How STBL Stablecoin Separates Principal and Yield: A New Model for RWA-Backed Stablecoins

Stablecoins have long promised a frictionless bridge between traditional finance and the world of decentralized finance (DeFi), but until recently, users faced a fundamental trade-off: either enjoy the liquidity of stablecoins or lock up funds to earn yield from real-world assets (RWAs). The STBL stablecoin model is changing this paradigm by separating principal and yield, unlocking new yield strategies while keeping stablecoin utility intact.

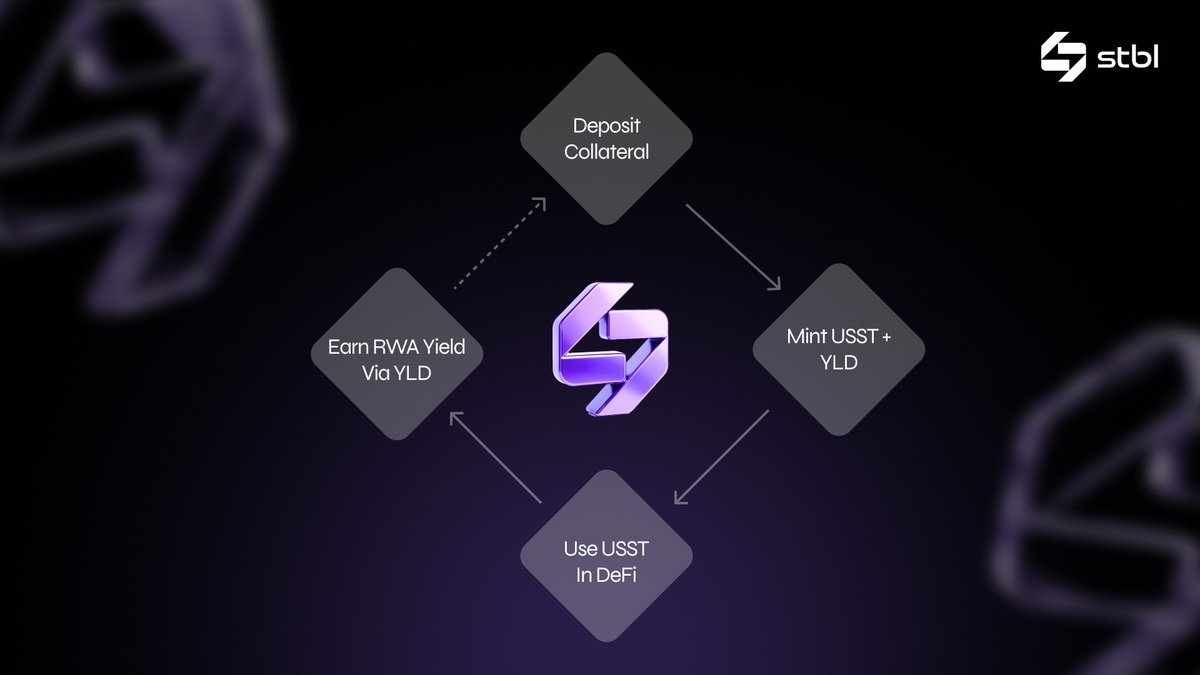

How the STBL Stablecoin Model Works

At its core, STBL leverages a three-token system to decouple principal from yield:

- USST: A USD-pegged stablecoin backed by tokenized RWAs such as U. S. Treasuries or money market funds.

- YLD: A non-fungible token (NFT) that represents the right to claim yield generated by the underlying collateral.

- STBL: The governance token, empowering holders to vote on protocol upgrades and risk parameters.

This design enables users to mint USST for spending or DeFi activities while holding YLD separately to accrue passive income with stablecoins. When users want their original collateral back, both USST and YLD must be returned, ensuring on-chain reconciliation of principal and yield. This mechanism is detailed in the official documentation at docs.stbl.com.

