How Yield-Bearing Stablecoins Like yoUSD Are Changing DeFi Passive Income

Imagine a world where your dollars don’t just sit idle in your wallet or exchange account, but actually work for you 24/7. Welcome to the era of yield-bearing stablecoins, where passive income meets price stability. The DeFi landscape is buzzing, and tokens like yoUSD are leading a seismic shift in how investors approach yield generation. Today, holding a stablecoin isn’t just about safety – it’s about stacking yield while you sleep.

yoUSD Stablecoin: Price Stability Meets Automated Yield

Let’s get straight to the numbers: Yield Optimizer USD (YOUSD) is currently priced at $1.04 – a testament to its peg integrity and market demand. What sets yoUSD apart isn’t just its tight price band, but its built-in, automated yield mechanism. Instead of chasing APYs across DeFi protocols or worrying about impermanent loss, yoUSD holders earn yield simply by holding the token. This is passive income reimagined for 2025.

yoUSD vs Traditional Stablecoins: Feature Comparison

| Feature | yoUSD (Yield Optimizer USD) | Traditional Stablecoins (e.g., USDC, USDT) |

|---|---|---|

| Current Price | $1.04 | $1.00 |

| Yield Generation | ✅ Yes (Passive Income) 💸 | ❌ No |

| Volatility Protection | ✅ Pegged to $1, with yield buffer 🛡️ | ✅ Pegged to $1 |

| Passive Income Potential | 🌟 High (via DeFi strategies) | 🚫 None |

| Mechanism | Lending, staking, real-world asset yield | Fiat-backed, no yield |

| Risk Factors | Smart contract, regulatory, liquidity, model complexity ⚠️ | Issuer risk, regulatory |

| Ideal For | DeFi users seeking yield 💰 | Stable storage & payments |

| Automatic Yield Distribution | ✅ Yes (built-in) 🔄 | ❌ No (requires external protocols) |

Stablecoins have always promised safety from volatility, but yield-bearing stablecoins like yoUSD take it further by unlocking new income streams. The secret sauce? Yield is sourced from diversified DeFi strategies – lending, staking, and even real-world asset exposure. The result: a single token that does it all, letting you tap into automated stablecoin yield without micromanaging your portfolio.

How Do Yield-Bearing Stablecoins Like yoUSD Work?

The magic behind yoUSD and its peers is all about smart contract automation. Here’s a quick breakdown of how these digital dollars generate returns:

- DeFi Lending Protocols: Your stablecoins are pooled and lent to borrowers on platforms like Aave or Compound. Interest paid by borrowers flows back to you.

- Staking and Savings Contracts: Some tokens convert your deposit (like DAI to sDAI) and auto-stake it in yield contracts. Your balance grows as interest accrues – no manual claiming needed.

- Real-World Asset Backing: Certain stablecoins invest in U. S. Treasuries or high-grade bonds. The yield from these assets is distributed proportionally to token holders.

This convergence of TradFi and DeFi means that simply holding a stablecoin can now outperform many traditional savings accounts. In fact, with U. S. banks averaging 0.5% APY and some DeFi yields soaring above 10%, the opportunity gap is immense.

Why Yield-Bearing Stablecoins Are Exploding in 2025

The numbers don’t lie: Yield-bearing stablecoins are up nearly 96% in 2025 alone (market insights). What’s fueling this meteoric rise?

- Automated Income: No need to actively manage positions or chase yields across platforms.

- Transparency: On-chain smart contracts provide real-time proof of reserves and yield distribution.

- Composability: These tokens plug into dozens of DeFi apps for lending, borrowing, or swapping – all while earning passive income.

- Risk Mitigation: Diversified strategies reduce single-point-of-failure risk compared to single-protocol farming.

With innovations like yoUSD, sDAI, USDe, and USDY blazing the trail, DeFi passive income is no longer reserved for technical power-users. It’s as simple as buying a token and watching your balance grow.

YOUSD (Yield Optimizer USD) Price & APY Prediction: 2026-2031

Forecasting the value and yield potential of YOUSD as yield-bearing stablecoins reshape DeFi passive income strategies

| Year | Minimum Price | Average Price | Maximum Price | Estimated APY Range | Key Market Scenario |

|---|---|---|---|---|---|

| 2026 | $1.00 | $1.04 | $1.08 | 4% – 9% | Regulatory clarity improves; DeFi TVL grows moderately |

| 2027 | $0.99 | $1.05 | $1.10 | 3.5% – 8.5% | Stablecoin adoption rises; mild competition pressures yields |

| 2028 | $0.98 | $1.05 | $1.12 | 3% – 8% | New entrants increase competition; yield mechanisms diversify |

| 2029 | $0.97 | $1.04 | $1.15 | 2.5% – 7.5% | Macro tightening; DeFi protocols focus on security |

| 2030 | $0.97 | $1.03 | $1.18 | 2% – 7% | Yield innovation stabilizes; regulatory frameworks mature |

| 2031 | $0.95 | $1.02 | $1.20 | 1.5% – 6.5% | YOUSD maintains peg; some market volatility during stress |

