Insights

TVL crowns market leaders, but APY dictates income potential. sUSDe dominates scale at $50.05 billion, suiting liquidity seekers despite modest 5.23% APY. sUSDS follows closely with $36.01 billion and 4.5% yield, favored for Sky’s battle-tested lending. syrupUSDC punches above its $27.4 billion TVL with 7.07% APY, making it a syrupUSDC returns standout for yield maximizers. BUIDL gains traction via tokenized security, while USYC carves a niche in high-conviction plays, rounding out the top 5.

Explore sUSDe vs sUSDS yield details here for deeper protocol contrasts.

2025 Top 5 Yield-Bearing Stablecoins by TVL: APY Comparison

| # | Stablecoin | TVL | APY | Key Yield Source |

|---|---|---|---|---|

| 1 | 🦋 sUSDe | $50.05B | 5.23% | Funding rates and basis |

| 2 | ☁️ sUSDS | $36.01B | 4.5% | Lending pools |

| 3 | 🍁 syrupUSDC | $27.4B | 7.07% | Institutional credit |

| 4 | 🏛️ BUIDL | Significant growth | ~Treasury rates | Tokenized T-bills |

| 5 | 📈 USYC | Rising TVL | Competitive | RWA optimization |

This ranking highlights trade-offs: chase syrupUSDC’s higher sUSDe APY alternative or anchor with sUSDS stability. As sUSDS yield and USYC TVL evolve, investors must weigh protocol risks against passive gains. BUIDL’s institutional backing adds a compliance edge, positioning it as a bridge to TradFi yields in DeFi.

Delving deeper, sUSDe’s basis trade model captures spreads but exposes users to perp market volatility, as seen in The Block’s report on its TVL swings. Contrast this with syrupUSDC’s vetted borrowers, yielding steadier payouts for BUIDL stablecoin alternatives.

BUIDL exemplifies this evolution, tokenizing BlackRock’s treasury management into a blockchain-native fund. Its TVL reflects rapid institutional adoption, driven by yields tracking short-term T-bill rates around 4-5%, minus fees. This setup minimizes smart contract risks while delivering BUIDL stablecoin predictability, making it a cornerstone for top stablecoins by TVL 2025. USYC, meanwhile, leverages real-world asset (RWA) strategies, optimizing yields through structured credit and tokenized securities. With rising TVL, it offers competitive APYs often exceeding 6%, appealing to those blending DeFi with traditional finance exposure.

Risks and Sustainability in Yield Generation

Behind the allure of these yield bearing stablecoins 2025, sustainability hinges on yield sources. sUSDe’s reliance on perpetual funding rates, as noted in yield compression reports, introduces volatility; rates dipped from double digits to 5.23%, triggering TVL fluctuations. sUSDS counters with diversified lending pools, where borrower overcollateralization buffers defaults, sustaining 4.5% APY. syrupUSDC’s institutional-grade vetting via Maple Finance yields steadier 7.07% returns, though credit risk persists in private markets.

BUIDL sidesteps much DeFi complexity by mirroring regulated treasuries, yet faces custody and oracle dependencies. USYC’s RWA focus amplifies yields but ties performance to off-chain asset quality, underscoring the need for due diligence. Federal Reserve studies link stablecoin inflows to Treasury yield suppression, hinting at macroeconomic ripple effects, while Bank Policy Institute cautions against interest-paying stables amplifying crises like 2008 money funds. Investors should prioritize audited reserves, transparent mechanics, and liquidity for redemptions.

Protocols like Pendle or Ondo enhance these bases through yield tokenization, but our top 5 prioritize core stability. For instance, stacking sUSDS in Sky’s ecosystem unlocks composability, while syrupUSDC integrates seamlessly into lending vaults for compounded gains.

Choosing Your Stack: Protocol Matchups

Match your risk tolerance to the lineup. Conservative portfolios favor sUSDS or BUIDL for ballast, with 4.5% and treasury-aligned yields shielding against perp squeezes plaguing sUSDe. Yield chasers eye syrupUSDC’s 7.07% edge or USYC’s RWA upside, balancing higher returns with vetted exposures. This breakdown of top yield-bearing stablecoins by TVL and APY reveals sUSDe’s liquidity premium versus syrupUSDC’s income punch.

| Stablecoin | Risk Level | Best For | 2025 Outlook |

|---|---|---|---|

| sUSDe | Medium | Liquidity and Scale | TVL Recovery Post-Compression |

| sUSDS | Low | Steady Lending | Institutional Growth |

| syrupUSDC | Medium-Low | High APY | Credit Pool Expansion |

| BUIDL | Low | TradFi Bridge | Regulatory Tailwinds |

| USYC | Medium | RWA Yields | Asset Tokenization Boom |

These best rebasing stables 2025 transform DeFi from speculative plays into income engines. As TVLs swell, sUSDe at $50.05 billion, sUSDS at $36.01 billion, syrupUSDC at $27.4 billion, institutional inflows signal maturity. Diversify across them to capture varied yields, monitor APY drifts, and stay attuned to regulatory shifts shaping stablecoin economics.

Ethena, Sky, and Maple’s innovations, paired with BlackRock’s BUIDL and USYC’s niche, position yield-bearing stables as 2025’s passive income leaders. Track sUSDS yield, sUSDe APY, and syrupUSDC returns closely; small edges compound over time in this treasury-fueled arena.