Stable: The First Layer 1 Blockchain Built for USDT—How It’s Changing Stablecoin Payments

Stablechain isn’t just another Layer 1 riding the stablecoin hype cycle. It’s a full-throttle, USDT-powered blockchain that’s gunning for the jugular of legacy payment rails and gas-guzzling DeFi chains. If you think stablecoin payments are boring, buckle up: Stable is flipping the script on how value moves across blockchains, and it’s got a $28 million war chest (courtesy of Bitfinex, Hack VC, and more) to prove it.

USDT as Native Gas: The Simplicity Crypto Deserves

Let’s cut through the noise. Most Layer 1s force users to juggle multiple tokens just to move their stables – ETH for gas on Ethereum, AVAX on Avalanche, MATIC on Polygon. Stablechain says: why not pay gas in the asset you’re actually using? On Stable, USDT is both your payment method and your gas token. No more swapping out stables for volatile utility coins just to send a transaction. The result? A frictionless experience that feels more like Venmo than MetaMask.

This isn’t just UX sugar. By letting users pay fees in USDT (or skip them entirely for peer-to-peer transfers), Stablechain eliminates one of DeFi’s most persistent headaches: unpredictable fees in unpredictable assets. It’s a bold move that could make stablecoin payments as seamless as sending an email.

Zero-Fee Transfers and Blazing Speed: Why Stable Outpaces Legacy Chains

Here’s where things get spicy. With gas-free USDT transfers, Stablechain lets users send value peer-to-peer without coughing up a single satoshi in fees. How? A protocol-managed paymaster sponsors gas costs for simple transfers – meaning grandma can send you $50 in USDT without even knowing what “gas” means.

“Stable isn’t just about cheap transactions; it’s about making stablecoins truly usable for global commerce. “

The network boasts sub-second block finality, putting it miles ahead of sluggish chains where settlement feels like watching paint dry. This is crucial for merchants, payroll platforms, and anyone who needs money to move now – not five minutes from now.

