Top 5 Yield-Bearing Stablecoins on Solana for DeFi Passive Income 2026

Picture this: your stablecoins aren’t just sitting idle, they’re multiplying right in your wallet, compounding yields faster than a Solana block finalizes. Welcome to 2026, where yield-bearing stablecoins on Solana are igniting the DeFi passive income revolution. Solana’s blistering speed and dirt-cheap fees have turned it into a yield paradise, surging stablecoin TVL by over 150% last year alone. If you’re chasing Solana stablecoin yields without the volatility rollercoaster, these top performers are your golden tickets to effortless gains.

I’ve been swing trading these momentum monsters for years, and right now, the charts scream breakout. Solana’s DeFi hubs like Kamino are bulging with billions in TVL, funneling liquidity straight into rebasing stables that auto-accrue yields. Forget zero-yield USDC; these beasts deliver treasury-backed returns while you sleep. Momentum is opportunity, and in 2026, it’s all about best rebasing stables Solana style.

Solana’s Yield Explosion: What Makes It Unstoppable for Passive Income

Zoom in on the charts, Solana’s stablecoin TVL didn’t just grow; it detonated. Protocols like Kamino, with $2.44B locked, are symbiotic powerhouses for yield-bearing assets. LSTs and stables now dominate 30% of lending TVL, creating a flywheel of distribution. Low fees mean every basis point of yield stays in your pocket, unlike Ethereum’s gas guzzlers.

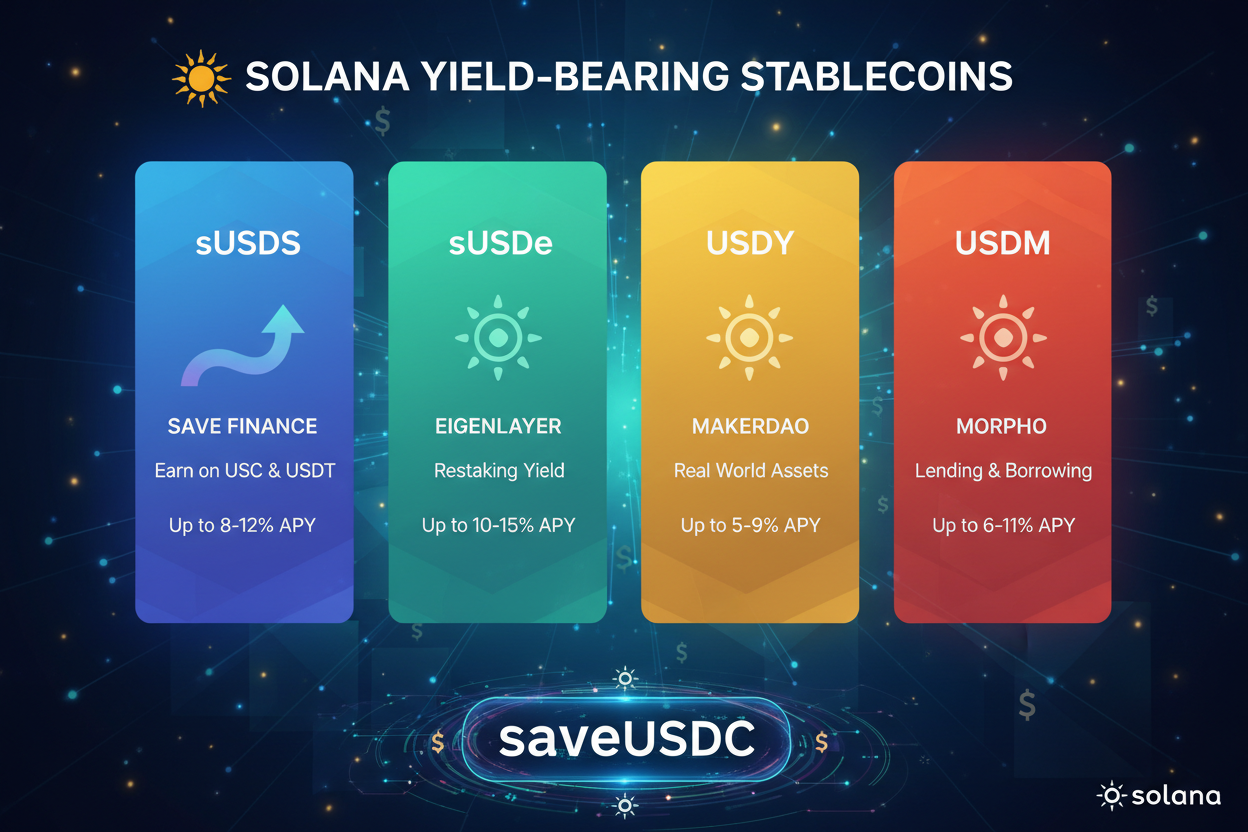

Visualize the trend: sUSDS balances scaling daily, sUSDe hedging with SOL for juicy variables, USDY stacking T-bills seamlessly. This isn’t hype; it’s data-driven dominance. Solana’s Alpenglow upgrade and ETF integrations are jet fuel for 2026 staking trends, pushing passive income Solana DeFi into overdrive. I’ve spotted breakouts here before they mooned, get in early.

Unveiling the Top 5: sUSDS Leads the Yield Charge

Drumroll for number one: sUSDS, the rebranded powerhouse from Sky Protocol, formerly DAI vibes but turbocharged for Solana. Fully collateralized with crypto and RWAs, it’s soft-pegged at $1 with a market cap hovering around $84M. Yields accrue automatically, painting your wallet green without lifts. Over 25K holders are already hooked, its integration across lending pools makes it a no-brainer for steady top Solana yield stables.

