How RWA-Backed Stablecoins Like STBL and USST Are Redefining Yield for DeFi Investors

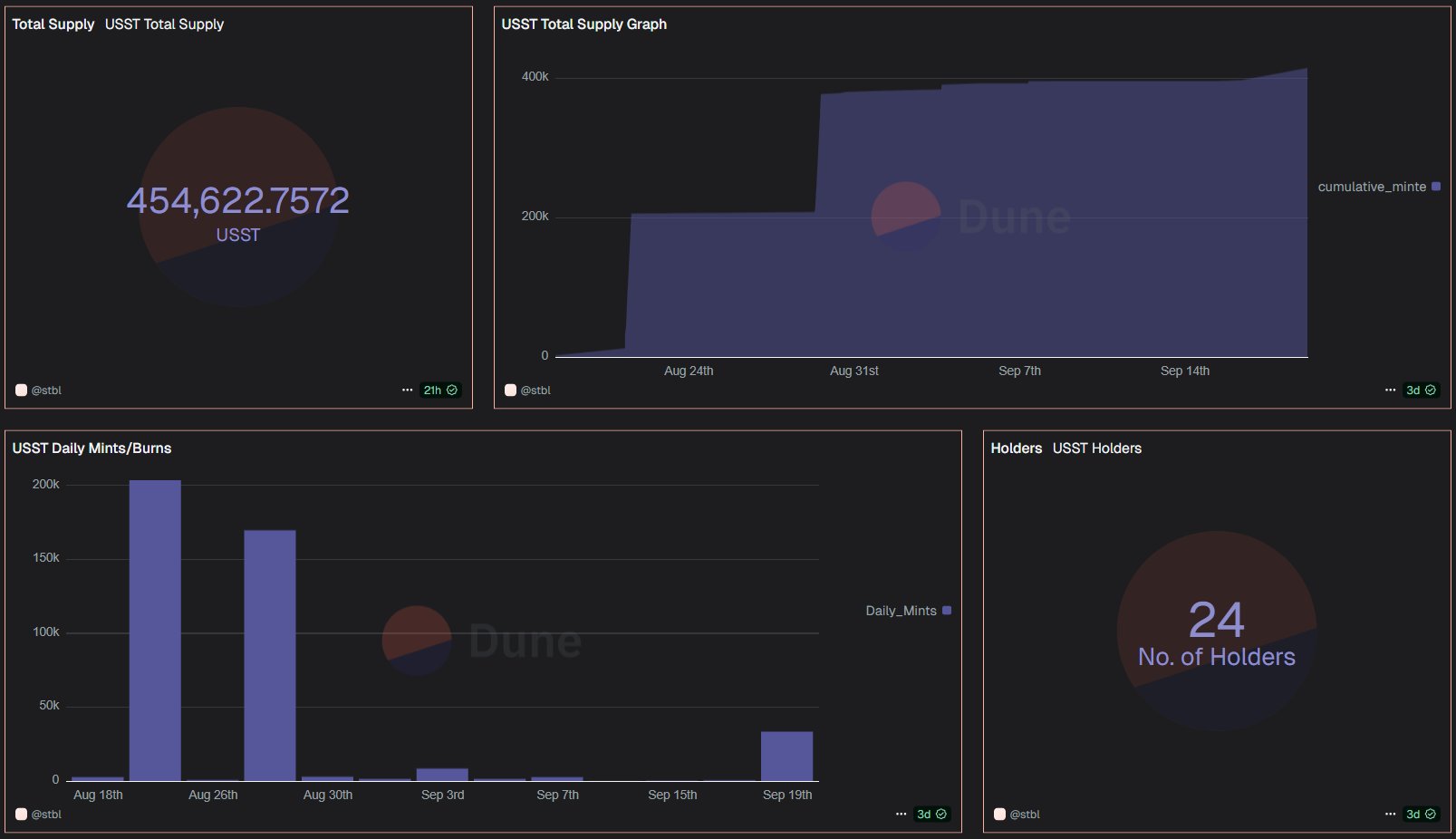

Yield-bearing stablecoins are entering a new phase, and the catalyst is real-world asset (RWA) collateralization. As DeFi investors chase both safety and sustainable returns, protocols like STBL are rewriting the stablecoin playbook. With STBL trading at $0.4005 (24h change: -0.1076%), the market is watching closely as this next-gen protocol fuses on-chain transparency with off-chain yield generation.

Why RWA-Backed Stablecoins Are Gaining Traction in 2025

Traditional stablecoins like USDT and USDC have long dominated DeFi liquidity but offer little to no native yield. Enter RWA-backed stablecoins such as USST, minted through protocols like STBL by depositing tokenized U. S. Treasuries and other real-world assets. This model provides two key advantages:

- True Transparency: Collateral is fully visible on-chain, with RWAs like Treasury Bills providing tangible backing.

- Sustainable Yield: Instead of relying on unsustainable incentives, yield comes directly from the underlying assets’ interest payments.

This paradigm shift means users can finally access genuine returns while holding a dollar-pegged asset, a feat that was elusive in earlier DeFi cycles.

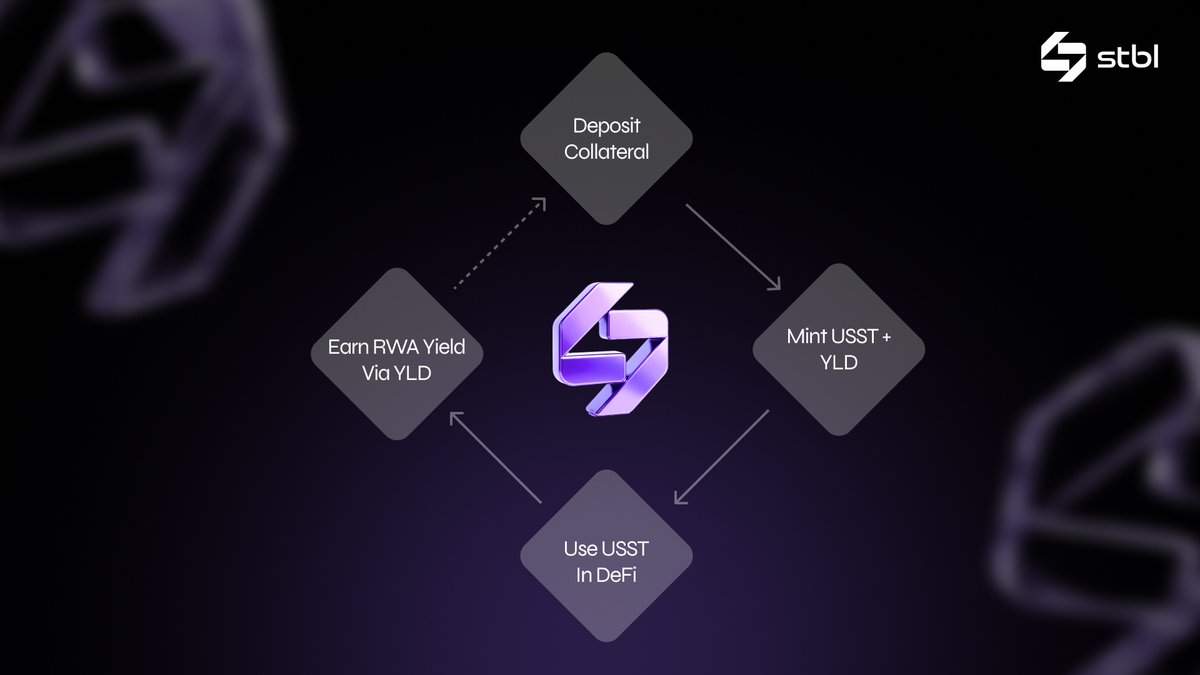

The Dual-Token Model: Decoupling Liquidity from Yield

The STBL ecosystem introduces a dual-token architecture that separates stablecoin liquidity from yield accrual, a concept now gaining traction across DeFi RWA stablecoins. Here’s how it works:

- USST Stablecoin: Minted by depositing RWAs, USST maintains its $1 peg and can be freely used across DeFi for payments, lending, or liquidity provision.

- YLD NFT: When you mint USST, you also receive a non-transferable YLD NFT representing your share of yield generated by the underlying RWAs. No staking or lockups required, just hold YLD to accrue passive income.

This separation unlocks new strategies: users can deploy USST in high-liquidity pools while keeping their yield rights intact via YLD NFTs. It’s a step beyond traditional rebasing models and solves key issues around composability and capital efficiency.

The Role of Governance: Power to the Community

The third pillar of the STBL protocol is its governance layer. The STBL token, currently priced at $0.4005, empowers holders to vote on everything from collateral types to protocol upgrades and fee structures. This decentralized approach ensures that both risk management and innovation remain aligned with community interests, a crucial factor as protocols compete to attract institutional-grade capital into DeFi RWA stablecoins.

Comparing STBL, USST, and Legacy Stablecoins: Key Features (2025)

| Feature | STBL | USST | Legacy Stablecoins (e.g., USDT, USDC) |

|---|---|---|---|

| Type | Governance & Utility Token | Stablecoin (USD-pegged) | Stablecoin (USD-pegged) |

| Backing | Protocol governance, collateral management | Tokenized RWAs (e.g., U.S. Treasuries) | Cash, cash equivalents, sometimes commercial paper |

| Yield Mechanism | Governs yield distribution via YLD NFTs | No direct yield, but liquidity separated from yield rights | No yield for holders |

| Yield Access | Via YLD NFTs (separate from liquidity) | Not applicable (liquidity only) | Not available |

| Transparency | On-chain governance, RWA-backed, transparent reserves | Full on-chain transparency of RWA collateral | Varies; some publish attestations, others less transparent |

| DeFi Integration | Governs protocol upgrades and integrations | Freely usable in DeFi, composable | Widely accepted in DeFi |

| Governance | STBL holders vote on protocol changes | No governance rights | No governance for holders |

| Price (2025-09-27) | $0.4005 | $1.00 (pegged) | $1.00 (pegged) |

| Issuer | STBL Protocol (Reeve Collins, Tether co-founder) | STBL Protocol | Tether, Circle, etc. |

| Unique Features | Dual-token model, yield-splitting, on-chain governance | Separation of liquidity and yield, RWA-backed | Simple design, high liquidity, no yield |

Latest Market Movements and Yield Outlook

The current price action reflects growing interest but also volatility as the ecosystem matures. With STBL at $0.4005, investors are watching closely for signs of TVL growth driven by increased RWA onboarding and more robust yield flows through YLD NFTs.

STBL (STBL) Price Prediction 2026-2031

Analyst Outlook Based on RWA Adoption, DeFi Trends, and Yield Innovation

| Year | Minimum Price | Average Price | Maximum Price | Yearly Change (%) | Key Market Scenario |

|---|---|---|---|---|---|

| 2026 | $0.38 | $0.55 | $0.80 | +37% | RWA-backed stablecoins see increased DeFi adoption; STBL ecosystem matures |

| 2027 | $0.50 | $0.72 | $1.10 | +31% | Yield-bearing models go mainstream; regulatory clarity boosts institutional inflows |

| 2028 | $0.65 | $1.00 | $1.60 | +39% | STBL integrates with major DeFi protocols; global RWA tokenization trend accelerates |

| 2029 | $0.85 | $1.32 | $2.10 | +32% | Expansion into new asset classes (e.g., real estate); competition rises |

| 2030 | $1.05 | $1.68 | $2.80 | +27% | Broad adoption in payments and DeFi; stablecoin 2.0 narrative dominates |

| 2031 | $1.25 | $2.10 | $3.60 | +25% | STBL among leading RWA-backed protocols; regulatory frameworks mature |

Price Prediction Summary

STBL is positioned to benefit from the rapid adoption of RWA-backed stablecoins and the growing demand for yield in DeFi. While price volatility remains due to competition and evolving regulations, the protocol’s innovative dual-token model and governance features could drive sustained growth. Progressive integration with DeFi and broader financial markets may push STBL to new highs by 2031, with significant upside in bullish scenarios.

