How sDAI Compares to USDe: Yield Strategies for Stablecoin Investors in 2024

Stablecoin investors in 2024 are spoiled for choice, but the real battle for passive income comes down to two titans: sDAI and USDe. Both are yield-bearing stablecoins, but their strategies, and risk appetites, couldn’t be more different. Whether you’re a DeFi conservative or a thrill-seeking yield chaser, understanding the mechanics behind these coins is non-negotiable if you want to maximize your stablecoin yield strategies and avoid getting rekt.

sDAI: The Steady Hand of Passive DeFi

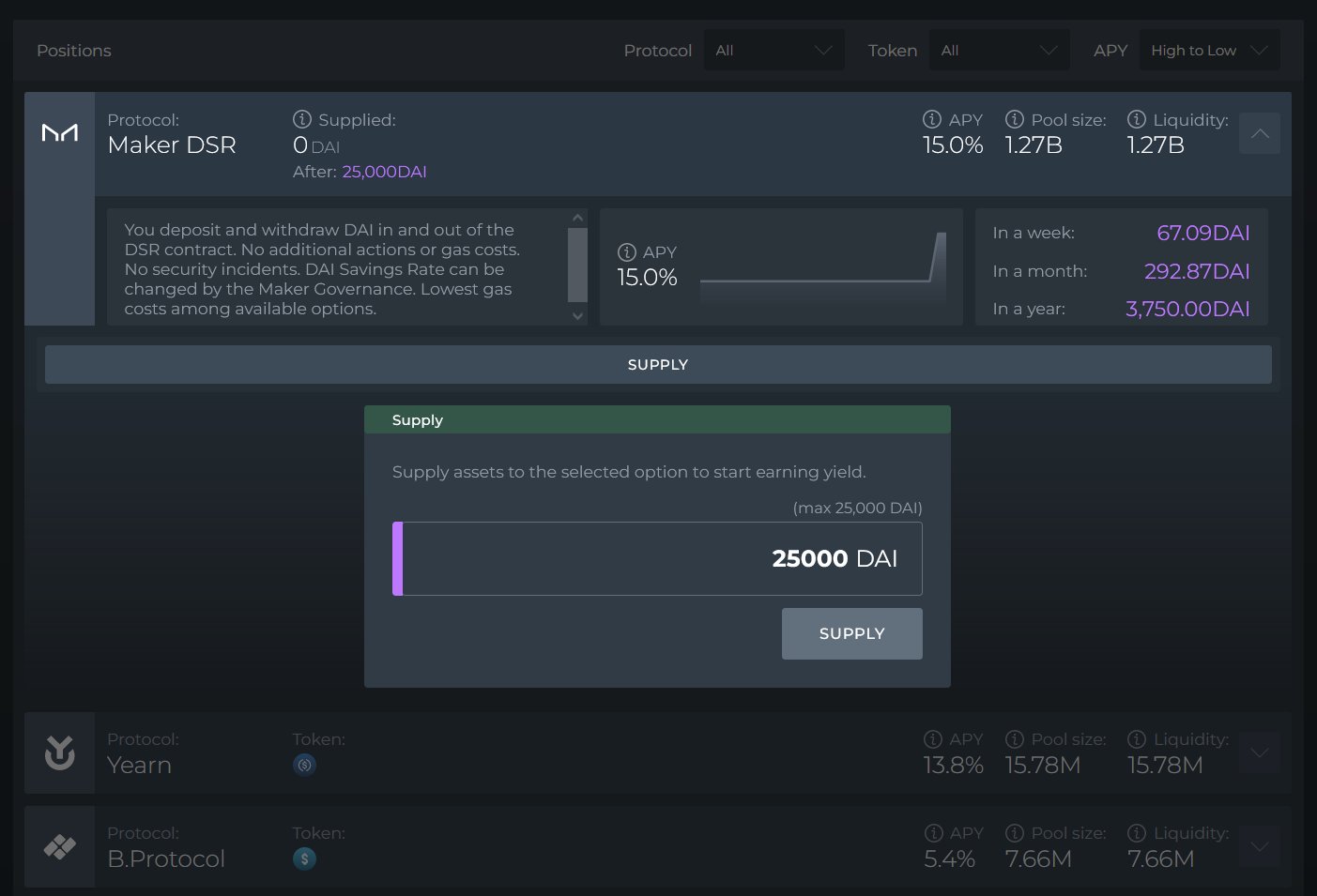

sDAI is the staked version of DAI, the OG decentralized stablecoin. When you deposit DAI into MakerDAO’s DSR (Dai Savings Rate) contract, you mint sDAI, your ticket to a hands-off, low-risk yield. In 2024, the annual yield on sDAI clocks in at a respectable 3.25%, as set by MakerDAO governance. No wild swings, no derivatives wizardry, just good old-fashioned protocol stability.

