sUSDS vs sUSDe Yields 2025: Sky vs Ethena Stablecoin Comparison for DeFi Passive Income

In the bustling arena of DeFi passive income, two yield-bearing stablecoins stand out for 2025: sUSDS from the Sky ecosystem and sUSDe from Ethena Labs. As of December 5,2025, sUSDS trades at $1.08, reflecting a modest 24-hour gain of and $0.001000 ( and 0.000930%), with a high of $1.09 and low of $1.07. These rebasing stables offer investors a way to earn while holding dollar-pegged assets, but their paths to yield diverge sharply. sUSDS leans on tokenized Treasuries and lending for reliable returns around 4.5%, while sUSDe’s delta-neutral strategy chases 8% to 15% APYs, sometimes spiking to 29% in bull runs. Which one fits your risk tolerance for sUSDS vs sUSDe yields 2025?

sUSDS vs sUSDe Price Comparison: Yield-Bearing Stablecoins and Major Cryptos (6 Months)

Real-time price performance comparison for DeFi passive income assets, including Sky Ecosystem’s sUSDS and Ethena’s sUSDe alongside related stablecoins and benchmarks like BTC and ETH

| Asset | Current Price | 6 Months Ago | Price Change |

|---|---|---|---|

| sUSDS | $1.08 | $1.08 | -0.1% |

| sUSDe | $1.21 | $1.21 | +0.0% |

| USDe | $1.00 | $1.00 | +0.0% |

| USDS | $0.9994 | $0.9994 | +0.0% |

| DAI | $1.00 | $1.00 | +0.0% |

| USDC | $0.0224 | $0.0224 | +0.0% |

| USDT | $1.00 | $1.00 | +0.0% |

| Bitcoin | $88,976.00 | $60,000.00 | +48.3% |

| Ethereum | $3,008.09 | $2,500.00 | +20.3% |

Analysis Summary

Yield-bearing stablecoins sUSDS and sUSDe show remarkable price stability over the past 6 months, with sUSDS at a slight -0.1% change and sUSDe unchanged at +0.0%, maintaining premiums above $1. Traditional stablecoins like USDe, USDS, DAI, and USDT also exhibit zero change, while Bitcoin and Ethereum deliver strong gains of +48.3% and +20.3%, respectively, highlighting the stability of DeFi yield assets amid broader market growth.

Key Insights

- sUSDS holds steady at $1.08 with minimal -0.1% change, reflecting its conservative yield mechanism tied to Treasuries and lending.

- sUSDe remains pegged at $1.21 with +0.0% change, benefiting from Ethena’s delta-neutral strategy for higher potential yields.

- Major stablecoins (USDe, USDS, DAI, USDT) show perfect +0.0% stability, ideal for low-risk DeFi passive income.

- Bitcoin surges +48.3% from $60,000 to $88,976, underscoring crypto market momentum.

- Ethereum gains +20.3% to $3,008.09, providing context for yield-bearing stablecoin performance in a bullish environment.

Prices and 6-month changes sourced exclusively from provided real-time CoinGecko data as of 2025-12-05. 6 Months Ago prices reference approximately 2025-06-08 values; changes formatted exactly as given without estimation or alteration.

Data Sources:

- Main Asset: https://www.coingecko.com/en/coins/susds

- sUSDe (Ethena Labs): https://www.coingecko.com/en/coins/susde

- USDe (Ethena Labs): https://www.coingecko.com/en/coins/usde

- USDS (Sky Ecosystem): https://www.coingecko.com/en/coins/usds

- DAI (MakerDAO): https://www.coingecko.com/en/coins/dai

- USD Coin (USDC): https://www.coingecko.com/en/coins/usdc

- Tether (USDT): https://www.coingecko.com/en/coins/tether

- Bitcoin (BTC): https://www.coingecko.com/en/coins/bitcoin

- Ethereum (ETH): https://www.coingecko.com/en/coins/ethereum

Disclaimer: Cryptocurrency prices are highly volatile and subject to market fluctuations. The data presented is for informational purposes only and should not be considered as investment advice. Always do your own research before making investment decisions.

Sky’s sUSDS has quietly climbed the ranks, surpassing Ethena’s USDe in supply on chains like Base and Solana. This growth signals strong demand for yield-bearing stablecoins 2025 that prioritize stability over speculation. Unlike pure crypto plays, sUSDS blends real-world assets (RWAs) like U. S. Treasury bonds with DeFi lending protocols. This hybrid setup delivers consistent payouts, insulated somewhat from crypto volatility. Investors chasing sUSDS yield 2025 appreciate its conservative edge, especially as broader markets fluctuate.

