How Yield-Bearing Stablecoins Like sDAI and USDe Are Redefining Passive Income in DeFi

In 2025, the world of decentralized finance (DeFi) is seeing a profound shift as yield-bearing stablecoins like sDAI and USDe take center stage. These innovative assets are redefining what passive income means for crypto investors, blending the stability of traditional stablecoins with the dynamic earning potential of DeFi protocols. Unlike the early days of DeFi, where yield farming demanded active management and risk tolerance, today’s yield-bearing stablecoins offer a more accessible and capital-efficient path to earning yield, simply by holding a stable, interest-generating asset.

What Makes Yield-Bearing Stablecoins Different?

Traditional stablecoins such as USDC or USDT are designed to maintain a 1: 1 peg with the US dollar, providing a safe haven from crypto volatility but offering no inherent yield. Yield-bearing stablecoins take this a step further, allowing users to earn passive income while retaining price stability. These assets are engineered to accrue interest or rewards automatically, without the need for users to lock funds in complex staking contracts or navigate multi-step DeFi strategies.

The current market reflects this evolution. As of October 19,2025, DAI is trading at $1.001, and HyperEVM Bridged USDE is priced at $1.002. These price points underscore the robust peg mechanisms at play, even as these assets generate yield for holders.

sDAI vs USDe: Yield-Bearing Stablecoin Comparison (Oct 2025)

| Stablecoin | Current Yield Rate | Market Cap / Supply | Key Features |

|---|---|---|---|

| sDAI 🟡 | 3.25% APY | Pegged to DAI ($1.001) | • Powered by MakerDAO DSR • Low risk, stable yield • Widely integrated in DeFi |

| USDe 🌐 | 7–7.4% APY | $5.8B+ supply | • Backed by staked ETH, BTC, USDT/USDC • High yield via derivatives • Fast-growing, synthetic stablecoin |

sDAI: The Passive Income Engine of MakerDAO

sDAI (Spark DAI) is a flagship example of stablecoin 2.0. By depositing DAI into MakerDAO’s DAI Savings Rate (DSR) contract, users receive sDAI, a rebasing token that automatically accrues interest. The current annualized yield sits at approximately 3.25%, with rates determined through MakerDAO governance and funded by interest from collateralized debt positions within the protocol. The result? Investors can earn steady returns while holding an asset that remains fully liquid and easily tradable across DeFi applications.

What sets sDAI apart is its simplicity and composability. Users don’t need to manage complex positions or monitor volatile liquidity pools. The yield is paid out directly to sDAI holders, making it an attractive option for both DeFi newcomers and seasoned capital allocators. For a comprehensive walkthrough on earning passive income with sDAI, see our complete guide for DeFi investors.

USDe: High-Yield Synthetic Dollars for the Internet Economy

While sDAI represents a crypto-native evolution of RWA-backed stablecoins, USDe (Ethena USDe) brings a synthetic twist to yield generation. USDe is backed by a diversified basket of assets, primarily staked ETH, BTC, and a mix of USDT/USDC, paired with short perpetual futures contracts to maintain a delta-neutral position. This innovative structure lets USDe maintain its $1 peg while generating yield from derivatives funding rates and staking rewards.

In 2024, Ethena’s sUSDe (the staked variant) achieved an average yield of 19%, with current APYs hovering around 7, 7.4% depending on market conditions. With over $5.8 billion in supply, USDe has quickly become a cornerstone of modern DeFi yield strategies, appealing to both retail and institutional participants.

Why Yield-Bearing Stablecoins Are Driving a New Era of DeFi Passive Income

Yield-bearing stablecoins like sDAI and USDe offer several compelling advantages:

- Passive Income: Earn interest automatically, no active management or rebalancing required.

- Capital Efficiency: Assets remain liquid and usable across DeFi protocols, maximizing utility.

