How Yield-Bearing Stablecoins Like yoUSD and yUSD Are Revolutionizing DeFi Passive Income

The DeFi landscape in late 2025 is witnessing a profound shift as yield-bearing stablecoins like yoUSD and yUSD gain traction among passive income seekers. Unlike traditional stablecoins such as USDT or USDC, which function purely as digital representations of the U. S. dollar with no inherent yield, these new stablecoins are engineered to generate automated, risk-adjusted returns for holders. For conservative investors and DeFi newcomers alike, this innovation is redefining what it means to have a “stablecoin savings account” in the digital era.

How Yield-Bearing Stablecoins Work: From Vaults to Automated Yield

At the core, yield-bearing stablecoins combine the price stability of fiat-pegged assets with the passive income potential typically found in DeFi lending, staking, or real-world asset exposure. When users deposit assets into protocols like the yoUSD DeFi vault, they receive a token (such as yoUSD or yUSD) that represents their claim on both the underlying capital and any yield generated by the protocol’s strategies.

For example, holding yUSD means your funds are allocated into a diversified set of DeFi lending pools or automated strategies. As interest accrues from borrowers or from staking rewards, your yUSD balance increases automatically – no manual reinvestment or yield farming required. This is a significant leap in user experience and capital efficiency compared to the old days of actively managing dozens of DeFi positions just to chase modest returns.

Mechanisms Behind the Yields: What Powers Your Passive Income?

Yield-bearing stablecoins employ several mechanisms to deliver returns while maintaining their peg:

Top Sources of Yield for Stablecoins in DeFi

-

Staking and Savings Contracts: Protocols such as MakerDAO offer savings mechanisms like the Dai Savings Rate (DSR). By depositing DAI, users receive sDAI, which automatically accrues interest over time, increasing their balance without manual intervention.

-

Real-World Asset Exposure (RWAs): Yield-bearing stablecoins like USDY by Ondo Finance are backed by U.S. Treasury bills and bank deposits. The yield from these traditional assets is passed through to token holders, providing a regulated and stable source of income.

