USDS vs sUSDe: Comparing Top Yield-Bearing Stablecoins for Solana Passive Income 2026

In the high-stakes world of Solana DeFi, USDS yield Solana and sUSDe passive income strategies dominate 2026 passive income plays. With USDS holding steady at $1.0000 (24h change and $0.000010), investors are piling into yield-bearing stablecoins that deliver real returns without the volatility headache. USDS from Sky and Ethena’s sUSDe lead the pack, boasting billions in TVL and APYs that crush traditional stables like USDC. This comparison cuts through the noise to spotlight why these two are your best bets for yield-bearing stablecoins 2026.

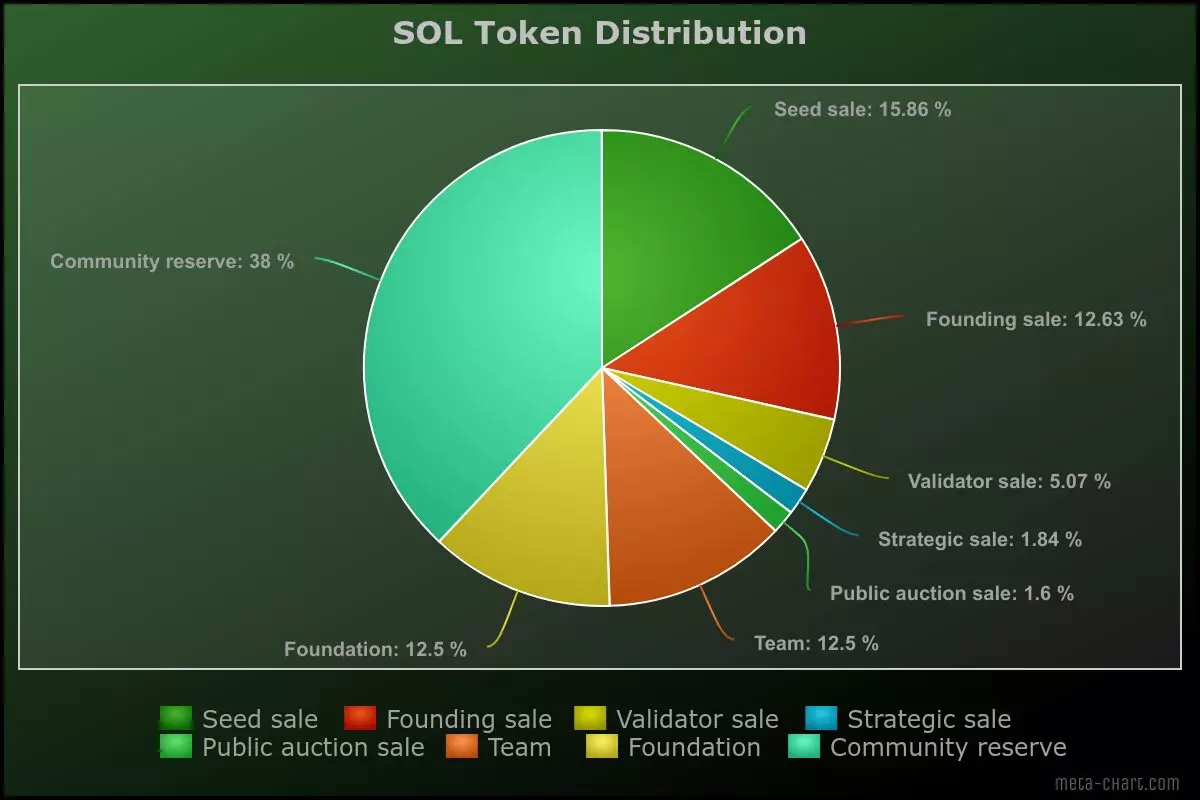

Solana’s speed and low fees supercharge these assets, turning simple deposits into compounding machines. Sky’s USDS, rebranded from DAI, sits at $4.90 billion supply as sUSDS, the largest decentralized yield-bearer. Ethena’s sUSDe hit $3.2 billion market cap by mid-2025, fueled by delta-neutral magic. Both integrate seamlessly into Solana protocols, but which edges out for best stablecoin yields Solana?

