How sUSDaf Delivers 21%+ Real Yield: Deep Dive Into the Hottest Yield-Bearing Stablecoin

Yield-bearing stablecoins are rewriting the rules of DeFi passive income, and right now, sUSDaf is at the center of this revolution. With an eye-popping estimated APY of 16.32% as of October 5,2025, sUSDaf from Asymmetry Finance has quickly become the most talked-about player in the race for the best stablecoin yield 2024. But how does sUSDaf actually deliver this real yield? Let’s break down why it’s capturing so much attention and what sets it apart in a market that’s ballooned to nearly $300 billion in total stablecoin capitalization since January 2024.

sUSDaf: The Mechanics Behind 16.32% Real Yield

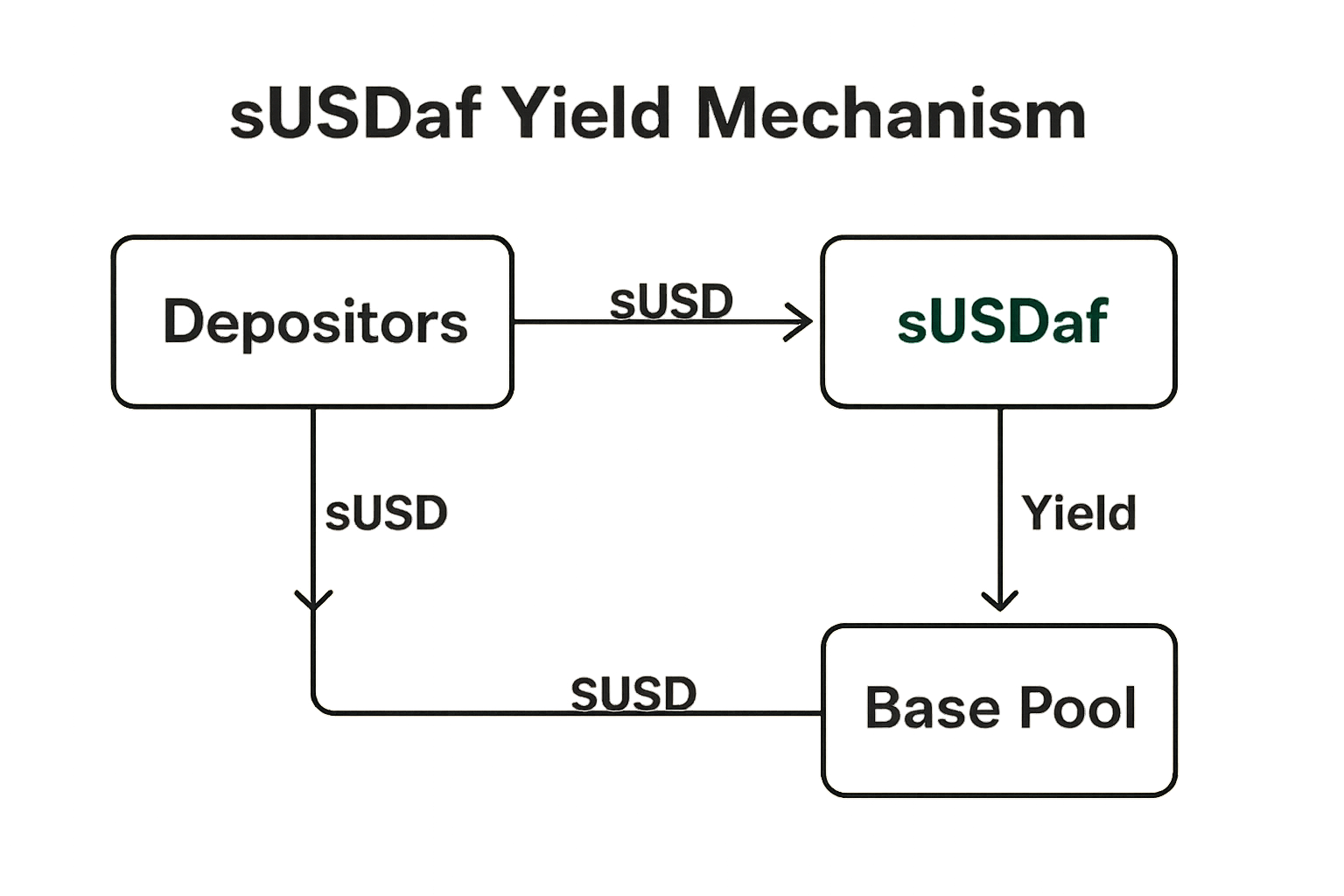

If you’re hunting for stablecoin passive income, understanding sUSDaf’s yield engine is essential. Unlike static stablecoins that simply peg to $1, sUSDaf taps into a two-pronged strategy to generate its robust yield:

- Borrower Interest Redistribution: When users borrow against collateral on Asymmetry Finance, they pay interest. A full 75% of these interest payments are funneled directly into Stability Pool depositors’ pockets – which means sUSDaf holders are constantly earning from active protocol usage.

- Liquidation Gains: When borrowers become under-collateralized, their positions can be liquidated at a discount. The resulting gains are distributed among sUSDaf holders who participate in Stability Pools, adding another layer of real, protocol-driven income.

