How sDAI Works: A Deep Dive into Yield-Bearing Stablecoins for Passive Income

Stablecoins have long been the backbone of DeFi, but 2025 marks a new era: the rise of yield-bearing stablecoins. Unlike their traditional counterparts, which simply track the US dollar, these innovative assets like sDAI now offer reliable passive income streams for holders. As the demand for low-risk yield intensifies among crypto investors, understanding how sDAI works is essential for anyone seeking to maximize returns without sacrificing liquidity or stability.

sDAI Yield: How Passive Income Is Generated in DeFi

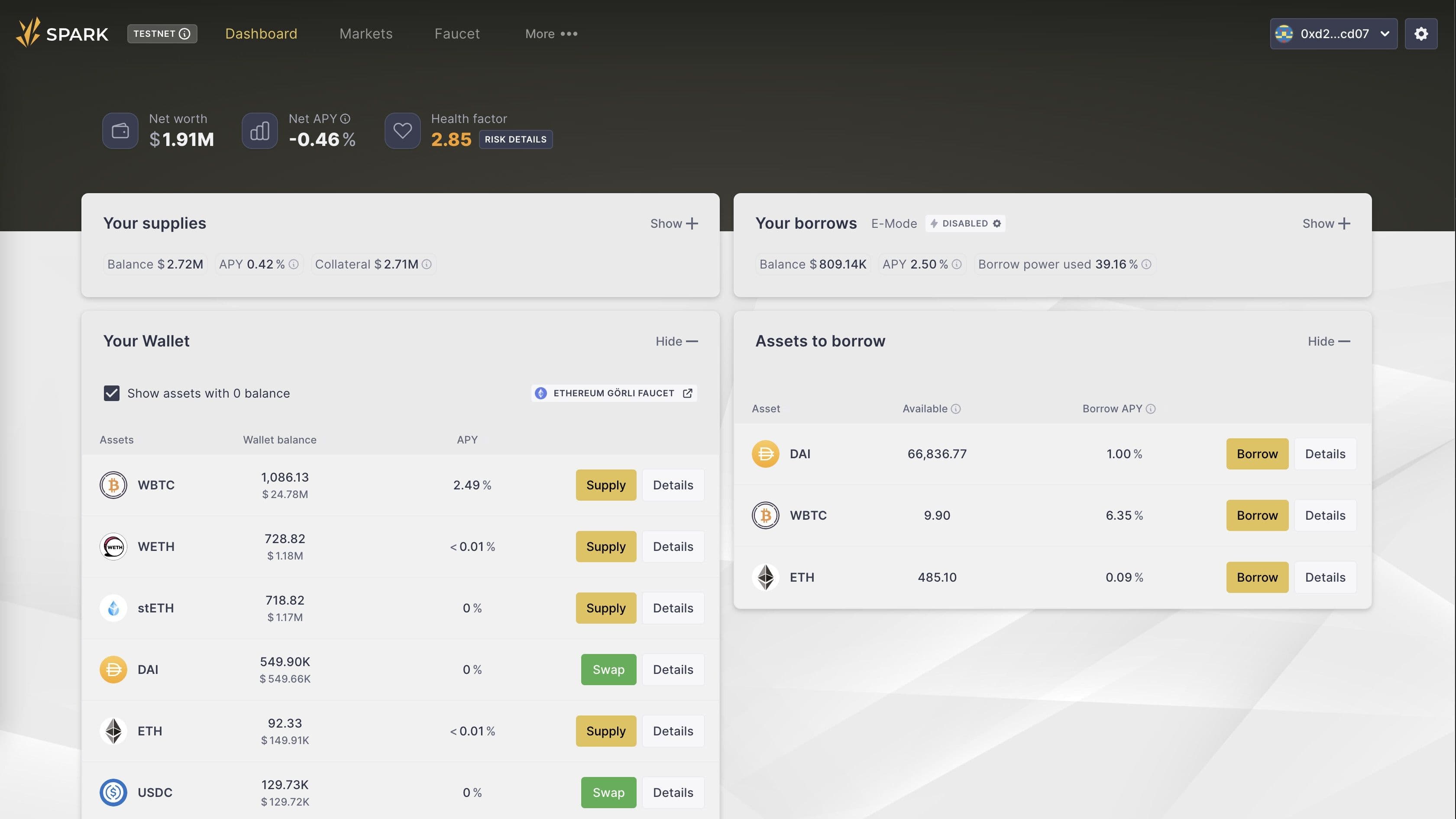

At its core, sDAI is a reimagined version of DAI. Developed by MakerDAO, sDAI allows users to earn yield simply by holding their tokens. The process is straightforward: deposit your DAI into the DAI Savings Rate (DSR) contract via platforms like Spark Protocol, and receive sDAI in return. From that moment, your sDAI balance automatically accrues interest, no need to claim rewards or manage complicated strategies.

