How to Earn Over 30% APY With USDe/USDT0 Stablecoin Yield Pools on Plasma and Curve

Stablecoin yield strategies have come a long way since the early days of DeFi, but if you’re looking for robust passive income without the wild price swings of volatile assets, the USDe/USDT0 pool on Curve’s Plasma network is worth a close look. As of September 30,2025, this pool is serving up an impressive 21.69% APY, with both USDe and USDT0 holding steady at $1.00. For stablecoin holders who want to put their dollars to work, that’s a compelling proposition.

USDe vs USDT0: Price, Curve Plasma APY, and 1-Month APY Trend Comparison

| Stablecoin | Current Price 💲 | Curve Plasma APY (%) 📈 | 1-Month APY Trend 📊 |

|---|---|---|---|

| USDe | $1.00 | 21.69% | ↗️ Started at 18%, peaked at 24%, now 21.69% |

| USDT0 | $1.00 | 21.69% | ↗️ Started at 18%, peaked at 24%, now 21.69% |

Why Plasma’s Stablecoin Yield Pools Are Gaining Traction

The combination of offshore freedom and scalability has turned platforms like Plasma into a magnet for liquidity. With over $3.86 million locked in the USDe/USDT0 pool alone, it’s clear that investors are chasing more than just base-level yields. What’s driving this? It comes down to three factors:

- High protocol incentives: Curve and Plasma have structured rewards to attract deep liquidity.

- Trading fees: Volatile market conditions mean more swaps, which means more revenue for LPs.

- Sophisticated integrations: Leveraged yield loops via Aave (available through DeFi Saver) let advanced users amplify returns responsibly.

If you’re used to seeing single-digit returns on centralized platforms or vanilla lending desks, these numbers are eye-opening. But as always in DeFi, higher yields come with nuances you’ll want to understand before diving in.

A Closer Look at the USDe/USDT0 Pool on Curve Plasma

This isn’t your average stablecoin farm. The Curve Plasma pool lets users deposit equal values of USDe and USDT0 (both currently priced at $1.00) into a liquidity pool. In return, you receive LP tokens representing your share of the pool, these can then be staked in the associated gauge contract for additional rewards.

The magic here is twofold:

- You earn from trading fees every time someone swaps between USDe and USDT0.

- You also stack protocol incentives distributed by Curve and Plasma, these are what push yields into double-digit territory.

If you’re wondering how safe this really is: Both tokens are pegged at $1.00 as of today, minimizing exposure to typical DeFi price risks like impermanent loss (as long as both stables hold their peg). However, always remember that smart contract risk and protocol changes can impact returns over time.

USDe Stablecoin (USDe) Price Prediction 2026-2031

Professional APY & Price Forecast for USDe/USDT0 on Curve Plasma (Based on 2025 Market Data)

| Year | Minimum Price | Average Price | Maximum Price | Year-over-Year Change (%) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $0.98 | $1.00 | $1.02 | +0.0% | Stablecoin maintains peg; minor volatility from DeFi incentives and market liquidity. |

| 2027 | $0.97 | $1.00 | $1.03 | 0.0% | Slightly increased volatility as DeFi adoption grows; regulatory scrutiny increases. |

| 2028 | $0.96 | $1.00 | $1.04 | +0.0% | Potential for temporary depegging events due to market stress or protocol upgrades. |

| 2029 | $0.97 | $1.00 | $1.03 | 0.0% | Stability returns as protocols mature; integration with more CeFi/DeFi platforms. |

| 2030 | $0.98 | $1.00 | $1.02 | 0.0% | Stablecoin market consolidates; USDe remains a top player with robust reserves. |

| 2031 | $0.98 | $1.00 | $1.02 | 0.0% | Matured ecosystem; price stability is prioritized, limited yield volatility. |

Price Prediction Summary

USDe is expected to maintain its $1.00 peg through 2031, with minor deviations reflecting typical stablecoin market dynamics. The minimum and maximum price predictions account for potential volatility from market stress, regulatory changes, and DeFi protocol adjustments. As the ecosystem matures, both price and APY yields are likely to stabilize, with USDe remaining a core stablecoin in DeFi.

Key Factors Affecting USDe Stablecoin Price

- DeFi and CeFi integration driving demand for USDe as collateral and yield asset.

- Regulatory developments affecting stablecoin operations and reserve transparency.