Sky Ecosystem’s sUSDS: Built for Resilience

Evolving from MakerDAO’s legacy, Sky’s sUSDS generates yield through a mix of tokenized Treasuries and optimized lending. Picture this: your capital earns from safe-haven bonds while dipping into DeFi pools for extra juice. Current annual yield hovers at approximately 4.5%, adjustable with market shifts. It’s not flashy, but in a year where yield compression hit flashier rivals, sUSDS offers ballast. Reports highlight its supply surge, flipping Ethena’s USDe in key metrics, underscoring a shift toward RWA-backed options in the Sky Ecosystem sUSDS narrative.

What sets sUSDS apart is its low-drama profile. No exotic derivatives here, just proven assets meeting DeFi efficiency. For portfolio builders, it’s the anchor in a diversified setup, pairing well with higher-volatility plays. Yet, don’t sleep on its growth: together with sUSDe, these two command ~77% of yield-bearing stablecoin liquidity, with lifetime yields topping $603 million.

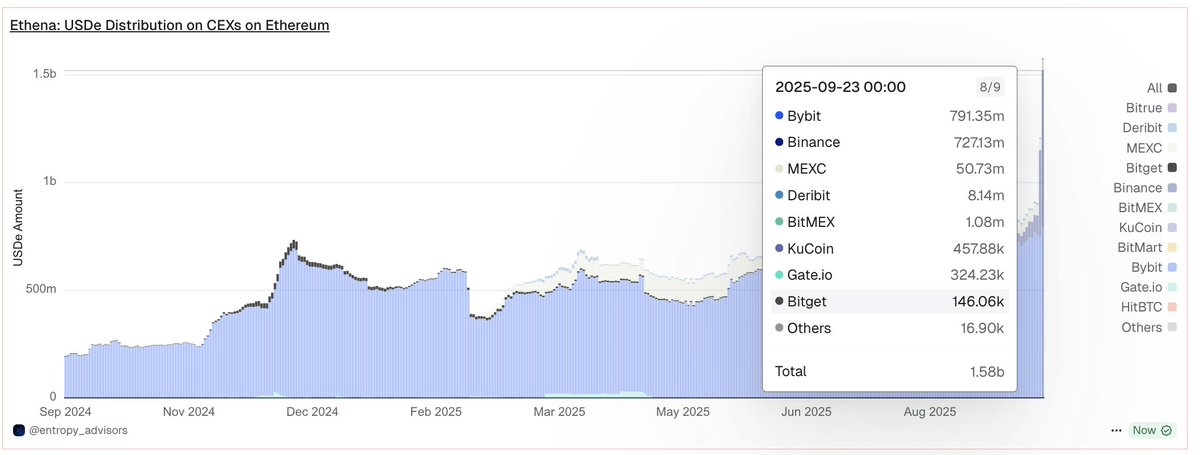

Ethena’s sUSDe: High-Octane Delta-Neutral Yields

Contrast that with sUSDe, Ethena’s poster child for aggressive passive income. This stablecoin stakes Ethereum while shorting ETH futures, pocketing staking rewards and perpetual funding rates. The result? A composite yield uncorrelated to traditional rates, averaging 18% APY in 2024 and ranging 8-15% now, with peaks at 29%. But here’s the rub: recent funding rate squeezes dropped TVL by 50%, from $14.8 billion to $10.1 billion. Still, for sUSDe APY comparison, it remains the benchmark, fueling protocols like Pendle and Aave.

Ethena’s dominance isn’t accidental. Galaxy Research crowns sUSDe the TVL and yield heavyweight, while Binance notes explosive demand for profit-yielding stables. In rebasing stables passive income strategies, sUSDe shines for those betting on sustained crypto momentum. Risks? Higher, tied to basis trades and market regimes. When perps flip negative, yields compress, as seen this year at lows of 5.1%.

Yield Mechanisms Head-to-Head: Risk vs Reward in 2025

Drilling into sUSDS vs sUSDe, yields tell divergent stories. sUSDS’s 4.5% stems from Treasuries (tracking T-bill rates) plus lending spreads, offering predictability. sUSDe’s 8-15% blends ETH staking (3-5%) with funding rates, which can soar or sour. Stablewatch emphasizes sUSDe’s uniqueness: uncorrelated to RWAs, thriving in volatile perp markets. Dune Analytics dashboards reveal sUSDe’s edge in peak conditions, but sUSDS pulls ahead in downturns.

For DeFi passive income, consider your horizon. Conservative stacks favor sUSDS for steady compounding; yield chasers eye sUSDe’s upside. Both face regulatory headwinds and rate shifts, but their duopoly suggests staying power. Artemis data projects onchain yields evolving, with sUSDe setting bars despite TVL dips.

sUSDS Price Prediction 2026-2031

Conservative projections for Sky Ecosystem’s yield-bearing stablecoin, factoring in steady 4.5% yields, DeFi adoption, and market cycles vs. higher-risk competitors like sUSDe

| Year | Minimum Price | Average Price | Maximum Price | YoY % Change (Avg) |

|---|---|---|---|---|

| 2026 | $1.05 | $1.15 | +6.5% | |

| 2027 | $1.10 | $1.25 | +8.7% | |

| 2028 | $1.15 | $1.35 | +8.0% | |

| 2029 | $1.20 | $1.48 | +9.6% | |

| 2030 | $1.25 | $1.60 | +8.1% | |

| 2031 | $1.30 | $1.72 | +7.5% |

Price Prediction Summary

sUSDS is poised for modest, steady price appreciation from its current $1.08 level, driven by reliable 4.5% yields and growing DeFi passive income demand. Average prices are projected to reach $1.72 by 2031, with min/max ranges reflecting bearish corrections and bullish adoption surges, maintaining premiums over $1 amid competition from variable-yield assets like sUSDe.

