How to Maximize Stablecoin Yields with Automated Vaults: A Guide to yoUSD and Yield Aggregators

Stablecoin yields have entered a new era of accessibility and sophistication, thanks to the rise of automated vaults and advanced yield aggregators. For DeFi users who want to earn passive income on USDC, DAI, or other stablecoins without micromanaging dozens of protocols, platforms like yoUSD are quickly becoming indispensable. With the right approach, you can capture optimized returns while sidestepping much of the complexity that once defined stablecoin yield farming.

Why Automated Stablecoin Vaults Matter in 2025

The landscape for DeFi stablecoin yields has evolved dramatically. Gone are the days when maximizing returns meant hopping between protocols and constantly monitoring APYs. Automated vaults now deploy smart contracts to allocate your funds across hundreds (sometimes thousands) of pools, continuously seeking out the highest risk-adjusted yields available.

This automation is not just about convenience – it’s about optimization. Vaults like yoUSD actively rebalance capital using real-time data, meaning your assets are always working in the most efficient places possible. The result? Higher and more consistent passive income with far less manual intervention.

Meet yoUSD: The Yield-Bearing Stablecoin Aggregator

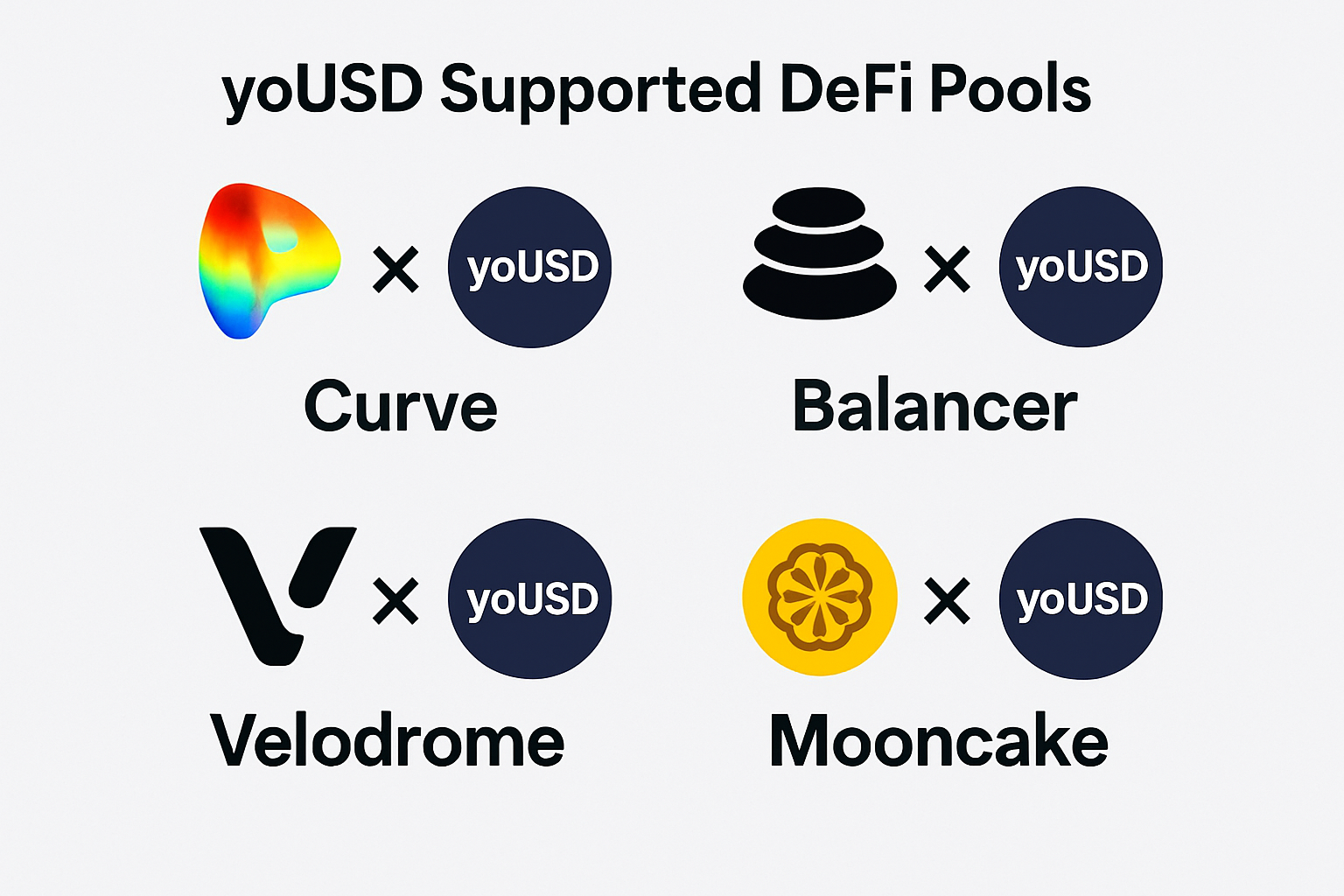

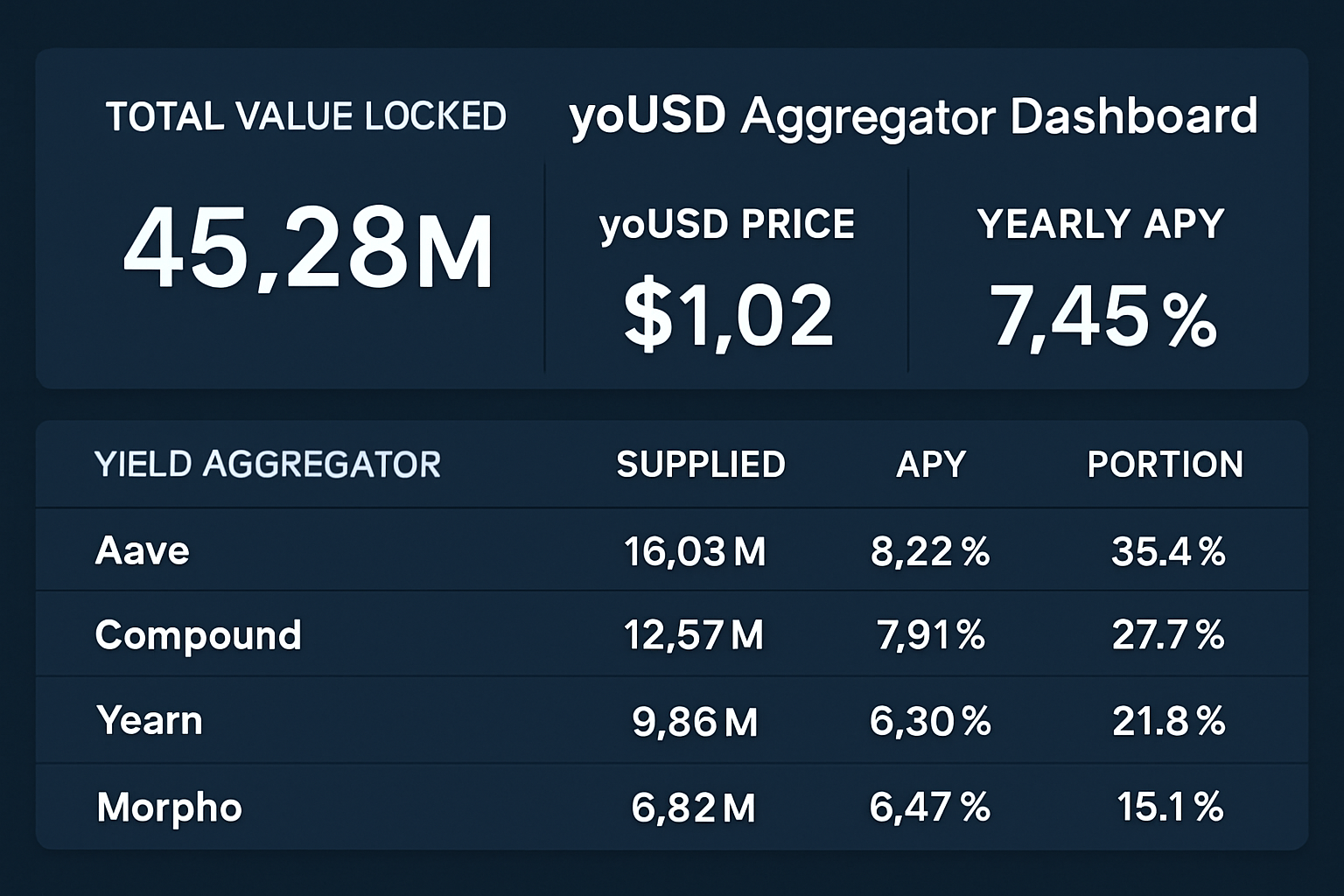

yoUSD stands out as a next-generation yield aggregator that takes hands-off investing to a new level. By depositing your stablecoins into the yoUSD vault, you gain exposure to a diversified set of over 100 strategies spanning lending markets, liquidity pools, and auto-compounding tokens across major chains like Ethereum, Base, and Unichain.