This makes sDAI the darling of risk-averse investors who want to earn yield without constantly checking their wallets for black swan events. Its returns might seem modest next to the headline-grabbing APYs elsewhere in DeFi, but when the market gets choppy, sDAI holders sleep soundly.

USDe: Yield on the Edge

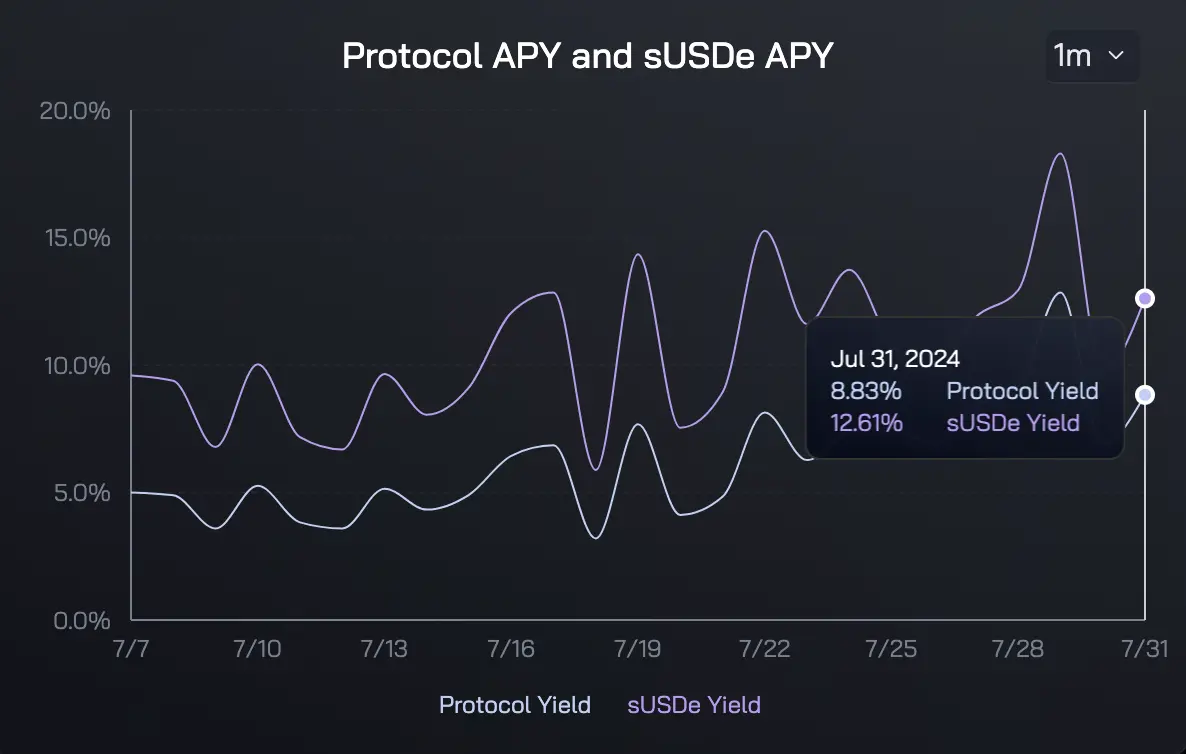

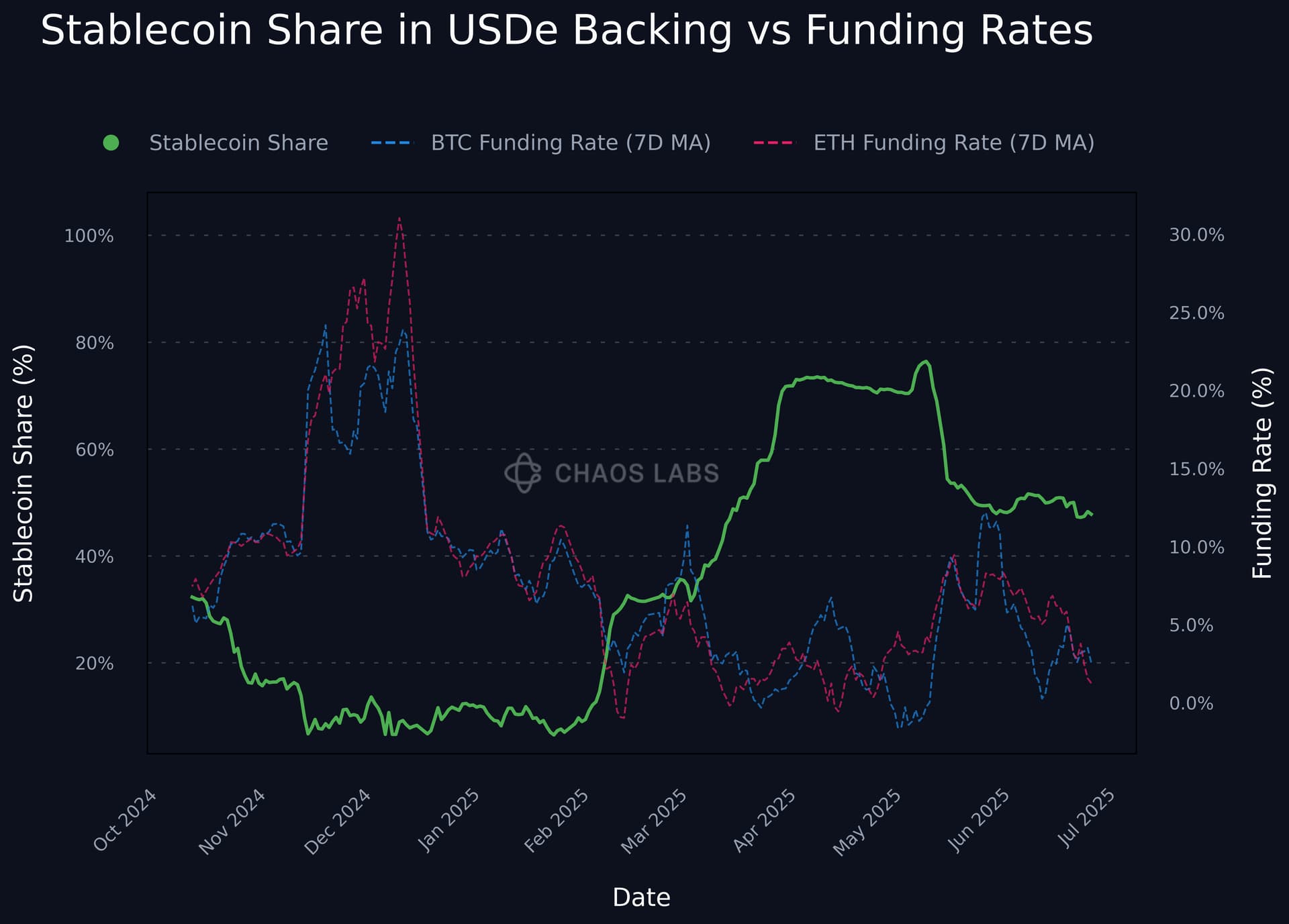

If sDAI is the calm port in the DeFi storm, USDe is a high-speed hydrofoil slicing through the waves. Minted by depositing stETH into the Ethena protocol, USDe uses a delta-neutral strategy: it earns staking rewards from stETH while hedging with ETH shorts to stay stable. The result? In 2024, staking USDe for sUSDe has delivered annual interest rates around 5%, with spikes as high as 19% during especially frothy market conditions. That’s enough to make even the most stoic DAI maximalist raise an eyebrow.

But there’s no free lunch: USDe’s strategy depends on the performance of derivatives markets and the protocol’s ability to maintain its hedges. If funding rates flip or liquidity dries up, yields can plummet, or worse. