How Yield-Bearing Stablecoins Like USST and YLD NFTs Are Redefining DeFi Passive Income

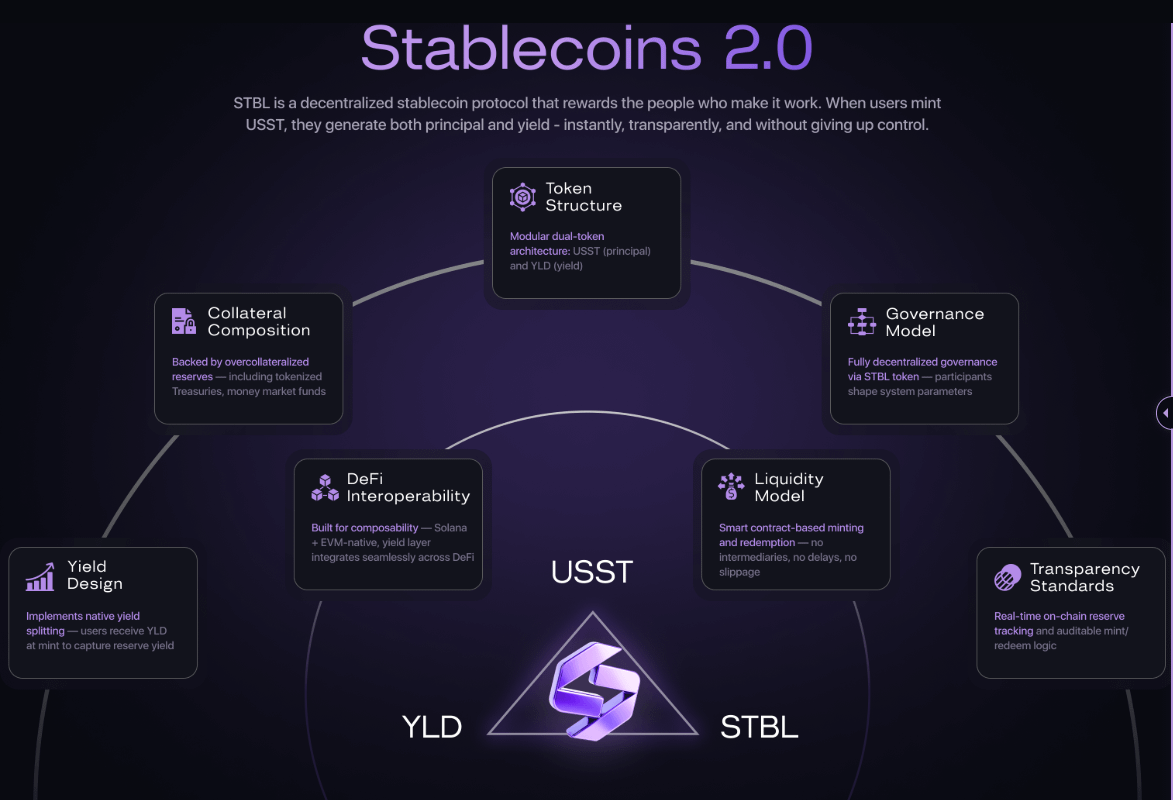

DeFi’s passive income game just got a monster upgrade. Forget the vanilla days of stablecoins sitting idle in your wallet, earning zilch. Yield-bearing stablecoins like USST and their sidekick YLD NFTs are flipping the script, letting you stack yield while keeping your capital stable and liquid. Welcome to Stablecoin 2.0 – where every dollar works overtime, and your risk appetite gets the royal treatment.

