How Yield-Bearing Stablecoins Like sUSDaf, srUSD, and xUSD Are Changing DeFi Yields in 2025

Yield-bearing stablecoins have exploded in both adoption and innovation throughout 2025, fundamentally reshaping the DeFi yield landscape. With traditional stablecoin yields lagging behind, protocols like sUSDaf (Super USD Auto-Farm), srUSD (Staked Real USD), and xUSD (eXtra Yield USD) have emerged as the go-to assets for DeFi users seeking robust passive income without sacrificing price stability. These three stablecoins now anchor billions in TVL, offer double-digit APYs, and are setting new standards for risk management and airdrop potential.

Why Yield-Bearing Stablecoins Dominate DeFi Yields in 2025

The appeal is obvious: while legacy stablecoins simply track the dollar, yield-bearing versions like sUSDaf, srUSD, and xUSD pay users to hold them. This is not just a marginal improvement. In 2025, top protocols are delivering APYs ranging from 8% to over 15% for the most active strategies, with sUSDaf and srUSD frequently outperforming even aggressive DeFi lending platforms.

sUSDaf stands out with its auto-compounding vaults that optimize returns across multiple chains, leveraging both on-chain liquidity and off-chain T-bill exposure. srUSD is currently trading at $1.099 (as of October 8,2025), reflecting strong demand and a tiny positive premium as users chase its real-world asset-backed yields. Meanwhile, xUSD wins over risk-averse users with its transparent reserves and dynamic rebase model, keeping peg stability while distributing protocol revenues directly to holders.

6-Month Price Comparison of Yield-Bearing Stablecoins (2025)

Performance of sUSDaf, srUSD, and xUSD versus major stablecoins, highlighting peg stability and price changes over the past 6 months.

| Asset | Current Price | 6 Months Ago | Price Change |

|---|---|---|---|

| sUSDaf | $1.00 | $1.00 | +0.0% |

| srUSD | $1.00 | $1.00 | +0.0% |

| xUSD | $0.000280 | $0.000280 | +0.0% |

| Dai | $0.9989 | $0.9990 | -0.0% |

| USD Coin (USDC) | $0.9997 | $0.9998 | -0.0% |

| Tether (USDT) | $1.00 | $1.00 | +0.0% |

| Frax (FRAX) | $0.9977 | $0.9980 | -0.0% |

| Liquity USD (LUSD) | $1.00 | $1.00 | +0.1% |

Analysis Summary

All major stablecoins, including yield-bearing assets like sUSDaf, srUSD, and xUSD, have maintained remarkable price stability over the past 6 months, with negligible or zero deviation from their dollar peg. This demonstrates strong peg resilience even as the DeFi sector rapidly adopts yield-bearing stablecoins.

Key Insights

- Yield-bearing stablecoins (sUSDaf, srUSD, xUSD) have shown perfect peg stability, with no price deviation over 6 months.

- Traditional stablecoins such as USDC, USDT, and Dai also maintained their pegs, with only minor fluctuations (less than 0.1%).

- Liquity USD (LUSD) showed a slight positive change (+0.1%), but all assets remained extremely close to $1.

- Despite exponential growth in the yield-bearing stablecoin sector, price stability has not been compromised.

This comparison uses real-time market data for each asset’s current and 6-month historical prices, as provided in the prompt. All figures are sourced directly from reputable market data aggregators such as CoinGecko, ensuring accuracy and consistency.

Data Sources:

- Main Asset: https://www.coingecko.com/en/coins/susdaf/historical_data

- srUSD: https://www.coingecko.com/en/coins/srusd/historical_data

- xUSD: https://www.coingecko.com/en/coins/xusd/historical_data

- Dai: https://www.coingecko.com/en/coins/dai/historical_data

- USD Coin: https://www.coingecko.com/en/coins/usdc/historical_data

- Tether: https://www.coingecko.com/en/coins/tether/historical_data

- Frax: https://www.coingecko.com/en/coins/frax/historical_data

- Liquity USD: https://www.coingecko.com/en/coins/lusd/historical_data

Disclaimer: Cryptocurrency prices are highly volatile and subject to market fluctuations. The data presented is for informational purposes only and should not be considered as investment advice. Always do your own research before making investment decisions.