USDS Mechanics: Collateralized Stability Meets Sky Savings Rate

USDS thrives on over-collateralization, backed by ETH, U. S. Treasuries, and crypto collateral for that rock-solid $1.0000 peg. Deposit into Sky’s Savings Rate module, and it morphs into sUSDS, accruing yield natively. No extra steps, just pure passive income. Data from DeFi Rate shows Sky protocols offering steady returns, often 4-8% APY base, boosted on Solana via lending pools.

The edge? Simplicity. As 4IRE notes, USDS is the “intuitive native savings rate” base layer. With $4.90 billion in sUSDS, it dwarfs competitors in decentralized TVL. Solana users leverage it in high-efficiency DEXs and vaults, where yields spike to 10% and during demand surges. Risks are minimal: over-collateralization weathers black swans better than synthetics.

Sky’s USDS delivers steady, collateral-backed yields, perfect for conservative Solana stackers chasing reliable USDS vs sUSDe comparison wins.

sUSDe’s Delta-Hedged Rocket Fuel for Aggressive Yields

Ethena flips the script with sUSDe, a synthetic dollar powered by perpetual futures hedging and staking. This delta-neutral strategy nets 8-11% APY, per stablecoininsider. org, outpacing USDS in bull runs. BlockEden. xyz calls it a “sophisticated derivatives trading” beast under a simple hood. Galaxy Research crowns sUSDe the TVL and yield heavyweight, dominating onchain metrics.

On Solana, sUSDe shines in composability. Base APY hovers at 5.5% (MEXC data), but layer it into protocols for 14% and boosts via RebelFi strategies. Market cap at $3.2 billion reflects explosive growth, though funding rate volatility adds spice. Peg holds 1: 1 to USD, mirroring USDS at $1.0000 stability.

Yield chasers love sUSDe’s upside: 9-11% from hedging crushes Sky’s baseline. But watch those perp markets; negative funding can trim gains.