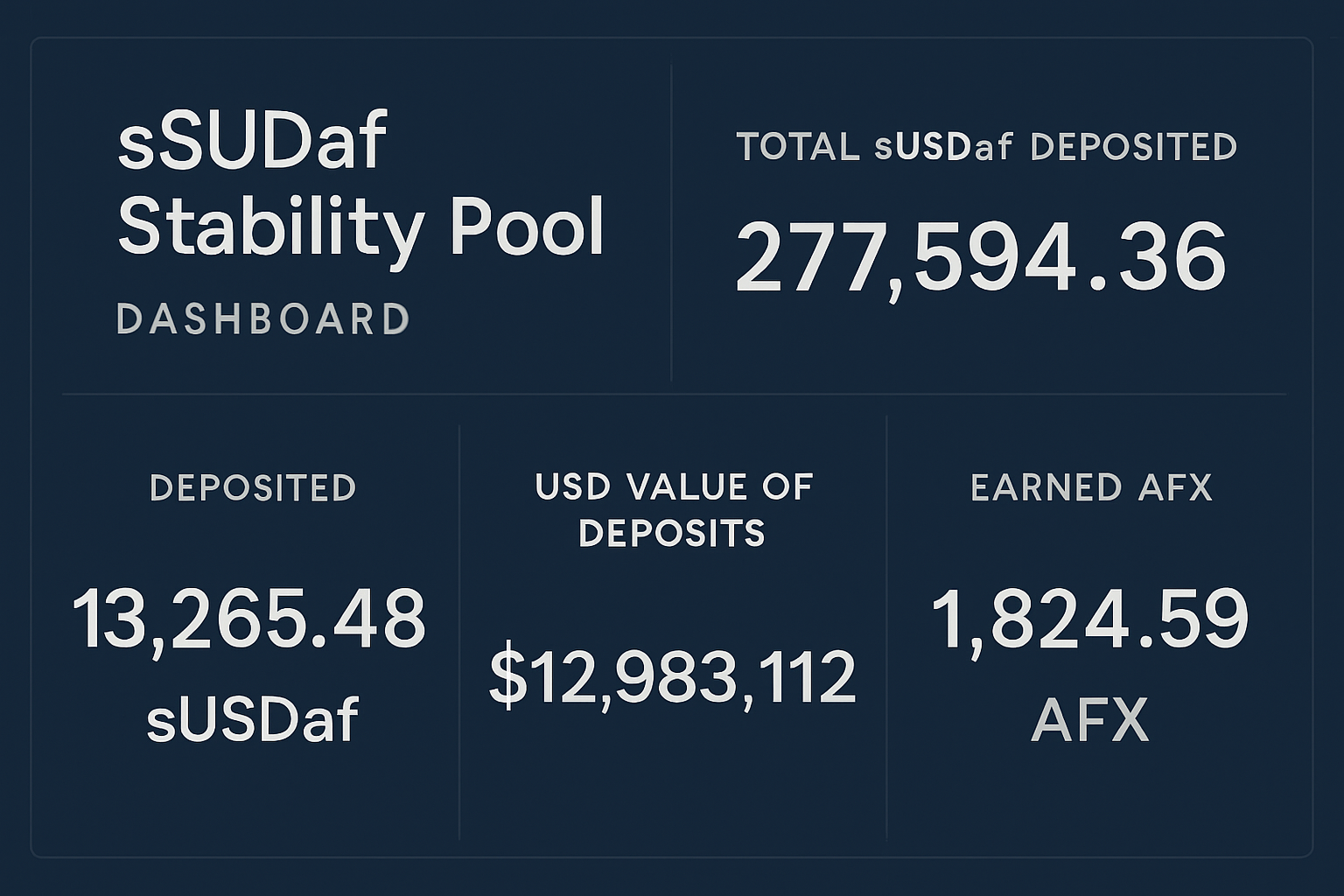

This isn’t just theoretical: these mechanisms are live and delivering results right now. You can verify current yields or dig deeper into protocol specifics via Asymmetry Finance’s official dashboard.

The Yield-Bearing Stablecoin Boom: Why Now?

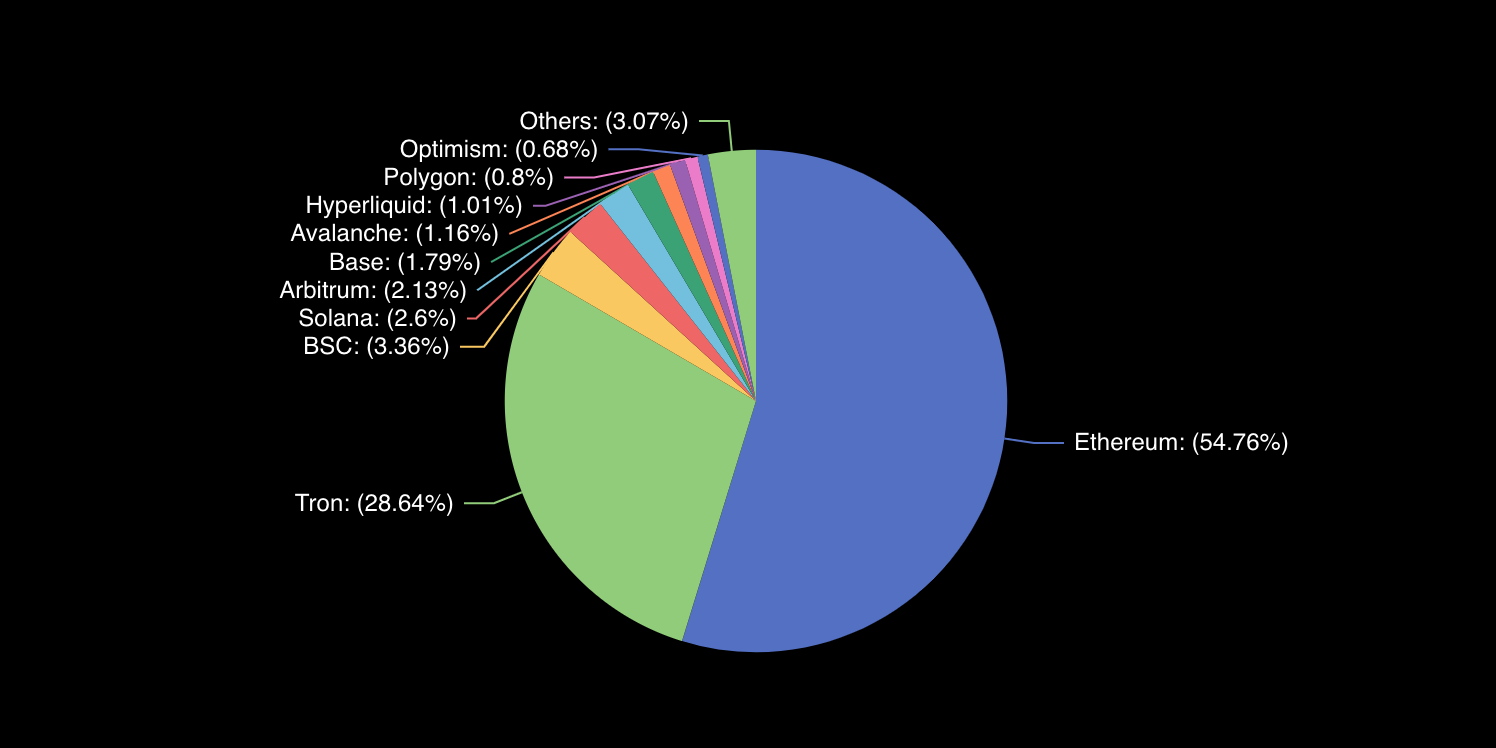

The explosive growth in stablecoin market cap – up 120% since early 2024 – is more than just a number. It signals massive demand for crypto-native assets that offer both stability and return potential. Traditional stablecoins like USDT and USDC provided price certainty but zero upside; now, protocols like Asymmetry Finance have pushed innovation further by letting users earn on-chain yields without sacrificing dollar-pegged value.

