How to Maximize Yield with RWA-Backed Stablecoins Like USST and YLD

Stablecoins have always promised a safe harbor in crypto, but RWA-backed stablecoins like USST and YLD are turning that promise into a passive income opportunity. If you’re looking to maximize yield while keeping risk in check, understanding the mechanics of these new yield-generating stablecoins is essential. Let’s break down how you can put your capital to work with STBL’s innovative dual-token system, and why this approach is gaining serious traction among DeFi yield strategists.

Why RWA-Backed Stablecoins Are Changing the Yield Game

Traditional stablecoins like USDT or USDC are great for stability but rarely offer meaningful yield unless you deploy them into external lending protocols. RWA-backed stablecoins flip the script by being collateralized with real-world assets, such as tokenized US Treasuries or bonds. This means the underlying collateral itself generates interest, which can be distributed directly to holders or through protocol-specific mechanisms.

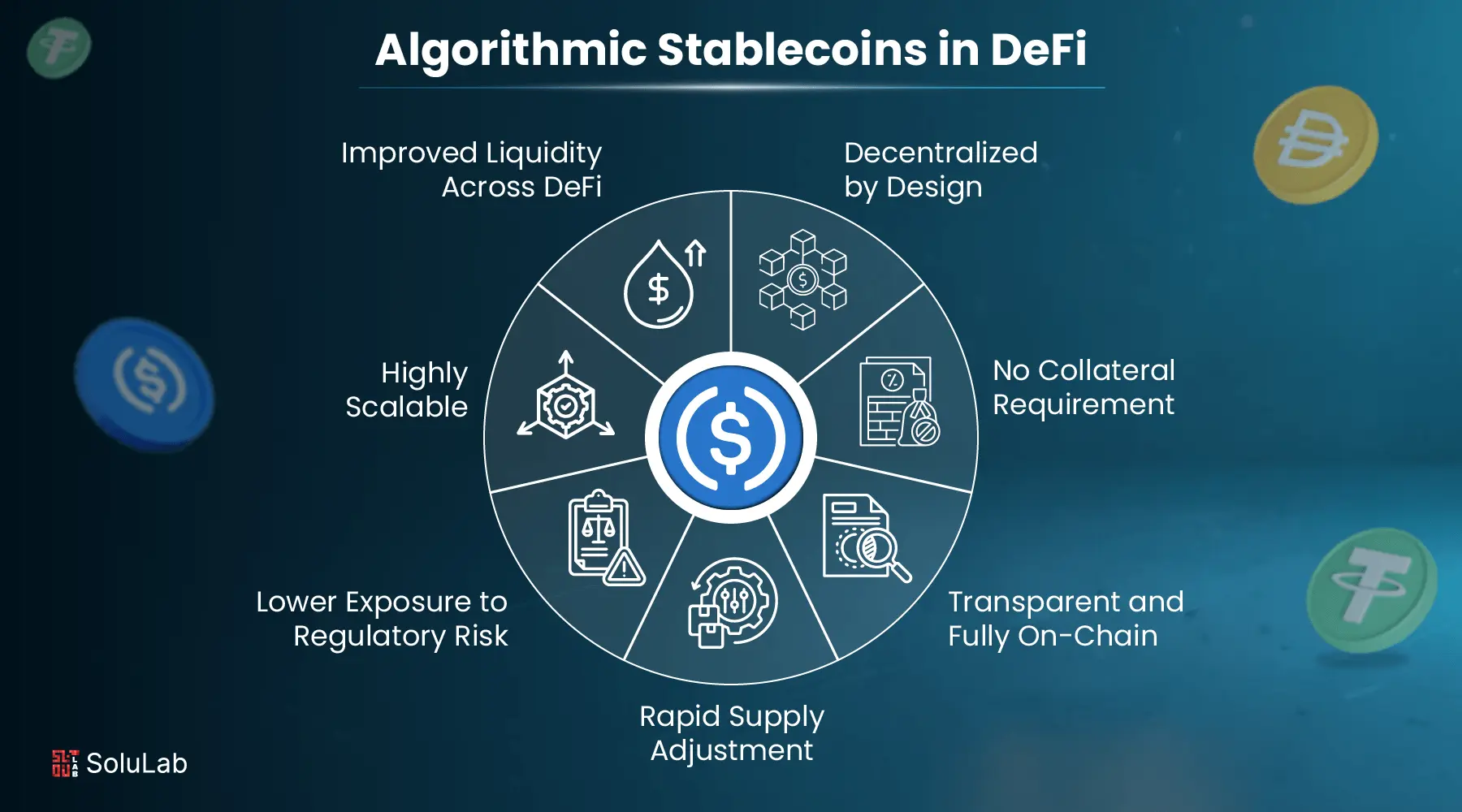

Key benefits include:

- Improved Stability: Backed by tangible assets like US Treasuries.

- Yield Generation: Earn passive income simply by holding or staking.

- Transparency and Trust: On-chain proof of reserves and regular audits.

- Regulatory Compatibility: Designed with compliance in mind.

This combination of stability and built-in yield is why products like USST and YLD are seeing explosive growth in 2025, especially as investors hunt for safer returns amid volatile markets.

The STBL Dual-Token Model: How USST and YLD Work Together

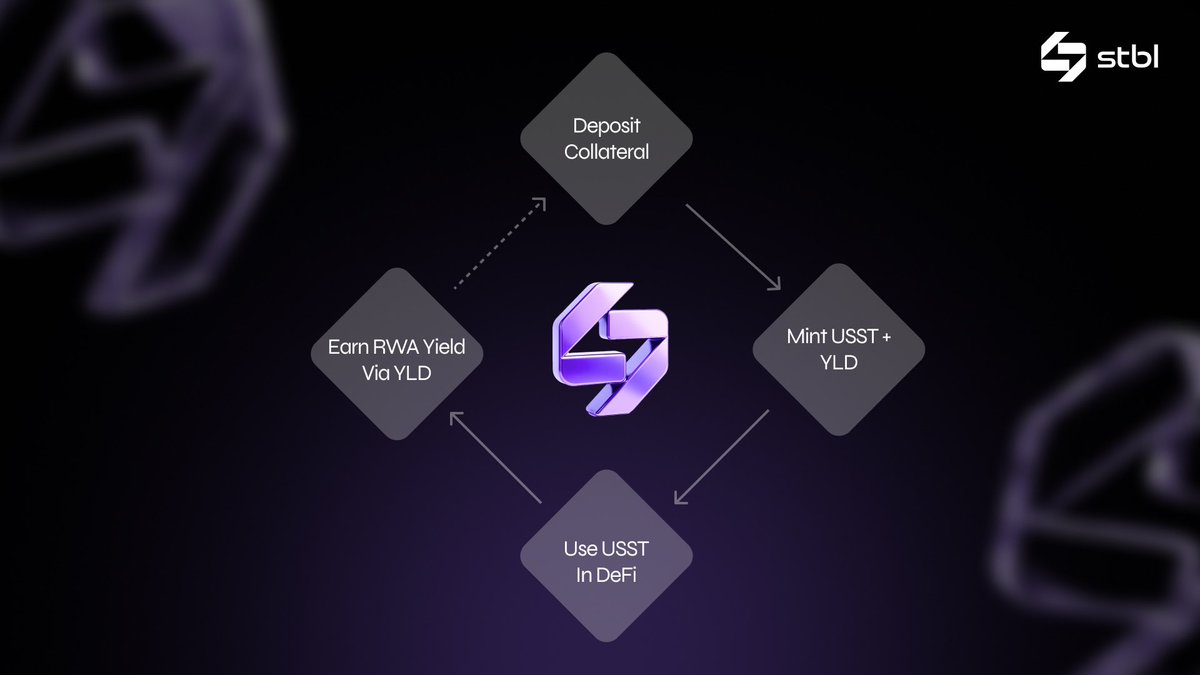

The STBL protocol introduces a clever dual-token system that lets users separate liquidity from yield rights. Here’s how it works:

Steps to Maximize Yield with USST and YLD Tokens

-

Mint USST and Receive YLD: Deposit approved tokenized real-world assets (like USDY, OUSG, or BUIDL) into the STBL protocol to mint USST stablecoins. You’ll automatically receive YLD tokens, which represent your yield rights from the deposited collateral.