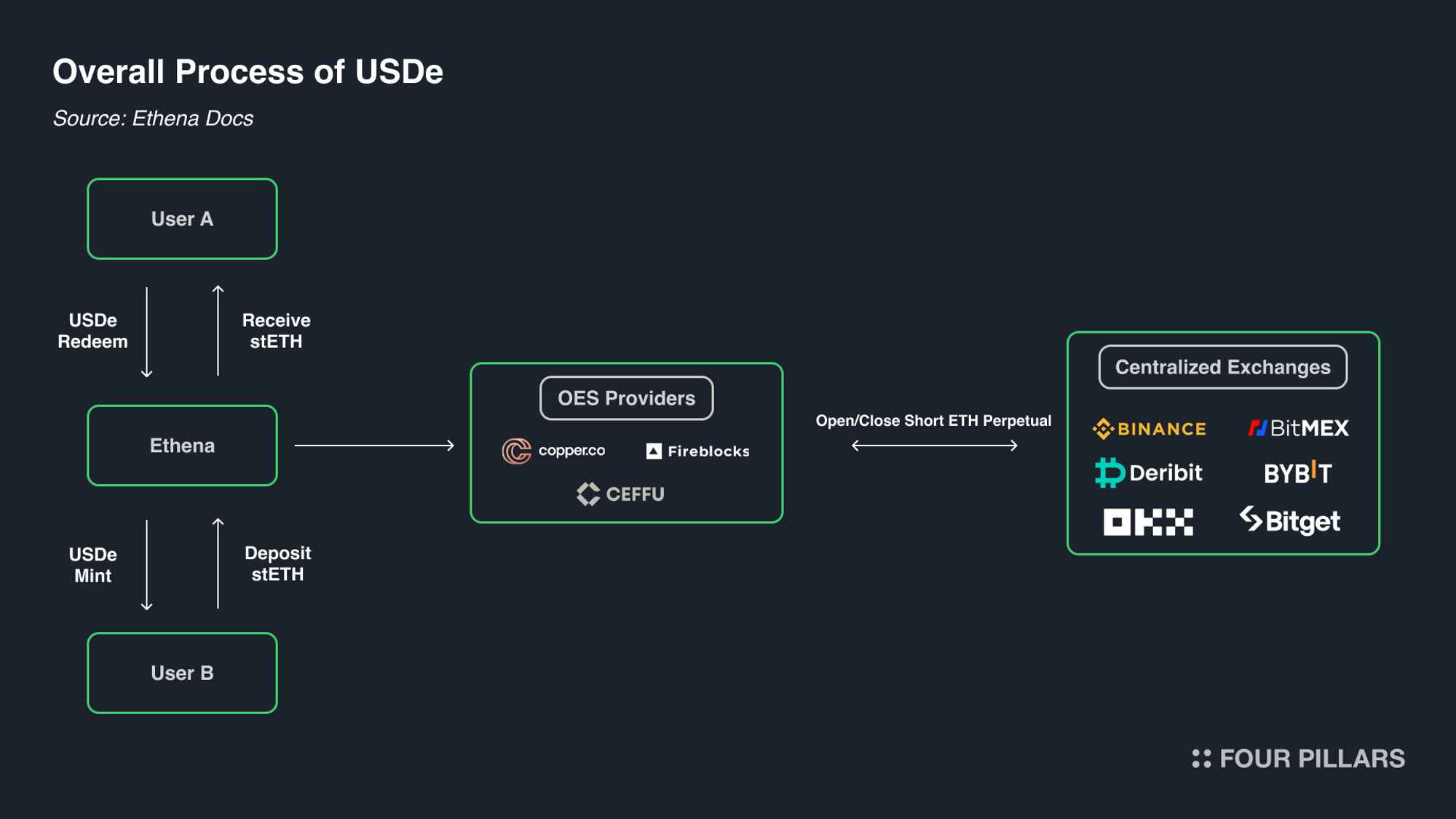

Protocols like yoUSD and yUSD typically aggregate yields from multiple sources. For instance, a portion of the stablecoin collateral might be lent out on Aave or Compound to earn interest, while another portion could be staked in savings contracts similar to MakerDAO’s sDAI. Some protocols even allocate funds to tokenized U. S. Treasuries or short-term repurchase agreements, blending TradFi stability with DeFi accessibility. The result: market yields in the 4%-5% range for most major products, with synthetic stablecoins like sUSDe occasionally offering higher rates depending on market conditions.

Why Passive Income Seekers Are Embracing Automated Stablecoin Yield

The appeal of yield-bearing stablecoins goes beyond headline rates. For many investors, the real value lies in:

- Automation: No need for constant monitoring or strategy rotation; yield accrues directly to your balance.

- Capital Efficiency: Stablecoin holders can finally put their idle dollars to work without sacrificing liquidity or safety.

- User-Friendliness: Products like yUSD lower the barrier to entry for DeFi yield optimization, making passive income accessible to a much wider audience.

This convergence of TradFi reliability and DeFi innovation is quickly making automated stablecoin yield a core pillar of modern portfolio construction. As more users seek out stable, risk-adjusted returns without the complexity of manual DeFi management, the adoption curve for these assets continues to steepen.

Feature Comparison: yoUSD vs yUSD Yield-Bearing Stablecoins

| Feature | yoUSD | yUSD |

|---|---|---|

| Type | Yield-Bearing Stablecoin | Yield-Bearing Stablecoin |

| Peg | USD ($1.00) | USD ($1.00) |

| Yield Source | DeFi Lending, Staking, RWAs | DeFi Lending, Staking, RWAs |

| Typical Annual Yield (2025) | 4% – 7% (market dependent) | 4% – 7% (market dependent) |

| Underlying Assets | Short-term Treasuries, DeFi protocols | Short-term Treasuries, DeFi protocols |

| Passive Income | ✅ Earns yield automatically | ✅ Earns yield automatically |

| Capital Efficiency | High: Combines stability and yield | High: Combines stability and yield |

| User Experience | Simple, auto-compounding | Simple, auto-compounding |

| Risks | Smart contract risk, regulatory, liquidity | Smart contract risk, regulatory, liquidity |

| DeFi Integration | Widely accepted in DeFi protocols | Widely accepted in DeFi protocols |

| Ideal For | Passive income seekers, DeFi users | Passive income seekers, DeFi users |