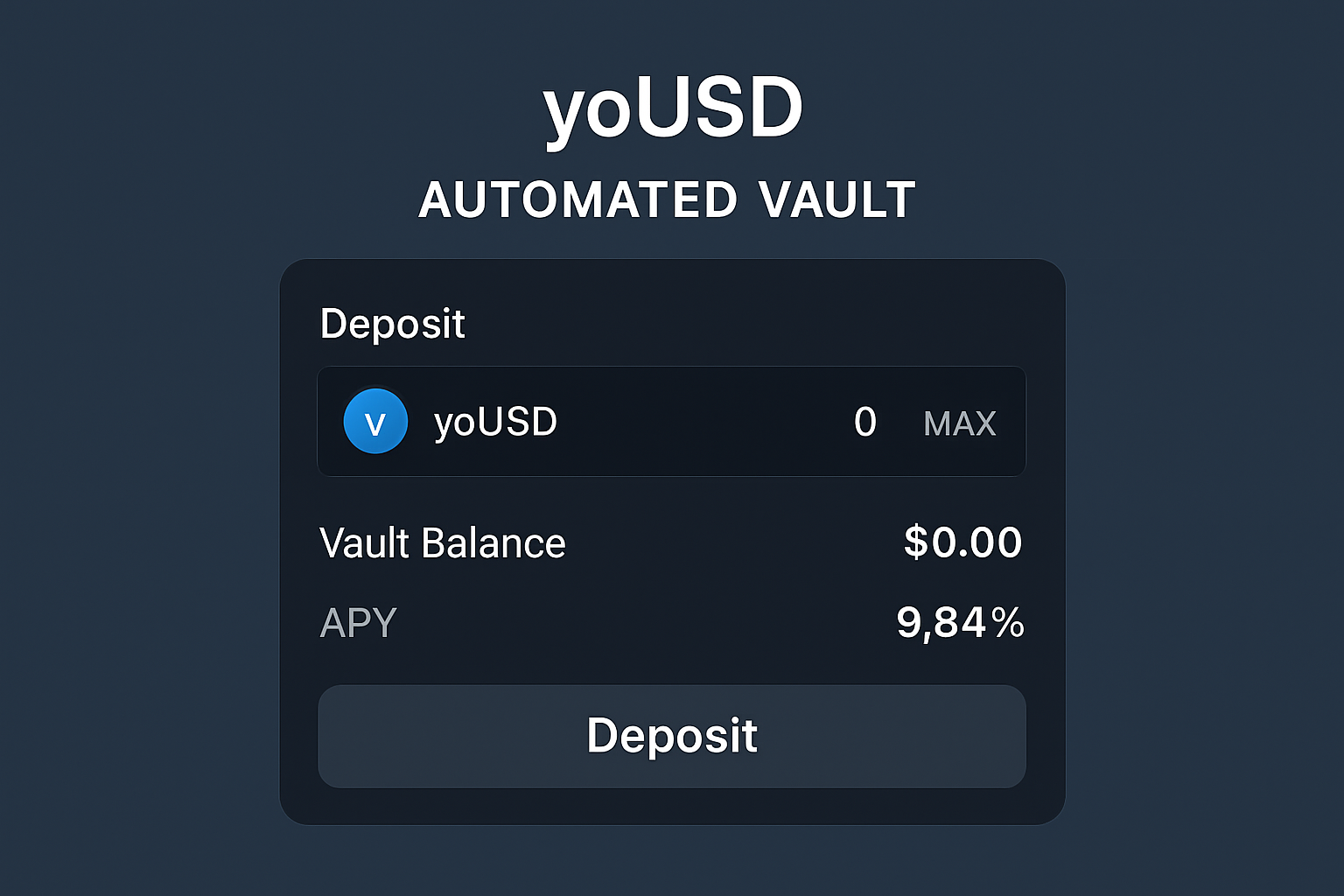

The platform’s risk-adjusted strategy engine scans more than 2,600 pools and dynamically allocates capital based on real-time yield opportunities and safety parameters. As of October 2025, yoUSD offers an approximate APY of 10%, making it one of the most competitive options for those seeking stablecoin yield optimization without sacrificing peace of mind. Additionally, users earn YO points within the ecosystem – further boosting potential rewards.

If you’re curious how this fits into broader DeFi trends or want a deeper dive into how these vaults work under the hood, consider our comprehensive analysis at Stable Coin Alerts.

Top Features That Make yoUSD Stand Out for Stablecoin Yields

-

Automated, Risk-Adjusted Yield Optimization: yoUSD uses a smart strategy engine to automatically allocate your stablecoins across over 100 yield strategies, optimizing returns while managing risk across lending, liquidity, and yield-bearing protocols.

-

Access to 2,600+ DeFi Pools: The platform taps into a vast array of pools and protocols on networks like Ethereum, Base, and Unichain, ensuring diversified exposure and maximizing earning opportunities.

-

Hands-Off Simplicity: With yoUSD, users enjoy a fully automated experience—no manual rebalancing or complex yield farming steps required. Just deposit stablecoins and let the vault handle the rest.

-

Competitive Yield Rates: As of October 2025, yoUSD offers an approximate APY of 10%, providing attractive returns compared to many traditional and DeFi alternatives.

-

YO Points Rewards: Depositing into yoUSD not only earns yield but also accrues YO points, which can be used within the YO ecosystem for additional benefits and incentives.

-

Multi-Chain Support: yoUSD operates across multiple blockchains, making it flexible and accessible for users seeking yield opportunities beyond a single network.