Current Metrics Showdown: TVL, APY, and Solana Flows

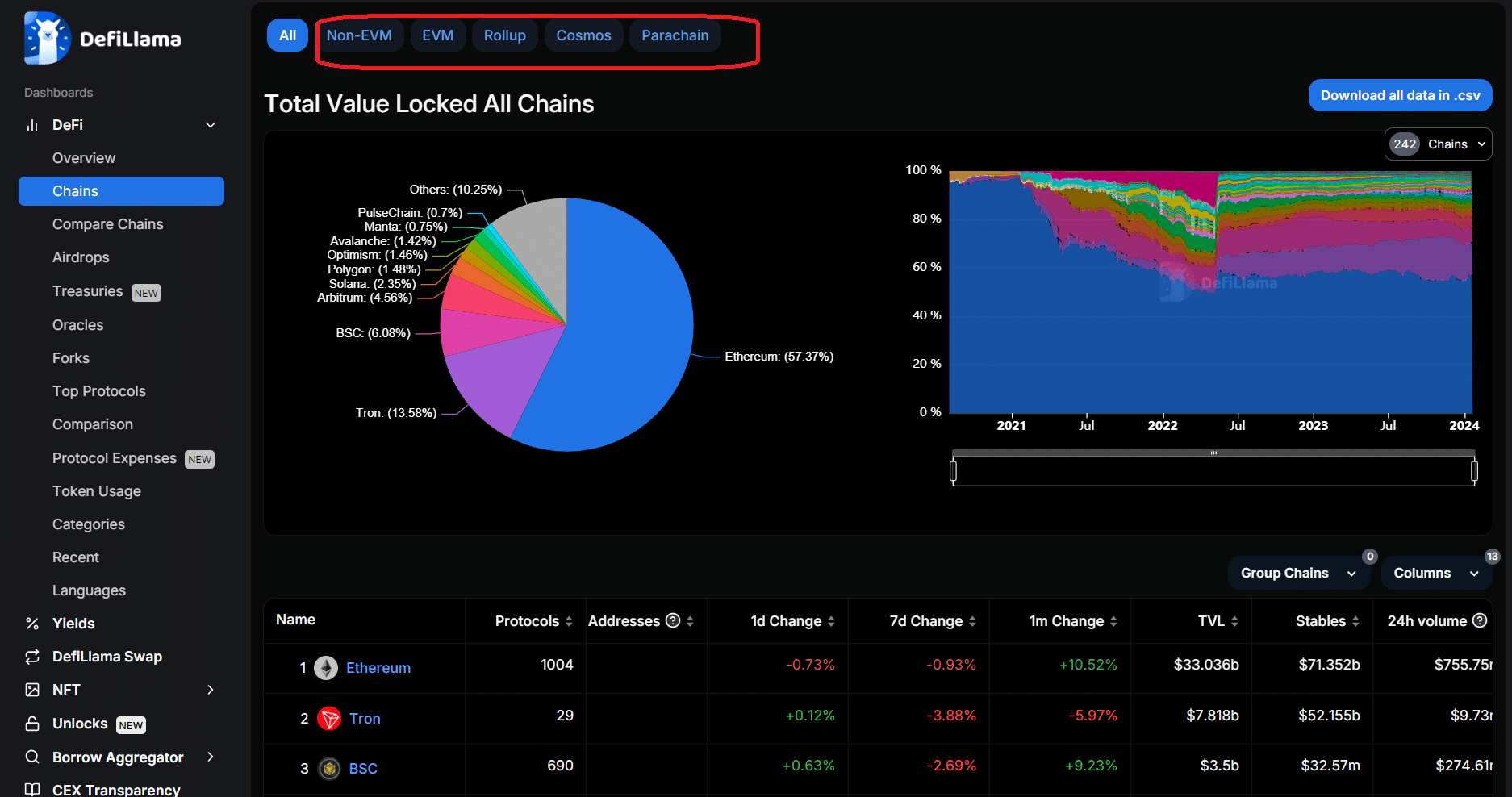

Stacking data: sUSDS TVL $4.90B vs sUSDe $3.2B. APYs? Ethena leads 8-11%, Sky steady 4-8%, per BenPay’s 2026 protocol analysis including Sky and Ethena. Solana integrations amplify both: USDS in Sky vaults, sUSDe in Ethena-optimized liquidity pools. DeFiLlama flows show Solana capturing 20% and of their activity, driven by sub-second txns.

24h USDS action: high $1.00, low $0.9984, change and 0.000010%. sUSDe mirrors peg tightness. For USDS yield Solana, Sky’s collateral wins safety; sUSDe owns raw yield for risk-tolerant plays. Boston University ranks both top for 2026, citing hedging and collateral as portfolio staples.

USDS Price Prediction 2027-2032

Peg Stability Forecast for Sky’s Yield-Bearing Stablecoin Amid Solana DeFi Growth and Passive Income Adoption

| Year | Minimum Price | Average Price | Maximum Price | Peg Deviation Range |

|---|---|---|---|---|

| 2027 | $0.995 | $1.000 | $1.005 | ±0.50% (Bearish depeg risk from market volatility) |

| 2028 | $0.996 | $1.000 | $1.004 | ±0.40% (Improved liquidity from TVL growth) |

| 2029 | $0.997 | $1.000 | $1.003 | ±0.30% (Regulatory tailwinds) |

| 2030 | $0.998 | $1.000 | $1.002 | ±0.20% (Tech upgrades enhance stability) |

| 2031 | $0.999 | $1.000 | $1.001 | ±0.10% (Mature adoption reduces risks) |

| 2032 | $0.9995 | $1.0000 | $1.0005 | ±0.05% (Near-perfect peg in bullish ecosystem) |

Price Prediction Summary

USDS is forecasted to maintain exceptional peg stability around $1.00 from 2027-2032, with progressively narrowing deviation ranges as Solana DeFi adoption surges, TVL expands to support Sky’s USDS ecosystem, and regulatory frameworks solidify trust. Average annual price holds steady at $1.00, reflecting robust over-collateralization by ETH and Treasuries, despite competition from sUSDe. Bearish scenarios account for temporary depegs during crypto winters, while bullish outlooks project premium liquidity.