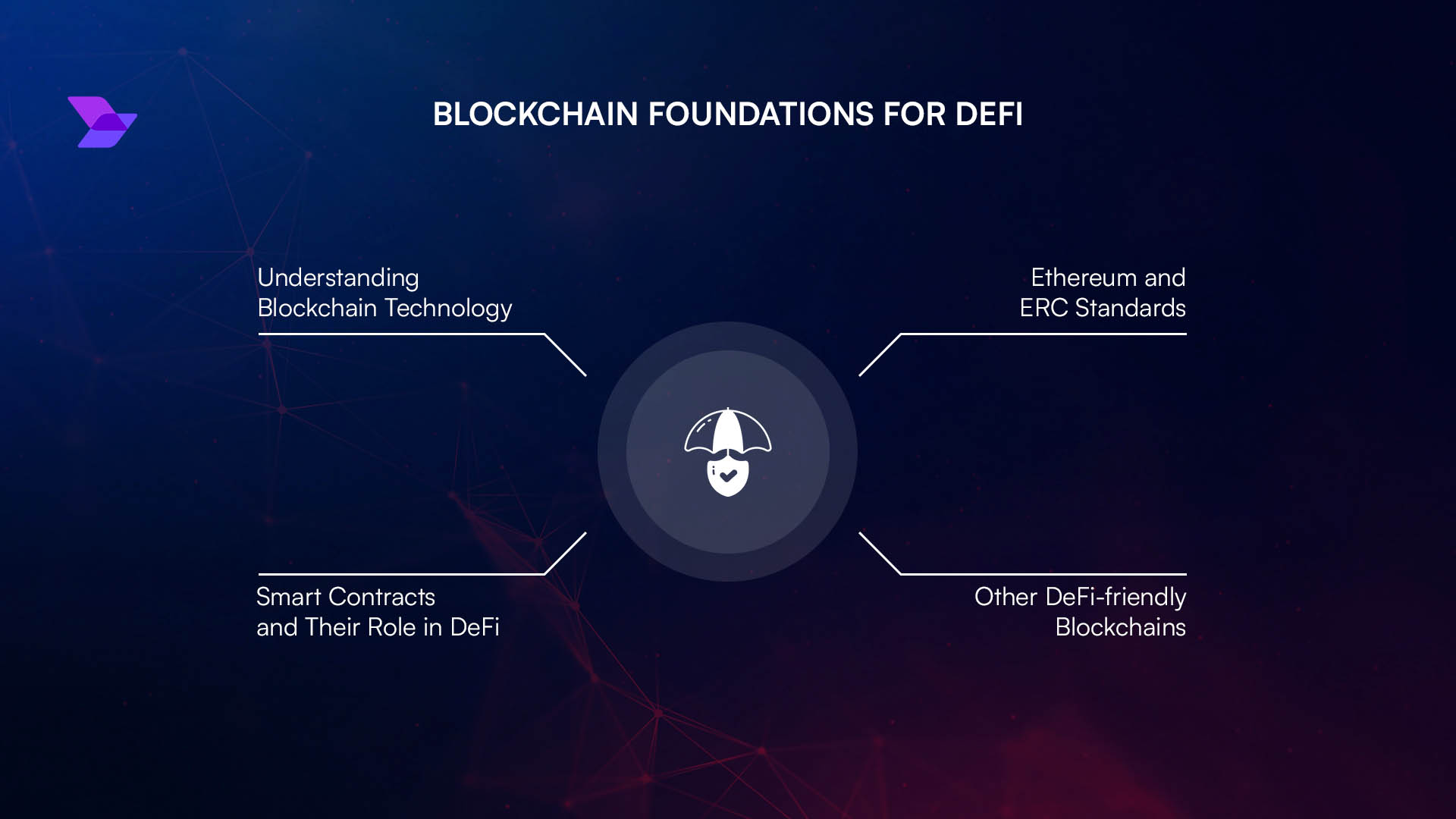

EVM Compatibility Meets Enterprise-Grade Infrastructure

If you’re a developer with Solidity chops or an enterprise with serious throughput needs, Stable has your back. The chain is fully EVM-compatible – meaning you can port over your Ethereum dApps with minimal fuss – but also offers dedicated blockspace for high-volume players. No more fighting meme coins or NFT drops for bandwidth.

Top 5 Use Cases Powered by Stable’s Zero-Fee USDT Network

-

Instant, Fee-Free Peer-to-Peer Remittances: Stable enables gas-free USDT transfers between users worldwide, making cross-border payments as simple as sending a text—no hidden fees, no delays.

-

Merchant Payments & E-Commerce: With USDT as the native gas token and zero transaction fees, merchants can accept stablecoin payments directly, eliminating costly intermediaries and volatile fees.

-

Enterprise Payroll & Mass Disbursements: Stable’s dedicated blockspace and rapid settlement empower businesses to pay employees or vendors in USDT instantly, at scale, and without transaction friction.

-

DeFi Applications & On-Chain Trading: Full EVM compatibility allows DeFi protocols to deploy on Stable, leveraging zero-fee USDT transfers for swaps, lending, and yield strategies—maximizing user returns.

-

Embedded Payments for Apps & APIs: Stable’s infrastructure lets apps, APIs, and AI agents embed seamless USDT payments into user experiences, enabling microtransactions and automated value exchange across the web.

This blend of flexibility and performance is already attracting heavyweight partners and dApp builders looking to escape the unpredictability of older chains. With its three-phase roadmap (native USDT layer now live, transfer aggregators next, then even faster speeds), expect innovation here to move at breakneck pace.

If you’re hungry for deeper technical breakdowns or want to see how this all stacks up against other stablecoin L1s like PayPal USD or Circle’s CCTP efforts, check out this comprehensive explainer from DeFi Coverage: How Stablechain Is Redefining Stablecoin Payments, USDT Native Layer 1 Explained.

What does all this mean for stablecoin adoption? In a word: acceleration. Stablechain’s approach doesn’t just shave off friction – it bulldozes the barriers that have kept stablecoins from mass payment adoption. No more onboarding headaches, no more explaining why you need to buy yet another token just to send a few dollars. For everyday users and global enterprises alike, this is the first time stablecoin payments actually feel, well, stable.

Why the Stable Blockchain USDT Model Matters for DeFi

Let’s not kid ourselves: DeFi has always been tantalizing, but it’s never been truly accessible to the masses. Stable flips that script with its Layer 1 stablecoin chain model. By removing volatile gas fees and embracing USDT as native gas, Stablechain creates a playground where yield farmers, payroll providers, and cross-border merchants can operate on predictable rails.

This predictability is rocket fuel for innovation. Imagine DAOs running payroll in USDT without fee anxiety, or remittance companies settling billions with sub-second finality and zero-gas headaches. Even high-frequency traders get a leg up with dedicated blockspace that won’t get clogged by NFT mints or memecoin mania.

The big question: will other stables follow suit? With Tether’s $500 billion clout behind it and major backers like Bitfinex and Hack VC fueling development, don’t be surprised if we see Circle or PayPal circle the wagons (pun intended) around their own Layer 1s soon. But for now, Stable has the first-mover advantage in the stablecoin payments infrastructure arms race.

The Waitlist Frenzy and What Comes Next

If you’re itching to get your hands dirty, you’re not alone – the Stablechain waitlist is swelling with everyone from DeFi degens to TradFi giants looking to tap into zero-fee stablecoin transfers. The roadmap is aggressive: after launching its native USDT layer with gas-free P2P transfers and EVM compatibility, next up are transfer aggregators (think batch settlements at warp speed) and tools built for dApp devs who want reliability at scale.

And let’s not ignore the elephant in the room: regulatory clarity. By building an enterprise-grade chain backed by U. S. Treasuries and designed for compliance-first payments, Stable isn’t just chasing retail adoption – it’s putting itself on a collision course with legacy payment networks worldwide.

Would you use Stablechain for daily payments if gas fees were always zero?

Stable is a new Layer 1 blockchain purpose-built for USDT payments, offering gas-free peer-to-peer transfers and instant settlement. With recent $28 million backing and support from major industry players, Stable aims to make stablecoin payments seamless and cost-free. We’re curious—would you use Stablechain for your everyday transactions if you never had to pay gas fees?

Stablechain vs Legacy Rails: Who Wins?

The battle lines are drawn. On one side: SWIFT wires, slow ACH payments, bloated remittance fees – all relics of a bygone era. On the other: Tether USDT blockchain, instant settlement, zero-gas transactions on a chain purpose-built for global value transfer.

If history teaches us anything in crypto, it’s that bold experiments often become tomorrow’s standards (remember when everyone thought stablecoins themselves were too risky?). With its unique blend of simplicity, speed, and scalability – not to mention serious financial firepower behind it – Stablechain might just be writing the next chapter of global payments.