Yield Bearing Stablecoins Tier List 2026: USDe USDS USDY Top Picks for Risk-Adjusted Returns

In the fast-evolving DeFi landscape of 2026, yield-bearing stablecoins stand out as the smart choice for investors chasing reliable passive income without the wild swings of traditional crypto. Titles like yield bearing stablecoins 2026 dominate searches because protocols such as USDe, USDS, and USDY deliver compelling risk-adjusted returns, blending stability with yields that traditional savings accounts can only dream of. Our tier list ranks the top seven, USDe, USDS, USDY, sDAI, USDM, USD0, and sUSDe, based on APY potential, backing mechanisms, TVL growth, and resilience amid regulatory shifts.

These assets aren’t just holding peg; they’re actively compounding value. USDS trades steadily at $1.00, with a 24-hour range from $0.9986 to $1.00, while USDY hovers at $1.10, reflecting its treasury-backed premium. This tier list cuts through the noise, prioritizing protocols that balance high yields with low depeg risk.

S-Tier: USDe, USDS, and USDY Lead the Pack

At the pinnacle sit USDe from Ethena Labs, USDS from Sky Protocol, and USDY from Ondo Finance. These S-tier picks excel in risk-adjusted yields, drawing billions in TVL. USDe’s delta-neutral strategy, hedging long crypto collateral with short perpetual futures, delivers around 13.78% APY without overcollateralization, hitting $12 billion market cap by late 2025. It’s a yield innovator that institutions love for its efficiency.

USDe has gained prominence by employing a delta-neutral strategy, offsetting crypto volatility through short positions in perpetual futures.

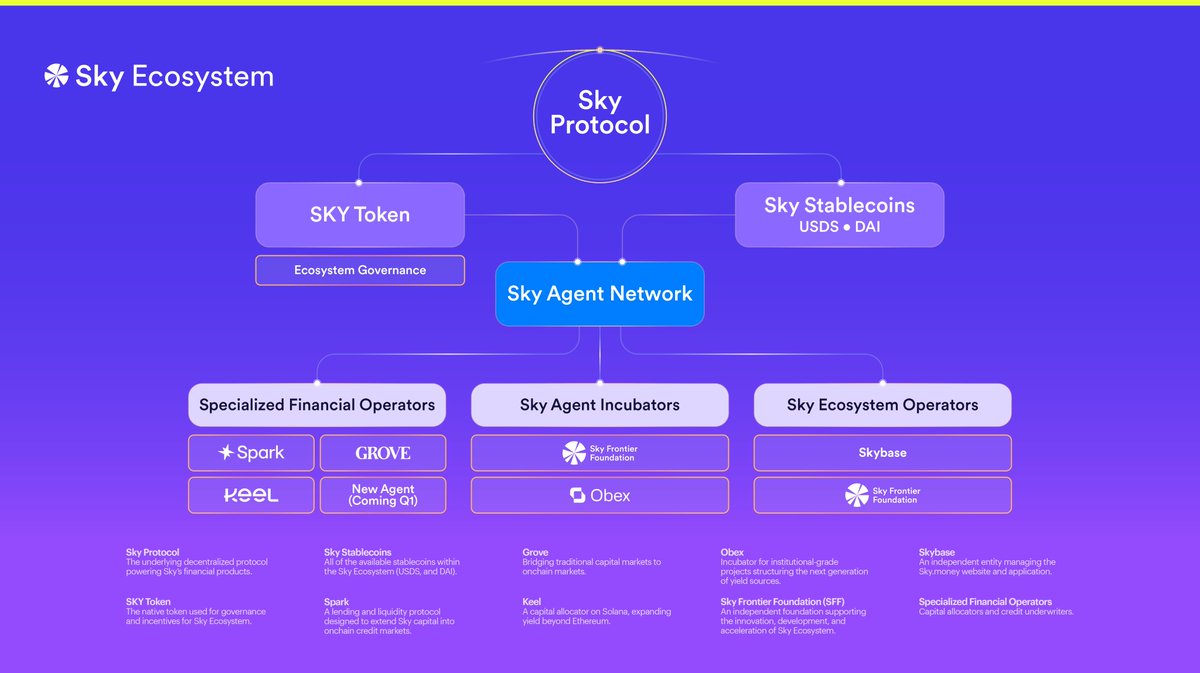

USDS, Sky’s flagship, powers the largest decentralized yield-bearer via its Sky Savings Rate (SSR) at 4.00%, with sUSDS supply nearing $4.90 billion. Deposit USDS to earn compounding sUSDS, perfect for hands-off income. Meanwhile, USDY tokenizes U. S. Treasuries and bank deposits for a steady 4.65% APY, paid monthly to non-U. S. investors despite a 40-day lockup. Its $1.10 price underscores the yield accrual baked in.

