How STBL and USST Are Revolutionizing Yield-Bearing Stablecoins with RWA Collateral

Stablecoins have long promised the best of both worlds: price stability and digital asset flexibility. Yet, for most investors, traditional stablecoins like USDT and USDC have delivered little in the way of yield. The recent surge in yield-bearing stablecoins, however, is changing that narrative, none more so than STBL and its flagship stablecoin, USST, which are setting new standards for passive income in DeFi by leveraging real-world asset (RWA) collateral.

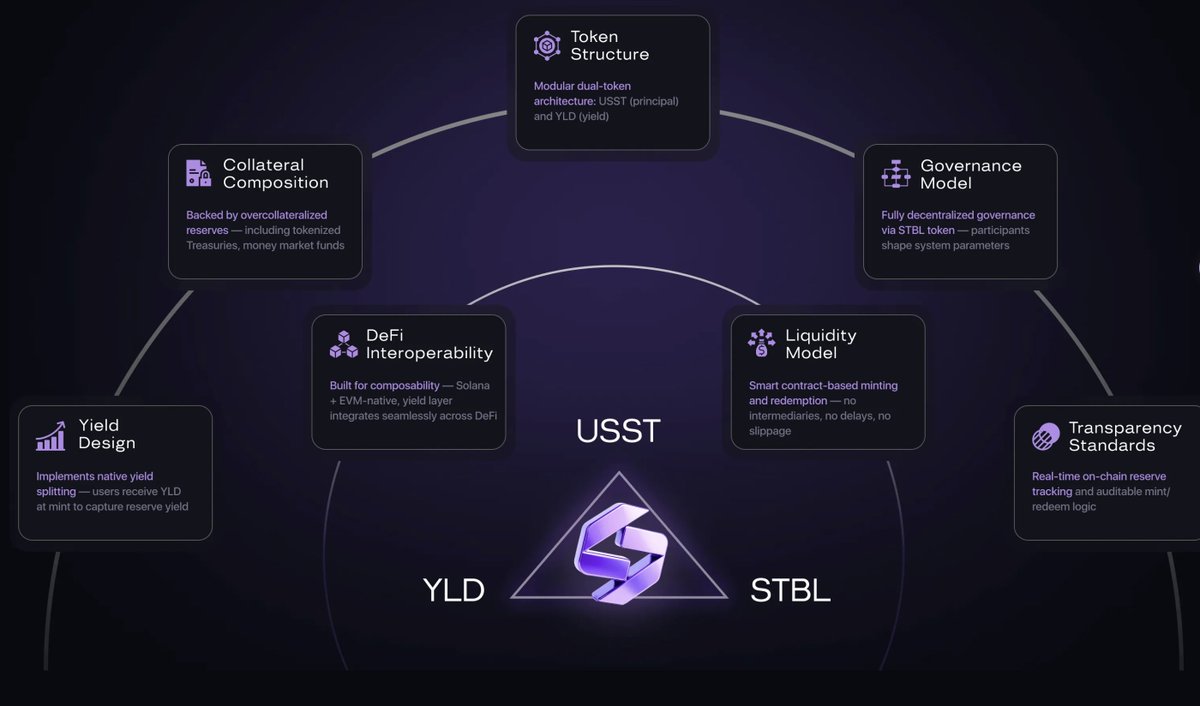

STBL’s Dual-Token Model: Separating Principal and Yield

The STBL protocol is pioneering a dual-token architecture that fundamentally rethinks how users access both liquidity and yield. At the heart of this system are two tokens:

- USST: A dollar-pegged stablecoin fully backed by tokenized RWAs such as U. S. Treasury Bills and AAA-rated money market funds. Each USST is minted by depositing approved RWA tokens as collateral, ensuring robust backing and 1: 1 redemption.

- YLD: A non-transferable NFT issued when minting USST, representing the right to claim yield generated by the underlying collateral. This allows users to spend or deploy their USST across DeFi protocols while YLD accrues returns independently, a sharp contrast to legacy models where stablecoin issuers pocket most of the yield.

This structure effectively decouples liquidity from yield generation. Users can utilize USST for payments or DeFi strategies while their YLD NFTs quietly accumulate passive income from RWA yields in the background. It’s a model designed for both active participants and conservative holders seeking steady returns without sacrificing utility.

Why RWA-Backed Stablecoins Are Gaining Traction

The integration of tokenized real-world assets has become a defining trend among next-generation stablecoins. By anchoring digital dollars like USST to high-quality RWAs, think U. S. Treasuries or institutional-grade money market funds, protocols can offer both stability and sustainable yields uncorrelated with crypto market volatility.

This approach contrasts sharply with earlier attempts at on-chain yield generation, which often relied on volatile lending rates or unsustainable incentives. Instead, RWA-backed models like STBL tap into established financial instruments with predictable returns, distributing these directly to users via mechanisms like YLD NFTs.

The numbers speak for themselves: as of today, STBL trades at $0.5990, reflecting growing demand for its innovative structure and transparent asset backing. This price action underscores how investor appetite is shifting toward protocols that combine regulatory-friendly collateralization with user-centric yield-sharing models.

