How to Earn Passive Income with yoUSD: The Automated Yield-Bearing Stablecoin

Imagine earning a steady stream of passive income simply by holding a stablecoin in your wallet. That’s the promise behind Yield Optimizer USD (YOUSD), one of 2025’s most talked-about automated yield-bearing stablecoins. As of October 18,2025, YOUSD is trading at $1.04, maintaining its peg while quietly compounding rewards for its holders. If you’re searching for a hands-off, DeFi-native way to make your capital work harder, it’s time to pay close attention to how yoUSD passive income strategies are reshaping the landscape.

Why YOUSD Stands Out in the Yield-Bearing Stablecoin Arena

The world of yield-bearing stablecoins has exploded, with protocols offering yields ranging from 2% to 10% APY. What sets YOUSD apart is its automated yield optimization: you don’t have to stake, farm, or jump between protocols. Simply hold YOUSD in your wallet, and the protocol does the heavy lifting, distributing yield directly to you via rebasing or value appreciation. This “hold to earn” model is not just convenient, it’s a game-changer for anyone tired of micromanaging their DeFi strategy.

YOUSD’s yield comes from a blend of on-chain lending, protocol-level rewards, and sophisticated DeFi strategies. Think of it as stacking multiple streams of yield, all funneled into one asset. The result? Consistent, compounding returns with minimal active management. According to recent market data, most fixed-income stablecoins are delivering 4%-5% APY, and YOUSD’s automated engine is designed to stay competitive in this range.

How YOUSD’s Automated Yield Mechanism Works

Let’s break down the mechanics. When you acquire YOUSD (currently at $1.04), you’re tapping into a protocol that automatically allocates your funds across the most lucrative DeFi opportunities. Whether it’s lending, staking, or liquidity provisioning, YOUSD’s smart contracts optimize for risk-adjusted returns and seamlessly rebalance as market conditions shift. Your wallet balance grows over time through:

- Rebasing: Your YOUSD token count increases as yield is distributed.

- Value Appreciation: The token’s price may tick up as returns are accrued, though it aims to stay close to $1.04.

This approach is ideal for both DeFi newcomers and experienced yield hunters who want to maximize returns without constant monitoring. The protocol’s transparency and automation make it a standout in the crowded field of automated stablecoin yield.

Getting Started: Earning Passive Income with YOUSD

Ready to put your dollars to work? Here’s how to start earning with YOUSD in three simple steps:

First, purchase YOUSD through a supported exchange or directly from the protocol’s dApp. Second, transfer your YOUSD to a compatible wallet, no staking or extra steps required. Third, monitor your wallet as your holdings grow automatically. The protocol’s yield is distributed seamlessly, and your balance compounds as long as you hold YOUSD.

Security and compliance are key: always use reputable wallets and exchanges, and make sure earning yield with YOUSD aligns with your local regulations. The market risks are minimal compared to volatile assets, but always stay informed about protocol updates and potential changes in yield rates. For a deeper dive into how these mechanisms work, check out our analysis on how YOUSD is changing DeFi passive income.

YOUSD (Yield Optimizer USD) Price & Yield Prediction: 2026-2031

Annual YOUSD Price Forecasts with Bullish/Bearish Scenarios and Yield Insights

| Year | Minimum Price | Average Price | Maximum Price | Estimated Average Yield (%) | Key Market Scenario |

|---|---|---|---|---|---|

| 2026 | $1.01 | $1.04 | $1.08 | 4.2% | Stable adoption; DeFi yields remain steady |

| 2027 | $1.00 | $1.05 | $1.10 | 4.0% | Minor regulatory tightening; increased competition |

| 2028 | $0.98 | $1.06 | $1.13 | 3.8% | Macro volatility; DeFi innovation |

| 2029 | $0.97 | $1.07 | $1.15 | 4.0% | New yield strategies; wider institutional use |

| 2030 | $0.97 | $1.08 | $1.18 | 4.1% | Mainstream adoption; stronger compliance |

| 2031 | $0.96 | $1.09 | $1.20 | 4.0% | Mature DeFi market; strong integration in TradFi |

Price Prediction Summary

YOUSD is designed to maintain price stability around $1 while providing automated yields. Over the next six years, the price is expected to remain close to its peg, with minor fluctuations driven by market cycles, regulatory events, and competition. Average yields are projected to stay in the 3.8%–4.2% range, reflecting industry trends. Bullish scenarios see increased adoption and higher yields, while bearish cases reflect regulatory pressure or DeFi downturns.