The current annualized yield on sDAI sits at 3.25%, set by MakerDAO governance based on protocol revenues and prevailing market rates. This rate is attractive compared to many traditional savings accounts and even some DeFi lending platforms, especially considering the minimal active management required.

What sets sDAI apart from legacy stablecoins? Traditional stablecoins such as USDT or USDC offer price stability but no inherent yield, your principal remains static unless you deploy it into external protocols yourself. In contrast, yield-bearing stablecoins like sDAI integrate earning potential directly into their design, making passive income seamless for everyday users.

The Mechanics Behind Rebasing Stablecoins Like sDAI

sDAI employs a mechanism known as “rebasing. ” Instead of paying out interest in separate transactions or tokens, the value of each sDAI token increases over time relative to DAI as interest accrues within the DSR contract. This means your wallet balance stays constant in terms of token count, but each token represents a larger share of the underlying pool over time.

Here’s how it works step-by-step:

- Deposit: Move your DAI into the DSR via Spark Protocol or another supported platform.

- Receive: Instantly get an equivalent amount of sDAI in return.

- Accrue: Hold your sDAI and watch its value grow as interest compounds automatically.

- Redeem: Swap back to DAI at any time, no lockups or penalties.

This structure offers flexibility rarely seen in traditional finance. There are no fixed terms or withdrawal restrictions; you decide when to cash out your yield. For those prioritizing both liquidity and steady returns, this model is highly attractive.

sDAI vs USDe: Comparing Leading Yield-Bearing Stablecoins

The emergence of multiple rebasing stablecoins has sparked debate among DeFi enthusiasts about which offers superior risk-adjusted returns. Alongside sDAI, projects like USDe have gained traction by tapping into different yield sources, including real-world assets such as US Treasurys or diversified DeFi lending pools.

sDAI’s unique value proposition lies in its integration with MakerDAO’s established ecosystem, robust governance process, and transparent collateral management. However, users should remain aware that all DeFi protocols carry inherent risks, particularly around smart contract security and collateral volatility, even when dealing with assets designed for stability.

If you’re curious about how other major yield-bearing stablecoins stack up against sDAI on metrics like APY, liquidity depth, or protocol risk profiles, check out our comprehensive comparison at Top Yield-Bearing Stablecoins in 2024.

sDAI (Savings DAI) Yield & Price Prediction 2026-2031

Professional outlook on sDAI’s yield-bearing value and passive income potential. Based on current DSR rates, DeFi adoption, and market trends.

| Year | Minimum Price | Average Price | Maximum Price | Annualized Yield (%) | Key Insights |

|---|---|---|---|---|---|

| 2026 | $0.99 | $1.01 | $1.02 | 3.10% | Stable near $1; yield slightly lower as DeFi rates normalize |

| 2027 | $0.99 | $1.01 | $1.03 | 3.25% | Continued DeFi growth; stable value with incremental yield increases |

| 2028 | $0.98 | $1.01 | $1.04 | 3.50% | Potential for higher yields amid global DeFi adoption; minor volatility from regulation |

| 2029 | $0.98 | $1.01 | $1.05 | 3.60% | Bullish DeFi cycle could push yields up; sDAI remains liquid and widely integrated |

| 2030 | $0.97 | $1.01 | $1.06 | 3.75% | Yield-bearing stablecoins become a standard; competition may drive innovation and temporary yield spikes |

| 2031 | $0.97 | $1.01 | $1.07 | 3.80% | Mature market, robust DeFi infrastructure; sDAI offers stable passive income with minimal price deviation |

Price Prediction Summary

sDAI is expected to maintain strong dollar-pegged price stability with minor deviations typical of stablecoins. Its annualized yield is projected to rise modestly, reflecting MakerDAO governance adjustments, broader DeFi adoption, and real-world asset integration. While minimum and maximum price ranges reflect both bullish and bearish scenarios, sDAI’s design ensures price remains close to $1, with primary upside coming from accrued yield rather than price appreciation. Overall, sDAI is positioned as a leading passive income instrument in crypto through 2031.