How USST and YLD NFTs Unleash Double-Duty Passive Income

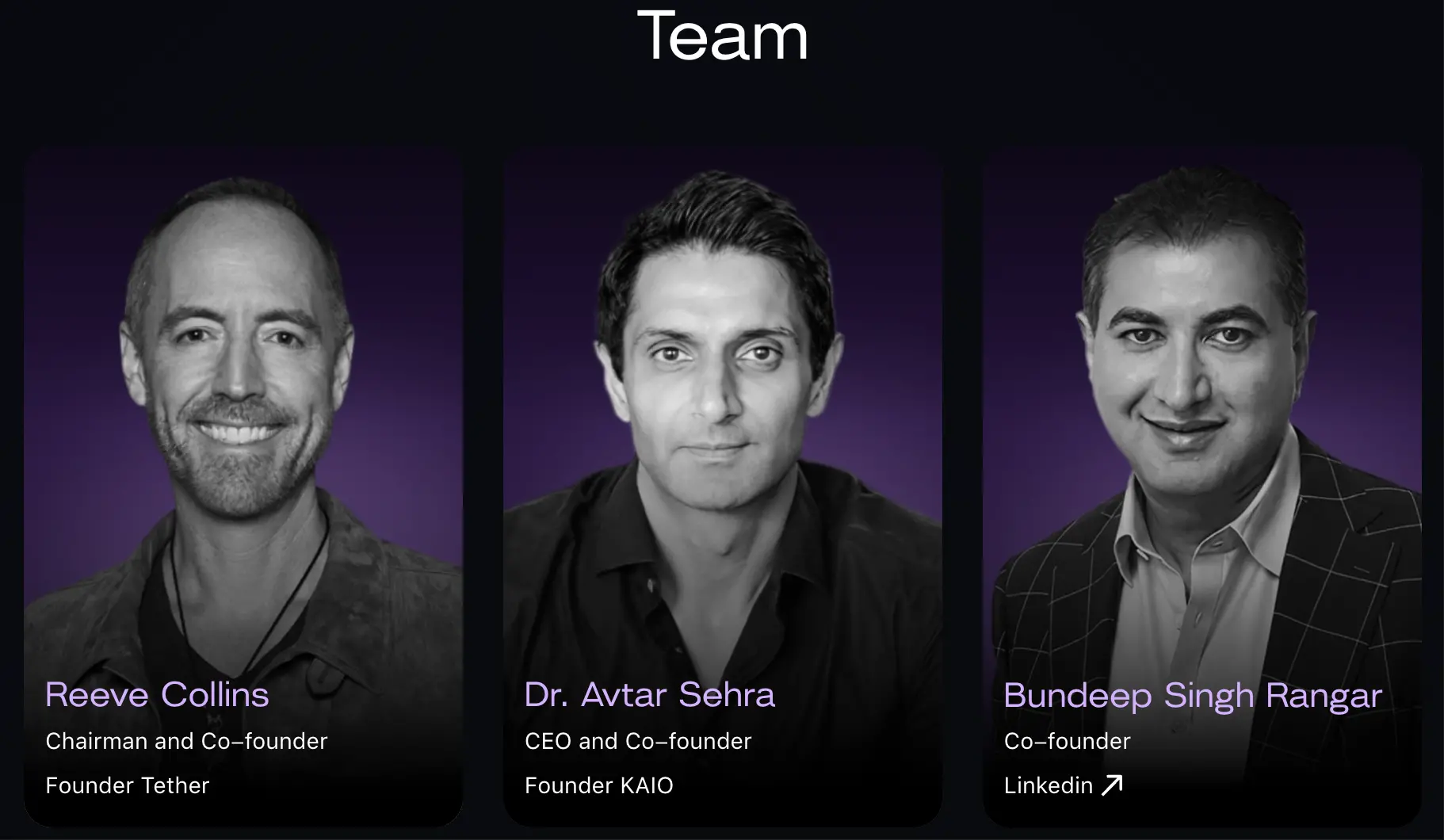

The STBL protocol, brainchild of Tether co-founder Reeve Collins, is leading this new charge. Here’s the play: You mint USST, a stablecoin fully backed by tokenized real-world assets (RWAs) like U. S. Treasuries. But instead of just parking your USST in a farm or lending pool, you get a non-transferable NFT called YLD. This NFT represents your claim on the juicy yield generated by those underlying RWAs.

The beauty? You can spend, lend or deploy your USST across DeFi protocols while still collecting yield through your YLD NFT. It’s like eating your cake, selling it to someone else, then collecting rent on their slice.