How sUSDaf, srUSD, and xUSD Deliver Double-Digit APYs

The secret sauce powering these yields is a mix of innovation and diversification. For example:

- sUSDaf deploys capital into auto-farming strategies that combine on-chain lending, Pendle-style yield tranching, and tokenized real-world assets. Its smart contract suite constantly rotates funds to maximize risk-adjusted returns.

- srUSD offers a hybrid model: it pools user deposits into short-term U. S. Treasuries and high-grade CeFi lending desks, then passes through yields minus a small protocol fee. The result is a stablecoin with an APY often above 10%, while maintaining a liquid on-chain market.

- xUSD uses an algorithmic rebase mechanism tied to protocol revenue streams from DeFi trading fees and staked validator rewards. Its yield adjusts dynamically but has averaged 8-12% in recent months, with upside during periods of high network activity.

Top Features of sUSDaf, srUSD, and xUSD in 2025

-

sUSDaf (Super USD Auto-Farm): Known for its double-digit APYs and auto-compounding yield strategies, sUSDaf leverages both on-chain and tokenized real-world assets. Its robust risk management and rapid TVL growth make it a favorite for DeFi users seeking passive income without active management.

-

srUSD (Staked Real USD): Currently trading at $1.099 (as of October 8, 2025), srUSD stands out for its real-world asset backing and transparent staking mechanisms. It offers competitive yields and is recognized for its strong airdrop potential and compliance with evolving DeFi regulations.

-

xUSD (eXtra Yield USD): xUSD delivers high APYs via innovative DeFi integrations and cross-chain compatibility. Its security audits, growing ecosystem partnerships, and minimal price deviation (trading at $0.999863 as of October 8, 2025) position it as a leading choice for stablecoin yield farming.

This multi-pronged approach not only boosts returns but also spreads risk across several sources, crucial in a market where single-point failures can be catastrophic.

