How RWA-Backed Stablecoins Like USST and STBL Unlock Sustainable On-Chain Yield

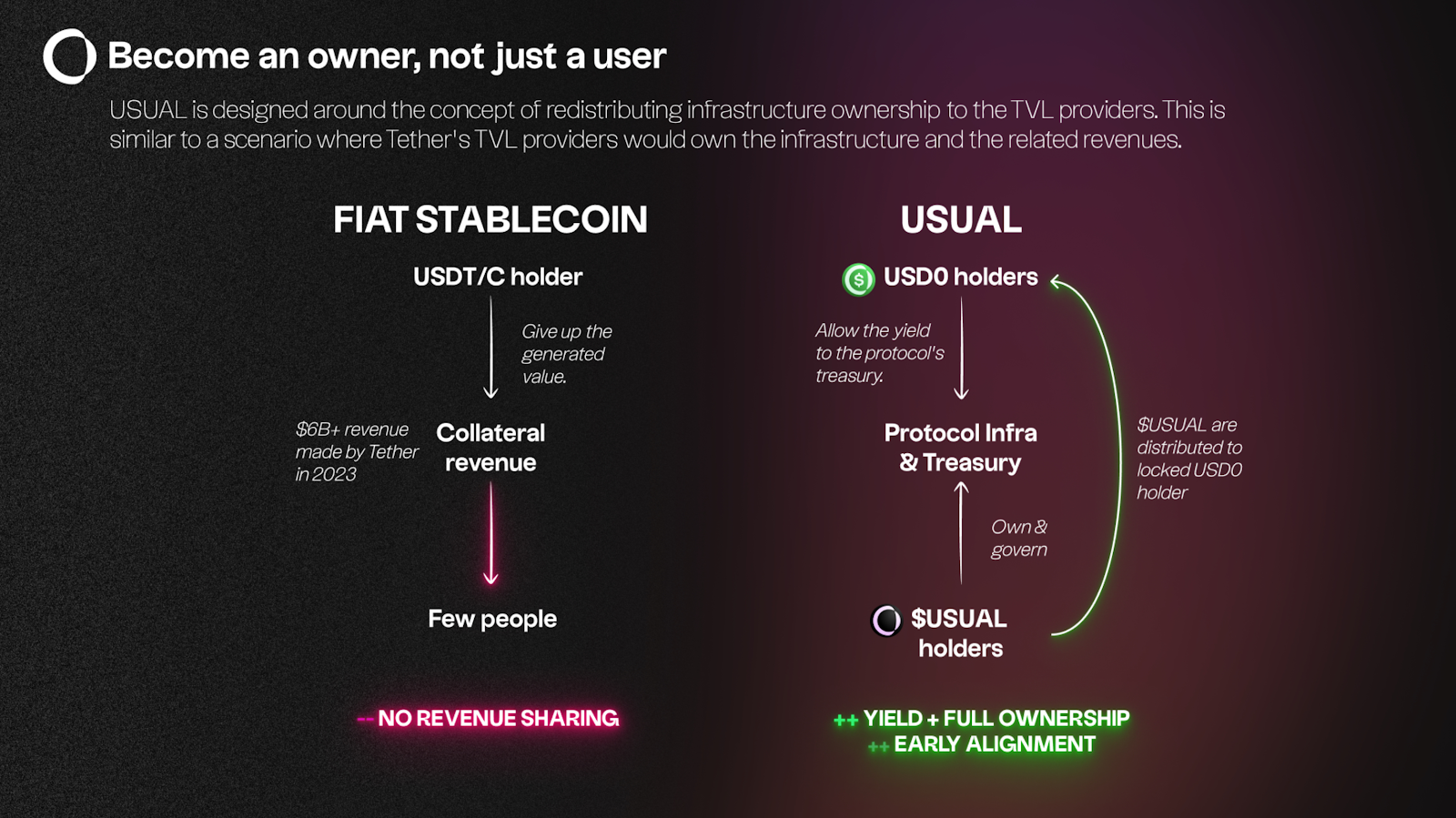

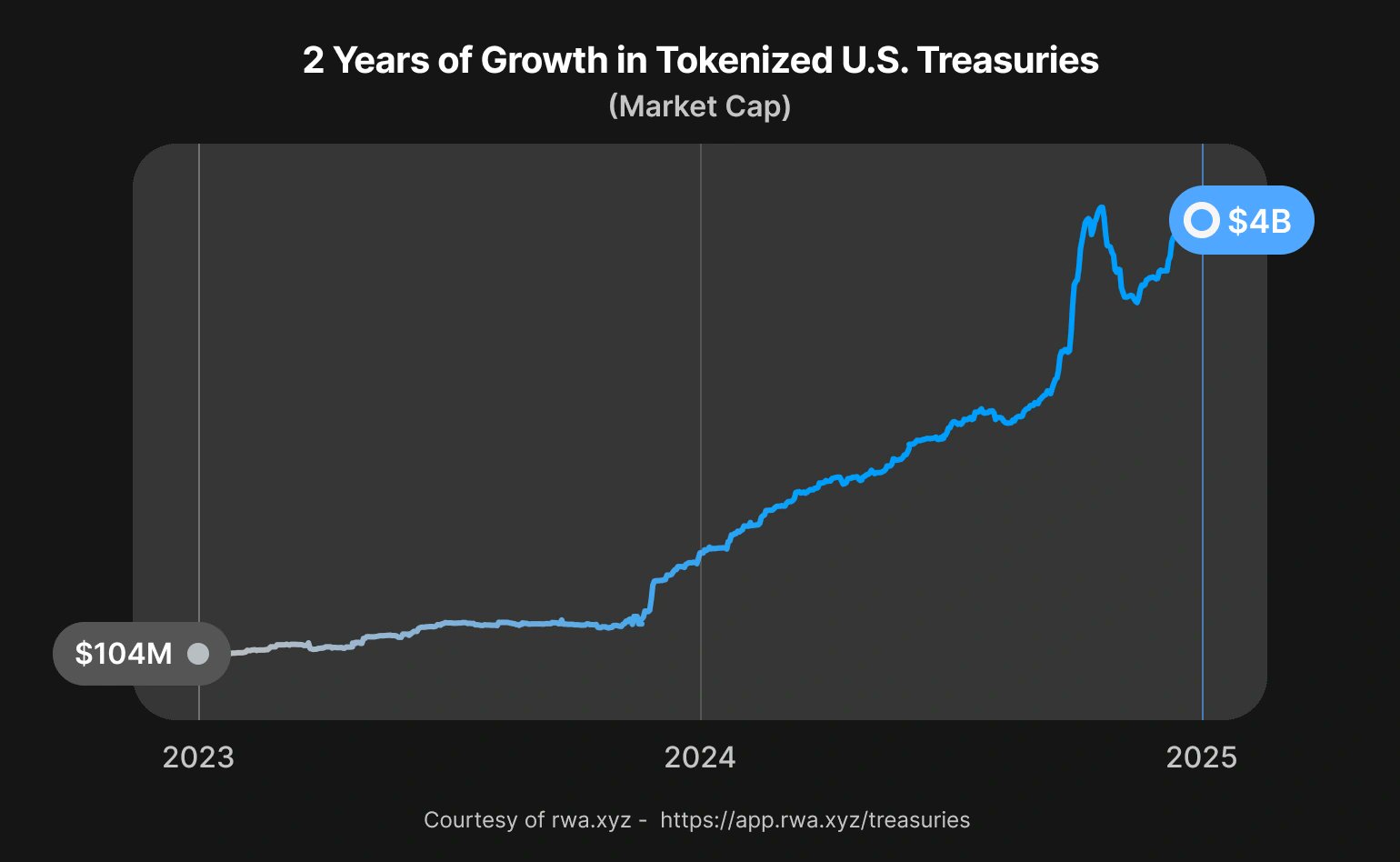

Stablecoins have long been the backbone of DeFi, but until recently, most offered little in the way of passive income or sustainable yield. The emergence of RWA-backed stablecoins like USST and STBL marks a pivotal shift in both design philosophy and practical utility. By leveraging tokenized real-world assets (RWAs) such as U. S. Treasury Bills, these protocols are unlocking new forms of on-chain yield that are not only transparent but also more resilient to market volatility.