- Protocol upgrades (Plasma, Curve, Ethena) improving scalability and risk management.

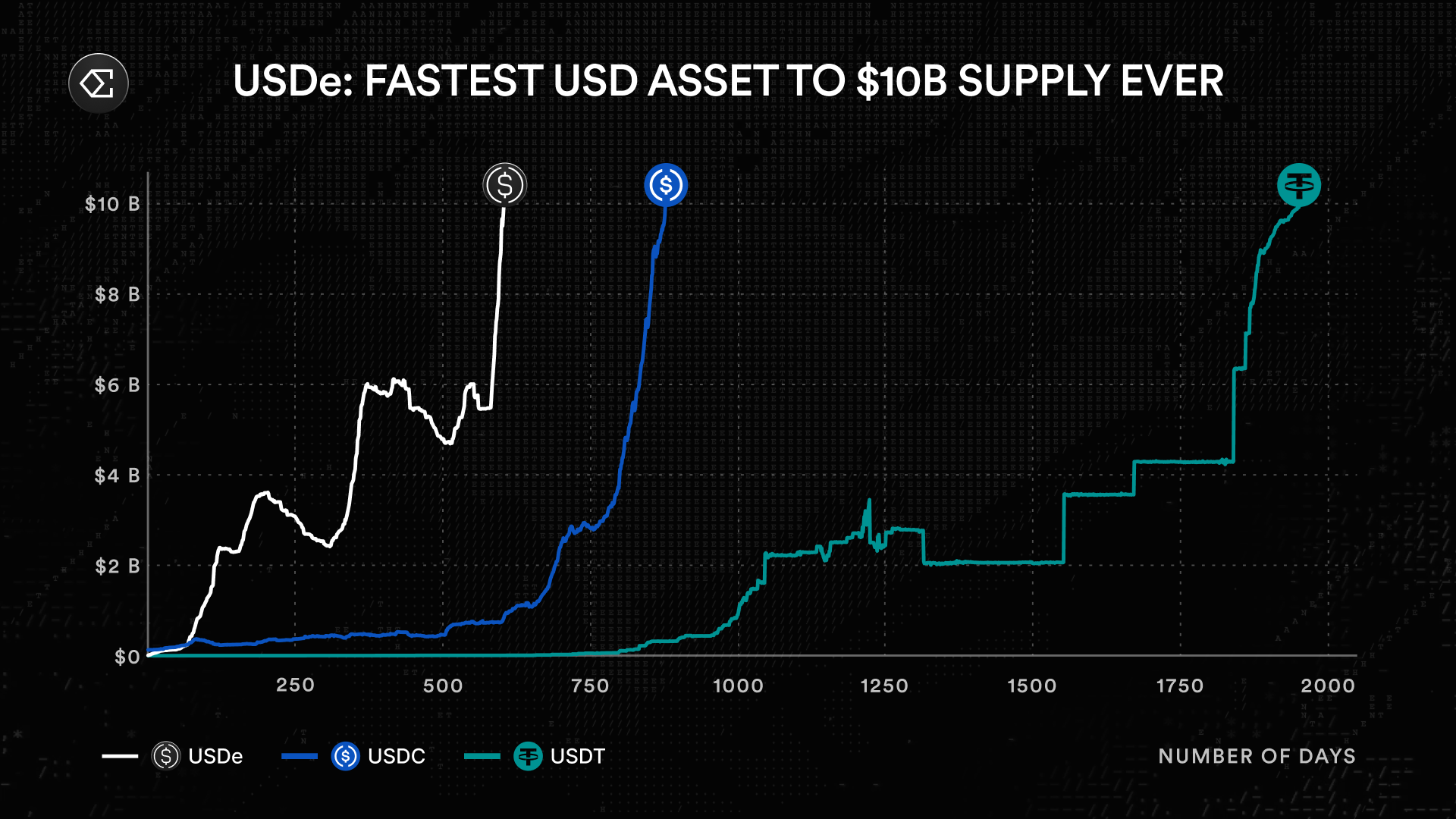

- Competition from other stablecoins (USDT, USDC, DAI) impacting market share and liquidity.

- Market cycles (bull/bear) influencing DeFi TVL, trading fees, and protocol incentives.

- Adoption of yield strategies, including liquid leverage, affecting demand and peg stability.