Key Factors Affecting USDS Price

- Solana ecosystem expansion and DeFi TVL growth (projected 5-10x by 2030) bolstering USDS liquidity

- Regulatory developments favoring compliant stablecoins like USDS (Sky LLC backing)

- Technological improvements in Sky Savings Rate and collateral management

- Competition with sUSDe (9-14% APY) driving innovation but pressuring yields (USDS 6-9%)

- Crypto market cycles impacting collateral (ETH volatility) and hedging strategies

- Increased passive income integrations on Solana reducing depeg risks through higher usage

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Diving deeper, Solana’s ecosystem multiplies these yields. USDS holders tap Aave/Compound forks; sUSDe fuels Morpho-style lending. Early data signals sUSDe pulling ahead in daily yield volume, but USDS’s scale ensures liquidity supremacy. Pick based on your risk dial: collateral calm or hedge hustle?

Next, we’ll unpack risks, step-by-step deployment on Solana, and yield-maxing combos. Stay tuned for the full USDS vs sUSDe breakdown.

Risks separate the pros from the gamblers in this USDS vs sUSDe comparison. USDS’s over-collateralization shines here, with ETH and Treasuries buffering depegs; historical DAI vaults survived 2022’s crypto winter intact. Sky’s audited smart contracts add layers, though liquidation cascades loom if collateral tanks 150% and. sUSDe? Delta-hedging brilliance, but perp funding rates flip negative in bear dumps, slashing APY to 2-4%. Ethena’s $3.2B scale mitigates some, yet oracle fails or exchange blowups spell trouble. Galaxy flags sUSDe’s TVL dominance but warns of concentration risk.

Risk-Adjusted Returns: Which Wins on Solana?

Sharpened metrics favor USDS for safety-first stacks. DeFi Rate logs Sky’s 4-8% as battle-tested; Ethena’s 8-11% tempts but volatility-adjusted yields even out. Solana’s 20% flow share (DeFiLlama) boosts both, yet USDS liquidity edges for quick exits at $1.0000. My take: conservative? USDS. Yield hogs? sUSDe, layered smartly.

USDS vs sUSDe: Key Comparison Metrics (As of February 2026)

| Metric | USDS (Sky) | sUSDe (Ethena) |

|---|---|---|

| TVL | $4.90B | $3.2B |

| APY | 4-8% | 8-11% |

| Risks | Liquidation (over-collateralization) | Funding rates (delta-hedging) |

| Backing Mechanism | Crypto collateral (ETH, U.S. Treasuries) | Delta-neutral (perpetuals + staking) |

| Solana Integrations | DeFi lending & savings rate protocols | DeFi yield optimization protocols |

