How RWA-Backed Stablecoins Like STBL and USST Are Redefining DeFi Yield and Compliance

In 2025, the stablecoin sector is undergoing a fundamental transformation, driven by the rise of RWA-backed stablecoins like STBL and its dual-token system. These innovations are redefining how DeFi participants access yield, manage risk, and comply with tightening regulatory standards. For investors seeking stable passive income without compromising on transparency or compliance, understanding the mechanics behind these new stablecoins is now essential.

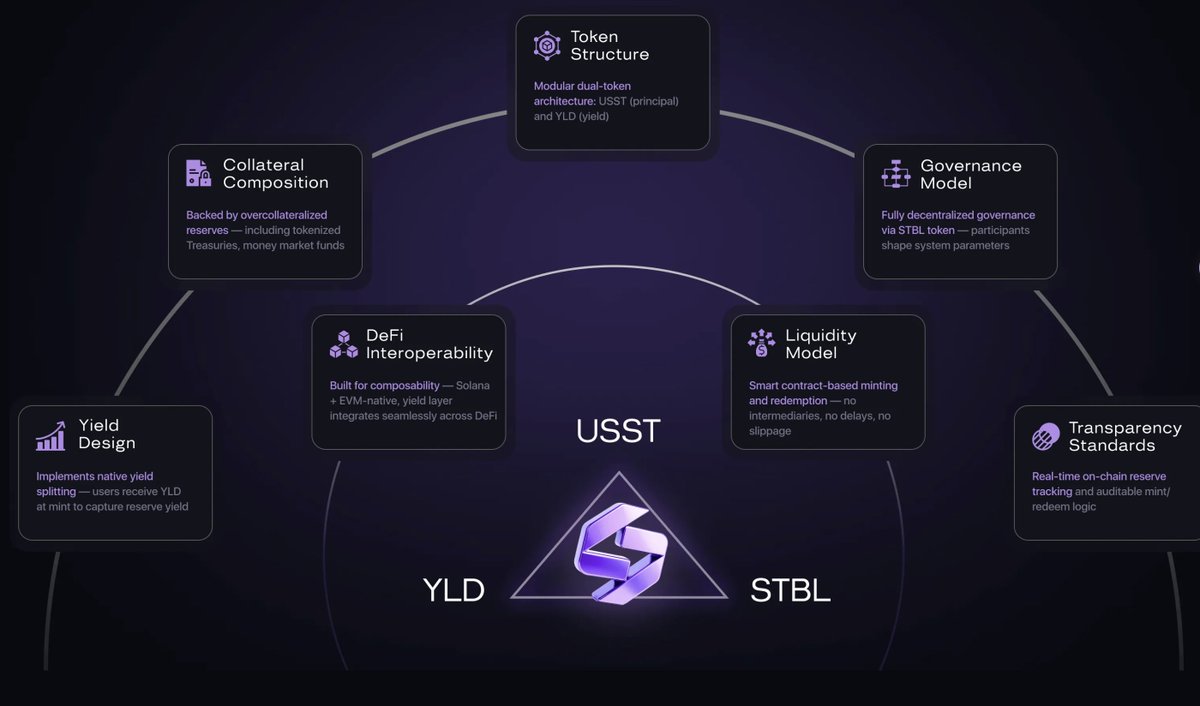

STBL’s Dual-Token Model: Separating Yield from Liquidity

The heart of STBL’s innovation lies in its dual-token architecture, designed to address long-standing trade-offs in DeFi. The USST token serves as a USD-pegged, RWA-backed stablecoin, built for transactional liquidity and broad DeFi integration. Its collateral is composed primarily of tokenized U. S. Treasury Bills and similar real-world assets, offering a robust foundation for price stability.

Upon minting USST, users also receive a separate YLD NFT. This token represents the right to claim yield generated by the underlying collateral. By splitting yield accrual (YLD) from transactional use (USST), STBL enables users to deploy stablecoins in DeFi while simultaneously earning passive income through YLD. This model removes the friction of choosing between utility and yield, a limitation that has long plagued traditional stablecoins.