-

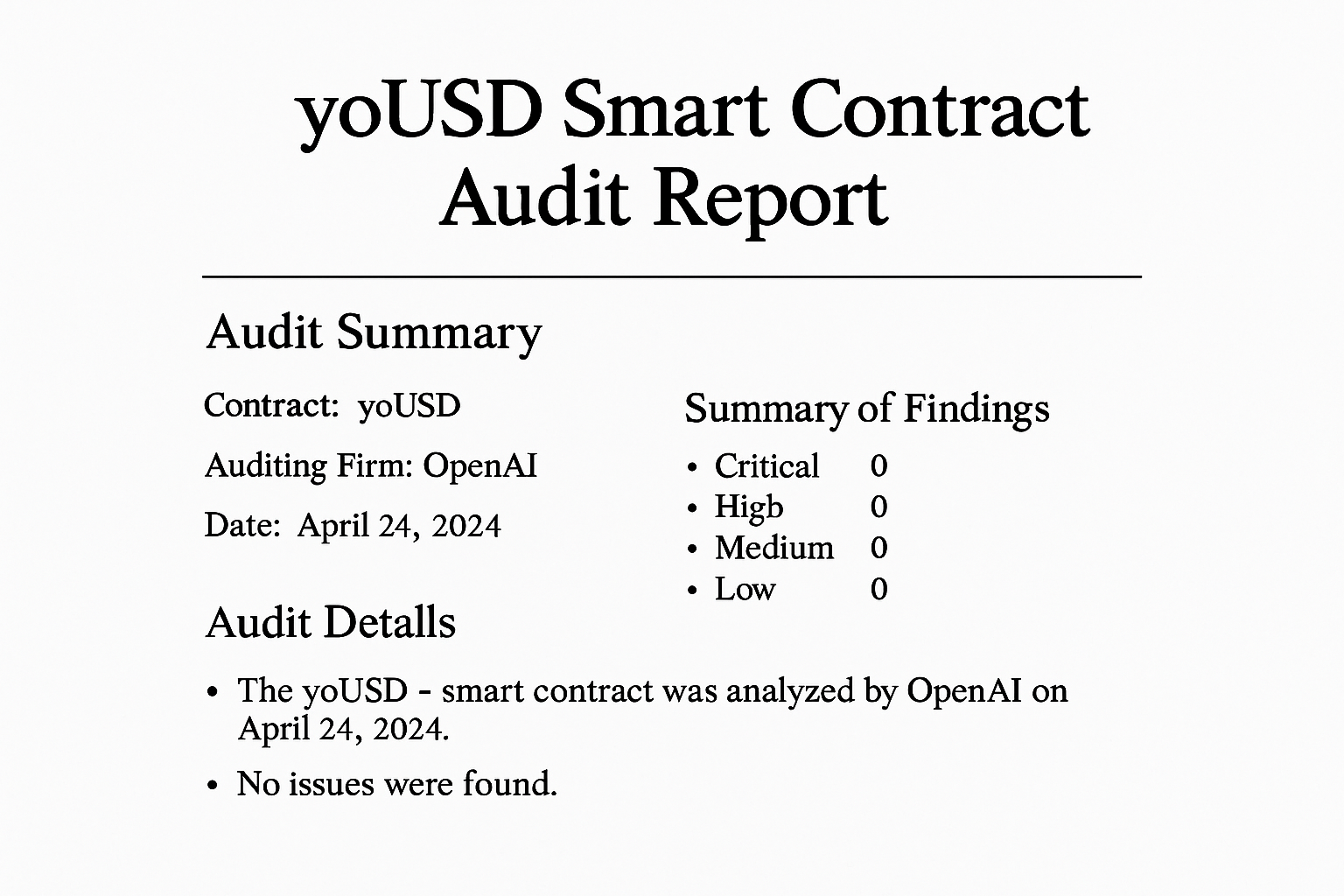

Transparent and Audited Smart Contracts: Security is prioritized with audited smart contracts, giving users confidence in the safety of their deposited assets.

Other Leading Automated Yield Aggregators Worth Knowing

The ecosystem doesn’t stop at yoUSD. Several other platforms have carved out their own niches in optimizing passive income from stablecoins:

- Toros Finance: Their dUSD dynamic vault farms incentives across Polygon-based pools and automatically shifts strategies as market conditions change.

- Alpaca Finance: Known for its market-neutral automated vaults that hedge against price swings while maintaining high APYs in both bull and bear markets.

- Vesper Finance: Offers “Grow” vaults that route USDC or DAI into blue-chip protocols like Aave or Curve for sustainable returns.

This diversity means investors can tailor their approach based on risk appetite and desired exposure – all while leveraging automation to handle daily management tasks.

Navigating Risks: What Every Investor Should Consider

No matter how sophisticated these platforms become, risk management remains paramount. Here are three critical factors to weigh before choosing any automated stablecoin vault:

- Smart Contract Risk: Even audited platforms can harbor vulnerabilities; always check audit history and community feedback.