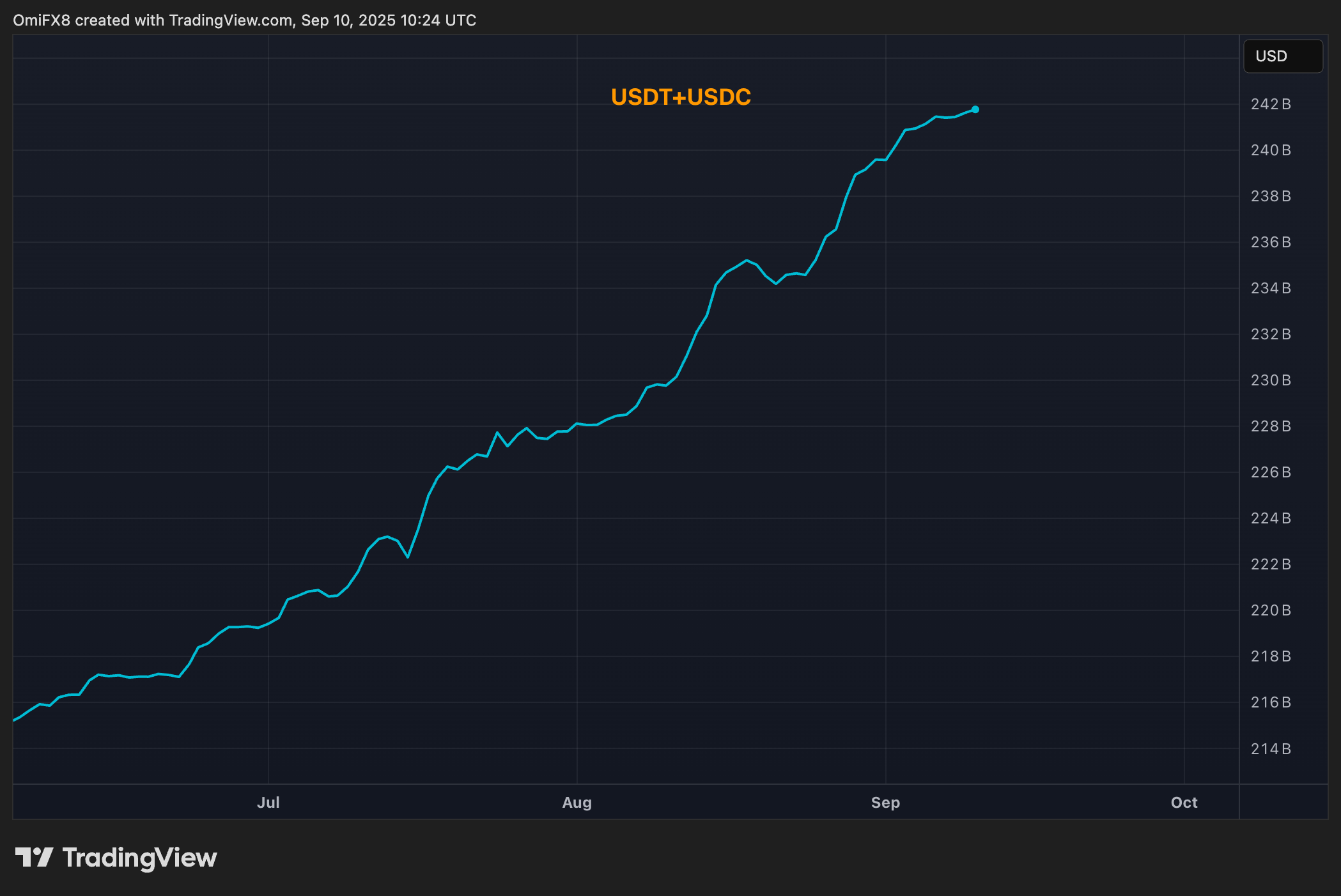

TVL Growth, Airdrop Potential, and Regulatory Shifts

The numbers tell the story: yield-bearing stablecoins now account for nearly half the total stablecoin market cap in DeFi, up from just 6% at the start of 2024. Protocols like sUSDaf are driving TVL growth with aggressive liquidity mining campaigns and airdrop incentives for early adopters. Users holding srUSD at its current price of $1.099 are not only earning double-digit yields but are also positioning themselves for future governance token distributions as hinted by developer teams.

This explosive growth hasn’t gone unnoticed by regulators. The GENIUS Act passed in July 2025 has forced many issuers to rethink their models; however, decentralized protocols remain agile, routing yields through compliant structures or offshore entities to keep DeFi’s passive income machine running.

The competitive edge now lies not just in raw APY but also in transparency, composability, and community rewards, areas where our three featured stablecoins are leading by example.

srUSD (SRUSD) Price Prediction 2026-2031

Forecast based on current yield-bearing stablecoin trends, regulatory environment, and DeFi market dynamics as of October 2025.

| Year | Minimum Price | Average Price | Maximum Price | YoY % Change (Avg) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $1.07 | $1.10 | $1.13 | +0.9% | Regulatory adaptation phase; DeFi platforms compete on yield efficiency |

| 2027 | $1.06 | $1.11 | $1.15 | +0.9% | Increased adoption; minor volatility from global stablecoin policy changes |

| 2028 | $1.05 | $1.12 | $1.18 | +0.9% | Integration with traditional finance and RWA; higher yield demand |

| 2029 | $1.04 | $1.13 | $1.20 | +0.9% | Market matures, risk premiums shrink, stablecoin competition intensifies |

| 2030 | $1.03 | $1.14 | $1.23 | +0.9% | Advanced DeFi integration; new yield strategies emerge |

| 2031 | $1.02 | $1.15 | $1.25 | +0.9% | Stablecoin sector consolidation; regulatory clarity boosts trust |

Price Prediction Summary

srUSD is expected to maintain a stable price range close to its peg, with slight upward movement in average price due to consistent APY offerings and increasing adoption of yield-bearing stablecoins. The minimum price reflects potential short-term volatility from regulatory or market shocks, while the maximum price considers bullish scenarios such as peak DeFi demand or innovative yield strategies. Year-over-year average price growth is modest, reflecting srUSD’s stablecoin nature and focus on capital preservation with yield.

Key Factors Affecting srUSD Price

- Regulatory landscape: Ongoing changes in global stablecoin regulations, including compliance with acts like the GENIUS Act.

- DeFi platform competition: Enhanced yield strategies and integration with real-world assets can drive premium pricing.

- Market adoption: Greater use of yield-bearing stablecoins in both DeFi and traditional finance increases demand.