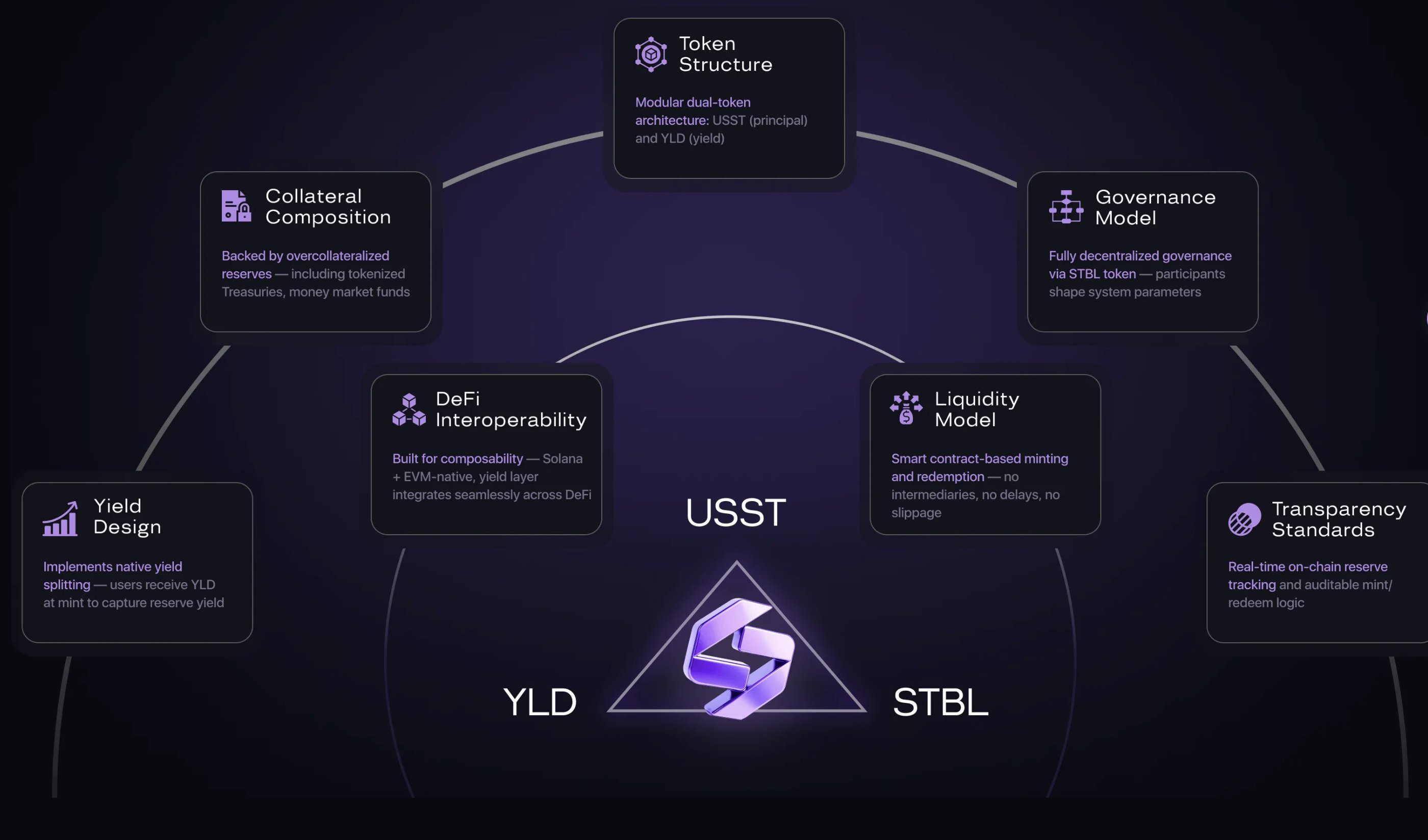

The Core Innovation: Yield Separation via Dual-Token Architecture

Traditional stablecoins like USDC and USDT provide dollar exposure but often leave yield generation solely in the hands of issuers or require users to engage in complex DeFi strategies. STBL’s dual-token model changes this dynamic entirely:

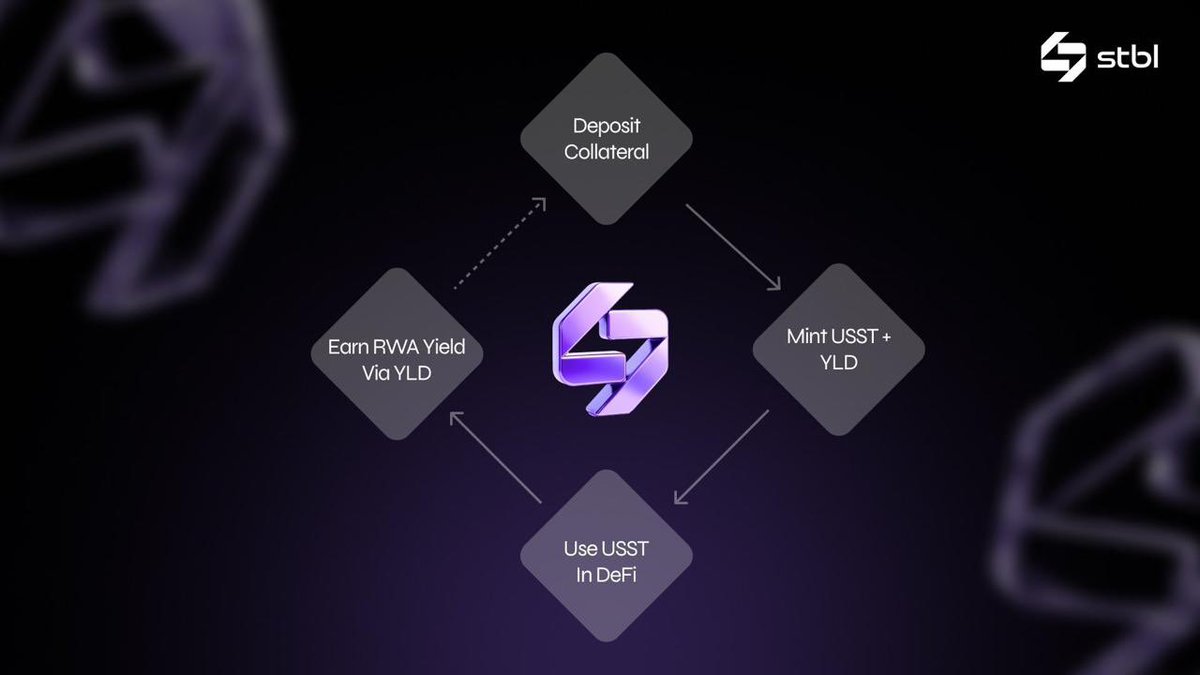

- USST: A fully liquid, dollar-pegged stablecoin backed 1: 1 by tokenized RWAs. Users can mint USST by depositing approved RWA tokens.

- YLD: An NFT issued alongside USST that represents the right to claim all yield generated by the underlying collateral, no staking or lockups required.

This architecture enables users to transact freely with their principal (USST) while their YLD NFTs accrue passive income independently. It’s a concept known as yield separation, and it offers a user-centric answer to longstanding trade-offs in DeFi: liquidity vs. yield.

Sustainable On-Chain Yield Backed by Real-World Assets

The secret sauce behind these new models is their integration of real-world assets into decentralized finance. By backing stablecoins with tokenized U. S. Treasuries and money market funds, protocols like STBL deliver yields that are:

Key Benefits of RWA-Backed Stablecoins for DeFi Investors

-

Passive Yield Without Staking: STBL’s YLD NFTs let users earn yield from real-world assets (RWAs) like U.S. Treasury Bills, without the need for staking or complex DeFi strategies.

-

Transparent, On-Chain Collateral: Every USST stablecoin is backed 1:1 by tokenized RWAs, with all collateral held and verified on-chain for maximum transparency and security.

-

Separation of Liquidity and Yield: The dual-token model allows USST to be used freely for payments and DeFi activities, while YLD NFTs accrue yield, removing the trade-off between liquidity and earning passive income.

-

Efficient Access to Sustainable On-Chain Yield: By leveraging yield from traditional assets like Treasury Bills, STBL provides a sustainable source of on-chain income, even during volatile crypto market cycles.

-

Enhanced Flexibility and Utility: USST is widely compatible with DeFi protocols, enabling investors to use stablecoins for trading, lending, or payments, while still benefiting from RWA-backed yield via YLD.

This approach stands in stark contrast to algorithmic or crypto-collateralized stablecoins, where yields can be volatile or even unsustainable during market stress. Here, the underlying assets are verifiable on-chain and generate consistent returns from traditional financial markets, a critical step toward making on-chain yields more dependable for everyday investors.