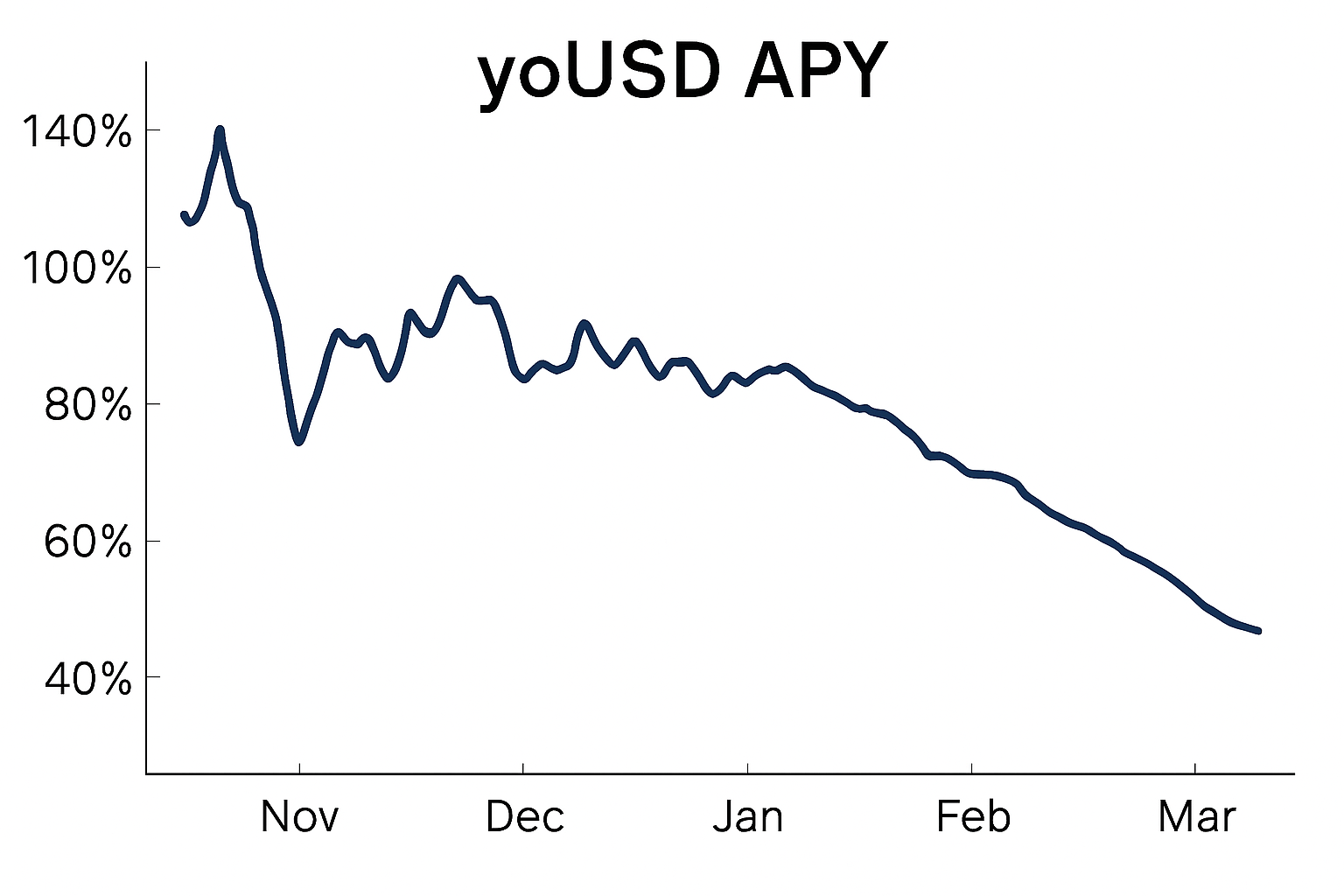

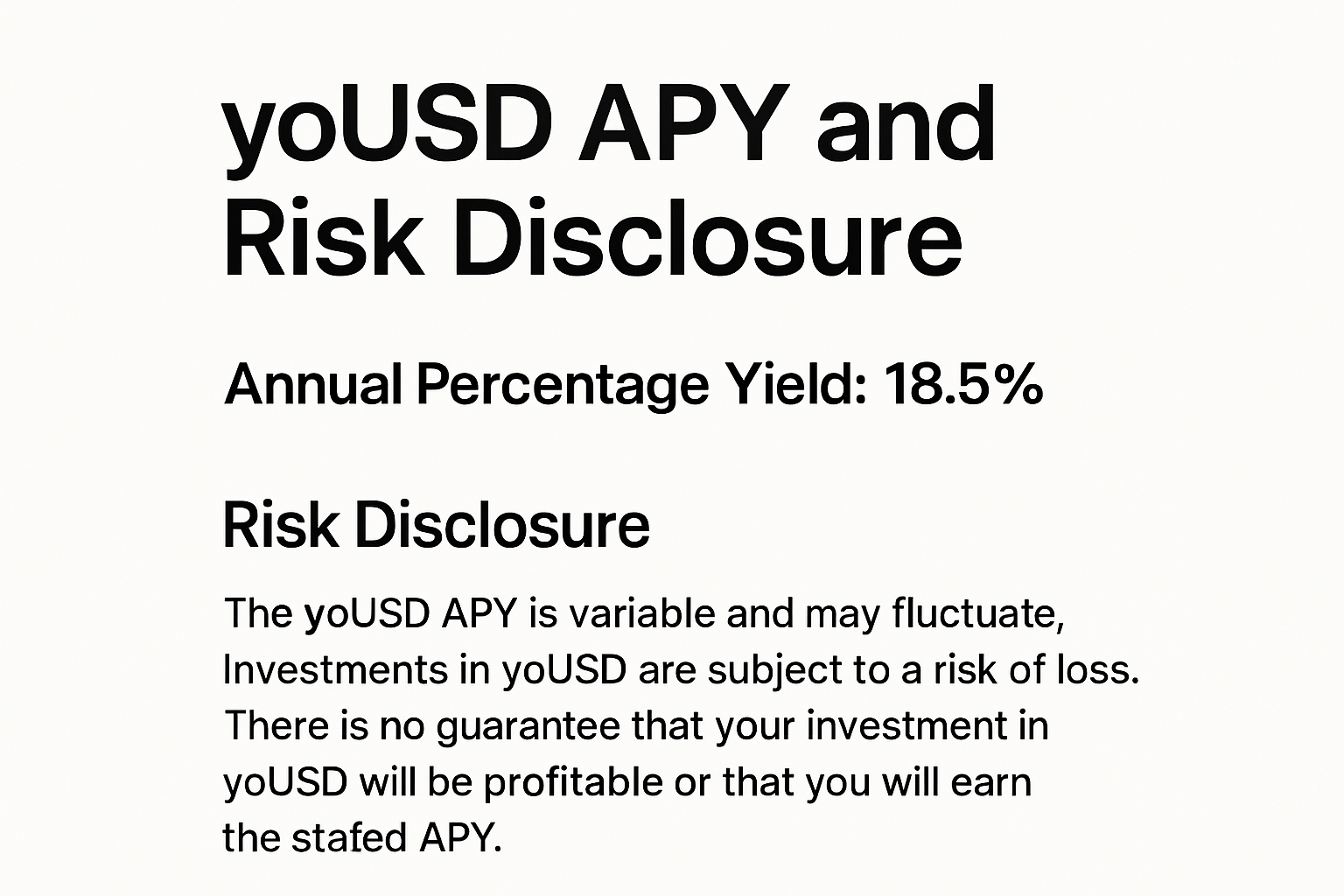

- Yield Volatility: APYs fluctuate as market dynamics shift; what’s true today may change tomorrow.

- Platform Reputation: Stick with providers known for transparency and reliability, reputation is hard-won but easily lost in DeFi.

Staying informed and adaptive is essential, as the DeFi landscape can shift with new protocols, incentive programs, or security incidents. Automated vaults like yoUSD are designed to respond dynamically to these changes, but users should still monitor their positions periodically and stay engaged with platform updates. Social channels and community forums often provide early warnings or insights into emerging risks or opportunities.

Practical Steps to Start Earning with Automated Stablecoin Vaults

Getting started with automated stablecoin vaults is more accessible than ever. Here’s a practical roadmap for those looking to capture yield without daily management headaches:

How to Deposit Stablecoins into an Automated Yield Aggregator

-

1. Choose a Reputable Yield AggregatorResearch established platforms like yoUSD, Toros Finance, Alpaca Finance, or Vesper Finance. Prioritize those with strong security audits, transparent strategies, and positive community feedback.

-

2. Connect Your Crypto WalletVisit the aggregator’s website and connect a supported wallet such as MetaMask, Coinbase Wallet, or WalletConnect. Ensure your wallet is on the correct network (e.g., Ethereum, Polygon, Base).

