How Delta-Neutral Strategies Power Modern Yield-Generating Stablecoins

Stablecoins have long promised a safe harbor from the wild price swings of crypto, but the latest generation takes things a step further. Yield-generating stablecoins like USDe, USR, and sUSN now offer passive income opportunities while maintaining their peg. The secret sauce? Delta-neutral strategies, which allow these protocols to capture yield with minimal exposure to market volatility.

Delta-Neutral: The Engine Behind Stablecoin Yields

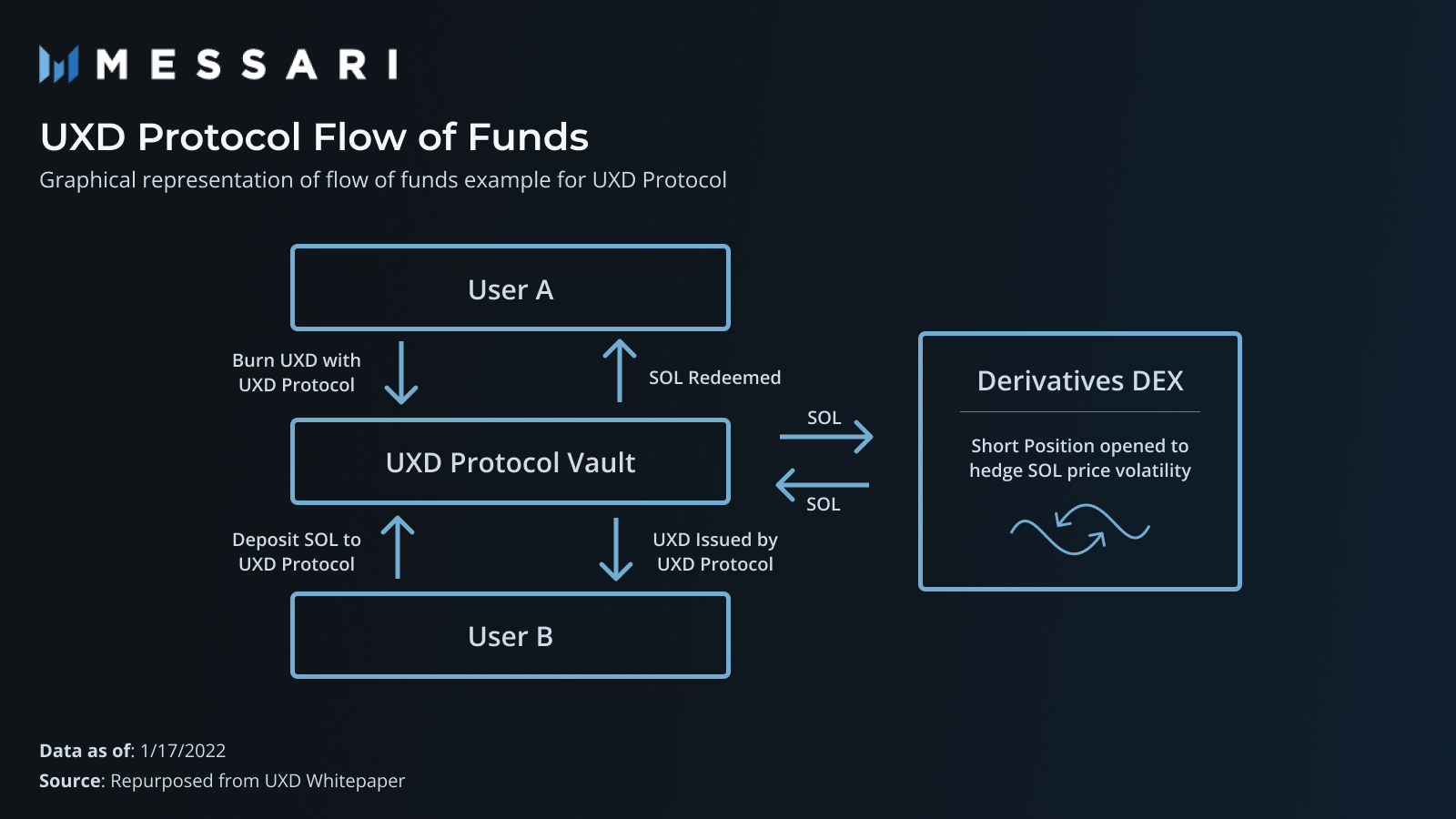

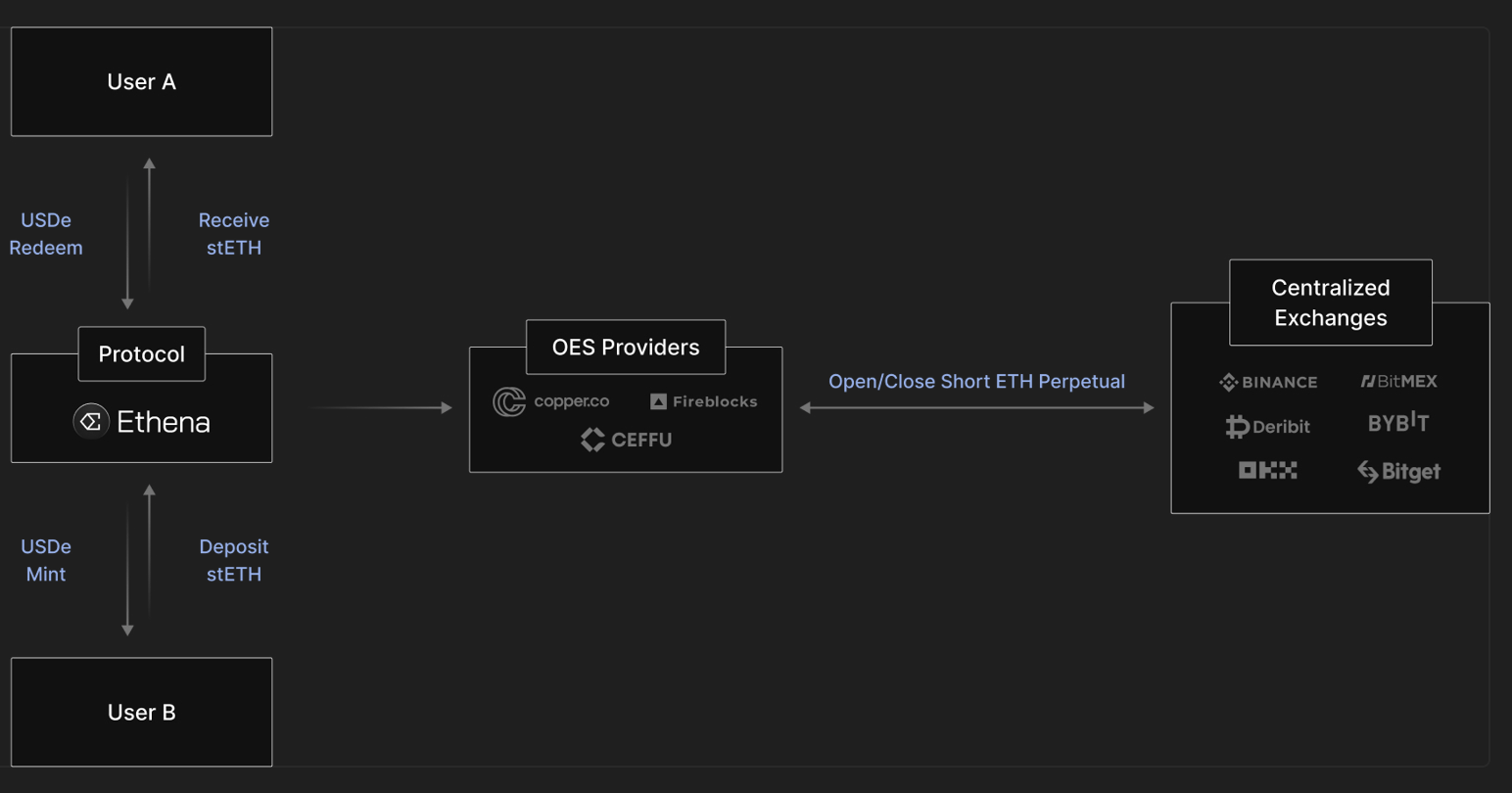

At its core, a delta-neutral strategy aims for near-zero price exposure by balancing long and short positions on correlated assets. In DeFi, this often means holding a spot position (like Ethereum) while simultaneously shorting its derivative (such as an ETH perpetual futures contract). This approach effectively neutralizes the impact of price movements in either direction, allowing protocols to focus on harvesting yield from funding rate arbitrage or staking rewards.

This is not just theory – it underpins some of the most innovative stablecoin protocols today. For example, Resolv’s USR stablecoin is fully collateralized by ETH and uses delta-neutral hedging with perpetual futures to lock in stability while generating returns for holders. Similarly, Noon Capital’s $USN leverages funding rate arbitrage and tokenized Treasury Bills to deliver consistent yields via its staked variant $sUSN (source).

How Delta-Neutral Stablecoins Generate Yield

The mechanics behind these yield-generating stablecoins are both elegant and robust:

Key Benefits of Delta-Neutral Strategies for Stablecoins

-

Minimized Exposure to Market Volatility: Delta-neutral strategies hedge both long and short positions, insulating stablecoins from price swings in underlying assets like Ethereum. This ensures the stablecoin maintains its peg even during turbulent market conditions.

-

Consistent Yield Generation: By leveraging mechanisms such as funding rate arbitrage and staking rewards, protocols like Resolv USR and Noon Capital’s $USN deliver steady returns to holders without exposing them to directional market risk.

-

Enhanced Stability and Reliability: Over-collateralized insurance pools and continuous rebalancing help maintain delta neutrality, reducing the risk of depegging and boosting user confidence in the stablecoin’s value.