Key Factors Affecting STBL Price

- Adoption rate of RWA-backed stablecoins in DeFi and traditional finance

- Expansion of tokenized asset types (e.g., beyond U.S. Treasuries)

- Regulatory clarity and global policy harmonization for stablecoins

- Integration with major DeFi protocols and cross-chain ecosystems

- Yield competitiveness compared to other stablecoins and DeFi protocols

- Market competition from other RWA-backed and algorithmic stablecoins

- Macro-economic trends affecting yields on underlying real-world assets

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

If you’re looking to dive deeper into how these mechanisms work in practice, and how they stack up against legacy models, check out our in-depth guide on how STBL and USST are revolutionizing yield-bearing stablecoins with RWA collateral.

One of the most compelling aspects of this new wave is the flexibility it offers DeFi-native users. By decoupling yield from liquidity, protocols like STBL empower users to optimize their stablecoin strategies without sacrificing either composability or passive income. For example, you can deploy USST across lending protocols and DEXs, maximizing your capital efficiency, while your YLD NFT quietly accumulates yield in the background.

This isn’t just a theoretical upgrade, it’s a practical leap for stablecoin investors who’ve been stuck choosing between yield and utility. The model also unlocks new risk management levers: because governance is on-chain and community-driven through the STBL token (still holding at $0.4005), protocol parameters can adapt dynamically as market conditions evolve.

Stablecoin Yield Strategies: What’s Working Now?

So how are DeFi investors actually deploying these tools? Here are three proven strategies emerging in 2025:

Top 3 Yield Strategies with STBL, USST, and YLD NFTs

-

Mint USST by Depositing Tokenized U.S. Treasuries: Use the STBL protocol to deposit real-world assets (such as tokenized U.S. Treasury Bills) and mint USST, a stablecoin pegged to the U.S. dollar. This strategy provides exposure to RWA-backed stability and enables further DeFi participation, while the current STBL price stands at $0.4005 (source).

-

Earn Passive Yield with YLD NFTs: When minting USST, users simultaneously receive YLD NFTs, which represent the yield generated from the underlying RWA collateral. These NFTs accrue interest automatically, allowing holders to earn passive income without staking or lockups. This yield is separated from the liquidity of USST, maximizing flexibility.

-

Deploy USST in DeFi Protocols for Additional Rewards: Utilize USST across major DeFi platforms (such as lending pools or liquidity farms) to earn extra rewards or incentives. Since USST’s liquidity is separated from yield (held via YLD NFTs), users can maximize capital efficiency by using USST in DeFi while still collecting RWA yield through their NFTs.

1. Passive Income Rotation: Mint USST with tokenized T-Bills, hold YLD NFT for steady yield, and rotate USST between lending platforms for bonus incentives.

2. Liquidity Mining Plus: Provide USST liquidity on major DEXs, capture trading fees while still earning RWA yield via your YLD NFT.

3. Governance Participation: Stake STBL tokens to participate in protocol votes, help shape future collateral mixes and fee structures while potentially earning extra rewards.

The bottom line? RWA-backed stablecoins like USST are unlocking a toolkit that simply didn’t exist with legacy stables. Yield separation means you don’t have to compromise on capital deployment or passive returns, finally delivering on the promise of programmable money.

What’s Next for Real World Asset Stablecoins?

The innovation cycle is just getting started. Expect to see more asset classes tokenized as collateral, from corporate bonds to real estate, broadening both the stability and the yield curve available to DeFi users. As protocols compete for TVL, governance will play an even bigger role in setting standards around transparency, risk management, and sustainable returns.

“Innovation rewards the prepared, ” says Reeve Collins, highlighting why early adopters of these models are already seeing outsized gains compared to traditional stablecoin holders.

If you want to learn more about maximizing your returns with these emerging protocols (and see how they compare side-by-side), check out our comprehensive analysis on how STBL’s dual-token model is changing yield-bearing stablecoins.