Yet even as adoption accelerates, it’s crucial for investors to approach yield-bearing stablecoins with pragmatic scrutiny. While automated yield protocols like yoUSD and yUSD offer a hands-off path to passive income, risks remain, especially in the underlying smart contracts and the evolving regulatory landscape. The promise of a “stablecoin savings account” is compelling, but as with any DeFi product, due diligence is non-negotiable.

Balancing Yield With Risk: What Informed Investors Should Watch

Yield-bearing stablecoins are not monolithic. Protocol design, collateral quality, and transparency standards can vary widely. Here are the most important risk factors to consider before allocating significant capital:

- Smart Contract Security: Even well-audited protocols can harbor vulnerabilities. Look for platforms with a proven track record and robust bug bounty programs.

- Liquidity Depth: In times of market stress, thin liquidity can lead to slippage or withdrawal delays. Prioritize stablecoins with deep on-chain and exchange liquidity.

- Regulatory Clarity: Jurisdictional uncertainty remains a wildcard. Stay informed on how regulators classify yield-bearing stablecoins in your region.

- Yield Sustainability: Beware of unusually high rates; sustainable protocols typically generate yields in the 4%-5% range by aggregating diversified sources.

Despite these caveats, the risk-adjusted return profile for leading products like yoUSD and yUSD remains competitive. For many, the ability to earn market-level yield without active management justifies the incremental risks, especially when protocols are transparent about their strategies and collateral backing.

How to Integrate Yield-Bearing Stablecoins Into Your Portfolio

For conservative investors, yield-bearing stablecoins can serve as a core holding or as a complement to more volatile crypto assets. Here’s a pragmatic approach to portfolio integration:

Smart Portfolio Strategies Using Yield-Bearing Stablecoins

-

Core Cash Position: Allocate a portion of your portfolio to yield-bearing stablecoins like sDAI (MakerDAO) or USDY (Ondo Finance). These assets maintain dollar-pegged stability while generating passive income—sDAI accrues interest via the Dai Savings Rate, and USDY is backed by U.S. Treasuries, currently offering yields around 4.29% annually. This approach provides a reliable, low-volatility foundation for your DeFi holdings.