How Yield Is Generated, and Why It’s Sustainable

Unlike many algorithmic or seigniorage-based stablecoins that struggled during market stress, STBL’s over-collateralization model ensures every minted USST remains fully backed by liquid RWAs. The protocol’s treasury dynamically manages asset allocation between short-term government debt and high-grade money markets to maximize risk-adjusted returns while preserving capital integrity.

The magic lies in how yield distribution is handled:

- Yield accrual: As underlying assets generate interest (e. g. , from U. S. Treasury Bills), this accrues within the protocol treasury.

- Payout mechanism: Holders of YLD NFTs receive periodic distributions proportional to their share of total YLD supply, without needing to lock up or unstake their principal (USST).

- Treasury transparency: All asset flows are on-chain and governed by community votes via the STBL token, ensuring user alignment at every step (see details here).

This design not only delivers sustainable returns but also empowers users with unprecedented control over collateral types, risk ratios, and future upgrades, a level of transparency sorely lacking in earlier generations of stablecoins.

STBL Price Prediction 2026-2031

Professional outlook for STBL based on RWA adoption, DeFi innovation, and evolving stablecoin markets.

| Year | Minimum Price (Bearish) | Average Price | Maximum Price (Bullish) | Year-over-Year % Change (Avg) | Key Market Scenario |

|---|---|---|---|---|---|

| 2026 | $0.54 | $0.72 | $1.05 | +20% | Continued RWA adoption; minor regulatory headwinds |

| 2027 | $0.62 | $0.85 | $1.32 | +18% | Broader DeFi integration; increased institutional usage |

| 2028 | $0.68 | $0.99 | $1.58 | +17% | Major RWA tokenization; competition heats up |

| 2029 | $0.76 | $1.12 | $1.85 | +13% | New categories of RWAs; global regulatory clarity |

| 2030 | $0.81 | $1.25 | $2.12 | +12% | Mainstream adoption; STBL becomes DeFi yield benchmark |

| 2031 | $0.88 | $1.38 | $2.40 | +10% | Mature market; protocol upgrades and global expansion |

Price Prediction Summary

STBL is positioned for steady growth over the next six years, with average prices expected to nearly double from current levels by 2031. The protocol’s innovative dual-token model, strong RWA backing, and community governance create a robust foundation, while expansion into new asset classes and regulatory clarity could drive further upside. However, competition and market risk remain, making STBL’s trajectory both promising and subject to evolving industry dynamics.

Key Factors Affecting STBL Price

- Adoption rate of real-world asset tokenization in DeFi

- Regulatory developments impacting stablecoins and RWA-backed tokens

- Expansion of STBL’s collateral types and yield mechanisms

- Integration with DeFi protocols and institutional platforms

- Market competition from existing and emerging yield-bearing stablecoins

- Macro-economic conditions affecting yield on traditional assets

- Community engagement and effectiveness of decentralized governance

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

The Role of Community Governance in Stablecoin 2.0

Centralized decision-making has been a persistent criticism leveled at legacy stables; rug pulls and opaque reserves are still fresh memories for many DeFi veterans. In response, STBL employs an on-chain governance model where holders vote on protocol parameters, from eligible RWA categories to collateralization ratios, ensuring adaptability as new opportunities arise in global credit markets.

This participatory approach aligns incentives between developers, investors, and end-users while fostering resilience against regulatory shocks or market dislocations, a necessity as DeFi matures into mainstream finance.

Looking beyond the architecture, STBL and USST are also shaping the future of passive income in DeFi by making yield accessible, flexible, and transparent. The dual-token model is more than a technical novelty; it’s a pragmatic answer to the needs of both retail and institutional investors who want to put their capital to work without sacrificing liquidity or security.