Key Factors Affecting Savings DAI Price

- MakerDAO’s DSR rate changes and protocol revenue

- Wider DeFi adoption and integration with traditional finance

- Regulatory clarity on stablecoins and DeFi products

- Smart contract security and risk management improvements

- Competition from other yield-bearing stablecoins (e.g., USDe, USDY)

- Macro interest rate environment and real-world asset yields

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Liquidity is an often-overlooked advantage of sDAI. Unlike some DeFi protocols that require lengthy lockups or impose withdrawal penalties, sDAI enables users to redeem back to DAI at any moment. This flexibility makes it a preferred choice for investors who want to maintain quick access to their funds while still earning a competitive yield. The current DAI price, at $0.999584, underscores the protocol’s commitment to peg stability even as it delivers passive income.

Another key strength of sDAI is its deep integration across the DeFi landscape. From lending markets and automated vaults to on-chain treasuries, sDAI is widely accepted as collateral and for liquidity provision. This broad support not only enhances utility but also helps diversify risk by spreading exposure across multiple platforms and use cases.

Risk and Security: What Every Yield Seeker Should Know

No discussion about yield-bearing stablecoins is complete without addressing risk. While sDAI’s design leverages MakerDAO’s time-tested governance and transparent collateral reserves, users are still exposed to potential smart contract vulnerabilities or black swan events affecting DAI’s underlying assets. It’s critical for investors to stay informed about ongoing audits, protocol upgrades, and the evolving regulatory environment around stablecoins.

Key Risks and Mitigations for Yield-Bearing Stablecoins

-

Smart Contract Vulnerabilities: Yield-bearing stablecoins like sDAI rely on complex smart contracts (e.g., MakerDAO’s DSR contract). Bugs or exploits could result in loss of funds. Mitigation: Choose stablecoins with regular third-party audits and a proven security track record. MakerDAO publishes audit reports and has a robust bug bounty program.