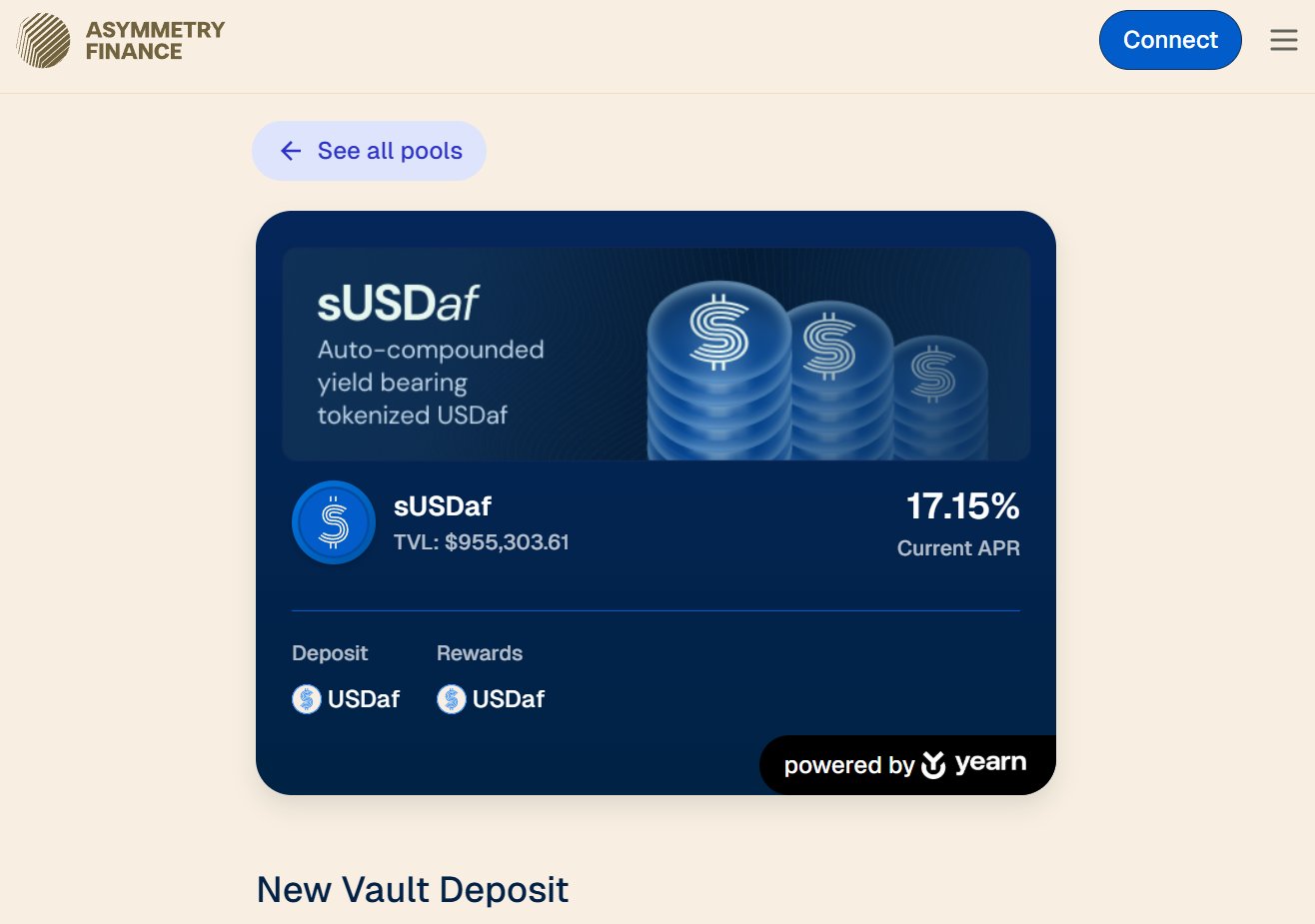

sUSDaf isn’t alone in this space, but its combination of transparent yield sources and seamless integration with DeFi powerhouses like Yearn Finance vaults gives it an edge over competitors such as sDAI or USD0 and and. For context, USD0 and and offered a peak annualized yield of 95.7% on December 19,2024 – but with significant lock-up caveats that limited access for many retail users (see full breakdown here). In contrast, sUSDaf’s auto-compounding through Yearn vaults means yields are not only competitive but also optimized for hands-off investors.

How sUSDaf Stands Out From Other Yield-Bearing Stablecoins

-

Unique Yield Generation Mechanism: sUSDaf combines interest from borrowers and liquidation gains from under-collateralized loans, while most alternatives like USD0++ or USDY primarily rely on passive income from U.S. Treasuries or on-chain lending protocols.

-

Auto-Compounding With Yearn Vaults: sUSDaf leverages Yearn Finance‘s vault infrastructure for auto-compounding and rebalancing yields—an edge over stablecoins like USDf or USDT, which lack integrated yield optimization.

-

Higher Real Yield Potential: As of October 5, 2025, sUSDaf offers an estimated APY of 16.32%, outpacing many competitors like USD0++ (11.14% APY) and USDY (typically 5–8% APY).

-

Stability Pool Participation: sUSDaf holders can deposit into Stability Pools and earn a share of liquidation profits, a feature not commonly found in most yield-bearing stablecoins such as USDC or DAI.

-

Decentralized, Multi-Protocol Integration: sUSDaf integrates with multiple DeFi protocols, enhancing risk management and yield diversity, whereas many competitors remain siloed within a single platform or asset class.

How Does Auto-Compounding Turbocharge Your Returns?

sUSDaf’s integration with Yearn vault infrastructure isn’t just a technical detail – it’s a game-changer for maximizing your DeFi stablecoin yields. Here’s why:

- Auto-Compounding: All earned interest and liquidation gains are automatically reinvested back into the pool, so your position grows without manual intervention.

- Auto-Rebalancing: The system dynamically shifts funds across multiple Stability Pools to chase the highest available returns while minimizing risk exposure.

- Simplified User Experience: No need to claim rewards or rebalance yourself – everything happens behind the scenes for truly passive income generation.

This approach not only saves time but also ensures you’re always capturing every possible basis point from your holdings – that’s what separates real yield stablecoins like sUSDaf from legacy products stuck in the past.

For investors who want to stay nimble and maximize their crypto cash positions, this blend of auto-compounding and protocol-native yield is a breakthrough. It means that your sUSDaf position is always working for you, day and night, compounding rewards that come directly from real economic activity on-chain. This is not a synthetic or speculative yield – it’s the result of actual borrower demand and market-driven liquidations.

sUSDaf vs sDAI: Yield, Risk & User Feedback Comparison (as of Oct 5, 2025)

| Metric | sUSDaf (Asymmetry Finance) | sDAI (MakerDAO) |

|---|---|---|

| Current APY | 16.32% 🚀 | 4.85% |

| Yield Source | Interest from borrowers (75% to depositors), liquidation gains, Yearn auto-compounding | DAI Savings Rate (DSR), MakerDAO vault yield |

| Risk Factors | Smart contract risk, liquidation volatility, protocol dependency on borrower activity | Smart contract risk, DAI peg stability, protocol governance |

| Auto-Compounding | Yes (via Yearn integration) 🔄 | No |

| Liquidity | High (integrated with major DeFi protocols) 💧 | Very High (widely adopted, deep liquidity) |

| User Testimonial | “Earning double-digit yield on stablecoins feels like a game-changer!” 😍 | “Reliable, but returns are lower than new stablecoins.” 🙂 |

sUSDaf vs sDAI: Where Does the Real Yield Stand?