The User Experience: Liquidity Without Sacrificing Passive Income

A major advantage of this model is flexibility. With USST, users maintain full liquidity, their funds can be used across DeFi protocols for payments, trading, or collateralization without being tied up in staking contracts. Meanwhile, the YLD NFT accrues all yield generated by the RWA collateral in real time.

This decoupling means investors no longer have to choose between earning passive income and keeping their assets liquid, a breakthrough for those seeking both stability and opportunity within DeFi.

Transparency and Security: Proof-of-Reserves On-Chain

The transparency baked into these protocols is another game changer. All RWA collateral backing USST is tokenized and stored on-chain, providing verifiable proof-of-reserves at any time. This not only boosts user confidence but also sets a new standard for risk management among stablecoin issuers.

If you’re interested in deepening your understanding of how STBL and USST are redefining sustainable DeFi yields through real-world asset integration, check out our detailed analysis at How RWA-Backed Stablecoins Like STBL And USST Are Redefining Yield For DeFi Investors.

Beyond transparency, this model introduces a new level of composability for DeFi strategies. Since the YLD NFT is a separate, tradable asset, users can sell, transfer, or even fractionalize their yield rights while continuing to use their USST stablecoins elsewhere in the ecosystem. This flexibility unlocks innovative yield-sharing products and secondary markets that were previously impossible with traditional stablecoin designs.

For more risk-averse investors, the ability to verify collateral on-chain and monitor yield flows in real time is a significant improvement over black-box models. With RWA-backed stablecoins like STBL, you’re no longer reliant on opaque third-party reporting or centralized trust assumptions. Instead, smart contracts enforce reserve backing and yield distribution transparently.

Real-World Impact: Expanding DeFi’s Reach and Use Cases

The dual-token architecture of STBL doesn’t just benefit individual investors, it also expands the potential applications for DeFi at large. Institutional players can now access regulated, yield-bearing digital dollars with full auditability. Retail users enjoy simple access to passive income without technical hurdles or lockups. And developers gain new building blocks for creating next-generation financial products.

How STBL Enables Innovative DeFi Products

-

On-Chain Savings Accounts with USST and YLD NFTs: Users can mint USST by depositing tokenized U.S. Treasuries or money market funds, and receive a YLD NFT that accrues yield from the underlying RWA. This enables DeFi platforms to offer transparent, non-custodial savings accounts where users retain full liquidity with USST while earning passive income through YLD NFTs.

-

DAOs Sharing Yield via Transferable YLD NFTs: DAOs can distribute yield rights by transferring YLD NFTs among members or contributors. This allows for flexible, programmable sharing of RWA-generated yield, supporting new models for community rewards, payroll, or grant disbursement—all transparently tracked on-chain.

-

Permissionless Money Markets Using USST as Collateral: Platforms like Aave and Compound can integrate USST as a collateral asset, benefiting from its 1:1 RWA backing and on-chain transparency. This unlocks new lending and borrowing markets, where users can access liquidity or leverage while their yield rights remain separated and tradable via YLD NFTs.

This innovation also helps bridge the gap between traditional finance and crypto-native protocols. By making yields from U. S. Treasuries available directly on-chain, and separating them from transactional liquidity, RWA-backed stablecoins like USST are making passive income accessible to anyone with a wallet.

What to Watch: Risks and Future Developments

No system is without risks. While tokenized RWAs provide stability and transparency, they still introduce dependencies on off-chain custodians and legal frameworks. Regulatory clarity around tokenized securities remains an evolving topic worldwide. Investors should also be aware that while YLD NFTs accrue real-world yield, these returns are ultimately linked to interest rates in traditional markets, which may fluctuate over time.

That said, the momentum behind yield separation stablecoins is growing rapidly as both retail users and institutions seek safer ways to earn on-chain income. As protocols like STBL continue to refine governance mechanisms and expand collateral options beyond Treasuries (think corporate bonds or real estate), we can expect even broader adoption across DeFi ecosystems.

If you want a deeper dive into how this technology is changing passive income strategies for crypto investors, and what’s next for real-world asset integration, explore our comprehensive guide at How STBL And USST Are Revolutionizing Yield-Bearing Stablecoins With RWA Collateral.