Price Prediction Summary

YOUSD is expected to maintain a tight price range close to its $1.00 peg, reflecting its stablecoin nature, with slight premium potential due to rising demand for yield. The average price is forecasted to hover above $1.00, with higher yields in early years tapering as DeFi matures and competition increases. APY is projected to gradually decline as the yield-bearing stablecoin sector becomes more efficient and regulatory oversight grows. Overall, YOUSD offers a stable passive income option, but price and yield premiums may compress over time as the market matures and risks are better managed.

Key Factors Affecting yoUSD Price

- DeFi adoption and total value locked (TVL) growth

- Regulatory clarity and global stablecoin policy

- Technological advancements in yield-generation protocols

- Increasing competition from new yield-bearing stablecoins

- Macro interest rate environment and on-chain/off-chain yield differentials

- Security improvements and risk management in DeFi

- Liquidity and on/off-ramp efficiency for stablecoins

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Risks and What to Watch For

Of course, no opportunity comes without risks. Even with robust smart contracts and diversified yield models, investors must stay vigilant:

- Smart Contract Bugs: Vulnerabilities can be exploited if not audited thoroughly.

- Liquidity Crunches: Stress events can make large redemptions challenging.

- Regulatory Uncertainty: Laws are evolving rapidly; what’s compliant today may not be tomorrow.

- Opaque Strategies: Some tokens use complex yield models that aren’t always easy to understand.

For a deeper dive into the top performing yield-bearing stables this year (including sDAI, USDe, and USDY), check out our full comparison guide at Stable Coin Alerts.

So, what does this mean for the average DeFi investor? In 2025, it’s about working smarter, not harder. With yoUSD stablecoin holding steady at $1.04, you’re not just preserving capital – you’re letting it compound in real time. The psychological shift is profound: passive income is no longer a side quest, it’s the main event. And with automated stablecoin yield strategies, even the most risk-averse can participate in DeFi’s upside without sleepless nights.

Building a Yield-Bearing Stablecoin Portfolio

Ready to ride the wave? Here’s how to position yourself for stablecoin yield growth in 2024 and beyond:

Steps to Build a Diversified Yield-Bearing Stablecoin Portfolio

-

1. Research Leading Yield-Bearing StablecoinsStart by identifying reputable yield-bearing stablecoins such as yoUSD (currently priced at $1.04), sDAI (Staked DAI), USDe (Ethena Labs), and USDY (Ondo Finance). Focus on established projects with transparent mechanisms and strong track records.

-

2. Understand Yield Generation MechanismsExamine how each stablecoin generates yield—whether through DeFi lending protocols (like Aave or Compound), staking contracts (such as MakerDAO’s DSR for sDAI), or real-world asset exposure (e.g., USDY’s U.S. Treasury bill backing). This helps you assess risk and potential returns.

-

3. Diversify Across Multiple Stablecoins and ProtocolsAllocate your funds across different yield-bearing stablecoins and platforms to reduce risk. For example, combine exposure to yoUSD, sDAI, and USDY, each leveraging distinct yield strategies and underlying assets.

-

4. Evaluate Platform Security and Smart Contract RisksPrioritize platforms with robust security audits and transparent governance. Review documentation and third-party audit reports for protocols like MakerDAO, Ondo Finance, and Ethena Labs to minimize smart contract vulnerabilities.

-

5. Monitor Regulatory and Liquidity FactorsStay updated on the evolving regulatory landscape and assess the liquidity of your chosen stablecoins. Ensure that you can efficiently convert your holdings back to fiat or other assets, especially during market volatility.

