Why Most Stablecoin Yields Are Low—and Where to Find Double-Digit APY in 2024

Stablecoins have become the backbone of decentralized finance (DeFi), providing dollar stability in a volatile crypto landscape. Yet, as of September 2025, the average yield for stablecoins in DeFi has dropped to just 5.8% APY, a far cry from the double-digit returns that once attracted crypto investors. This sharp decline has left many asking: Why are stablecoin yields so low today, and where can you still find double-digit APY?

Why Stablecoin Yields Have Fallen in 2024

The decline in stablecoin yields is no accident. It’s the product of several converging forces shaping today’s onchain yield environment:

- Market Maturation: As DeFi protocols mature, risk premiums have compressed. Early platforms paid outsized rewards to bootstrap liquidity and compensate for smart contract risk; now, with greater security and institutional capital, yields have normalized.

- Lower Borrowing Demand: Speculative trading activity has cooled. With less leverage chasing risky trades, there’s less demand to borrow stablecoins at high rates, directly reducing lender returns.

- Regulatory Pressure: Platforms are under tighter scrutiny, pushing them toward more conservative practices and compliant asset strategies, often at the cost of yield.

- Macro Interest Rates: When U. S. Treasury yields fall, so do returns on reserve assets backing many stablecoins, limiting what issuers can pay out to holders.

This context is crucial for understanding why top-tier centralized offerings like Coinbase USDC cap out around 4-5% APY even when Federal Reserve rates are elevated.

The Hunt for Double-Digit Yield: Where Opportunity Remains

The good news? Despite lower average yields across DeFi, a handful of innovative protocols still offer double-digit APYs on stablecoins by leveraging new strategies or tapping into alternative sources of real-world and synthetic yield. Let’s examine three standout opportunities that have consistently delivered above-market returns in 2024:

Top Double-Digit Stablecoin Yield Opportunities in 2024

-

Ethena USDe (sUSDe) on Ethena Earn: Currently offering 15-25% APY through innovative delta-neutral strategies that combine staked ETH and perpetual futures. Rewards are paid in both USDe and ENA tokens. Ethena is notable for its transparent on-chain mechanics and saw rapid TVL growth in 2024, making it a standout for yield-seeking investors.

-

sDAI via Spark Protocol: sDAI is a yield-bearing version of DAI, earning 10-12% APY (as of June 2024) by redirecting DAI into MakerDAO’s real-world asset strategies. Accessible through the Spark Protocol, sDAI offers minimal smart contract risk and is an attractive option for those seeking stable, on-chain returns.

-

Mountain Protocol USDM: USDM is a regulated, yield-bearing stablecoin backed by U.S. Treasuries, offering 10-11% APY (to non-U.S. users) with yield automatically accruing to holders. Its compliance-first approach and transparent structure make it a compelling choice for high stablecoin returns without exposure to crypto market volatility.

1. Ethena USDe (sUSDe) on Ethena Earn

Earning Potential: 15-25% APY (as of June, September 2024)

Ethena‘s sUSDe stands out by combining staked ETH collateral with delta-neutral perpetual futures positions. This strategy captures funding rate differentials without exposing users to direct crypto price volatility. Rewards are paid in both USDe and ENA tokens, making it one of the most lucrative options for those comfortable with novel DeFi mechanics and time-locked staking.

Why it matters: Ethena’s transparent onchain structure and rapid TVL growth signal strong user confidence, but always weigh platform risks when chasing high returns.