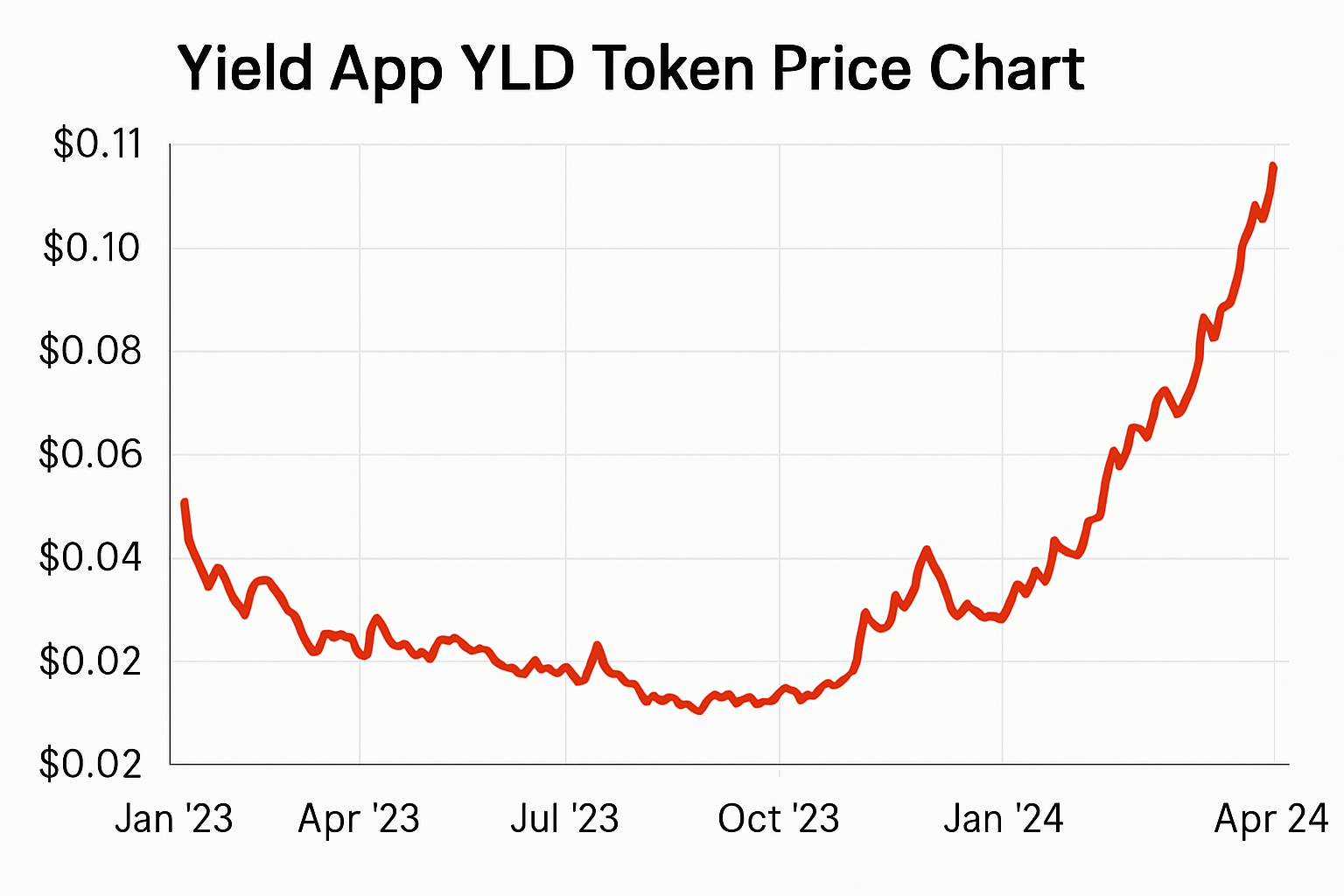

Current price check: The Yield App (YLD) token is clocking in at $0.000855, with 24h action ranging from $0.000855 to $0.000936 (source). Stay sharp – these micro-moves matter when you’re stacking interest on every decimal.