Yield Generation Backed by Real-World Assets

Unlike algorithmic or crypto-collateralized stablecoins, real-world asset stablecoins like USST derive their yield from tangible off-chain sources. The protocol’s reserves are transparently allocated to assets such as U. S. Treasury Bills, which currently deliver yields in the 4% range according to recent market data. This income is programmatically distributed to YLD holders, creating a predictable, sustainable yield stream without requiring users to lock tokens in complex staking contracts or chase riskier DeFi strategies.

This approach appeals to conservative investors and institutions seeking exposure to on-chain dollar assets with verifiable backing and compliance features. As the DeFi landscape matures, demand for such products is accelerating, especially given macroeconomic factors like rising interest rates and increased scrutiny on crypto-native yield mechanisms.

Compliance and Transparency: Meeting Institutional Standards

One of the most significant barriers to institutional adoption of DeFi has been regulatory uncertainty and opaque reserve management. STBL addresses these challenges by ensuring all collateral assets are fully tokenized and visible on-chain, providing verifiable proof of reserves at all times. Features such as whitelisting and blacklisting further enable USST to meet evolving compliance requirements, positioning it as a viable solution for regulated entities.

This focus on transparency and compliance is not just a marketing point – it’s a response to legislative changes like the U. S. GENIUS Act, which restricts interest-bearing stablecoins. By decoupling yield from the core stablecoin (USST), STBL can offer a compliant payment asset while maintaining a separate channel for yield distribution through YLD NFTs.

STBL Price Prediction 2026-2031

Forecast based on RWA-backed stablecoin growth, DeFi adoption, regulatory trends, and current market data (as of October 2025: $0.1663 per STBL).

| Year | Minimum Price | Average Price | Maximum Price | % Change (Avg, YoY) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $0.12 | $0.19 | $0.32 | +14% | Continued RWA adoption; regulatory clarity improves DeFi trust, but competition from other stablecoins limits upside. |

| 2027 | $0.15 | $0.25 | $0.40 | +32% | Institutional adoption grows; more tokenized RWAs onboarded; positive regulatory environment. Bullish cycle possible. |

| 2028 | $0.18 | $0.30 | $0.48 | +20% | Yield-bearing stablecoins become mainstream; STBL/USST adoption in DeFi lending surges; tech upgrades boost utility. |

| 2029 | $0.22 | $0.35 | $0.55 | +17% | Global DeFi expansion; integration with TradFi, but macroeconomic risks (e.g., interest rate changes) could cause volatility. |

| 2030 | $0.25 | $0.40 | $0.62 | +14% | Stablecoin regulation matures; STBL benefits from compliance-first model and transparent reserves; competition intensifies. |

| 2031 | $0.28 | $0.44 | $0.70 | +10% | RWA-backed stablecoins dominate DeFi; STBL/USST used in cross-border payments and on-chain money markets. |

Price Prediction Summary

STBL is positioned for steady, progressive growth as RWA-backed stablecoins transform DeFi. Price appreciation is supported by increasing adoption, expanding use cases, and regulatory clarity, but competition and macroeconomic cycles may introduce volatility. The yield-splitting model and compliance focus differentiate STBL, supporting its long-term value proposition.

Key Factors Affecting STBL Price

- Adoption of RWA-backed stablecoins in DeFi and TradFi sectors

- Regulatory clarity and compliance-focused design

- Yield-splitting mechanism attracting both retail and institutional users

- Expansion of tokenized real-world assets (e.g., Treasuries, money market funds)

- Integration with major DeFi protocols and cross-chain platforms

- Competition from other yield-bearing and compliant stablecoins

- Broader macroeconomic factors such as interest rates and global financial stability

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

STBL Price Update: Governance Token Holds at $0.166319

As of October 10,2025, STBL’s governance token is trading at $0.166319, with a 24-hour change of -0.05110 (-0.23503%). The intraday high reached $0.222266, while the low was $0.156286. This price action reflects both the speculative interest in RWA-backed protocols and ongoing developments in DeFi compliance standards.