Key Factors Affecting yoUSD Price

- Adoption rate of yield-bearing stablecoins and DeFi protocols

- Global regulatory developments impacting stablecoins and DeFi

- Security of underlying smart contracts and platforms

- Evolution of yield-generation mechanisms and protocol upgrades

- Competition from other yield-bearing and algorithmic stablecoins

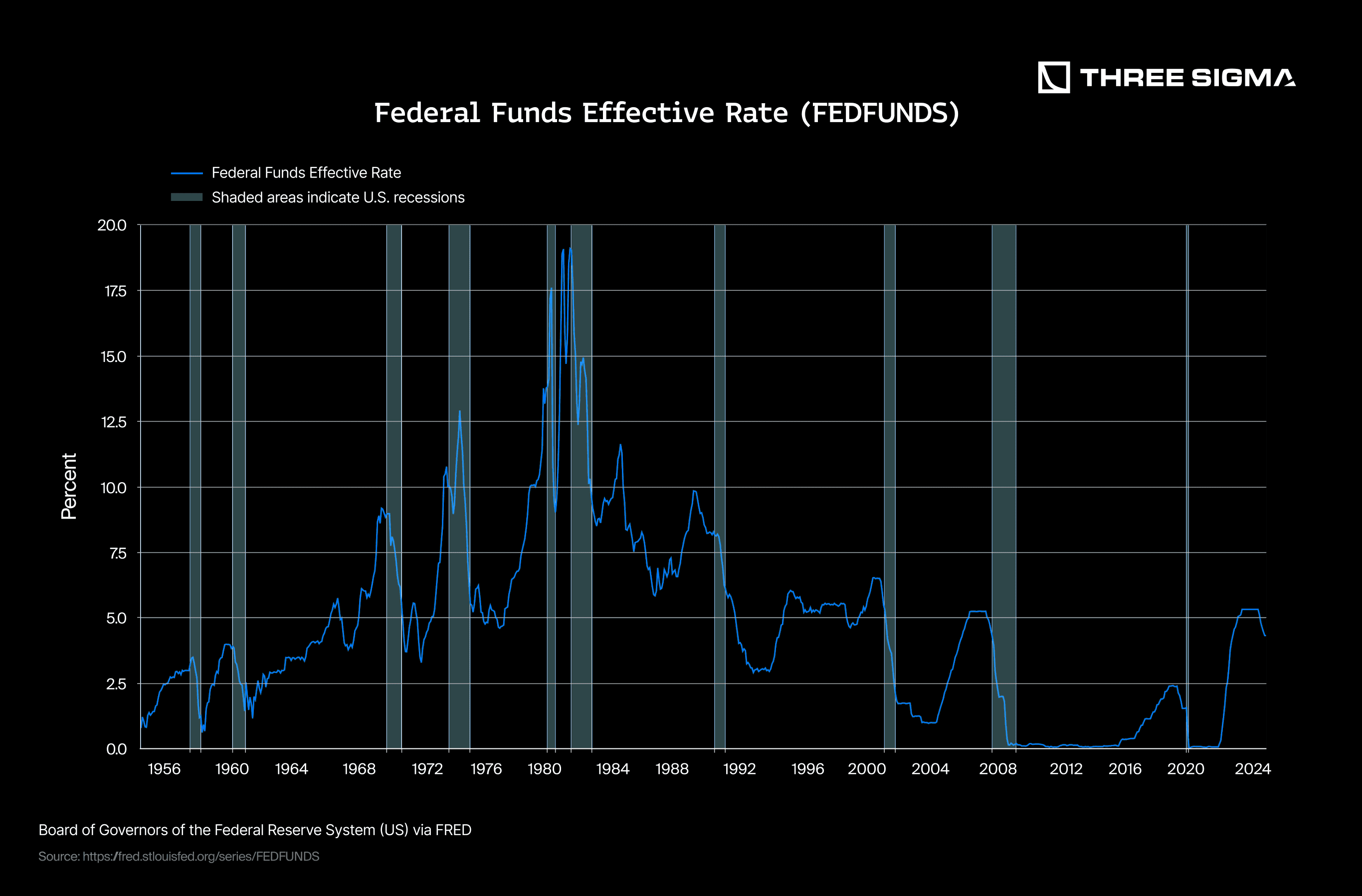

- Macro-economic factors influencing crypto and traditional finance yields

- Integration with traditional finance (TradFi) systems

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

What makes YOUSD especially compelling is its ability to democratize DeFi yield. You don’t need to be a technical wizard or spend hours researching the latest protocols. The automation layer does the heavy lifting, letting you focus on your broader investment goals while your stablecoin balance quietly grows. This is the new face of DeFi’s “set it and forget it” revolution, and the numbers speak for themselves.

Comparing YOUSD to Other Yield-Bearing Stablecoins

YOUSD is part of a new generation of stablecoins that compete head-to-head with established names like sDAI, USDe, and sfrxUSD. What sets YOUSD apart is its relentless focus on yield optimization and portfolio automation. While traditional stablecoin staking often requires manual intervention or exposes you to lockup periods, YOUSD’s rebasing and value accrual happen in real time, with no staking friction or withdrawal delays.

Top 3 Differences: YOUSD vs. Other Yield-Bearing Stablecoins

-

1. Fully Automated Yield GenerationUnlike many yield-bearing stablecoins that require users to manually stake or lend their tokens, YOUSD offers automated yield accrual—simply holding YOUSD in your wallet is enough to start earning passive income. No extra steps or DeFi navigation needed!

-

2. Transparent, On-Chain Yield MechanismYOUSD’s yield is generated and distributed directly on-chain, ensuring real-time transparency and verifiability. Many other stablecoins rely on off-chain or opaque mechanisms, but YOUSD holders can track their earnings and protocol performance live on the blockchain.