-

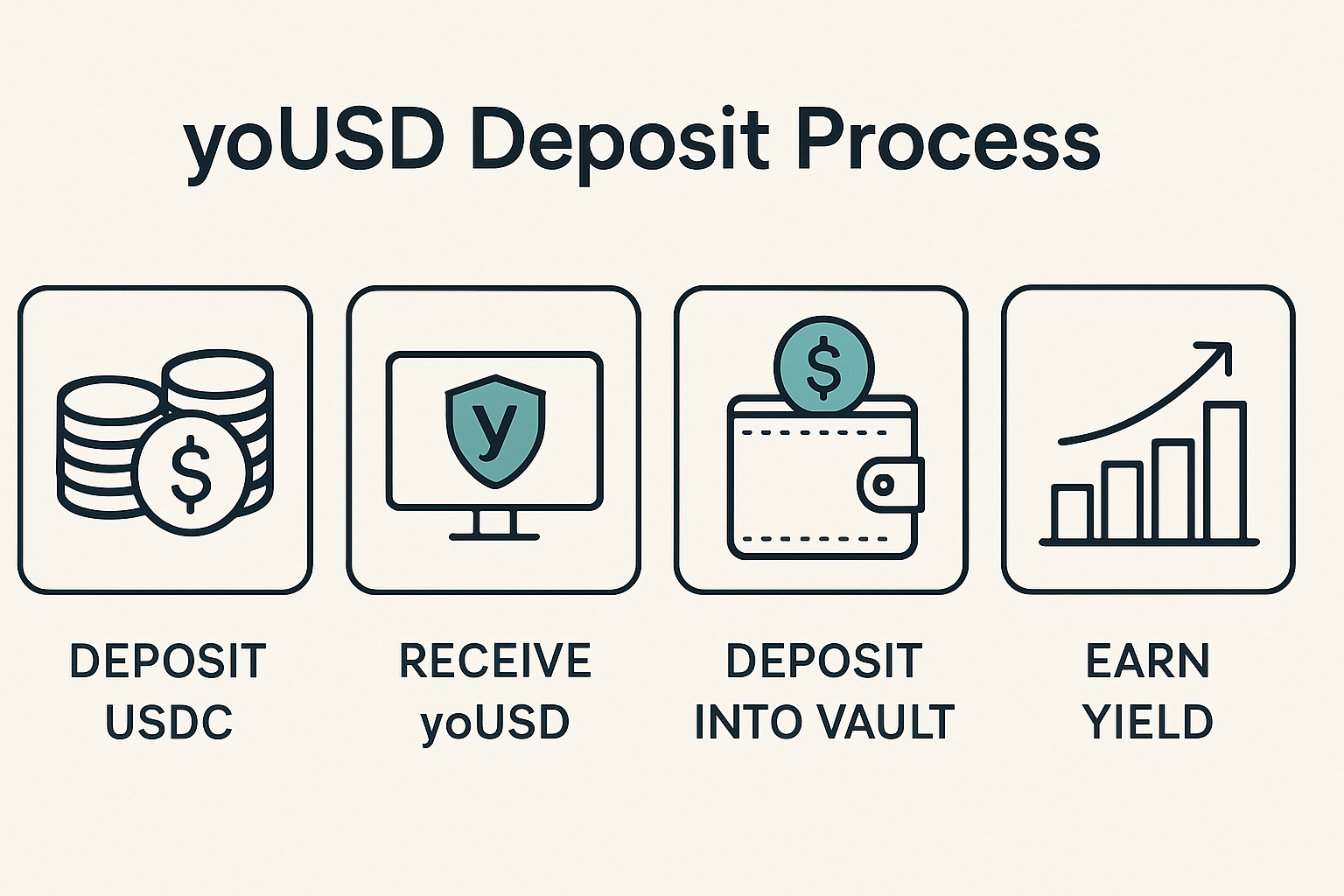

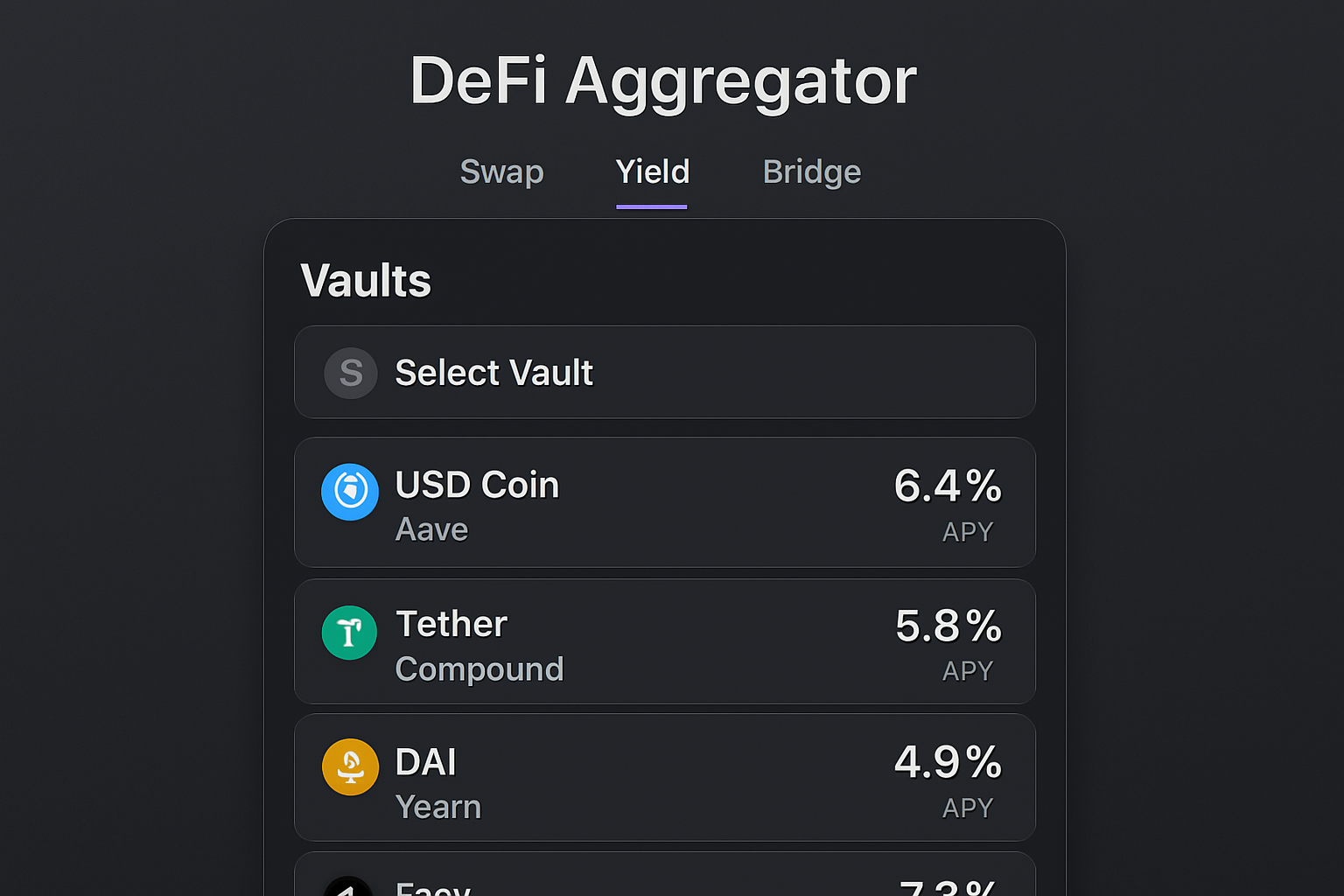

3. Select the Stablecoin and VaultChoose which stablecoin to deposit (e.g., USDC, DAI, USDT) and select the specific automated vault (such as yoUSD Vault or Vesper Grow: USDC) that matches your risk and yield preferences.

-

4. Review Yield Rates and TermsCheck the current APY (e.g., yoUSD offers around 10% APY as of October 2025) and review any platform fees, lock-up periods, and risk disclosures before proceeding.

-

5. Approve and Deposit StablecoinsApprove the aggregator’s smart contract to access your stablecoins, then enter the deposit amount and confirm the transaction in your wallet. Wait for blockchain confirmation.