Solving Stablecoin’s Liquidity-Versus-Yield Dilemma

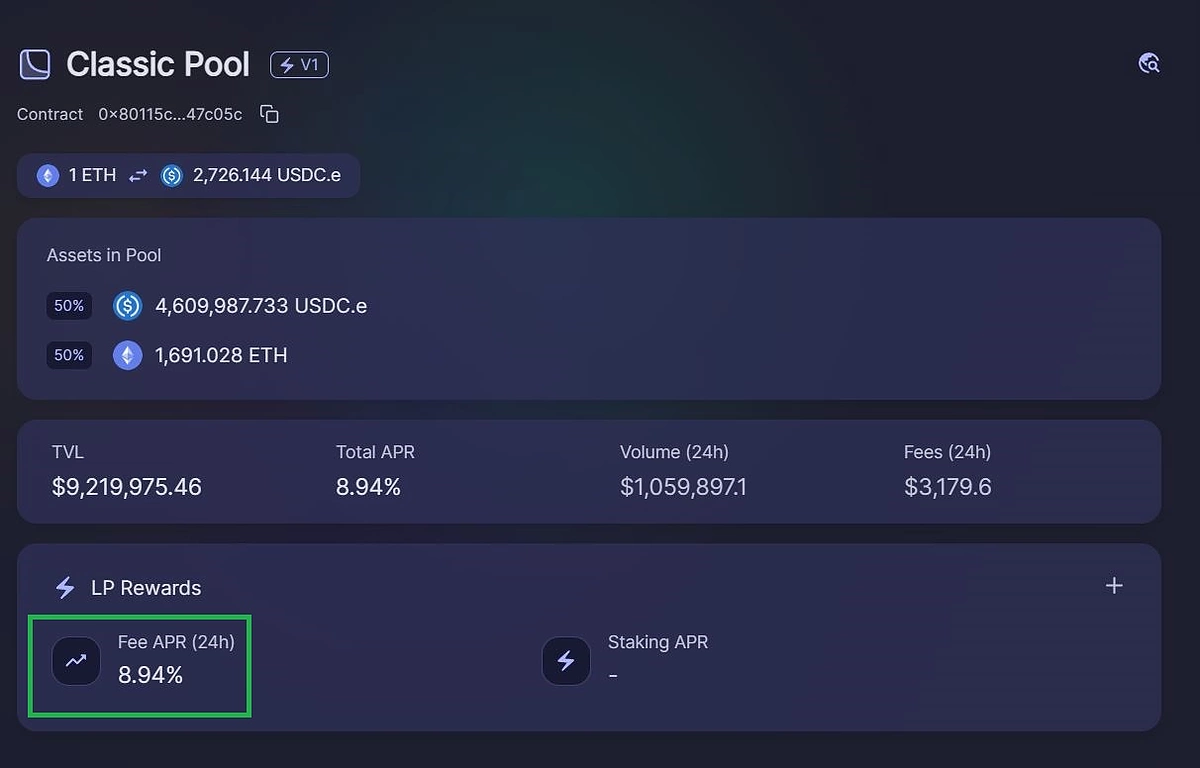

The traditional model for RWA-backed stablecoins like USDT or USDC forces holders to choose: keep coins liquid for transactions or lock them up in protocols for a share of the underlying asset’s yield. STBL’s approach eliminates this trade-off. By splitting principal (USST) from yield (YLD), users can deploy USST throughout DeFi, trading, lending, or payments, while still capturing returns through YLD.

This separation also unlocks secondary markets for both tokens. For example, some users may want immediate liquidity, selling their YLD rights to others seeking higher yields. This creates a dynamic ecosystem where risk appetites and time horizons can be matched efficiently.

The Mechanics Behind Principal-Yield Separation

The process begins when a user deposits eligible RWAs into the protocol. In return, they receive an equivalent amount of USST (the spendable stablecoin) and YLD (the NFT representing future yield). The protocol then manages these assets transparently via on-chain reserves, an important step toward regulatory compliance as highlighted in recent coverage at stbl.com.

The key innovation here is that USST remains fully liquid, allowing seamless integration with existing DeFi protocols. Meanwhile, YLD accrues interest based on yields generated by RWAs such as tokenized treasuries. This model not only optimizes passive income opportunities but also ensures that redemption always requires both tokens, maintaining systemic integrity and preventing double-spending or over-collateralization.

STBL (STBL) Price Prediction 2026-2031

Forecast for the STBL Governance Token Based on RWA-Backed Stablecoin Growth and DeFi Adoption (Baseline: $0.36 as of Q3 2025)

| Year | Minimum Price | Average Price | Maximum Price | Annual % Change (Avg) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $0.32 | $0.44 | $0.61 | +22% | Adoption grows as RWA-backed stablecoins gain traction; regulatory clarity improves, but volatility remains due to broader DeFi market. |

| 2027 | $0.38 | $0.52 | $0.78 | +18% | Protocol upgrades and increased DeFi integration boost STBL demand; competition from other RWA protocols tempers gains. |

| 2028 | $0.43 | $0.62 | $0.99 | +19% | Stablecoin regulation matures globally; STBL governance role expands, supporting steady price appreciation. |

| 2029 | $0.52 | $0.73 | $1.24 | +18% | Institutional adoption of RWA-backed assets accelerates; bullish scenario as STBL becomes a leading governance token in the sector. |

| 2030 | $0.61 | $0.86 | $1.56 | +18% | New DeFi primitives built on STBL drive utility; macroeconomic stability supports continued growth. |

| 2031 | $0.70 | $1.01 | $1.90 | +17% | Matured ecosystem and network effects sustain demand for STBL governance; risk of protocol forks or tech disruption remains. |