The RWA Revolution: Institutional Collateral Meets On-Chain Flexibility

This isn’t just clever tokenomics – it’s a seismic shift in how DeFi can tap into institutional-grade collateral without sacrificing decentralization or composability. Thanks to a strategic partnership with Ondo Finance, STBL uses USDY as primary collateral for up to $50 million in USST mints. That means users get exposure to short-term U. S. Treasuries’ yield, all wrapped up in a compliant, freely-movable stablecoin.

The protocol splits yield from RWAs into two streams: one for the stablecoin holders (USST), another for YLD NFT holders who actually claim that yield. This separation lets degens use their USST for lending and borrowing strategies while still pocketing passive income via YLD NFTs – maximizing capital efficiency without doubling down on risk.

Peg Drama: The Realities of Launching Next-Gen Stablecoins

No innovation comes without growing pains – just ask anyone who watched USST’s debut fireworks show. Shortly after its October 10 launch, USST depegged to $0.96 from its $1 target. The culprit? Liquidity crunches as traders rushed in for arbitrage and early farming rewards.

This underscores a critical lesson: even RWA-backed stablecoins need robust liquidity management and circuit breakers to keep their pegs tight under stress. As the market matures, expect protocols like STBL to implement more dynamic stabilization mechanisms – because no one wants their “stable” coin doing acrobatics during volatile weeks.

Yield App (YLD) Price Prediction 2026-2031

Professional outlook based on current DeFi trends, market data, and the evolving yield-bearing stablecoin sector.

| Year | Minimum Price | Average Price | Maximum Price | % Change (Avg. YoY) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $0.00070 | $0.00110 | $0.00200 | +28.7% | Recovery from USST launch volatility; gradual adoption of YLD NFTs; increased RWA utilization. |

| 2027 | $0.00090 | $0.00140 | $0.00260 | +27.3% | Improved liquidity, broader DeFi integrations, and growing user trust after initial depegging issues. |

| 2028 | $0.00110 | $0.00180 | $0.00340 | +28.6% | Regulatory clarity and mainstream RWA adoption drive new capital inflows; yield-bearing stablecoins mature. |

| 2029 | $0.00130 | $0.00220 | $0.00440 | +22.2% | Yield stablecoins capture significant stablecoin market share; YLD benefits from passive income trend. |

| 2030 | $0.00120 | $0.00270 | $0.00580 | +22.7% | Increased competition but strong sector growth; DeFi protocols integrate more RWA-backed products. |

| 2031 | $0.00110 | $0.00330 | $0.00700 | +22.2% | Market consolidation; top protocols, including YLD, solidify positions as core DeFi passive income tools. |

Price Prediction Summary

Yield App (YLD) is positioned to benefit from the explosive growth in yield-bearing stablecoins and DeFi passive income products. Despite short-term volatility and the 2025 USST depegging event, YLD’s innovative NFT yield model and real-world asset backing provide long-term potential. If adoption and liquidity improve, and regulatory frameworks solidify, YLD could see steady price appreciation over the next six years, with significant upside in bullish scenarios.

Key Factors Affecting Yield App Price

- Adoption and integration of yield-bearing stablecoins and NFTs in DeFi protocols.

- Liquidity management and the ability to maintain stable yields and user trust.

- Regulatory developments regarding RWAs and stablecoins.

- Technological improvements in NFT yield distribution and composability.

- Competition from other yield-bearing stablecoins (e.g., sUSDe, BUIDL, sUSDS).

- Macro trends in DeFi user growth and institutional participation.

- Market sentiment following the 2025 USST depegging event and subsequent protocol responses.

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

The Explosive Growth of Yield-Bearing Stablecoins: By The Numbers

If you think this is a niche trend, think again:

- Total market cap: Yield-bearing stables have exploded from $660 million to $11 billion in less than two years (source).

- Annual yields: Top protocols like Ethena’s sUSDe and BlackRock’s BUIDL are serving up yields between 4% and 18% APY.

- Mainstream adoption: JPMorgan analysts predict these assets could snag up to half of the entire $250 billion stablecoin market by 2026.