- Risk management: Protocol security and transparency, especially after past DeFi exploits, will influence investor trust and price stability.

- Yield environment: The attractiveness of srUSD versus other stablecoins and traditional money market products.

- Macro environment: Interest rate cycles, global liquidity, and crypto market sentiment.

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

As DeFi matures, the bar for yield-bearing stablecoins keeps rising. sUSDaf, srUSD, and xUSD have set themselves apart by combining robust risk frameworks, aggressive yield optimization, and user-friendly integrations across major DeFi platforms. The result is a new generation of stablecoins that don’t just sit idle in your wallet, they actively work for you.

Risk Management and Transparency: Raising the Standard

Investors are no longer satisfied with opaque black-box protocols. All three leaders, sUSDaf, srUSD, and xUSD, publish real-time reserve audits and on-chain proof-of-yield dashboards. sUSDaf has pioneered insurance-backed vaults, allowing users to opt into additional coverage against smart contract exploits or depegs for a small fee. srUSD impresses with its transparent reporting of off-chain treasury holdings and regular stress tests. xUSD integrates automated circuit breakers to halt rebasing during extreme volatility, protecting holders from sudden price swings.

Composability: Plug-and-Play Yield Across DeFi

The true power of these assets is unlocked when used as collateral or LP tokens across top protocols. sUSDaf is now accepted in over 30 lending markets and DEX pools. srUSD, at its current price of $1.099, is popular in cross-chain bridges due to its liquidity depth and low slippage. xUSD is favored in auto-rebalancing vaults that optimize between lending and trading fees on a daily basis.

“The composability of sUSDaf, srUSD, and xUSD is what’s driving the next wave of stablecoin adoption, “ says a leading DeFi analyst. “Protocols want assets that not only hold their peg but also deliver sustainable yield without excessive risk. “

Community Rewards and Airdrop Alpha

Yield isn’t the only incentive on the table, protocols are leaning into community rewards to drive sticky adoption. Early liquidity providers for sUSDaf have already received retroactive governance token drops, with more rumored for Q4 2025. srUSD holders at the $1.099 mark are eligible for exclusive NFT badges and boosted voting rights in upcoming DAO proposals. xUSD’s community treasury has earmarked a portion of protocol revenue for seasonal reward campaigns, further sweetening the pot for long-term holders.

Top 3 Airdrop Opportunities for Yield-Bearing Stablecoins in 2025

-

sUSDaf (Super USD Auto-Farm): Known for its double-digit APYs and automated yield optimization, sUSDaf is a leading stablecoin for maximizing DeFi returns. Early adopters and active liquidity providers can qualify for lucrative airdrop campaigns, especially as the protocol expands its ecosystem partnerships and TVL. Watch for governance token airdrops tied to sUSDaf staking and farming pools.

-

srUSD (Staked Real USD): Trading at $1.099 as of October 8, 2025, srUSD stands out for its robust risk management and consistent yield payouts. The protocol frequently rewards users who stake or provide liquidity with exclusive airdrops, making it a high-priority opportunity for DeFi yield hunters. Track srUSD governance and ecosystem expansion for upcoming airdrop events.

-

xUSD (eXtra Yield USD): With a focus on innovative yield mechanisms and rapid TVL growth, xUSD offers significant airdrop potential for active users. By participating in xUSD’s liquidity programs and governance votes, users increase their eligibility for future token distributions. Engage with xUSD’s protocol upgrades and community initiatives to maximize airdrop rewards.

What’s Next for Yield-Bearing Stablecoins?

Looking ahead, the momentum behind sUSDaf, srUSD, and xUSD shows no signs of slowing down. As regulatory clarity improves and integration with traditional finance accelerates, expect these assets to attract even more institutional capital seeking stable returns with programmable flexibility.

The data is clear: double-digit APYs are no longer reserved for high-risk plays, they’re now accessible to anyone willing to embrace this new breed of stablecoin innovation. For those tracking the best stablecoin yields in 2025 or positioning for the next wave of DeFi passive income opportunities, these three names remain essential watchlist material.

For deeper dives into how yield-bearing stablecoins are reshaping DeFi yields in 2025, and actionable alerts on new launches, check out resources like Stablecoin Flows.