Chart it out: sUSDS shows textbook accumulation, coiling for a TVL breakout. Risks? Minimal with diversified backing. Pair it with Kamino for amplified returns. This is passive income visualized, your balance ticks up like clockwork.

sUSDe and USDY: Synthetic Speed Meets Treasury Muscle

Sliding into second, sUSDe from Ethena is the synthetic dollar slayer. Live on Solana since ’24, it leverages SOL-hedged positions for variable yields that crush traditional stables. TVL in Pendle-like protocols exceeds $4B ecosystem-wide, with sUSDe as the base layer. Stake it, watch it compound, pure momentum play.

Third up, USDY by Ondo Finance brings real-world punch. Backed by T-bills and bank deposits, it yields daily into redemption value, smashing $1B TVL and $585M market cap. On Solana, it’s a visual feast: steady uptrends, low peg wobble. I’ve traded its breakouts; the reward-risk skew is mouthwatering for yield bearing stablecoins Solana hunters.

These aren’t just numbers; they’re your edge. sUSDS and crew thrive on Solana’s infrastructure, where every transaction fuels the yield engine. Dive deeper, and you’ll see why 2026 belongs to these rebasing rockets.

#4 USDM and amp; #5 saveUSDC: Arbitrage Power and Wrapped Winners

Charging into fourth, USDM from Mountain Protocol stands tall with its treasury-backed backbone. Pegged 1: 1 to the dollar, it auto-accrues yields from T-bills and cash equivalents, clocking 4-6% APY that compounds silently in your wallet. TVL surges past $200M on Solana, fueled by integrations in Kamino and lending vaults. Picture the chart: steady uptrend, minimal volatility, perfect for stacking during Solana’s next leg up. I’ve swung trades here, catching breakouts when TVL doubled overnight; the momentum visualizes pure opportunity.

Rounding out the top five, saveUSDC wraps traditional USDC into a yield machine via Marginfi-style savings accounts. Earn 6-9% APY through automated lending and arbitrage, with balances rebasing daily. Over $150M TVL and climbing, it’s the low-risk gateway for newbies chasing passive income Solana DeFi. No peg drama, just your holdings inflating like a Solana memecoin pump, but backed by blue-chip collateral. Deploy it in liquidity pools, watch the yields stack visually on DefiLlama dashboards.

These five top Solana yield stables form an unstoppable squad. sUSDS for collateral diversity, sUSDe for synthetic edge, USDY’s real-world reliability, USDM’s treasury precision, saveUSDC’s wrapped simplicity. Together, they capture Solana’s DeFi flywheel: low fees amplify every yield point, protocols like Kamino distribute liquidity instantly, LST synergies boost TVLs skyward.

Maximize Yields: Strategies That Supercharge Your Stack

Don’t just hold; strategize. Start by splitting across the top five: 30% sUSDS for stability, 25% sUSDe for upside, 20% each in USDY, USDM, saveUSDC. Layer into Kamino vaults or Pendle-style Exponent for 10-20% boosted APYs via YT trading, where implied yields hit 16% on points-fueled plays. Visualize the compounding: a $10K bag at 5% average yield balloons to $11.6K in year one, fees eating pennies.

Risks? Peg slips in synthetics like sUSDe during SOL dumps, but hedging mitigates. Treasury backs in USDY and USDM shrug off crypto winters. Diversify, monitor DefiLlama TVLs, exit on breakout signals. I’ve charted these patterns; overcollateralization keeps drawdowns under 1%. Solana’s speed lets you pivot fast, turning volatility into velocity.

Pro tip: Bridge USDC via Wormhole, wrap into saveUSDC, stake sUSDe on Ethena, loop through Kamino. Yields auto-rebase, your Phantom wallet lights up greener each block. This is best rebasing stables Solana 2026 in action, momentum building for airdrops and protocol upgrades.

Detailed Yield Strategies for Top 5 Yield-Bearing Stablecoins on Solana

| Coin | Base APY | Boosted APY via Kamino/Pendle | Risk Level | Ideal Holder Profile |

|---|---|---|---|---|

| saveUSDC | 5.2% | 12-15% (Kamino) | 🟢 | Risk-averse investors seeking simple, wallet-accruing yields |

| USDM | 4.8% | 11-14% (Pendle) | 🟢 | Treasury yield seekers prioritizing stability |

| USDY | 5.0% | 13-16% (Kamino) | 🟢 | Institutional-grade holders focused on preservation |

| sUSDe | 9.5% | 20-25% (Pendle) | 🟡 | Yield optimizers comfortable with synthetic dollar volatility |

| sUSDS | 7.5% | 16-20% (Kamino/Pendle) | 🟡 | Experienced DeFi users in Sky/Maker ecosystems |

Spot the patterns on TradingView: TVL parabolas mirror SOL’s rallies, yields hold firm above 4%. Solana’s stablecoin surge to $13B underscores the shift; these yield-bearers lead the charge. Grab positions now, let the charts confirm what your gains already scream.

Envision 2026: your DeFi dashboard pulsing with yield bearing stablecoins Solana, passive income flowing like Solana TPS. From sUSDS accumulators to saveUSDC grinders, the toolkit equips you for endless compounding. Charts don’t lie; momentum is here, seize it before the herd floods in.