-

Utilize USST in DeFi Applications: Put your USST to work by trading, lending, or using it as collateral on major DeFi platforms. This can generate additional returns while maintaining liquidity.

-

Hold or Trade YLD Tokens: YLD tokens accrue yield over time based on the performance of the underlying RWAs. Hold them to receive periodic yield distributions, or trade them on supported exchanges to realize gains or adjust your strategy.

-

Participate in Governance with STBL Tokens: By holding STBL tokens, you can vote on protocol decisions such as new collateral types or yield policies. Active participation may help shape yield opportunities in your favor.

-

Stay Informed on Protocol Developments: Regularly check official STBL updates for new collateral options, policy changes, or enhancements that could impact your yield. Staying updated ensures you don’t miss out on new opportunities.

You begin by depositing approved tokenized RWAs (like USDY, OUSG, or BUIDL) into the protocol. In exchange, you mint USST, a stablecoin designed for seamless use across DeFi platforms. At the same time, you receive YLD tokens, which represent your claim on the yield generated by your deposited collateral.

This separation unlocks several strategies:

- Use USST for DeFi Yield: Deploy your USST in trading pools, lending protocols, or as collateral elsewhere to stack extra rewards.

- Hold or Trade YLD: Keep YLD for periodic yield distributions based on RWA performance, or trade it if you want liquidity now rather than steady income over time.

Tapping Into Passive Income With Minimal Volatility

If you’re tired of chasing high APYs with unpredictable risks, RWA-backed stablecoins offer a more measured approach. By anchoring value to real-world assets and distributing actual interest income via tokens like YLD, protocols like STBL let you participate in global fixed-income markets, without leaving DeFi. This model reduces opportunity cost and brings borderless access to low-risk returns that were traditionally reserved for institutional players.

I’m seeing more investors opt for these strategies as part of a diversified portfolio, especially those who want exposure to DeFi yields without betting the farm on volatile governance tokens or undercollateralized lending pools. The key is staying up-to-date on protocol developments and understanding how each piece (USST for liquidity, YLD for income) fits your personal risk profile.

Active participation in governance is another underappreciated lever for maximizing your returns. By holding STBL tokens, you can vote on proposals that directly impact the protocol’s risk parameters, yield distribution rules, and new collateral integrations. This isn’t just about having a say – it’s an opportunity to help shape the incentives and direction of a platform where your capital is at work. For those who want to get hands-on, regular governance engagement can put you at the forefront of upcoming yield opportunities and protocol upgrades. You can read more about how this works in detail at STBL’s official documentation.

Managing Risks While Chasing Yield

Let’s be real: no yield comes without tradeoffs. Even with RWA-backed stablecoins, you’ll want to monitor a few key risks:

- Collateral Quality: Make sure the underlying assets (like USDY, OUSG) are transparent and regularly audited.

- Smart Contract Risk: DeFi protocols aren’t immune to bugs or exploits – stick to platforms with robust security audits.

- Regulatory Shifts: As regulators catch up with RWA-backed models, compliance requirements may evolve quickly.

- Liquidity Needs: If you need to exit quickly, check USST and YLD liquidity on major DEXs before committing large amounts.

This isn’t about scaring you off – it’s about being proactive so your passive income doesn’t come with nasty surprises. The good news? Most top-tier protocols now provide real-time dashboards for collateral health, yield rates, and audit status, making it easier than ever to stay informed.

Simple Strategies for Getting Started

If you’re new to RWA-backed stablecoins or want a quick playbook for maximizing returns with minimal fuss, here are a few practical tactics I recommend:

- Diversify Collateral Sources: Don’t just stick with one RWA provider; spread deposits across multiple approved assets like USDY and OUSG for added safety.