With its dual-token system, transparent reserves, and focus on regulatory-grade compliance, STBL is setting a new standard for what yield-bearing stablecoins can achieve in decentralized finance.

For investors, the emergence of yield separation in RWA-backed stablecoins like STBL offers a new toolkit for portfolio construction. Instead of being forced to choose between liquidity and yield, users can now allocate capital more precisely: keep USST in DeFi protocols for payments or collateral, and hold YLD for passive income. This flexibility is especially valuable in volatile markets, where risk management and regulatory clarity are increasingly non-negotiable.

How RWA-Backed Stablecoins Are Changing DeFi Yield Strategies

The practical impact of STBL’s approach is already visible in DeFi protocols that have integrated USST and YLD. By decoupling the yield from the transactional layer, these protocols can offer compliant, USD-pegged liquidity while still enabling users to capture real-world yields. For example, treasury-backed yield streams can now be accessed on-chain without exposing users to the algorithmic risks or overcollateralization requirements that plagued earlier stablecoin models.

This paradigm is also attracting institutional capital. With transparent on-chain reserves and robust compliance tooling, USST is positioned as a bridge between traditional finance (TradFi) and DeFi. The result is a more resilient DeFi ecosystem where risk is better understood and returns are more predictable.

Key Advantages of RWA-Backed Stablecoins in DeFi

-

Stable Value Backed by Real-World Assets: RWA-backed stablecoins like STBL’s USST are collateralized by tangible assets such as U.S. Treasury Bills, providing a stable USD peg and reducing volatility compared to algorithmic or crypto-only stablecoins.

-

Innovative Dual-Token Yield Model: The STBL protocol separates transactional liquidity (USST) from yield accrual (YLD), allowing users to utilize USST in DeFi while YLD holders earn passive income from underlying RWA yields.

-

Predictable and Transparent Yield Generation: By leveraging income-generating RWAs, yields are distributed directly to YLD holders, offering more predictable returns without complex staking or liquidity mining mechanisms.

-

Enhanced Regulatory Compliance: USST incorporates whitelist and blacklist features, enabling institution-grade compliance and making it suitable for regulated DeFi environments.

-

On-Chain Transparency and Verifiable Reserves: All collateral assets are tokenized and stored on-chain, allowing investors to independently verify reserves and ensuring transparency for all participants.

-

Bridging TradFi and DeFi Ecosystems: RWA-backed stablecoins like USST serve as a bridge between traditional finance and decentralized finance, attracting institutional capital and fostering broader adoption.

What to Watch: Risks and Future Outlook

While the advantages are clear, RWA-backed stablecoins like STBL are not without their own set of risks. Regulatory landscapes remain fluid, especially as governments refine definitions around digital assets and yield products. There is also execution risk in maintaining transparent, on-chain representations of off-chain assets. Investors must stay vigilant about protocol governance, third-party custodianship, and evolving compliance requirements.

That said, the direction of travel is clear: as DeFi matures, products that combine stable yields, real-world asset backing, and regulatory transparency will likely capture growing market share. The separation of yield from liquidity will become a blueprint for future stablecoin designs, especially as institutional players demand higher standards.

The Bottom Line for Yield-Focused Crypto Investors

For those seeking to maximize passive income in crypto without sacrificing compliance or transparency, STBL’s dual-token model represents a pragmatic evolution. The current STBL governance token price of $0.166319 (as of October 10,2025) reflects a market that is beginning to price in both the protocol’s innovative design and its potential for mainstream adoption.

Ultimately, the success of RWA-backed stablecoins will hinge on continued execution: maintaining transparent reserves, adapting to regulatory changes, and delivering predictable yields. For now, STBL and similar projects are setting a new standard for what yield-bearing stablecoins can deliver in the next phase of decentralized finance.