So what’s driving the stampede into yield-bearing stablecoins and NFT models like USST and YLD? It’s simple: unmatched capital efficiency, a taste of TradFi yields with DeFi flexibility, and the allure of stacking returns without sacrificing liquidity. You’re not just earning on your idle dollars – you’re unlocking strategies that were once reserved for hedge funds or institutional whales.

The best part? The composability of these assets means you can deploy USST in lending protocols, liquidity pools, or as collateral for other DeFi adventures, all while your YLD NFT quietly stacks yield in the background. Imagine using your stablecoins to farm, borrow, or pay bills – and still collecting interest like a boss. That’s the kind of double-dipping degens dream about.

Risks and Realities: What Every Yield Hunter Needs to Know

Of course, every shiny new DeFi toy comes with a manual (and a few warning labels). The USST depeg event was a wake-up call: even RWA-backed stables aren’t immune to liquidity crunches or market shocks. If you’re chasing those sweet yields, keep your eyes peeled for:

Key Risks & Due Diligence Tips for Yield-Bearing Stablecoins

-

Liquidity Crunches Can Break the Peg: Even the mighty USST, backed by tokenized U.S. Treasuries, recently depegged to $0.96 after launch due to liquidity issues. Always check on-chain liquidity levels and the depth of trading pools before investing.

-

Collateral Quality Matters: Platforms like STBL use real-world assets (RWAs) such as Ondo Finance’s USDY for collateral. Verify that collateral is transparent, high-quality, and over-collateralized—preferably with institutional-grade assets.

-

Smart Contract & Protocol Risks: Yield-bearing stablecoins and NFTs like YLD rely on complex smart contracts. Review audits from reputable firms and monitor for recent security incidents or protocol upgrades.

-

Regulatory Uncertainty: Regulatory scrutiny is rising, especially for stablecoins backed by RWAs. Check if the protocol has clear compliance disclosures and is accessible in your jurisdiction.

-

Yield Sustainability & Source: Yields for stablecoins like USST and YLD NFTs are sourced from RWAs. Scrutinize how yields are generated—look for transparent, sustainable sources like U.S. Treasuries, not opaque DeFi loops.

-

Platform Track Record & Team: STBL was founded by Tether co-founder Reeve Collins and has partnered with established players like Ondo Finance. Favor projects with experienced teams and a public track record over anonymous or unproven ventures.

-

Market Volatility & Price Data: Yield App’s YLD token is currently priced at $0.000855 with minimal 24h change. Monitor token price movements, volatility, and market depth to avoid sudden losses.

-

Redemption & Exit Mechanisms: Ensure you can redeem your stablecoins or NFTs for underlying assets or fiat. Check for clear redemption processes and any lock-up periods or exit fees.

- Liquidity risk: Can you exit without slippage when things get spicy?

- Smart contract risk: Is the protocol audited? Are there circuit breakers?

- Regulatory risk: How compliant is your favorite RWA-backed stablecoin?

- Peg stability: What mechanisms exist to restore the $1 peg during stress?

The STBL protocol is already adapting with more dynamic stabilization tools and deeper integrations with institutional partners like Ondo Finance. That’s a bullish sign – but never treat any stablecoin as truly “risk-free. ” In DeFi, fortune favors the bold but only the prepared survive.

The Road Ahead: Stablecoin 2.0 Goes Mainstream

The writing is on the blockchain: yield-bearing stablecoins are here to stay, and they’re gunning for a massive slice of global liquidity. As protocols like STBL refine their models – blending deflationary buybacks, on-chain governance, and real-world asset backing – we’ll see more compliant, scalable options hit the market.

If you’re not earning yield on your stables in 2025, you’re leaving money on the table – or worse, letting someone else farm it instead.

The next wave will see even tighter integration between DeFi rails and traditional finance assets. Imagine borrowing against tokenized treasuries at a click or streaming yield straight into your DAOs treasury wallet. The days of “dumb dollars” are numbered.

If you want to stay ahead of the curve (and avoid getting rekt by sudden depegs), keep one eye on protocol upgrades and another on liquidity dashboards. And don’t sleep on emerging players like Ethena’s sUSDe or BlackRock’s BUIDL either – competition breeds innovation (and sometimes juicier yields).