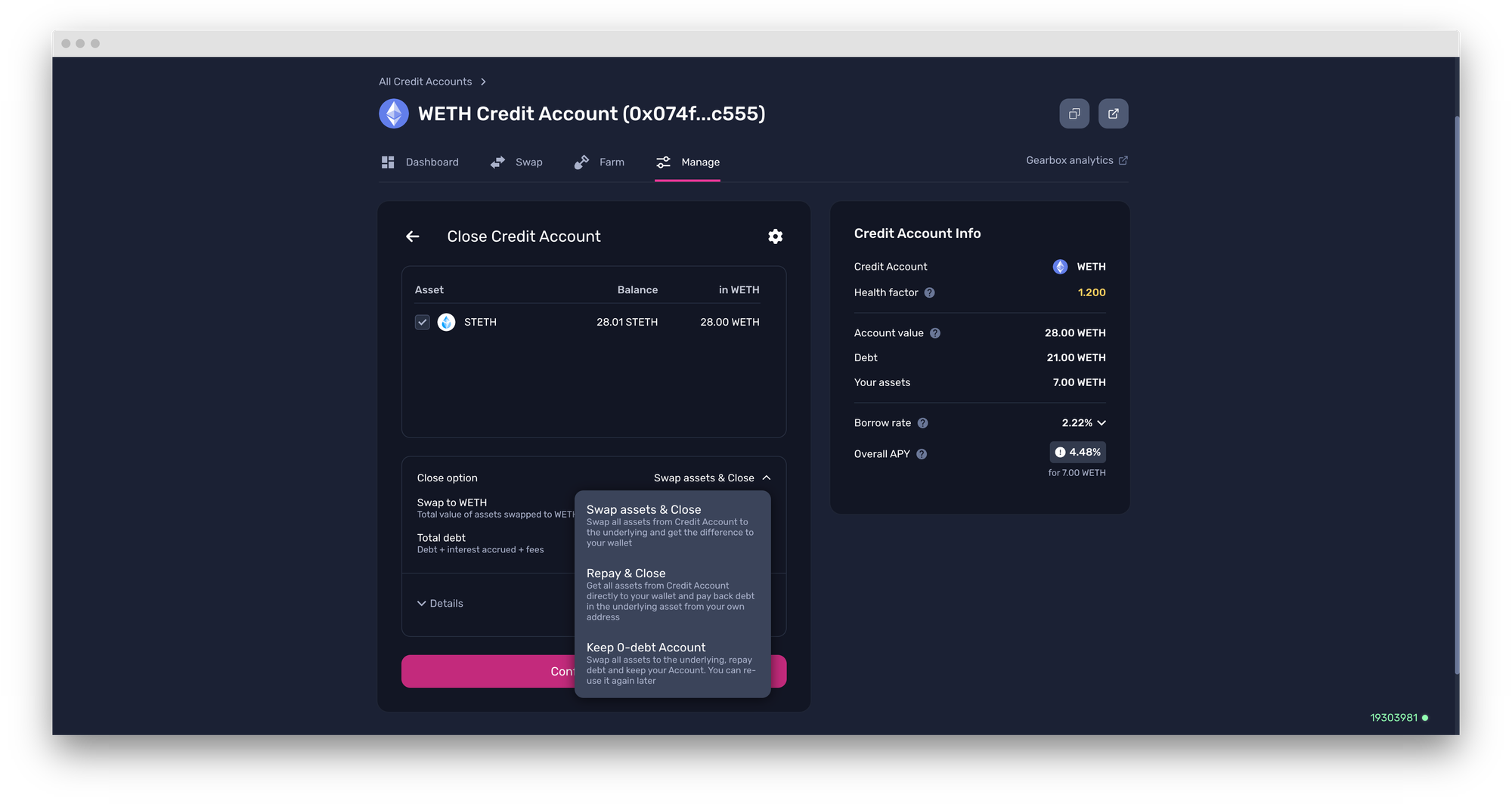

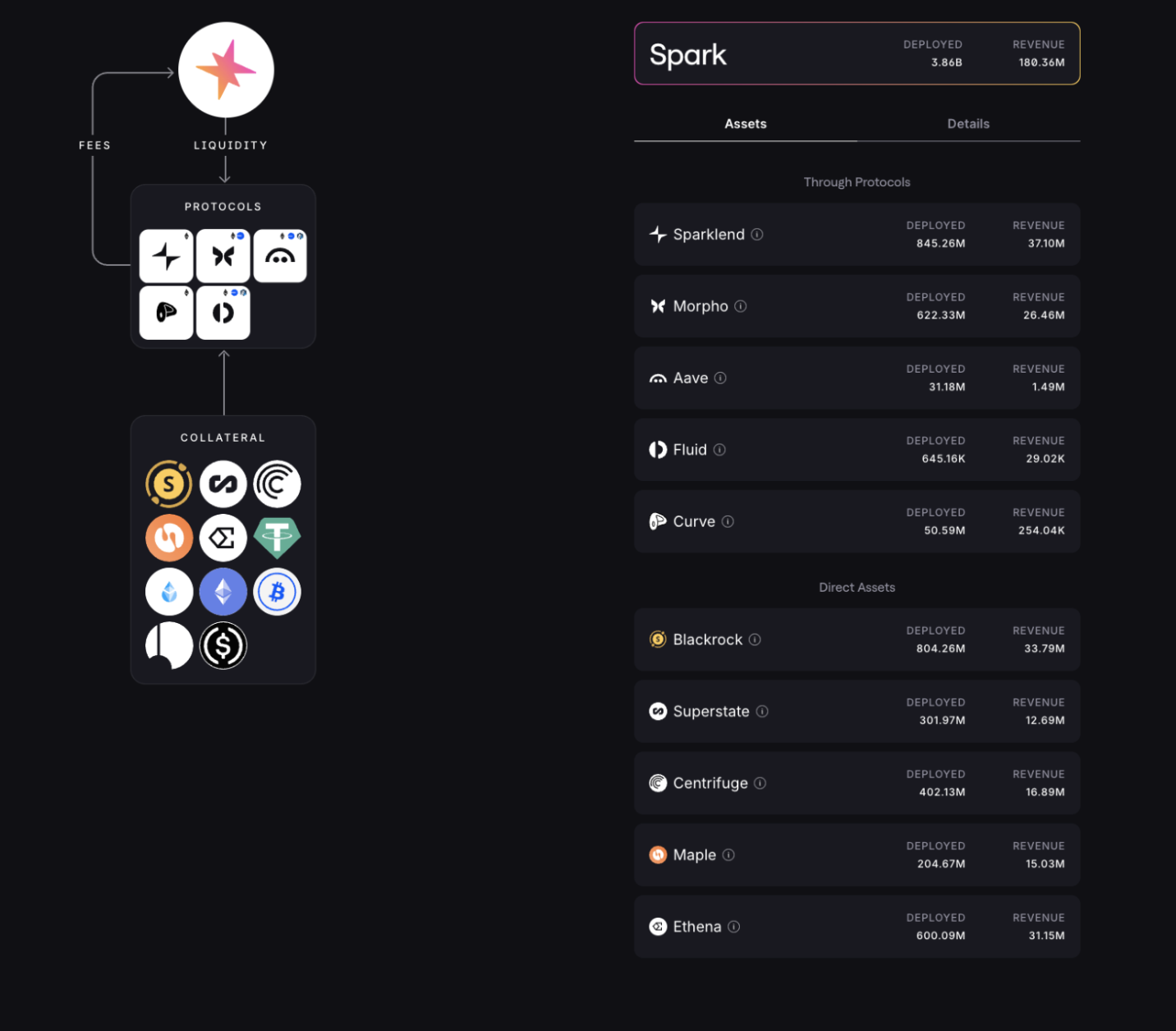

2. sDAI via Spark Protocol

Earning Potential: 10-12% APY (as of June 2024)

sDAI is a yield-bearing version of DAI that channels user deposits into MakerDAO’s real-world asset strategies, think short-term U. S. Treasuries and investment grade debt, via Spark Protocol. The result? Double-digit APYs with minimal smart contract exposure compared to more experimental protocols.

This approach appeals to conservative DeFi users seeking predictable income without sacrificing decentralization or composability within Ethereum’s ecosystem.

3. Mountain Protocol USDM

Earning Potential: 10-11% APY (for non-U. S. users)

If regulatory clarity is your priority, Mountain Protocol’s USDM offers a compelling alternative: a regulated stablecoin backed entirely by U. S. Treasuries that automatically accrues yield to holders outside the United States. By blending TradFi compliance with DeFi accessibility, it delivers attractive returns while minimizing operational risk, a rare combination in today’s market.

Navigating Risks While Chasing Yield

Pursuing higher stablecoin yields isn’t without its tradeoffs. Platforms offering elevated returns may carry additional risks, from smart contract vulnerabilities to liquidity constraints or evolving regulatory interpretations. Always perform thorough due diligence before allocating significant capital to any protocol promising above-average rewards.

It’s also crucial to monitor how these high-yield platforms generate returns. For instance, Ethena’s delta-neutral approach depends on futures market efficiency and persistent funding spreads, which can change rapidly in volatile conditions. Spark Protocol’s sDAI yield, while more conservative, is still influenced by MakerDAO’s allocation to real-world assets and the broader health of traditional credit markets. Mountain Protocol USDM, though regulated and backed by Treasuries, is only available to non-U. S. users, a reminder that jurisdictional limitations remain a real consideration for global investors.

Comparing High-Yield Stablecoin Options