- Harvest Yield Regularly: Set reminders to claim or restake your YLD tokens so your earned interest compounds over time.

- Monitor Protocol Updates: Join community channels or set up alerts for changes in collateral eligibility or yield distribution policies.

- Add Liquidity With Care: If providing USST as liquidity on DEXs, watch out for impermanent loss – but remember that stablecoin pairs usually keep this risk low.

Pro Tip: Stay Flexible

The most successful passive income stablecoin investors I know aren’t glued to one strategy. They adapt as new protocols launch, yields shift, or governance votes open up fresh opportunities. Remember: the DeFi landscape moves fast – but by focusing on transparency, diversification, and active management of both USST and YLD positions, you’ll be far ahead of the curve.

6-Month Price Comparison: USST, YLD, and Major Cryptocurrencies

Evaluating the Stability and Yield Potential of RWA-Backed Stablecoins (USST), YLD, and Leading Crypto Assets (as of 2025-09-21)

| Asset | Current Price | 6 Months Ago | Price Change |

|---|---|---|---|

| USST (RWA-backed Stablecoin) | $1.00 | $1.00 | +0.0% |

| Yield Token (YLD) | $0.000874 | $0.000900 | -2.9% |

| Tether (USDT) | $1.00 | $1.00 | +0.0% |

| USD Coin (USDC) | $1.00 | $1.00 | +0.0% |

| Dai (DAI) | $0.9996 | $1.00 | -0.0% |

| Bitcoin (BTC) | $115,721.00 | $65,000.00 | +77.3% |

| Ethereum (ETH) | $4,468.69 | $3,500.00 | +27.7% |

| Frax (FRAX) | $0.9973 | $1.00 | -0.3% |

Analysis Summary

USST and other leading stablecoins (USDT, USDC, DAI, FRAX) have maintained their peg to the US dollar over the past six months, showing minimal price fluctuations. In contrast, major cryptocurrencies like Bitcoin and Ethereum have experienced significant price appreciation. The YLD token, which represents yield rights in the STBL ecosystem, has seen a modest decline over the same period.

Key Insights

- USST, USDT, and USDC have demonstrated perfect price stability, maintaining their $1.00 peg over six months.

- YLD token experienced a slight decrease in value (-2.9%), reflecting minor market volatility or yield adjustments.

- Bitcoin (+77.3%) and Ethereum (+27.7%) significantly outperformed stablecoins in price appreciation, highlighting their higher volatility and growth potential.

- DAI and FRAX showed minimal deviation from their peg, with DAI nearly unchanged and FRAX down just -0.3%.

- RWA-backed stablecoins like USST offer stability and yield opportunities without price volatility, making them attractive for risk-averse yield strategies.

This comparison uses exact real-time price data for each asset from reputable sources (CoinGecko) as of 2025-09-21. The table presents the current price, price from six months ago, and the percentage change over that period, allowing for a clear evaluation of both stability and performance across different asset types.

Data Sources:

- Main Asset: https://www.coingecko.com/en/coins/usst

- Yield Token: https://www.coingecko.com/en/coins/yield-token

- Tether: https://www.coingecko.com/en/coins/tether

- USD Coin: https://www.coingecko.com/en/coins/usd-coin

- Dai: https://www.coingecko.com/en/coins/dai

- Bitcoin: https://www.coingecko.com/en/coins/bitcoin

- Ethereum: https://www.coingecko.com/en/coins/ethereum

- Frax: https://www.coingecko.com/en/coins/frax

Disclaimer: Cryptocurrency prices are highly volatile and subject to market fluctuations. The data presented is for informational purposes only and should not be considered as investment advice. Always do your own research before making investment decisions.

If you’re ready to dive deeper into STBL’s dual-token mechanics or want to test out different DeFi yield strategies using RWA-backed stablecoins, there’s never been a better time. With institutional-grade assets backing your digital dollars and innovative tools like STBL’s governance model at your fingertips, earning steady returns in crypto finally feels accessible – without sacrificing sleep along the way.