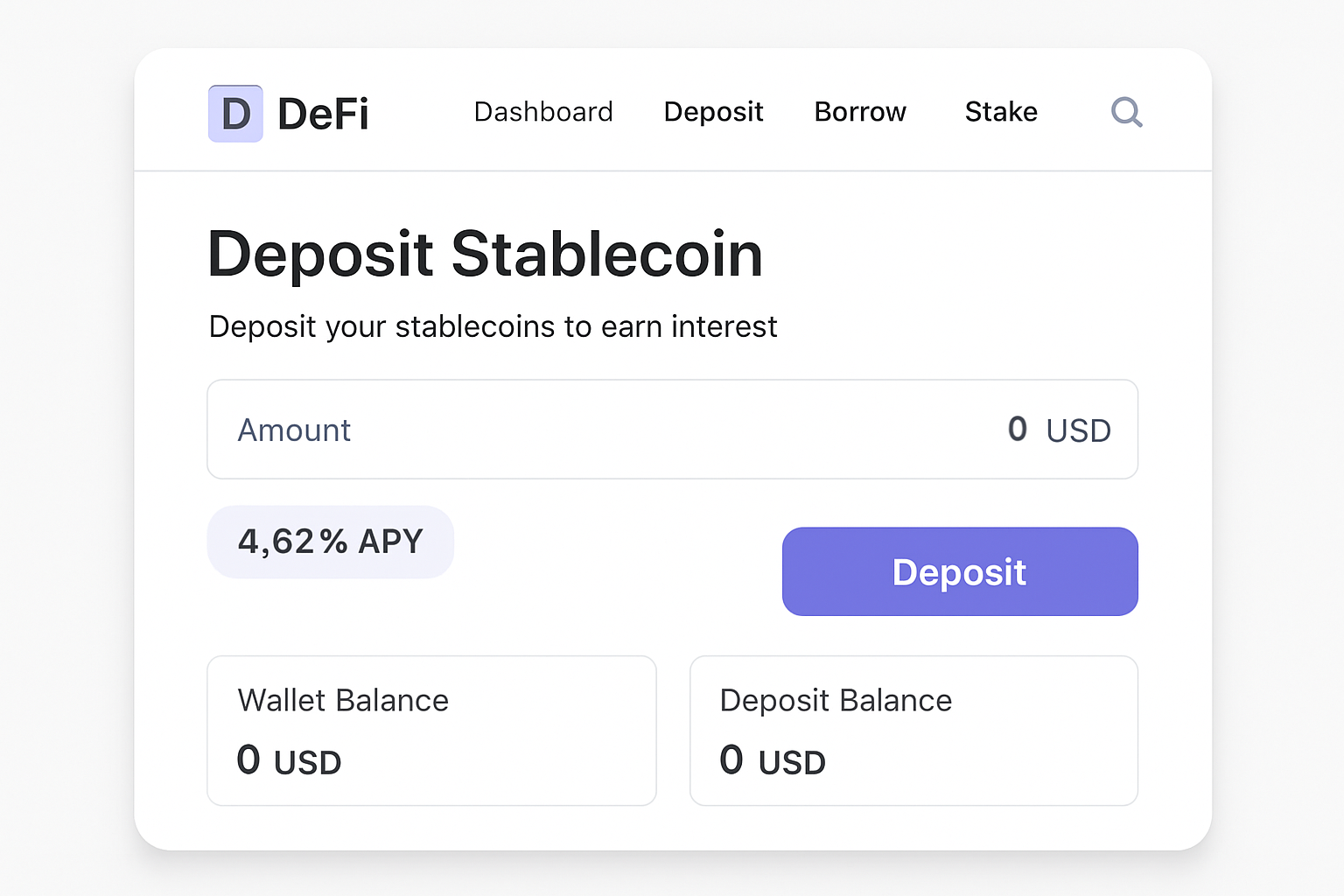

- User-Friendly: No complex interfaces or technical hurdles, simply hold the asset to earn yield.

This new class of stablecoins is also attracting attention from payment giants and Wall Street, as highlighted in recent industry reports. The convergence of TradFi and DeFi is no longer theoretical, yield-bearing stablecoins are now core components of institutional portfolios and payment infrastructure worldwide.

sDAI and USDe Yield-Bearing Stablecoin Price & Yield Prediction Table (2026-2031)

Forecasting sDAI and USDe price stability and projected annualized yield returns based on evolving DeFi trends, adoption rates, and regulatory landscape.

| Year | Asset | Minimum Price | Average Price | Maximum Price | Projected Min Yield (APY) | Projected Avg Yield (APY) | Projected Max Yield (APY) | Market Scenario Insights |

|---|---|---|---|---|---|---|---|---|

| 2026 | sDAI | $0.995 | $1.00 | $1.01 | 2.80% | 3.20% | 3.60% | Stable DSR, gradual DeFi adoption, minor regulatory headwinds |

| 2026 | USDe | $0.993 | $1.00 | $1.015 | 5.50% | 7.00% | 8.00% | High DeFi demand, robust funding rates, moderate volatility |

| 2027 | sDAI | $0.995 | $1.00 | $1.012 | 2.60% | 3.10% | 3.80% | MakerDAO adjusts DSR, increased institutional use |

| 2027 | USDe | $0.991 | $1.002 | $1.018 | 5.00% | 6.80% | 8.50% | Yield compression as competition rises, but DeFi growth continues |

| 2028 | sDAI | $0.994 | $1.00 | $1.013 | 2.50% | 3.05% | 4.00% | Stablecoin regulation matures, DSR volatility increases |

| 2028 | USDe | $0.990 | $1.003 | $1.020 | 4.80% | 6.50% | 9.00% | Yield volatility due to market cycles, more RWA integration |

| 2029 | sDAI | $0.993 | $1.00 | $1.015 | 2.40% | 3.00% | 4.20% | Broader TradFi integration, stable yields |

| 2029 | USDe | $0.988 | $1.003 | $1.022 | 4.50% | 6.20% | 9.50% | Peak DeFi adoption, but increased regulatory oversight |

| 2030 | sDAI | $0.992 | $1.00 | $1.017 | 2.30% | 2.90% | 4.30% | Yield competition from new stablecoin protocols |

| 2030 | USDe | $0.986 | $1.004 | $1.025 | 4.20% | 6.00% | 10.00% | Potential market stress tests, but strong user base |

| 2031 | sDAI | $0.990 | $1.00 | $1.018 | 2.10% | 2.80% | 4.50% | Matured market, DSR stabilizes, low volatility |

| 2031 | USDe | $0.985 | $1.005 | $1.030 | 4.00% | 5.80% | 10.50% | Market consolidation, possible global regulatory clarity |