-

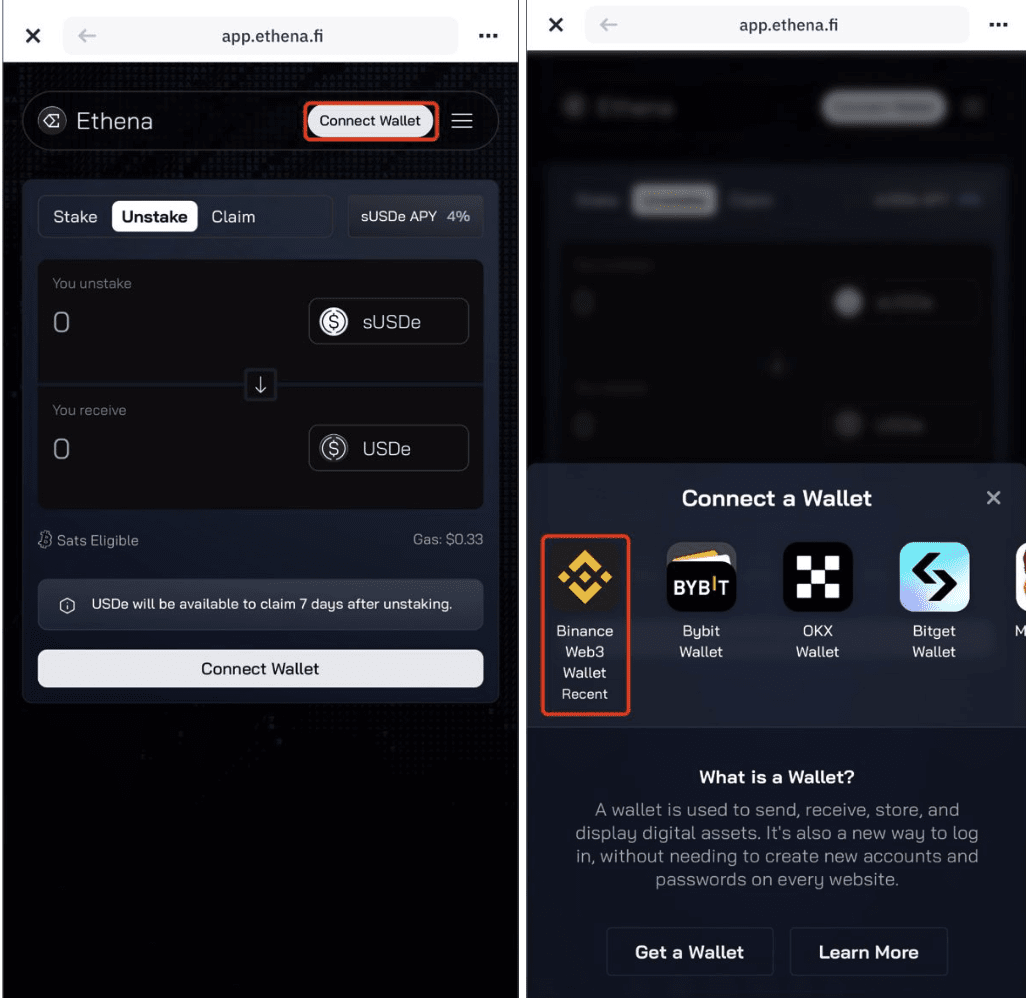

Liquidity Buffer: Maintain a flexible reserve in yield-bearing stablecoins such as sUSDe (Ethena) or USDY. These tokens can be quickly deployed for trading opportunities or to meet unexpected expenses, all while earning yield (sUSDe has delivered yields between 7% and 19% depending on market conditions). This strategy ensures your liquidity works for you, rather than sitting idle.

-

Yield-Enhanced Diversification: Integrate a mix of yield-bearing stablecoins across different protocols (e.g., sDAI, USDY, sUSDe) to diversify both yield sources and risk exposures. By combining assets backed by DeFi lending, real-world assets, and synthetic strategies, you can optimize returns while reducing reliance on any single protocol or mechanism.

Start small, monitor performance, and gradually increase exposure as you gain confidence in both the protocol and your own risk tolerance. Many investors use these stablecoins as a liquidity buffer, earning yield while waiting for new opportunities or as a hedge against crypto market volatility.

For those interested in deeper dives into protocol mechanics, advanced DeFi users can explore composable strategies by pairing yield-bearing stablecoins with other DeFi primitives. This opens up even more nuanced ways to optimize passive income while maintaining capital stability.

Looking Ahead: The Future of Stablecoin Savings Accounts

The next phase of DeFi will likely see further convergence between traditional finance and on-chain protocols. As regulatory clarity improves and smart contract security matures, yield-bearing stablecoins are poised to become the backbone of digital savings accounts, combining the best of both worlds for risk-conscious investors.

For those seeking a more technical breakdown of how protocols like yUSD are redefining stablecoin yield strategies, see our detailed analysis at this resource.

The bottom line: automated, risk-adjusted yield is no longer just for DeFi power users. With products like yoUSD and yUSD, passive income is finally accessible, transparent, and, most importantly, stable enough for mainstream adoption.