Top Yield-Bearing Stablecoins in 2024: sDAI, USDe, USDY, and More Compared for DeFi Passive Income

Yield-bearing stablecoins have rapidly evolved into a cornerstone of DeFi passive income strategies in 2024. Unlike traditional stablecoins such as USDC or USDT, which offer no native yield, these new digital dollars are engineered to help investors earn competitive APY while maintaining dollar-pegged stability. The current landscape is defined by five leaders: sDAI, USDe, USDY, OUSD, and yoUSD. Each brings a unique approach to risk, integration, and yield generation, making the right choice a matter of matching your risk tolerance and portfolio goals with the nuances of each protocol.

Why Yield-Bearing Stablecoins Dominate DeFi Passive Income in 2024

The appetite for stable yet lucrative returns has never been greater. With U. S. Treasury yields fluctuating and traditional bank savings rates lagging behind inflation, DeFi users increasingly turn to yield-bearing stablecoins for consistent on-chain income. These assets harness a variety of mechanisms, from lending aggregation to real-world asset backing, to deliver APYs that can outpace both TradFi and non-yielding crypto alternatives.

At their core, these coins are pegged 1: 1 to the U. S. dollar but integrate with protocols that generate yield through lending markets, staking rewards, delta-neutral trading strategies, or tokenized exposure to real-world assets like Treasuries. The result is an ecosystem where passive income is accessible without sacrificing price stability, a critical factor for conservative and institutional investors alike.

Comparing the Top Yield-Bearing Stablecoins: sDAI vs USDe vs USDY vs OUSD vs yoUSD

Top 5 Yield-Bearing Stablecoins for Passive Income in 2024

-

sDAI (Savings DAI): sDAI is a yield-bearing version of DAI, generated by depositing DAI into MakerDAO’s DAI Savings Rate (DSR) contract. Current APY: 3.25%. sDAI is widely integrated across DeFi platforms and offers a straightforward, reliable yield mechanism determined by MakerDAO governance.

-

USDe (Ethena USDe): USDe is a synthetic stablecoin from Ethena Labs, offering native yield through a delta-neutral strategy involving staked Ethereum and derivatives. Recent APY: 7%–7.4%. USDe stands out for its competitive returns and strong protocol incentives, appealing to risk-tolerant DeFi users.

-

USDY (Ondo USDY): USDY is a tokenized note issued by Ondo Finance, backed by U.S. Treasury bills and other short-term government securities. Market cap as of April 2025: $590 million. It delivers real-world yield and institutional-grade security, making it a bridge between traditional finance and DeFi.

-

OUSD (Origin Dollar): OUSD is a rebasing stablecoin that automatically earns yield from DeFi lending and liquidity pools. Its seamless wallet integration means users receive yield passively, with balances increasing directly in their wallets. OUSD is a popular choice for hands-off DeFi investors.

-

yoUSD (Yearn Optimized USD): yoUSD is Yearn’s yield-optimized stablecoin, aggregating returns from top DeFi lending protocols to maximize APY. By leveraging Yearn’s automated strategies, yoUSD holders benefit from efficient yield optimization across multiple platforms.

sDAI (Savings DAI) stands out for its simplicity and robust integration across DeFi platforms. By depositing DAI into MakerDAO’s DSR contract, users mint sDAI and earn a straightforward yield, currently 3.25% APY. This mechanism is governed by MakerDAO governance and offers transparency plus deep liquidity across protocols like Aave and Compound. For cautious investors seeking predictable returns without complex strategies or additional risks from derivatives exposure, sDAI is a pragmatic choice.

