How sDAI Compares to USDe: Yield, Risk, and Opportunities for Stablecoin Investors

Yield-bearing stablecoins are transforming the DeFi landscape by offering passive income opportunities with varying risk profiles. Two of the most prominent contenders in this space, sDAI and USDe, have attracted significant attention from both risk-averse investors and yield chasers. But how do these stablecoins stack up against each other when it comes to yield, risk, and broader opportunities?

![]()

sDAI vs USDe: Mechanism Designs That Shape Yield

Understanding the underlying mechanism is crucial for any stablecoin passive income strategy. sDAI is a product of MakerDAO’s DAI Savings Rate (DSR) system. When users deposit DAI into the DSR contract, they receive sDAI, which automatically accrues interest at a rate set by Maker governance. As of October 23,2025, the sDAI yield stands at 3.25%. This accumulating token increases in value over time rather than issuing new units, making it non-rebasing and straightforward for tracking returns.

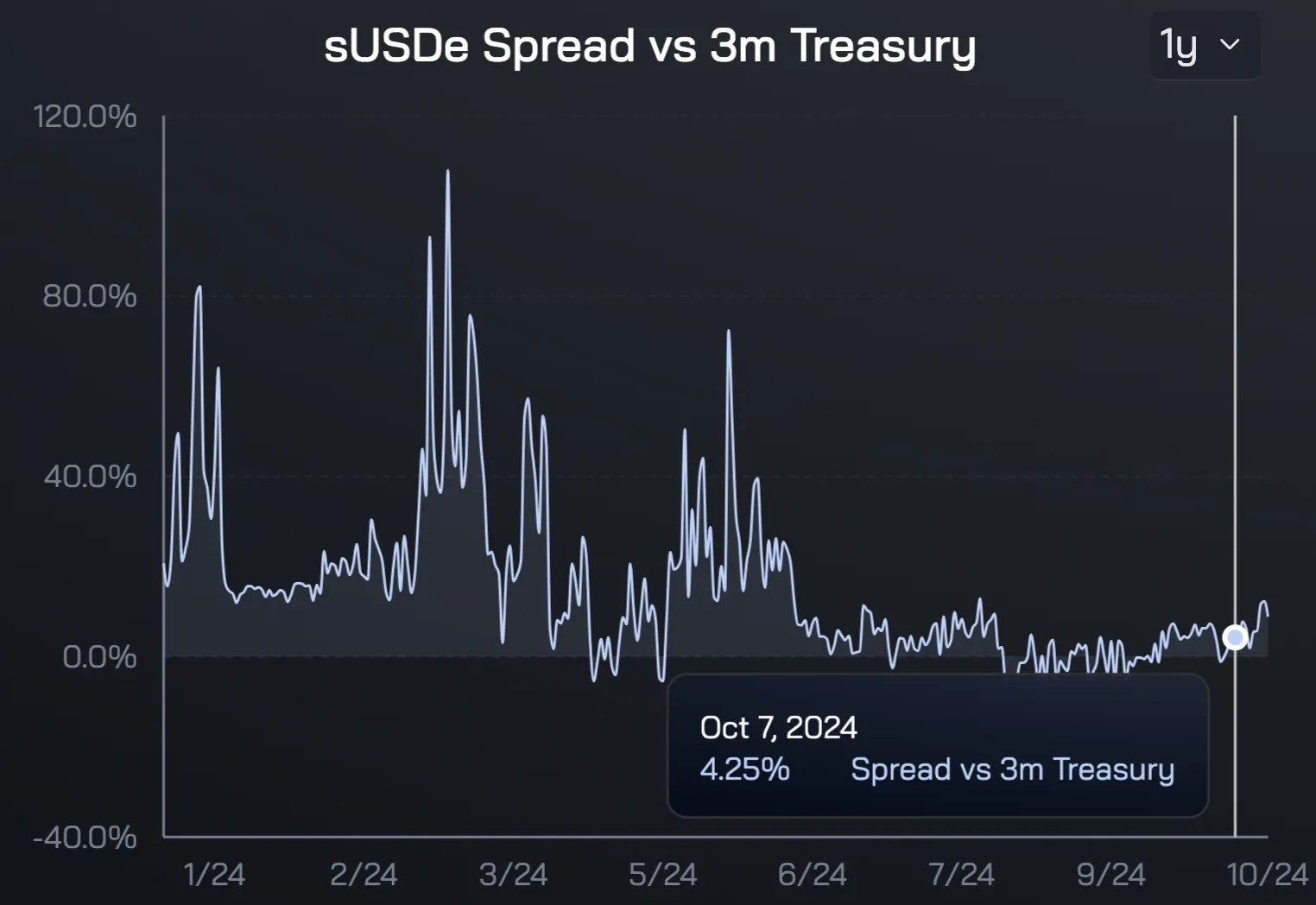

USDe, on the other hand, is minted via Ethena Protocol by depositing staked ETH (stETH). The protocol hedges ETH exposure by shorting ETH perpetual futures, generating yield from both stETH staking rewards and positive funding rates. This hybrid CeDeFi approach has produced yields ranging from 5% to 15%, peaking up to 29% during periods of favorable market conditions. However, these returns are inherently more volatile because they depend on external market dynamics like funding rates and ETH price movements.

Yield Comparison: Predictable Returns vs Market-Driven APY

The difference in yield between sDAI and USDe is not just a matter of numbers, it’s about predictability versus potential. With sDAI’s current rate at 3.25%, investors can expect relatively stable returns that move slowly in response to MakerDAO governance adjustments or shifts in collateral performance. This makes sDAI appealing for those who prioritize capital preservation over chasing high APYs.

USDe’s yield is a different story entirely. The protocol’s ability to deliver higher yields, sometimes as high as 15% or more, is attractive, but it comes with notable caveats. Yields fluctuate based on funding rates in derivatives markets and stETH performance; if funding turns negative or market volatility spikes, yields can drop sharply or even go negative temporarily. This dynamic has already been seen as USDe’s yields fell from initial highs near 55% down to their current range.