-

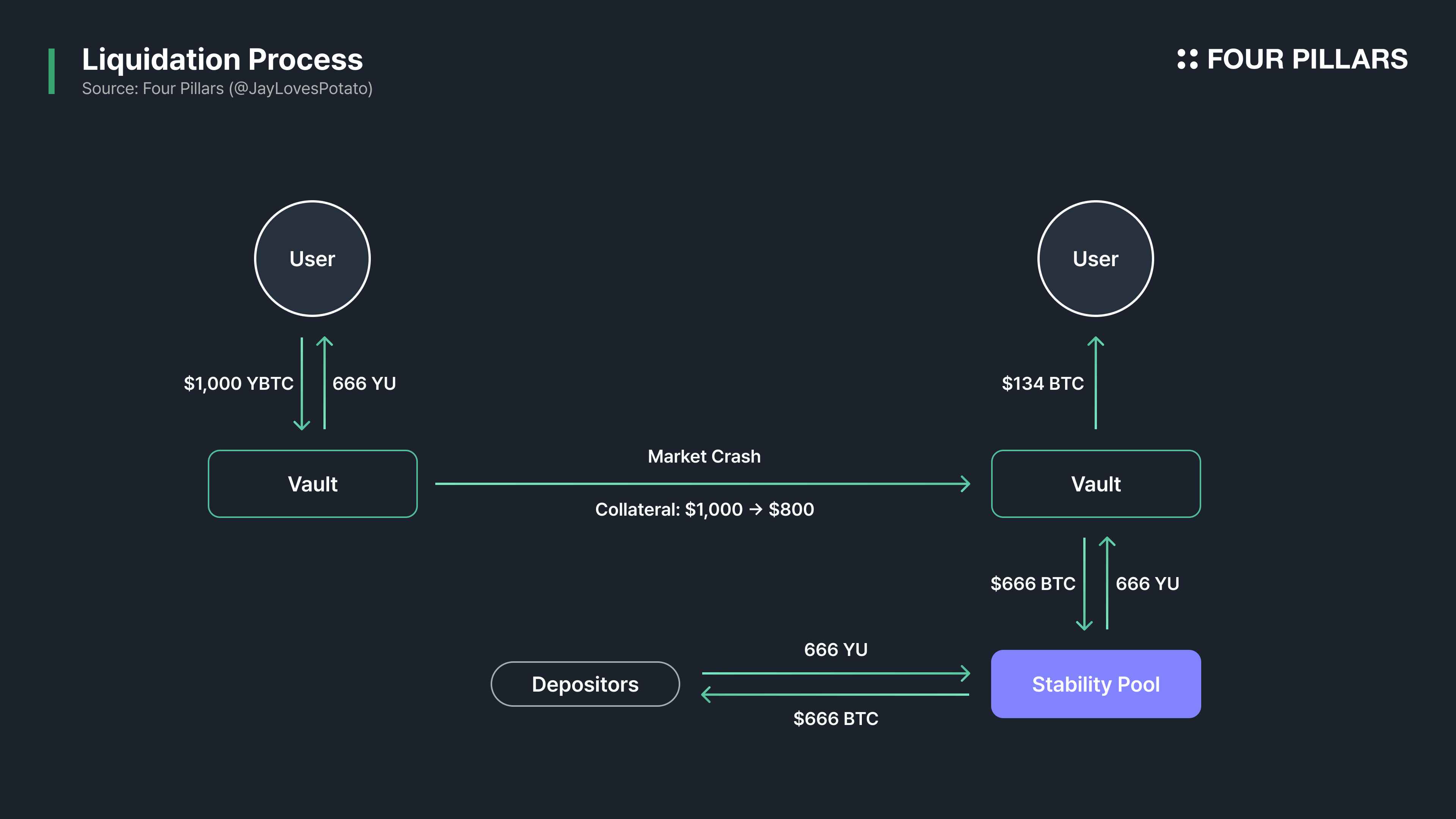

Collateral Volatility & Liquidation Risk: sDAI’s value depends on the health of MakerDAO’s collateral (mainly crypto assets). Sharp price drops in collateral could trigger liquidations, potentially impacting DAI’s stability.Mitigation: MakerDAO maintains overcollateralization ratios and uses automated liquidation mechanisms to protect DAI’s $0.9996 peg.

-

Protocol Governance Risks: The yield and security of sDAI are governed by MakerDAO’s decentralized governance. Poor decisions or governance attacks could affect yields or protocol safety.Mitigation: sDAI holders benefit from transparent, on-chain governance with active community participation and regular updates.

-

Depegging Risk: Although designed to maintain a 1:1 peg, DAI (and thus sDAI) could temporarily deviate from $1.00. As of now, DAI is priced at $0.9996.Mitigation: MakerDAO uses automated stabilization mechanisms and diversified collateral to minimize depegging events.

-

Platform Integration & Counterparty Risk: Earning sDAI often involves third-party DeFi platforms (e.g., Spark Protocol). Integrations or platform-specific vulnerabilities could expose users to additional risks.Mitigation: Use well-established DeFi platforms with strong reputations and security practices. Spark Protocol, for example, is widely adopted and regularly audited.

For those new to DeFi or seeking a conservative approach, allocating only a portion of your stablecoin holdings into sDAI can provide a balance between yield generation and capital preservation. Always use reputable platforms like Spark Protocol when interacting with the DSR contract, and monitor governance updates from MakerDAO for any changes in the savings rate or risk parameters.

Optimizing Your Passive Income DeFi Strategy

sDAI isn’t just a tool for passive income, it can be a foundational element in broader DeFi strategies. By combining sDAI with other protocols (such as using it as collateral in lending markets or pairing with other rebasing stablecoins), sophisticated users can layer yields while maintaining exposure to high-quality assets. This modularity is what sets modern DeFi apart from traditional finance; you’re no longer limited by siloed products or rigid structures.

If you’re ready to take your passive income journey further, explore advanced strategies that leverage automated vaults or compare APYs across leading platforms in our guide How to Earn Passive Income with sDAI: A Complete Guide for DeFi Investors.

The evolution of rebasing stablecoins like sDAI signals a maturing DeFi ecosystem, one where earning reliable yield doesn’t require constant management or outsized risk-taking. With MakerDAO’s robust infrastructure behind it, sDAI stands out as an accessible entry point for both new and seasoned crypto investors aiming to capture steady returns in an otherwise volatile market.