Price Prediction Summary

STBL’s price outlook is positive through 2031, driven by the increasing adoption of RWA-backed stablecoins and advancements in DeFi. The protocol’s unique separation of principal and yield, combined with strong governance utility, positions it well for long-term growth. However, as a governance token, STBL remains subject to crypto market cycles and evolving regulatory environments. Investors should expect moderate volatility, with significant upside if RWA integration in DeFi outpaces competitors.

Key Factors Affecting STBL Stablecoin Price

- Growth and adoption of RWA-backed stablecoins and DeFi platforms

- Regulatory developments impacting stablecoins and tokenized assets

- Technological improvements in the STBL protocol and ecosystem

- Competition from other governance tokens and RWA protocols

- Institutional participation and liquidity entering the RWA DeFi space

- Macro market cycles and sentiment in the broader crypto sector

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Real-Time Valuation: STBL Governance Token Update

The market has responded positively to this new approach. As of September 23,2025, the STBL governance token is trading at $0.359302, up 0.02336% over the past 24 hours. This price point reflects growing confidence in RWA-backed stablecoins that prioritize transparency and user empowerment.

By introducing a transparent, on-chain principal-yield separation, the STBL protocol is not only addressing some of the core limitations of legacy stablecoins but also paving the way for more sophisticated DeFi yield strategies. The ability to independently trade or hold USST and YLD means that users can tailor their exposure to liquidity or yield according to their individual risk preferences and market outlook.

This flexibility stands in stark contrast to the monolithic design of earlier RWA-backed stablecoins. For example, while USDT and USDC remain foundational for DeFi, they do not offer direct access to underlying asset yields without additional staking or third-party wrappers. In comparison, STBL’s design natively unlocks passive income with stablecoins, no lockups or convoluted workarounds required.

Implications for DeFi Users and Yield Seekers

For DeFi enthusiasts, this separation opens up a variety of new opportunities:

Key Benefits of Principal-Yield Separation in STBL

-

Enhanced Liquidity: Users can freely transact with USST stablecoins, backed by real-world assets, without locking up their funds to earn yield.

-

Direct Access to Yield: The YLD NFT allows users to claim yield from the underlying assets independently, making yield strategies more flexible and transparent.

-

No Trade-off Between Liquidity and Returns: By separating principal and yield, STBL users avoid the traditional dilemma of choosing between spending their stablecoins or earning yield—they can do both simultaneously.

-

On-Chain Transparency and Security: All reserves and yield generation are managed transparently on-chain, allowing users to verify collateral and protocol activity at any time.

-

Decentralized Governance: STBL token holders participate in protocol decisions, ensuring user interests are represented and the system remains adaptable to regulatory and market changes.

Investors seeking steady returns can simply acquire YLD tokens on secondary markets, gaining access to RWA yields without sacrificing liquidity. Meanwhile, those prioritizing transactional utility can use USST as a dollar-pegged medium of exchange across protocols, confident that their original deposit is earning yield elsewhere.

The governance token (STBL) further enhances community engagement by allowing holders to shape protocol evolution, such as adjusting collateral types or refining risk parameters. With STBL currently priced at $0.359302, its modest appreciation signals growing institutional interest in compliant, user-centric stablecoin solutions that bridge TradFi yields with DeFi composability.

Regulatory Alignment and On-Chain Transparency

As regulatory scrutiny intensifies around stablecoin reserves and transparency, STBL’s model provides an auditable framework for tracking both principal and yield obligations on-chain. Every USST minted corresponds directly to tokenized RWAs held in reserve; every YLD NFT represents a clear claim on generated interest. This architecture not only simplifies compliance but also fosters trust among both retail and institutional participants.

The protocol’s embrace of decentralized governance, anchored by the STBL token, means upgrades can be implemented efficiently while remaining responsive to evolving regulatory guidance or user needs. For more technical insights into these mechanics, see docs.stbl.com.

What Sets STBL Apart?

Ultimately, what distinguishes STBL from its predecessors is its elegant solution to an age-old dilemma: how do you maximize both liquidity and yield from your digital dollars? By splitting principal (USST) from yield (YLD), and anchoring them with transparent RWA backing plus robust governance via the STBL token (currently $0.359302), this protocol offers a blueprint for future-proofing stablecoin utility in an increasingly competitive landscape.