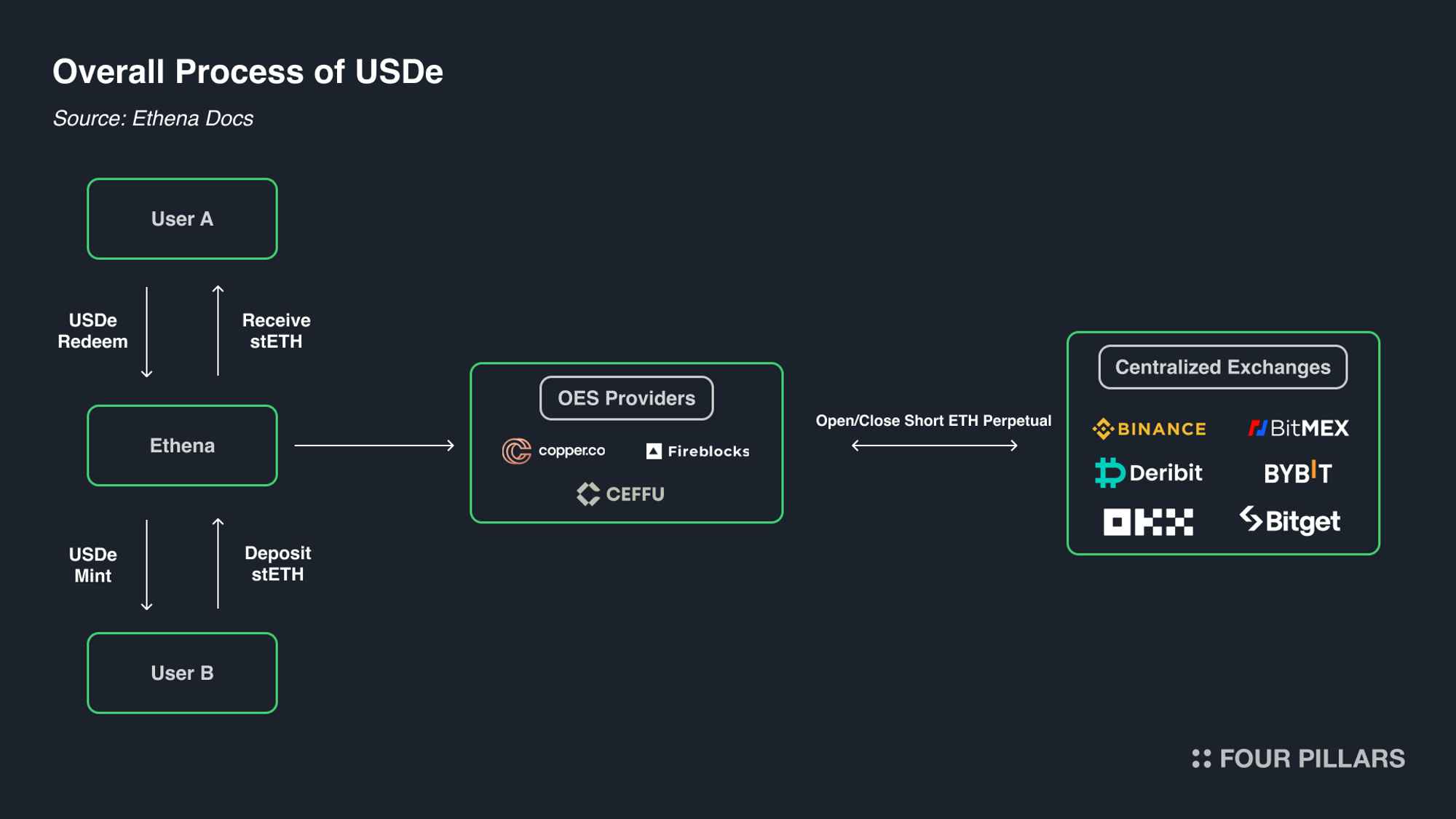

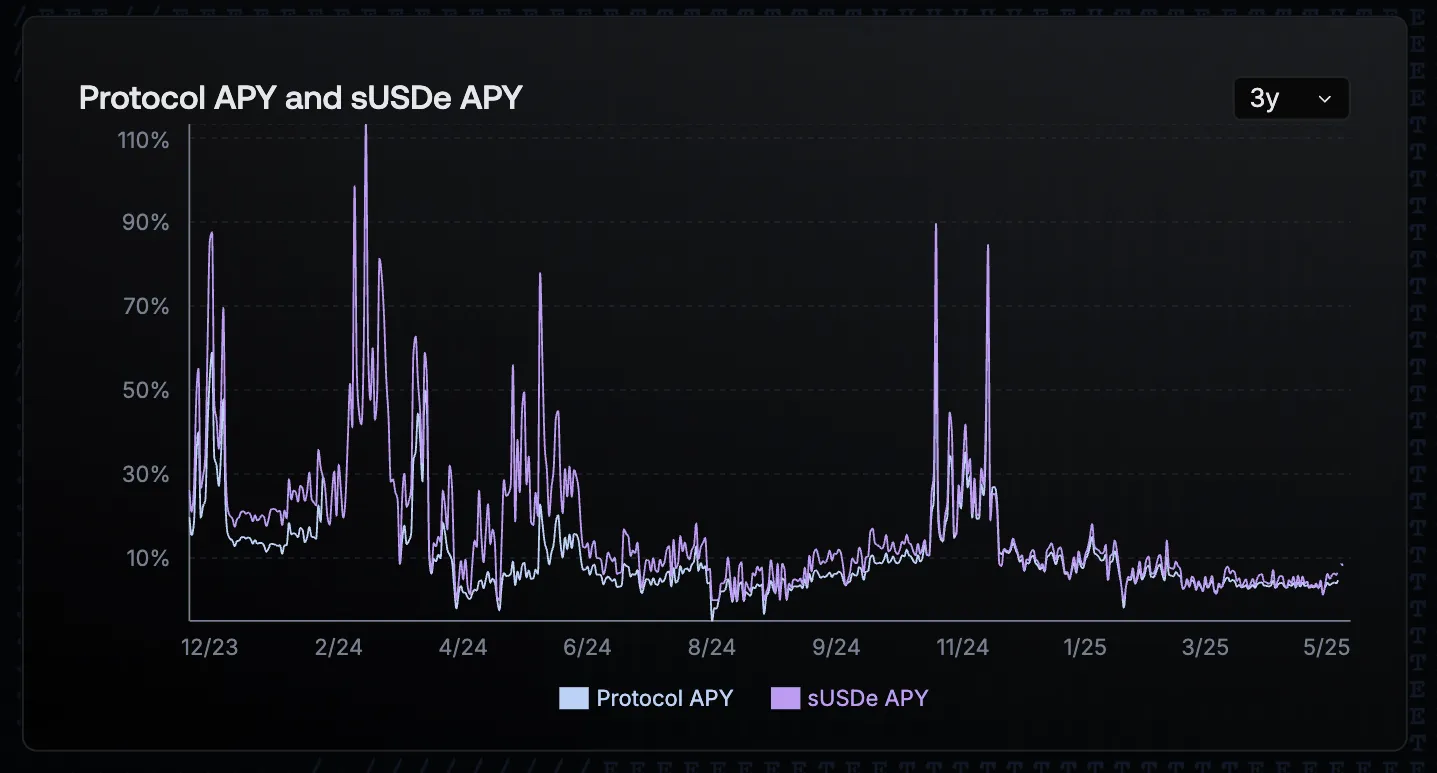

USDe (Ethena’s Synthetic Dollar) takes a more sophisticated approach. It leverages delta-neutral hedging with staked ETH (stETH) and short perpetual futures positions to maintain its peg while generating yield from both staking rewards and funding rate arbitrage. In Q2-Q3 2024, USDe delivered yields ranging from 7% to 19%, before stabilizing around 7-7.4% APY. These higher returns come with added complexity, investors must consider smart contract risk and the sustainability of funding rates in volatile markets.

USDY (Ondo Finance) bridges DeFi with TradFi by backing each token with U. S. Treasury bills or notes, real-world assets held in regulated custody accounts. As of April 2025, USDY boasted nearly $590 million in market cap and offered yields reflective of short-term Treasury rates (typically between 4%–5%). This blend of transparency and regulatory oversight makes USDY especially appealing for institutions or individuals wary of purely crypto-native mechanisms.

OUSD (Origin Dollar) innovates through automatic rebasing: users simply hold OUSD in their wallets as it accrues yield from underlying lending pools like Aave and Compound as well as liquidity provision on Curve. No staking or manual claims are required, the balance grows automatically as protocol earnings are distributed proportionally among holders.

yoUSD (Yearn Optimized USD), meanwhile, aggregates returns from multiple top-tier lending protocols via Yearn’s vault strategy engine. This allows yoUSD holders to benefit from optimized lending rates across platforms without active management, ideal for investors seeking maximum APY through automated diversification.