-

Attractive Option for Risk-Averse Investors: Yield-generating stablecoins powered by delta-neutral strategies offer a compelling alternative for those seeking stable returns in the crypto space, without the unpredictability of traditional assets.

-

Scalable and Transparent Yield Models: Delta-neutral protocols often use on-chain mechanisms for yield distribution, ensuring transparency and scalability as adoption grows.

The protocol takes user deposits (usually in ETH or another volatile asset), then opens an offsetting short position in a perpetual futures market. As funding rates fluctuate – often with longs paying shorts during bullish periods – the protocol earns yield from these payments without being exposed to underlying price risk. This yield is then distributed to stablecoin holders as passive income.

This process is dynamic and requires sophisticated risk management. Protocols must continuously rebalance their positions to maintain neutrality as prices move and funding rates shift. Some platforms, like Resolv, further bolster stability by introducing over-collateralized insurance pools to absorb unexpected losses (details here).

The Rise of Delta-Neutral Stablecoins in DeFi Portfolios

The appeal of delta-neutral stablecoins lies in their ability to offer attractive yields without subjecting investors to the rollercoaster ride typical of crypto markets. As traditional DeFi yields compress and volatility remains high, these instruments are finding their way into more risk-managed portfolios.

This trend is underscored by the explosive growth in supply for coins like Ethena’s USDe and Resolv’s USR – investors are voting with their wallets for stability plus income.

However, it’s crucial to remember that delta-neutral does not mean risk-free. While price exposure is minimized, other risks remain: funding rates can turn negative, counterparty defaults are possible on derivatives exchanges, and smart contract vulnerabilities are always a consideration in DeFi. The most robust protocols address these head-on with transparent risk disclosures and layered insurance mechanisms.

Another factor driving adoption is the increasing sophistication of DeFi users. Investors are now seeking more than just simple staking or lending returns; they want stablecoin yield strategies that can weather market turbulence. Delta-neutral stablecoins fit this bill by offering a blend of predictability and yield that’s hard to find elsewhere in crypto.

What to Watch: Choosing the Right Delta-Neutral Stablecoin

Not all delta-neutral stablecoins are created equal. Here’s what savvy investors should consider when evaluating options:

Key Factors to Evaluate Before Investing in Delta-Neutral Stablecoins

-

Collateral Quality and Transparency: Ensure the stablecoin is fully backed by high-quality, liquid assets (e.g., Ethereum or tokenized Treasury Bills) and that collateral details are transparently disclosed. Established protocols like Resolv’s USR and Noon Capital’s $USN provide clear information about their collateral structures.

-

Delta-Neutral Mechanism Robustness: Assess how effectively the protocol maintains delta-neutrality. Look for clear documentation on hedging strategies, such as perpetual futures shorting or funding rate arbitrage, and evidence of regular rebalancing to manage market exposure.

-

Yield Generation and Sustainability: Analyze the sources of yield, such as funding rates, staking rewards, or arbitrage opportunities. Sustainable returns—like those offered by Noon Capital’s $sUSN through funding rate arbitrage and tokenized T-Bills—are preferable to unsustainably high, short-term yields.

-

Risk Management and Insurance: Investigate the presence of risk mitigation measures, including over-collateralized insurance pools or reserves. Protocols like Resolv employ such mechanisms to absorb potential losses from market volatility or hedging failures.

-

Protocol Transparency and Audits: Favor stablecoins whose smart contracts and financials are regularly audited by reputable third parties. Transparent reporting and open-source codebases increase trust and reduce the risk of hidden vulnerabilities.

-

Liquidity and Redemption Process: Check the stablecoin’s on-chain and exchange liquidity, as well as the clarity and speed of its redemption process. High liquidity and straightforward redemptions, as seen with leading delta-neutral stablecoins, are essential for investor confidence.

- Transparency: Are hedging mechanics and collateral reserves clearly disclosed?

- Yield Sources: Is the protocol overly reliant on volatile funding rates or are there diversified income streams (like tokenized T-Bills)?

- Risk Controls: Does the platform use over-collateralization, insurance funds, or automated rebalancing?

- Ecosystem Integration: Can you use the stablecoin across popular DeFi protocols for liquidity mining or as collateral?

The best projects communicate their strategy and risks openly, look for detailed docs and active community engagement before allocating capital.

The Future: Delta-Neutral Strategies Set the Standard for Stable Yield

The evolution of yield-generating stablecoins, powered by delta-neutral strategies, is reshaping how investors approach passive income in digital assets. As DeFi matures, expect to see even more creative approaches, combining yield from multiple sources, integrating real-world assets like Treasuries, and building smarter insurance systems.

This innovation isn’t just technical; it’s changing investor psychology. For those who previously sat on the sidelines due to volatility fears, delta-neutral stablecoins offer a compelling bridge into DeFi yields with a much lower risk profile.

The bottom line? If you’re seeking steady returns while sidestepping wild price swings, keep an eye on this space. Delta-neutral strategies aren’t just powering today’s most resilient stablecoins, they’re setting a new benchmark for sustainable crypto income.