Key Factors Affecting sUSDS from Sky Ecosystem Price

- DeFi adoption and TVL growth in yield-bearing stablecoins (sUSDS/sUSDe control ~77% market share)

- Regulatory clarity for stablecoins boosting conservative options like sUSDS

- Interest rate trends impacting treasury-backed yields (steady 4.5% vs. sUSDe’s 8-15% volatility)

- Crypto market cycles: bull runs expanding premiums, bears compressing to $1.05+ floors

- Sky Ecosystem expansions on Base/Solana driving supply/demand dynamics

- Competition and risk appetite shifting between steady sUSDS and high-yield sUSDe

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Market performance adds nuance. sUSDS at $1.08 embodies premium pricing from rebase mechanics and demand. sUSDe, post-retraction, holds firm as leader per MEXC and Netcoins. As DeFi stable yields mature, blending both could optimize returns.

Blending sUSDS and sUSDe isn’t just theory; it’s a practical hedge in volatile times. Allocate 60% to sUSDS at its steady $1.08 for ballast, 40% to sUSDe for growth potential. This mix smooths out yield swings, capturing sUSDS’s reliability while tapping sUSDe’s upside in bull phases. Sky’s expansion on Base and Solana bolsters liquidity, making swaps seamless across ecosystems.

Risks Unpacked: What Could Derail Your Yields?

Every yield comes with strings. sUSDS faces interest rate risks if T-bills dip, though its DeFi lending layer adds buffer. Regulatory scrutiny on RWAs looms, but Sky’s MakerDAO roots provide battle-tested governance. sUSDe? Basis risk is the beast: negative funding rates crushed yields to 5.1% earlier, triggering that 50% TVL plunge. Counterparty exposure in perps and staked ETH adds layers, uncorrelated yet crypto-tied. I favor sUSDS for core holdings, viewing sUSDe as a tactical overweight during perp-friendly markets.

sUSDS vs sUSDe: 2025 Yields Comparison for DeFi Passive Income

| Category | sUSDS (Sky Ecosystem) | sUSDe (Ethena Labs) |

|---|---|---|

| Yield (APY) | ≈4.5% | 8-15% (peaks up to 29%) |

| Mechanism | RWA-backed: Tokenized U.S. Treasury bonds + DeFi lending | Delta-neutral: staked ETH + short ETH futures (staking rewards + funding rates) |

| Risk Profile | Low risk 🛡️ | Higher volatility ⚠️ |

| Current Price (2025-12-05) | $1.08 | N/A |

| 24h Change (2025-12-05) | +$0.001000 (+0.000930%) | N/A |

| 24h Range (2025-12-05) | $1.07 – $1.09 | N/A |

| TVL / Supply | Rapid growth; flipped USDe supply | ~$10.1B (down from $14.8B peak) |

| 2025 Outlook | Stable, conservative returns for low-risk income | High potential yields, but funding compression risks |

DeFiLlama and Dune metrics underscore this: sUSDS thrives in compression, sUSDe dominates expansions. Lifetime payouts over $603 million affirm their scale, but watch protocol incentives. Ethena’s ENA token and Sky’s governance votes influence sustainability, rewarding engaged holders.

Strategies for Max Passive Income in 2025

Optimize with Pendle for fixed yields on sUSDe PTs, locking 15% and floors. Pair sUSDS in Aave for boosted lending APYs without selling. Loop strategies? Deposit sUSDS into Sky vaults, earn rebases, then collateralize for leverage. For sUSDe, Ethena’s insurance fund mitigates black swans, but cap exposure at 20% of portfolio. Track via DefiRate for live benchmarks; as Galaxy notes, onchain yield evolution favors diversified stables. My take: start small, monitor funding rates weekly, rebalance quarterly.

Tax efficiency matters too. Rebasing mechanics mean accruals over distributions, potentially deferring events. Consult pros, but these stables shine for long-term HODLers eyeing yield bearing stablecoins 2025.

Looking ahead, expect sUSDS to hold 4.5% amid rate cuts, sUSDe to rebound if ETH perps heat up. Their 77% liquidity grip positions them as DeFi bedrock. Whether you’re building wealth steadily or chasing alpha, these offer paths tailored to your edge. Dive in with eyes open, stack yields smartly, and let compounding do the heavy lifting.