-

3. Consistent Dollar Peg with Current Price at $1.04YOUSD maintains a stable dollar value (current price: $1.04 as of October 18, 2025) while delivering yield. Some other yield-bearing stablecoins experience greater price fluctuations or require complex mechanisms to maintain their peg, but YOUSD’s automated protocol keeps it simple and stable for holders.

For anyone comparing yield-bearing stablecoin strategies, YOUSD’s ease of use and transparency are major advantages. It’s also designed to stay competitive with the market’s best APYs, so you’re not sacrificing returns for convenience. If you want to see how YOUSD stacks up against the competition, check out this comprehensive comparison of top yield-bearing stablecoins in 2024.

YOUSD DeFi Pools: Unleashing Advanced Yield Strategies

For more adventurous users, YOUSD can often be deployed in DeFi pools or paired with other assets to unlock even higher yield opportunities. By providing liquidity to select pools, you can earn additional rewards on top of YOUSD’s native yield. However, keep in mind that these strategies may introduce extra risks such as impermanent loss or smart contract vulnerabilities.

Always do your due diligence before deploying YOUSD into third-party protocols. Stick with audited platforms and consider diversifying your yield-bearing holdings to spread risk. If you’re curious about advanced strategies, our guide on how YUSD and vyUSD are redefining stablecoin yield is a must-read.

Key Takeaways for 2025: YOUSD’s Role in Automated Stablecoin Yield

As the DeFi ecosystem matures, automated yield-bearing stablecoins like YOUSD are setting a new standard for passive income. With YOUSD trading at $1.04 as of October 18,2025, and consistently delivering competitive yields, it’s a powerful tool for anyone looking to maximize returns while minimizing hassle.

Whether you’re a seasoned DeFi investor or just starting your journey, YOUSD offers a rare blend of simplicity, security, and steady growth. The future of passive income is automated, and YOUSD is leading the charge.