-

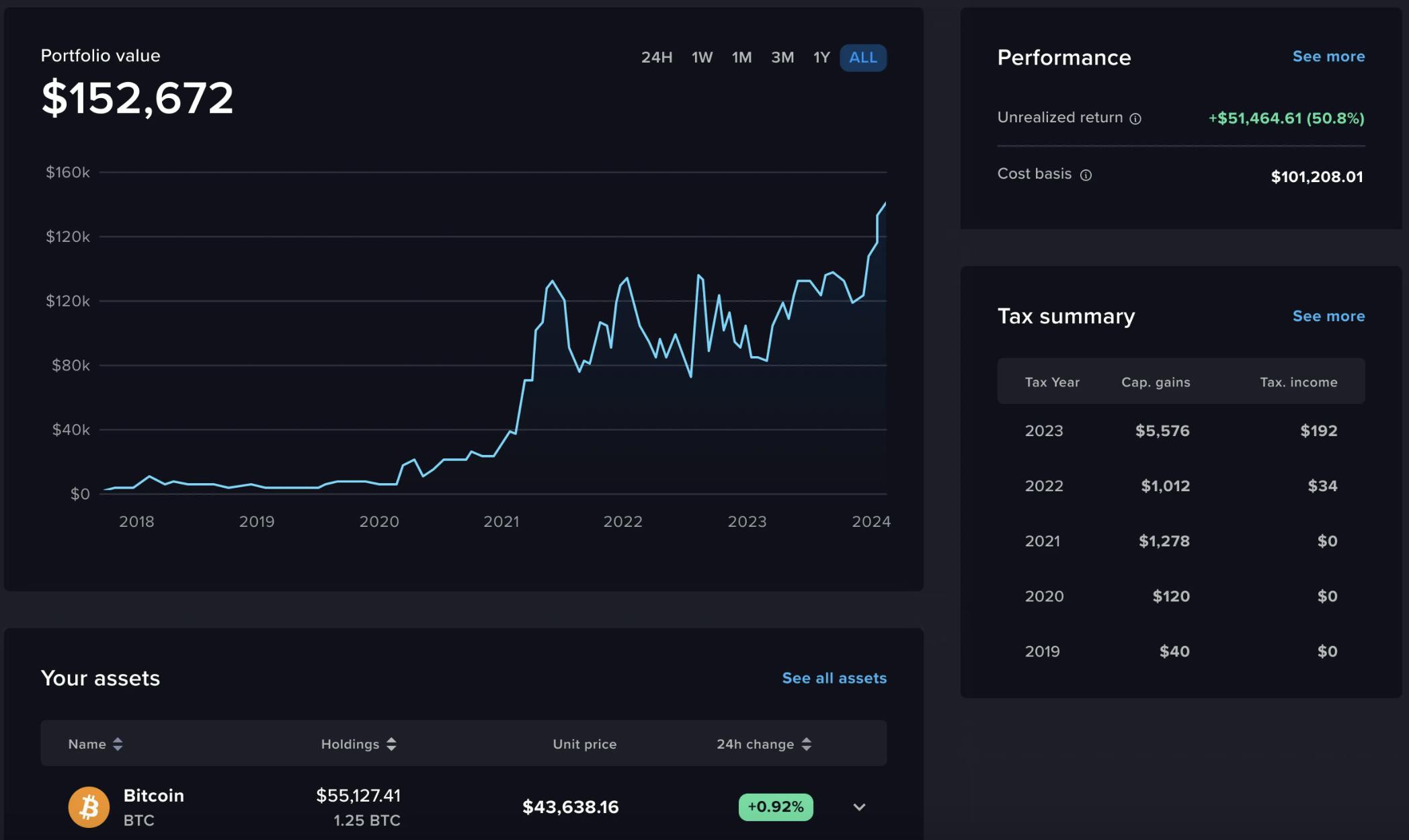

6. Regularly Rebalance and Track Portfolio PerformanceUse portfolio tracking tools to monitor yields, price stability, and risk exposure. Rebalance periodically based on market conditions, yield rates, and any changes in protocol fundamentals.

First, diversify across protocols and assets – don’t put all your eggs in one basket. Consider a mix of sDAI, USDe, USDY, and yoUSD to spread risk while maximizing returns. Next, monitor APYs and platform health regularly. Automated doesn’t mean set-and-forget forever – stay informed about protocol updates and market shifts. Finally, use on-chain dashboards to track your yield accruals and spot red flags early.

Momentum is opportunity: The sooner you position yourself in yield-bearing stables, the more compounding power you unleash. Don’t wait for the next bull run to start earning.

What’s Next for DeFi Passive Income?

The future of stablecoin yield strategies is bright – and rapidly evolving. We’re already seeing experiments with multi-layered yield streams, real-world asset integrations, and even insurance-backed stables. Expect more protocols to offer transparent on-chain reporting, easier fiat onramps, and seamless integrations with wallets and exchanges.

As DeFi matures, regulators will inevitably step in – but the genie is out of the bottle. The appetite for high-yield, low-volatility assets is global and growing. For those who move early and stay educated, the rewards could be game-changing.

Final Checklist: Is Yield-Bearing Right For You?

If you’re ready to explore more, don’t miss our deep-dive on how YUSD and vyUSD are redefining stablecoin yield strategies in 2025. The passive income revolution is here – and it’s pegged, automated, and ready to work for you.