Let’s break down the key features and tradeoffs between these three standout options:

Comparison of Leading Yield-Bearing Stablecoins in 2024

| Platform / Stablecoin | APY Range (2024) | Risk Level | Regulatory Status | Composability | User Eligibility |

|---|---|---|---|---|---|

| Ethena sUSDe (via Ethena Earn) | 15-25% | Medium-High (delta-neutral, smart contract risk) | Unregulated, transparent on-chain | High (widely integrated in DeFi) | Global (no major restrictions) |

| sDAI (via Spark Protocol) | 10-12% | Low-Medium (MakerDAO RWA exposure) | Unregulated, DeFi-native | High (DeFi composable) | Global (no major restrictions) |

| Mountain Protocol USDM | 10-11% | Low (backed by U.S. Treasuries) | Regulated (Bermuda, excludes U.S. persons) | Medium (growing DeFi support) | Non-U.S. users only |

While all three deliver double-digit APY potential in 2024, their mechanics, and associated risks, differ meaningfully. Ethena offers the highest headline rates but introduces more complexity and smart contract dependencies. sDAI is a sweet spot for those who value simplicity and decentralized governance. USDM appeals to non-U. S. users who want TradFi compliance without sacrificing yield.

Best Practices for DeFi Yield Seekers in 2024

- Diversify: Don’t put all your eggs in one protocol, spread your stablecoin allocations across multiple platforms to mitigate idiosyncratic risk.

- Stay Informed: Regulatory environments shift quickly; keep up with policy updates affecting DeFi yields in your jurisdiction.

- Monitor Protocol Health: Watch TVL trends, audit reports, and community activity for early warning signs of trouble or opportunity.

- Understand Underlying Strategies: Know whether your yield comes from real-world assets (like Treasuries), trading incentives (like ENA or TOKE emissions), or synthetic derivatives (like perpetuals).

The era of easy double-digit stablecoin APY is fading for passive holders, but not gone entirely for those willing to do their homework. By understanding the mechanics behind today’s leading high-yield options and rigorously managing risk, it’s still possible to earn robust returns without leaving the relative safety of dollar-pegged assets.