Why These Top the Risk-Adjusted Charts

Risk-adjusted returns hinge on more than raw APY; consider backing, liquidity, and macro resilience. USDe shines in volatile markets thanks to arbitrage across exchanges, but watch funding rate risks. USDS leverages Sky’s mature ecosystem, minimizing smart contract vulnerabilities post its 2024 launch. USDY’s TradFi anchor, short-term Treasuries, offers the lowest volatility, ideal for conservative portfolios chasing USDY treasuries exposure.

The U. S. GENIUS Act of 2025 bolsters confidence, enforcing 1: 1 safe asset backing and Fed oversight, though no FDIC protection lingers as a gap. Amid this, S-tier assets like these maintain pegs effortlessly: USDS at a rock-solid $1.00, USDY’s premium signaling trust.

Ethena USDe (USDe) Price Prediction 2027-2032

Forecasts for the leading yield-bearing stablecoin, accounting for peg stability, yield premiums, adoption trends, regulatory factors, and market cycle risks

| Year | Minimum Price | Average Price | Maximum Price | YoY % Change (Avg) |

|---|---|---|---|---|

| 2027 | $0.97 | $1.01 | $1.06 | +1.0% |

| 2028 | $0.98 | $1.03 | $1.08 | +2.0% |

| 2029 | $0.98 | $1.05 | $1.11 | +2.0% |

| 2030 | $0.99 | $1.07 | $1.14 | +2.0% |

| 2031 | $0.99 | $1.10 | $1.17 | +2.8% |

| 2032 | $1.00 | $1.13 | $1.21 | +2.7% |

Price Prediction Summary

USDe is projected to hold strong price stability near $1.00 with a modest upward trajectory in average prices due to growing investor confidence, yield premiums from its delta-neutral strategy (12-15% APY baseline), and institutional adoption. Minimum prices reflect bearish depeg risks during volatility, while maximums capture bullish scenarios of premium trading amid DeFi expansion. Overall bullish outlook with improving risk profile through 2032.

Key Factors Affecting Ethena USDe Price

- Rising TVL and institutional adoption driving demand and slight yield premiums

- Regulatory clarity from U.S. GENIUS Act and global frameworks reducing depeg risks

- Technological enhancements in delta-hedging and arbitrage for sustained high APYs

- Intensifying competition from USDS (4-6% APY) and USDY (4.5-5.5% APY)

- Crypto market cycles impacting hedging efficacy and short-term volatility

- Broader onchain yield trends and tokenized asset growth boosting utility

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

A-Tier Contenders: sDAI, USDM, USD0, and sUSDe Step Up

Dropping to A-tier, sDAI from MakerDAO remains a rebasing classic, auto-compounding DAI yields via trusted DeFi strategies. It’s battle-tested for sDAI vs USDe debates, offering 5-7% APY with overcollateralized security. USDM from Mountain Protocol mirrors USDY’s treasury focus but with broader access, yielding steadily around 4-5%.

USD0 emerges as a dark horse, blending liquidity and yield through optimized lending pools, while sUSDe, Ethena’s staked variant, amps up USDe rewards for liquidity providers. These hold strong for diversified bags, especially in best rebasing stablecoins hunts. Check our detailed TVL and APY breakdown for deeper stats.

Transitioning from S to A-tier reveals nuanced trade-offs: sDAI prioritizes decentralization, USDM regulatory nods. All peg near $1.00, but USDY’s $1.10 edge highlights yield visibility.