-

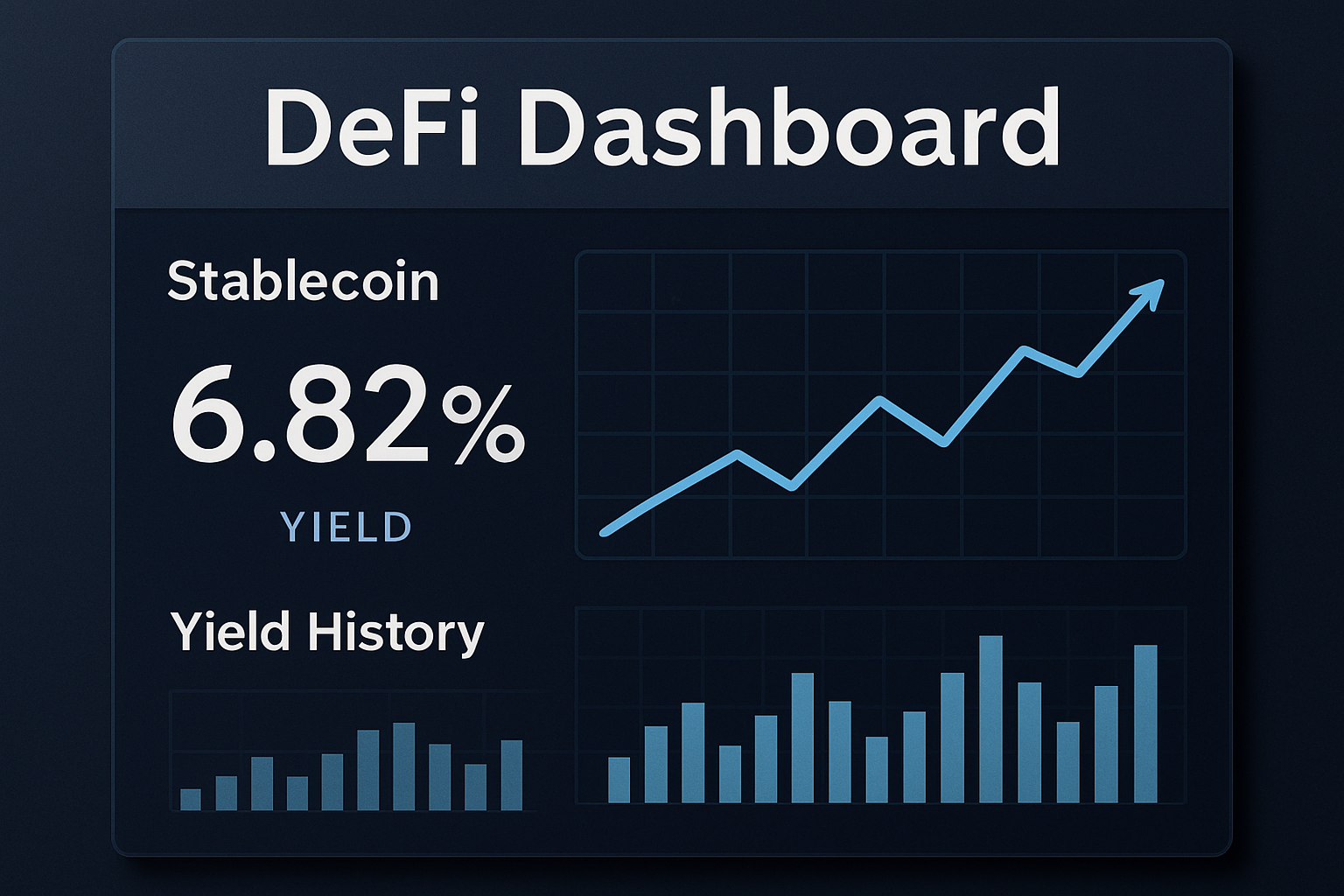

6. Monitor Your Position and EarningsTrack your deposit, accrued yield, and any reward points (like YO points in the yoUSD ecosystem) via the aggregator’s dashboard. Withdraw or compound your earnings as desired.

Once your deposit is complete, you’ll receive a vault token (such as yoUSD) representing your share of the underlying assets plus accrued yield. Many platforms also offer additional incentives in the form of points or governance tokens, which can further enhance returns when claimed or staked within their ecosystem.

For those seeking deeper insights into how these strategies compare across platforms and chains, our detailed comparison of leading stablecoin yield aggregators breaks down performance data, security measures, and unique features side by side.

The Future of Yield-Bearing Stablecoins

The evolution of yield-bearing stablecoins signals a broader trend in DeFi: passive income strategies are becoming more sophisticated yet increasingly hands-off. As platforms like yoUSD and its peers continue to refine their risk-adjusted strategy engines and expand cross-chain integrations, users can expect even greater efficiency in how their capital is allocated.

This sector’s growth is also pushing forward innovations in transparency and composability. For instance, some vaults now offer real-time dashboards that break down exactly where your funds are deployed and what portion of your returns comes from each protocol. Others are experimenting with modular vault structures that allow for custom risk profiles or exposure to specific sectors within DeFi.

Key Takeaways for Maximizing Your USDC Passive Income

- Automation unlocks consistent returns: Letting smart contracts manage allocation removes emotional decision-making and missed opportunities.

- Diversification reduces risk: By spreading capital across multiple protocols and chains, you insulate yourself from isolated failures.

- Stay informed: Even automated solutions benefit from periodic oversight, keep up with platform news and industry developments.

If you’re ready to explore this new frontier of passive income but want more guidance on choosing between sDAI, USDe, vyUSD, or other options, read our expert guide on top yield-bearing stablecoins.