Price Prediction Summary

Both sDAI and USDe are expected to maintain price stability near the $1.00 peg, with minor deviations in extreme market scenarios. sDAI yields are projected to remain moderate, reflecting DAI Savings Rate adjustments and growing institutional adoption, while USDe yields are likely to remain higher but gradually compress as competition and regulatory frameworks evolve. Yield-bearing stablecoins are poised to become a core passive income tool in DeFi, especially as regulatory clarity and technological integrations mature.

Key Factors Affecting Savings DAI Price

- MakerDAO DSR adjustments directly impacting sDAI yields.

- DeFi adoption rates and integration with TradFi (Traditional Finance).

- Regulatory developments affecting stablecoin operations and yields.

- Competition from new yield-bearing stablecoins and protocols.

- Market liquidity and stress events influencing price stability.

- Evolution of RWA (Real World Asset) integration into stablecoin backing.

- Derivatives funding rates and DeFi protocol innovation (especially for USDe).

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

However, as with any innovation in DeFi, these opportunities come with their own set of risks. . .

Smart contract vulnerabilities remain a central concern. While protocols like MakerDAO and Ethena undergo regular audits, the inherent complexity of DeFi code means risks can never be fully eliminated. Regulatory ambiguity is another factor; global authorities are still developing frameworks for stablecoin oversight, and sudden policy shifts could impact the accessibility or legality of certain assets. Finally, liquidity constraints may arise during periods of market stress, making it challenging to convert large holdings of sDAI or USDe back to fiat or other stablecoins without slippage.

Navigating Risks: What Every Investor Should Know

For those considering adding yield-bearing stablecoins to their DeFi toolkit, a balanced approach is essential. Here’s a quick risk-reward breakdown to guide your strategy:

Pros and Cons of Holding Yield-Bearing Stablecoins

-

Earn Passive Income Effortlessly: Yield-bearing stablecoins like sDAI (currently earning ~3.25% APY) and USDe (with sUSDe yields around 7–7.4% APY) let holders automatically accrue interest, turning stablecoins into income-generating assets without active management.

-

Enhanced Capital Efficiency: These assets combine the price stability of traditional stablecoins with yield generation, allowing users to maximize the utility of their capital within DeFi protocols and payment platforms.

-

User-Friendly Experience: Platforms like MakerDAO and Ethena make it easy to access yield-bearing stablecoins, often requiring just a simple deposit or swap, with no need for complex staking or active DeFi strategies.

-

Exposure to Smart Contract Risks: Holding yield-bearing stablecoins means trusting the underlying smart contracts. Vulnerabilities or exploits in protocols like MakerDAO or Ethena could result in loss of funds.

-

Regulatory Uncertainty: The legal status of yield-bearing stablecoins is still evolving globally, and future regulations could impact their usage, yields, or even restrict access in certain jurisdictions.

-

Potential Liquidity Constraints: During periods of high market volatility or stress, converting large amounts of sDAI or USDe back to fiat or other assets may be challenging, possibly leading to slippage or delays.

Due diligence is key. Monitor protocol updates, governance proposals, and audit results. Diversifying across multiple yield-bearing stablecoins can also help mitigate protocol-specific risks. For those seeking to compare the latest opportunities, our curated list of top yield-bearing stablecoins in 2024 offers a detailed overview of APYs, mechanisms, and underlying collateral.

How Yield-Bearing Stablecoins Are Integrating into the Broader Ecosystem

Stablecoin 2.0 isn’t just about passive income. These assets are increasingly woven into the fabric of DeFi, powering lending protocols, liquidity pools, cross-border payments, and even on-chain treasuries. The composability of sDAI and USDe means they can be used as collateral, traded on decentralized exchanges, or integrated into automated portfolio strategies. As real-world asset (RWA) tokenization gains steam, expect even more hybrid models that blend yield from both crypto-native and off-chain sources.

For investors, this translates to unprecedented flexibility. You can earn yield while participating in other DeFi activities, compounding returns without sacrificing stability or liquidity. The days of choosing between safety and earning potential are fading as protocols continue to innovate on both fronts.

What’s Next? The Future of Stablecoin Yields

Looking ahead, competition among protocols is likely to drive further improvements in transparency, security, and user experience. As regulatory clarity improves, institutional adoption should accelerate, bringing even greater scale and stability to the sector. For retail users, the simplicity and reliability of sDAI and USDe are already setting a new standard for passive income in crypto.

To stay ahead in this rapidly evolving space, follow the latest research and compare market leaders. For a side-by-side breakdown of sDAI, USDe, USDT, and more, visit StablecoinFlows’ comprehensive 2024 list.

Understanding the why behind the yield is more important than ever. As always, assess both the rewards and the risks before allocating capital to any new protocol or asset.