These A-tier options shine for investors blending DeFi purity with yield stability. sDAI auto-rebases your balance as Maker’s vaults harvest fees and lending rewards, a staple in stablecoin tier list discussions for its transparency. USDM, backed by tokenized Treasuries, appeals to those eyeing Mountain Protocol’s compliance edge, delivering consistent 4-5% without the lockups plaguing USDY. USD0, from a rising liquidity protocol, optimizes across chains for frictionless yields around 5%, while sUSDe supercharges base USDe by staking for extra incentives, pushing effective APYs toward 15% in bull runs.

Tier Breakdown: Risks, Rewards, and Real-World Fit

Navigating risk adjusted stablecoin yields means weighing each protocol’s Achilles’ heel. USDe’s futures hedging dazzles with high USDe yield but courts funding rate flips in prolonged bear markets; I’ve seen it dip briefly during 2025 volatility, yet rebound swiftly. USDS counters with Sky’s battle-hardened governance, its USDS savings rate at 4% feeling like a safe harbor, especially as sUSDS TVL swells past $4.9 billion. USDY prioritizes capital preservation via TradFi assets, but that 40-day lockup and non-U. S. restriction narrow its appeal, perfect for offshore HNWIs, less so for retail traders.

Top 7 Yield-Bearing Stablecoins Comparison (2026 Tier List)

| Name | APY Range | Backing Type | TVL (est.) | Peg Stability | Risks |

|---|---|---|---|---|---|

| 🥇 USDe (Ethena) | 10-18% | Delta-neutral (crypto collateral + perp futures) | $6B+ | Strong (∼$1.00) ✅ | Funding rate dependency, liquidation risk, volatility |

| 🥈 USDS (Sky) | 3.5-5% | Actively managed (Sky Savings Rate) | $5.8B | $1.00 (±0.14%) ✅✅ | Governance risk, market contraction, smart contract |

| 🥉 USDY (Ondo) | 4-5% | US Treasuries + bank deposits (1:1) | $2B | $1.10 (1.07-1.12) ⚠️ | Regulatory (non-US only), 40-day lock-up, yield variance |

| sDAI (Sky) | 4-7% | Yield-bearing DAI (overcollateralized) | $1.5B | Stable to DAI (~$1.00) ✅ | Smart contract, DAI depeg contagion |

| USDM (Mountain) | 4-6% | Short-term Treasury bills | $800M | Strong (~$1.00) ✅ | Custodial risk, RWA counterparty |

| USD0 | 5-8% | RWA-backed (multi-asset) | $500M | Good (~$1.00) ✅ | Protocol maturity, liquidity |

| sUSDe (Ethena) | 12-20% | Liquid staked USDe | $2B | Strong (∼$1.00) ✅ | Compounding + USDe risks (funding, liquidation) |

sDAI edges USDe in purist DeFi circles for its overcollateralized ethos, dodging counterparty risks inherent in Ethena’s derivatives play. USDM and USD0 offer middle-ground liquidity, with USD0’s multi-chain bridging minimizing gas wars. sUSDe rounds out the pack, rewarding loyalty to Ethena’s ecosystem but amplifying base exposures. All hover near $1.00 pegs, USDS locked at $1.00, USDY’s $1.10 premium a yield telltale, proving resilience post-GENIUS Act scrutiny.

Portfolio construction favors diversification: allocate 40% to S-tier for growth, 60% A-tier for ballast. In 2026’s rate-cut cycle, expect USDe yield to compress toward 10-12% while treasury plays like USDY and USDM hold 4.5% floors. I’ve modeled scenarios where mixing sDAI’s rebasing with USDS SSR crushes plain stables by 300bps annually, net of fees.

Regulatory tailwinds persist, but smart contract audits and insurance funds remain key differentiators. USDe and sUSDe lead in innovation, sDAI in decentralization, USDY in safety, pick per your risk tolerance. For passive income seekers, these seven redefine ‘set-it-and-forget-it’ in DeFi. Monitor TVL shifts via our TVL risk analysis, and layer in liquidity mining for boosts. Yields evolve fast; stay vigilant for the next rebasing frontier.

Yield-bearing stablecoins like these aren’t fads, they’re the infrastructure upgrade crypto needed. With USDS at $1.00 and USDY at $1.10, the compounding machine hums on, turning idle capital into sustainable gains.