The competition among yield-bearing stablecoins is heating up. While sDAI remains a favorite for DeFi veterans chasing consistent returns, its APY has hovered in the single-digit range for most of 2025. In contrast, sUSDaf’s current 16.32% APY stands out as one of the highest sustainable yields in DeFi, without requiring complex farming strategies or risky leverage.

Let’s break down what makes sUSDaf unique compared to other top contenders:

Key Features & Risks: sUSDaf vs sDAI vs USD0++

-

sUSDaf (Asymmetry Finance): Yield: Currently offers an estimated 16.32% APY (as of October 5, 2025). Mechanism: Yield is generated from borrower interest and liquidation gains on under-collateralized loans; 75% of interest goes to Stability Pool depositors. Integrations: Utilizes Yearn Finance vaults for auto-compounding and rebalancing. Risks: Exposed to smart contract risk, liquidation event volatility, and protocol dependency.

-

sDAI (Spark Protocol): Yield: Variable, typically 3-8% APY depending on DAI Savings Rate (DSR). Mechanism: Earns yield from MakerDAO‘s DSR, which is funded by real-world assets and protocol fees. Integrations: Widely supported across DeFi platforms, with deep liquidity and composability. Risks: Exposed to MakerDAO governance changes, DSR fluctuations, and smart contract vulnerabilities.

-

USD0++ (USD0 by Ondo Finance): Yield: Offers 11.14% APY at time of writing; peaked at 95.7% annualized yield (Dec 19, 2024). Mechanism: Yield comes from tokenized US Treasuries and on-chain strategies managed by Ondo Finance. Integrations: Tradable on major DeFi protocols; some products may require lock-up periods. Risks: Regulatory exposure, counterparty risk, and U.S. Treasury market volatility.

If you’re seeking DeFi stablecoin yields that are both attractive and transparent, sUSDaf’s open model (with real-time stats available on Asymmetry Finance) offers a compelling alternative to opaque or centralized options.

What Are the Risks? Staying Smart in a Fast-Moving Market

No yield comes without risk – even with the best stablecoin yield 2024 has seen so far. The primary risks with sUSDaf include:

- Protocol Risk: Like all DeFi protocols, smart contract vulnerabilities could impact funds. Asymmetry Finance publishes regular audits, but users should always do their own research.

- Peg Stability: If borrower demand dries up or liquidation mechanisms fail during extreme volatility, there could be temporary deviations from the $1 peg.

- Market Liquidity: Rapid inflows or outflows may impact short-term liquidity. However, integration with Yearn vaults helps buffer these swings by spreading exposure across multiple pools.

The good news? All yields are fully on-chain and visible at any time via Asymmetry’s dashboard (see here). This level of transparency is rare among high-yielding stablecoins, a major advantage for those who value risk management as much as returns.

Is Now the Time to Move Into Real Yield Stablecoins?

The numbers don’t lie: with stablecoin market cap nearing $300 billion and protocols like Asymmetry Finance leading innovation in fixed rate stablecoin yield, we’re witnessing a new era for passive crypto income. Whether you’re parking dry powder ahead of your next swing trade or building long-term wealth through compounding yields, products like sUSDaf are rewriting what’s possible for conservative DeFi investors.

The key takeaway? Don’t settle for zero-yield stables when real opportunity exists. With mechanisms built on borrower demand and liquidation gains – all turbocharged by auto-compounding through Yearn vaults – sUSDaf delivers some of the best stablecoin yields available right now. Stay alert to protocol updates, monitor APYs regularly, and remember: in crypto markets as dynamic as these, momentum truly is opportunity.