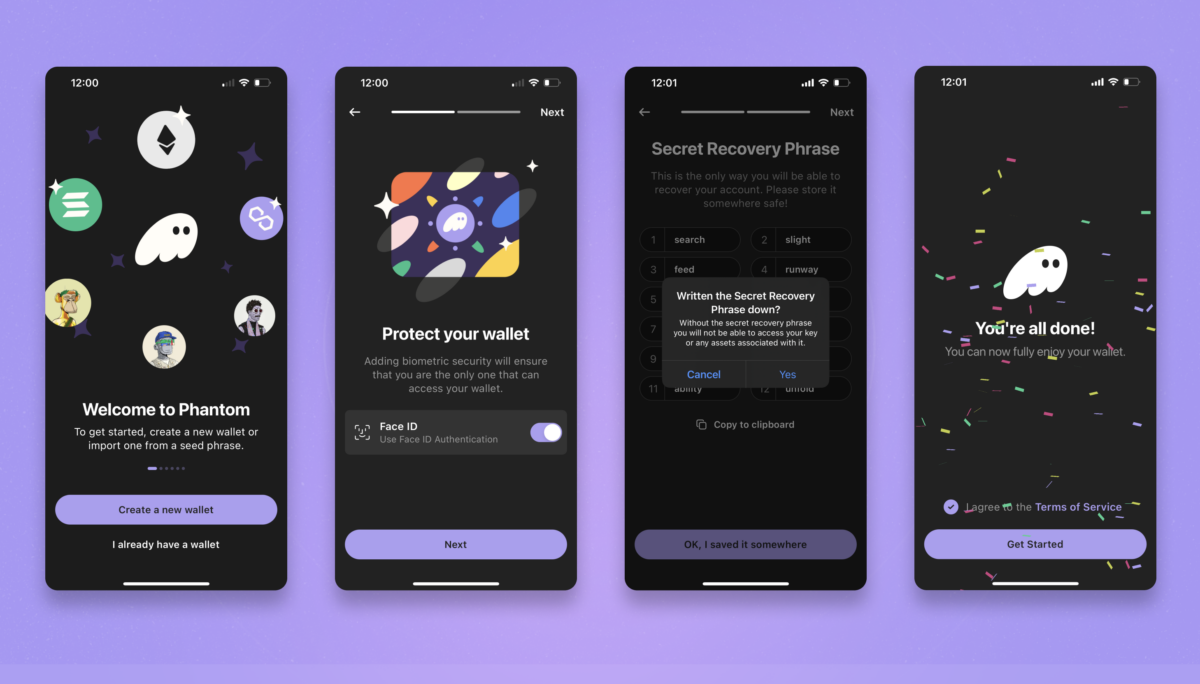

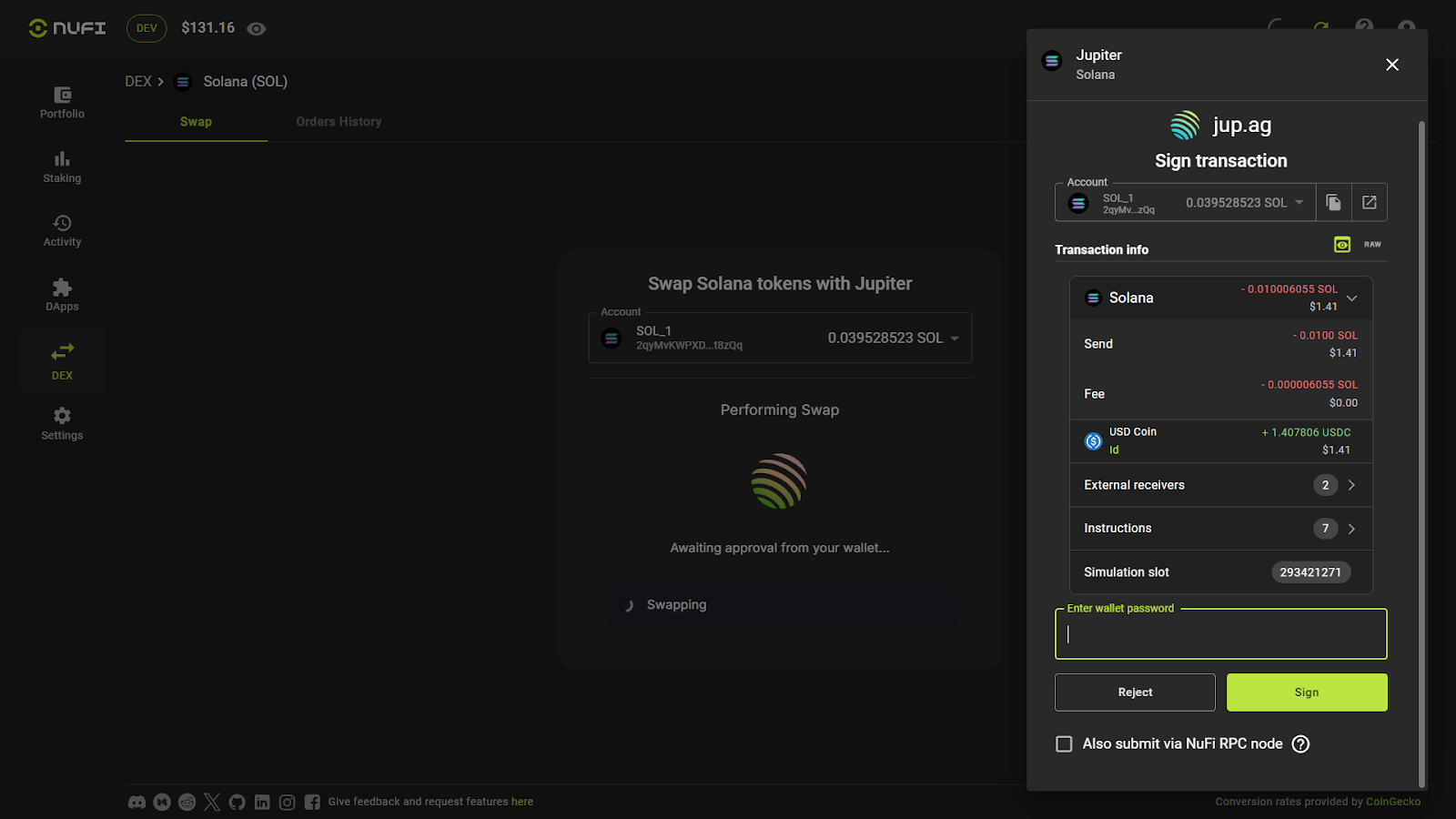

Deploying on Solana demands precision. Phantom wallet first, then bridge USDC via Wormhole. For USDS: swap on Jupiter DEX, deposit Sky Savings Rate via their Solana app. Watch gas under $0.01. sUSDe? Mint USDe on Ethena’s Solana deployment, stake to sUSDe. Both auto-compound; track via DeFiLlama dashboards.

5 Steps to USDS/sUSDe Yield on Solana

-

1. Fund Phantom Wallet: Download Phantom, Solana’s top wallet. Buy SOL/USDC via MoonPay on-ramp or transfer from Binance/Coinbase.

-

2. Bridge or Swap to USDS/sUSDe: Use Jupiter DEX to swap USDC to USDS (Sky) or USDe (Ethena) on Solana. Bridge via Wormhole if needed.

-

3. Deposit and Stake: Deposit USDS into Sky Savings Rate for auto-accruing sUSDS. Stake USDe to sUSDe via Ethena on Solana.

-

4. Monitor APY: Track real-time yields on DeFiLlama (Sky/Ethena pages) or DeFi Rate. USDS/sUSDe APYs range 4-11% per latest data.

-

5. Compound Weekly: sUSDS/sUSDe auto-accrue value. Weekly, swap accrued yield via Jupiter or restake in protocols like Kamino for boosted returns.

Max yields? Combo kings. USDS in Solana vaults like Marginfi hits 10% and ; sUSDe pairs with Kamino liquidity for 14% spikes (RebelFi). Pendle locks boost further, selling future yields. BenPay ranks Sky/Ethena top protocols; stack USDS base, sUSDe kicker for 9% blended. Solana’s speed turns weekly rebalances into hourly edges.

Solana-Specific Yield Boosters

2026 data screams opportunity: MEXC notes sUSDe composability amps base 5.5% APY; 4IRE crowns USDS simplest entry. BingX-like 4% floors undervalues Solana multipliers. My data dives show $10K USDS deploy yielding $600-800 annually conservative, $900 and aggressive via sUSDe. Pegs hold: USDS 24h low $0.9984, high $1.00, change and 0.000010%.

USDS scales with Sky’s $4.90B muscle for liquidity locks; sUSDe surges on Ethena innovation. For best stablecoin yields Solana, blend both: 60/40 USDS/sUSDe hedges risks, nets 7-10%. Track flows, ape early protocol upgrades. Innovation rewards the prepared – gear up for Solana’s yield era now.

Spot these edges via top yield-bearing stablecoins deep dives. Deploy today, compound tomorrow.