Navigating Risk Profiles and Ecosystem Integrations

The diversity among these top five stablecoins extends beyond yield mechanics into risk profiles and ecosystem reach:

- sDAI: Minimal smart contract risk; highly liquid; best for conservative stakers

- USDe: Higher yield potential; complex hedging; suitable for advanced users comfortable with derivatives

- USDY: Real-world asset backing; regulatory compliance; attractive for TradFi crossover investors

- OUSD: Seamless user experience; auto-rebasing; moderate protocol risk due to pooled lending

- yoUSD: Automated optimization; diversified exposure; dependent on Yearn’s strategy performance

Diversification remains key, allocating across multiple stablecoins can reduce exposure to individual protocol failure while optimizing aggregate yield. For deeper dives into how these models stack up by TVL or detailed risk analysis, check resources like Stablecoin Flows’ comprehensive comparison.

As the stablecoin sector matures, integration and composability have become decisive factors for yield and risk management. sDAI enjoys broad adoption across blue-chip DeFi protocols, making it easy to use as collateral or in liquidity pools without sacrificing yield. This flexibility is especially valuable for users who want their stablecoins to remain productive while engaging in other DeFi activities.

USDe and yoUSD cater to more yield-hungry investors. USDe’s dual-source yield (staking plus perpetual funding) is enticing, but users should monitor the sustainability of funding rates and the robustness of its delta-neutral strategy. yoUSD, powered by Yearn’s battle-tested vaults, spreads risk across multiple lending venues, but remains reliant on Yearn’s automated allocation logic and underlying protocol security.

USDY is carving out a niche among institutions and compliance-focused investors. Its backing by short-term Treasuries and regulated custodianship provides a high degree of transparency and legal clarity. This makes USDY a strong candidate for those seeking exposure to on-chain yield with TradFi-grade oversight.

OUSD stands out for its user-friendliness: simply holding OUSD in a wallet is enough to earn yield, with no need for staking or interacting with smart contracts after the initial mint. This frictionless experience has helped OUSD attract both new entrants and DeFi veterans who value convenience alongside returns.

How to Maximize DeFi Passive Income With Yield-Bearing Stablecoins

Choosing the right mix of stablecoins depends on your personal risk appetite, technical comfort, and desired level of involvement. Conservative investors might favor sDAI and USDY for their transparency and regulatory alignment. Those chasing higher APY could blend USDe and yoUSD, accepting greater complexity and risk in exchange for higher returns. Meanwhile, OUSD offers a hassle-free option for users who want set-and-forget yield accrual.

Key strategies include:

- Portfolio diversification: Split allocations among sDAI, USDe, USDY, OUSD, and yoUSD to balance risk and return.

- Active monitoring: Track protocol updates, governance changes, and market conditions that may impact yields or security.

- Utilizing DeFi integrations: Deploy stablecoins as collateral or in liquidity pools to stack additional rewards.

The table below summarizes the core features and current yields for each stablecoin:

Comparison of Top Yield-Bearing Stablecoins in 2024

| Stablecoin | APY (2024) | Risk Profile | DeFi Integration Level | Unique Yield Mechanism |

|---|---|---|---|---|

| sDAI (Savings DAI) | 3.25% | Low | Very High | Interest from MakerDAO DSR |

| USDe (Ethena USDe) | 7% – 7.4% (historically up to 19%) | Medium-High | High | Delta-neutral strategy: staked ETH + derivatives |

| USDY (Ondo USDY) | Reflects U.S. Treasury yields (~5%) | Low-Medium | Medium | Tokenized T-bills, real-world asset yield |

| OUSD (Origin Dollar) | Varies (historically 3-7%) | Medium | High | Automated yield from DeFi lending & LPs (rebasing) |

| yoUSD (Yearn Optimized USD) | Varies (typically 3-6%) | Medium | Medium-High | Aggregates top DeFi lending yields |

Final Thoughts: The Future of Yield-Bearing Stablecoins

The competition among yield-bearing stablecoins in 2024 is driving rapid innovation in both yield generation and risk management. As on-chain liquidity deepens and real-world asset tokenization expands, expect more hybrid models blending DeFi efficiency with TradFi safety nets. For now, the five leaders, sDAI, USDe, USDY, OUSD, and yoUSD, offer a well-rounded toolkit for anyone looking to generate passive income while minimizing volatility.

If you’re new to stablecoin yields or want deeper analysis on risk-adjusted returns and airdrop opportunities, explore ongoing research at Stablecoin Flows’ APY comparison hub.