Key Differences Between sDAI and USDe for Stablecoin Investors

-

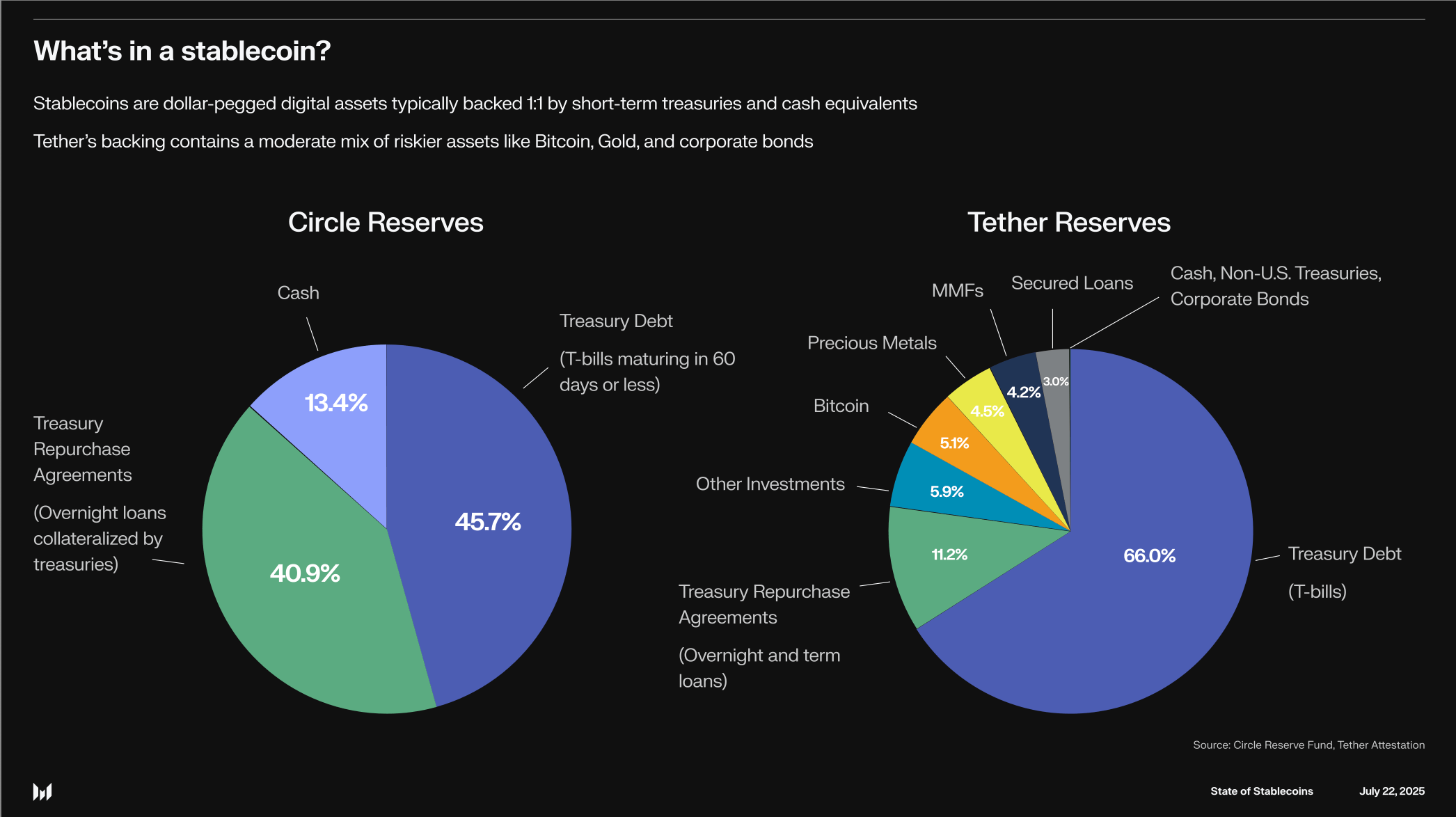

Mechanism Design: sDAI is created by depositing DAI into MakerDAO’s DAI Savings Rate (DSR) contract, earning yield from overcollateralized crypto assets. USDe is minted by depositing staked ETH (stETH) into the Ethena protocol, which uses a hedged strategy combining staking rewards and derivatives.

-

Yield Potential: sDAI currently offers an annual yield of approximately 3.25%. USDe yields historically range from 5% to 15%, with peaks up to 29% during favorable market conditions, reflecting its more aggressive yield strategy.

-

Risk Profile: sDAI is considered lower risk, with yield determined by MakerDAO governance and collateral performance. USDe carries higher risk, relying on market funding rates and complex hedging strategies that can be volatile.

-

Investor Suitability: sDAI is ideal for investors seeking stable, predictable returns with minimal risk. USDe is better suited for those willing to accept higher risk in pursuit of greater yield.

-

Underlying Assets: sDAI is backed by a diverse basket of overcollateralized assets managed by MakerDAO. USDe is backed by staked ETH and utilizes derivatives for its hedging strategy.

Risk Analysis: What Could Go Wrong?

No yield opportunity is without risk, especially in DeFi. With sDAI, risk is primarily tied to the health of MakerDAO’s collateral portfolio (which includes real-world assets, crypto collateral, and stability mechanisms) as well as governance decisions that impact the DSR rate. While historically resilient, even during periods of heightened market stress, MakerDAO’s model is not immune to black swan events or rapid changes in crypto collateral values.

USDe introduces additional layers of complexity, and risk, through its use of derivatives markets for hedging ETH exposure. If funding rates turn negative or if there are disruptions on major derivatives exchanges, yields can evaporate quickly or even result in losses if the hedged positions become unbalanced. Furthermore, reliance on stETH exposes USDe holders to risks associated with Ethereum staking infrastructure.

For a deeper dive into how these models compare across TVL, APY ranges, and risk factors, see our comprehensive yield-bearing stablecoins comparison.

Choosing between sDAI and USDe ultimately comes down to your risk tolerance, investment horizon, and appetite for yield volatility. Investors seeking stablecoin passive income with minimal surprises are likely to gravitate toward sDAI’s conservative 3.25% yield, which is less exposed to external market shocks. Meanwhile, those comfortable with more complex DeFi yield opportunities, and the swings that come with them, may find USDe’s higher but less predictable returns more compelling.

Opportunities in the Evolving Stablecoin Market

The rise of yield-bearing stablecoins like sDAI and USDe is a testament to DeFi’s ability to innovate beyond traditional savings products. Both tokens offer on-chain access to passive income, but they serve different investor profiles and portfolio strategies.