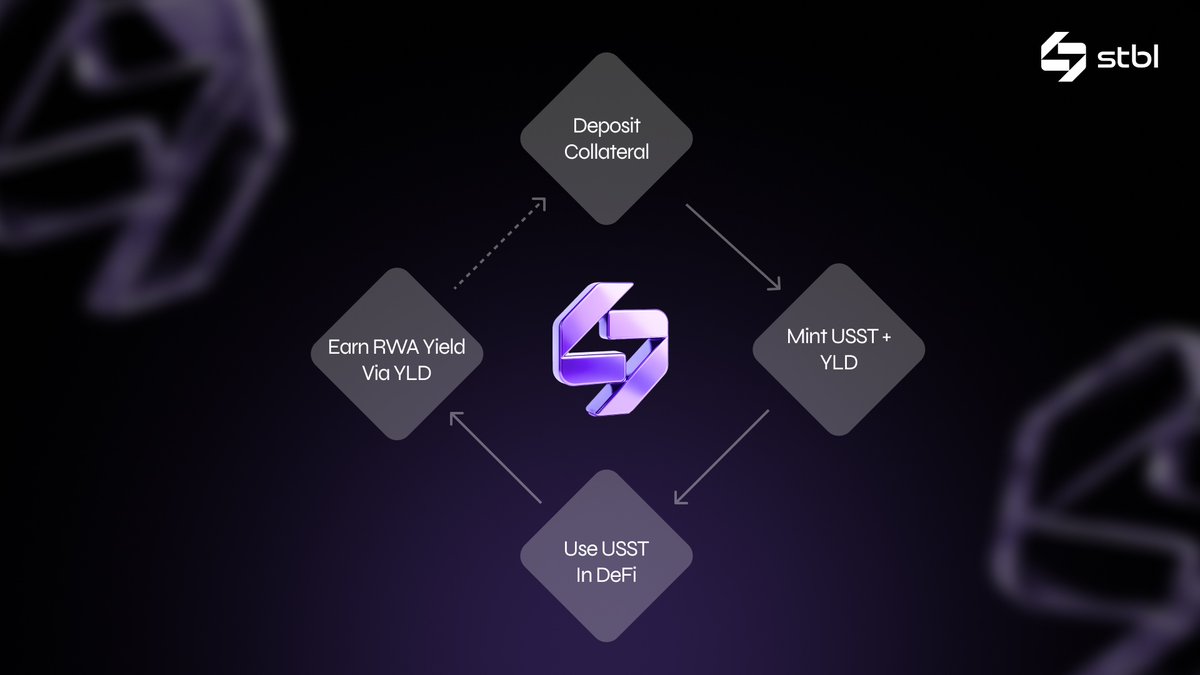

How Users Earn Yield with STBL

For those new to yield-bearing stablecoins, the process is refreshingly straightforward. Users deposit approved RWA tokens (such as tokenized U. S. Treasuries) into the protocol, mint USST stablecoins, and automatically receive YLD NFTs representing their share of yield. These YLD NFTs are non-transferable, ensuring only those who provided collateral reap the rewards, but USST can be freely used across DeFi protocols, traded, or spent for payments.

Key Benefits of RWA-Backed Yield Stablecoins Like STBL

-

Stable Value Backed by Real-World Assets: USST is fully collateralized by tokenized real-world assets such as U.S. Treasury Bills and AAA-rated money market funds, providing a transparent and robust foundation for maintaining its $1 peg. This over-collateralization model helps safeguard against crypto market volatility.

-

Dual-Token Model for Enhanced Flexibility: The STBL protocol introduces a unique structure where USST serves as the spendable stablecoin, while YLD NFTs represent the right to claim yield. This separation allows users to utilize USST in DeFi protocols or payments while their YLD accrues passive income independently.

-

On-Chain Yield Generation from RWAs: Yield for YLD holders is sourced directly from the returns generated by the underlying RWA collateral, such as interest from U.S. Treasury securities. This approach offers sustainable, real-world-backed passive income rather than relying solely on DeFi lending rates.

-

Decentralized and Transparent Governance: STBL employs a community-driven governance model, allowing token holders to vote on key parameters like collateral types and protocol upgrades. This ensures ongoing transparency and adaptability as the ecosystem evolves.

-

Increased Utility and Liquidity: With the separation of principal (USST) and yield (YLD), users can freely transact or deploy their stablecoins across DeFi platforms without sacrificing their ability to earn yield, maximizing both liquidity and income potential.

-

Dynamic Treasury and Risk Management: The protocol’s treasury mechanism actively manages asset allocation and yield distribution, maintaining the stability of USST and optimizing returns for YLD holders. This helps ensure the system remains resilient and responsive to market changes.

This decoupling means you’re never forced to choose between spending power and earning potential. Whether you’re staking in a liquidity pool or simply holding USST in your wallet, your YLD NFT quietly accumulates returns sourced from real-world asset yields.

Comparing STBL vs sDAI: What Sets It Apart?

While protocols like sDAI have popularized rebasing stablecoins that accrue yield directly on the principal, STBL’s split-token approach offers greater composability. By separating principal (USST) from yield rights (YLD), users gain flexibility in how they deploy capital across DeFi strategies, without forfeiting passive income opportunities.

This model also sidesteps some regulatory uncertainty around rebasing tokens by keeping principal balances fixed while distributing yield via NFTs. As more jurisdictions scrutinize DeFi products, this architectural nuance could prove decisive for long-term adoption.

Risks and Considerations

No innovation comes without tradeoffs. While RWA-backed models offer robust transparency and predictable returns, they do introduce dependencies on off-chain assets and custodianship frameworks. Protocol governance helps mitigate these risks by allowing token holders to vote on asset eligibility and risk parameters, but users must remain vigilant about evolving regulatory landscapes and counterparty exposure.

Price-wise, STBL’s current level at $0.5990 reflects early-stage volatility typical of emerging protocols but also suggests strong market interest as adoption ramps up (see analysis). As with any DeFi product, prudent portfolio sizing and ongoing due diligence are essential.

What’s Next for Yield-Bearing Stablecoins?

The success of STBL and USST is likely just the beginning for RWA-backed stablecoin innovation. As tokenization expands into new asset classes, think real estate debt or global corporate bonds, the universe of available collateral will broaden, unlocking even more diverse sources of yield for DeFi participants.

Protocols that prioritize transparency, user alignment through governance, and flexible access to passive income will set themselves apart as “Stablecoin 2.0” becomes a mainstream portfolio staple.