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Diversifying Your Stablecoin Yield Strategy

The beauty of today’s DeFi landscape is choice. While the current 21.69% APY on the Curve Plasma pool stands out, it’s smart not to put all your eggs in one basket, especially when alternatives like Ethena staking (9%-11% APY) or Wildcat Finance (around 11.5% APY) exist for those seeking different risk/reward profiles (see details here). Each platform has its own quirks; Ethena focuses on sUSDe rebasing mechanics while Wildcat offers peer-to-peer lending markets.

If you’re optimizing for maximum yield with minimal volatility, blending several stablecoin strategies can help smooth out risk while keeping your passive income pipeline flowing strong.

- Consider looping strategies: Advanced users can leverage protocols like Aave on Plasma via DeFi Saver to loop stablecoins and boost effective yields, but be mindful of liquidation thresholds!

- Monitor incentive programs: Yields change frequently based on reward schedules; keep an eye out for new seasons or bonus events announced by protocols.

- Diversify across pools: Splitting funds between high-APY pools like Curve/Plasma and more conservative options helps balance upside with safety.

One thing that sets stablecoin yield plasma pools apart right now is their ability to adapt quickly. Protocols can adjust rewards, tweak mechanics, or integrate new partners on the fly. For example, Ethena’s integration with Pendle allows for yield tokenization, meaning you can trade your future yield up front, a compelling option if you want to lock in profits or manage risk dynamically. Meanwhile, platforms like OKX Earn and Binance are experimenting with on-chain stablecoin strategies that sometimes eclipse 50% APY (albeit with caps and regional restrictions).

Managing Risk While Chasing the Highest APY Stablecoin Pools

Let’s be real: double-digit APYs on stablecoins sound almost too good to be true. The reality is that these yields are sustainable only as long as incentives remain high and both tokens keep their peg. Always ask yourself:

- Is the protocol audited? Look for recent security reviews and open-source codebases.

- What are the smart contract risks? Even blue-chip protocols have been exploited in the past.

- Are there any withdrawal restrictions or lockups? Make sure you’re not stuck during a market event.

If you’re leveraging (using Liquid Leverage via Aave/DeFi Saver), understand how liquidation works and set conservative collateral ratios. Nobody likes a forced unwind when markets get choppy.

Key Risks & Mitigation Strategies for Stablecoin Yield Farming

-

Smart Contract Risk: Yield pools on platforms like Curve Finance and Plasma rely on complex smart contracts. Bugs or vulnerabilities can lead to loss of funds. Mitigation: Stick to well-audited protocols, monitor for new audits, and consider using insurance providers like Nexus Mutual for extra coverage.

-

Stablecoin Depegging: Even established stablecoins like USDe and USDT0 can lose their $1.00 peg (current price: $1.00). Mitigation: Diversify across multiple stablecoins, monitor peg stability on platforms like CoinMarketCap, and avoid overexposure to a single asset.

-

Regulatory and Platform Risk: DeFi platforms may face regulatory scrutiny or operational disruptions. Mitigation: Use reputable, established platforms (e.g., Curve, Plasma, Ethena), keep funds in self-custody wallets where possible, and avoid depositing more than you can afford to lose.

Passive Income That Stays Flexible

The best part about farming stablecoin yields on Plasma is flexibility. You can deposit or withdraw at any time, rebalance between pools as incentives shift, or even move into newer products as they launch. This agile approach is what keeps DeFi ahead of traditional finance, you’re never locked into yesterday’s rates.

If you’re just starting out, begin small with the USDe/USDT0 pool at Curve Plasma. Track your rewards over a few weeks before increasing exposure. For more advanced users, experiment with looping or try staking sUSDe via Ethena for diversified returns (more here).

The Bottom Line: Smart Yield With Stablecoins Is Here to Stay

As of September 30,2025, both USDe and USDT0 are holding rock-solid at $1.00, while Curve’s Plasma pool offers an eye-popping 21.69% APY. Whether you’re optimizing for risk-adjusted returns or simply want to keep your capital working overtime without wild swings, this new wave of Plasma stablecoin yield farming deserves your attention.

The DeFi landscape will keep evolving, but for now, these pools offer one of the most attractive passive income opportunities in crypto. Just remember: stay nimble, diversify where possible, and always do your homework before chasing headline APYs.