- sDAI: Best suited for users who want low-maintenance, transparent returns that can be easily tracked and integrated into DeFi protocols. Its non-rebasing design also makes it a favorite for accounting simplicity.

- USDe: Designed for active users or institutional players who understand derivatives risk and are prepared to monitor their positions more closely. The protocol’s hybrid CeDeFi model can amplify returns during bullish funding environments but requires vigilance.

Beyond individual risk appetites, these stablecoins reflect a broader trend: the convergence of TradFi and DeFi yield strategies. As more protocols experiment with new ways to generate “real yield” from on-chain and off-chain sources, we’re likely to see further innovation, but also new risks that require careful analysis.

Stablecoin and Crypto Price Comparison: sDAI vs USDe and Peers

6-Month Price Performance of Leading Yield-Bearing and Traditional Stablecoins (as of 2025-10-23)

| Asset | Current Price | 6 Months Ago | Price Change |

|---|---|---|---|

| Savings DAI (sDAI) | $1.21 | $1.16 | +4.3% |

| Ethena USDe (USDe) | $1.00 | $1.00 | +0.2% |

| Dai (DAI) | $1.00 | $1.00 | +0.0% |

| USD Coin (USDC) | $0.0327 | $0.0327 | +0.0% |

| Tether (USDT) | $1.00 | $1.00 | +0.0% |

| Frax (FRAX) | $0.9964 | $0.9964 | +0.0% |

| Liquity USD (LUSD) | $1.00 | $1.00 | +0.0% |

| Ethereum (ETH) | $3,899.99 | $3,899.99 | +0.0% |

Analysis Summary

Over the past six months, sDAI has shown the strongest price appreciation among major stablecoins, rising by 4.3%, while USDe experienced a minimal 0.2% increase. All other leading stablecoins and Ethereum maintained price stability, reflecting their design to track the US dollar or, in ETH’s case, a stable period.

Key Insights

- sDAI outperformed other stablecoins in price growth, reflecting its yield-accruing mechanism.

- USDe maintained its peg with a slight positive change, despite offering higher variable yields.

- Traditional stablecoins (DAI, USDC, USDT, FRAX, LUSD) remained stable, with negligible or zero price movement.

- Ethereum’s price was unchanged over the period, highlighting a stable market phase for major crypto assets.

This comparison uses real-time price data for each asset, directly referencing the provided historical and current prices from reputable market sources. Only assets and figures from the supplied data are included, ensuring accuracy and transparency.

Data Sources:

- Main Asset: https://www.coingecko.com/en/coins/savings-dai

- Ethena USDe: https://www.coingecko.com/en/coins/ethena-usde

- Dai: https://www.coingecko.com/en/coins/dai

- USD Coin: https://www.coingecko.com/en/coins/usd-coin

- Tether: https://www.coingecko.com/en/coins/tether

- Frax: https://www.coingecko.com/en/coins/frax

- Liquity USD: https://www.coingecko.com/en/coins/liquity-usd

- Ethereum: https://www.coingecko.com/en/coins/ethereum

Disclaimer: Cryptocurrency prices are highly volatile and subject to market fluctuations. The data presented is for informational purposes only and should not be considered as investment advice. Always do your own research before making investment decisions.

If you’re considering diversifying across multiple stablecoins or want to compare TVL, APY, and risk profiles across the sector, check out our latest overview of top yield-bearing stablecoins by TVL and APY.

Best Practices for Stablecoin Yield Seekers

Before allocating capital to any yield-bearing stablecoin, consider these best practices:

1. Stay Informed: Monitor protocol updates, MakerDAO governance changes can impact sDAI rates, while Ethena’s hedging mechanics depend on real-time market data.

2. Diversify: Don’t put all your eggs in one basket; spreading exposure across different mechanisms can help cushion against unforeseen events.

3. Assess Counterparty Risk: Understand where your assets are held (on-chain contracts vs centralized exchanges) and review audit reports.

4. Track Yield Sustainability: Be wary of yields that seem too good to last, high rates often mean high risk or temporary market conditions.

The bottom line: There is no one-size-fits-all answer in the sDAI vs USDe debate. Your choice should reflect your unique goals as a DeFi investor, and your understanding of the why behind the yield.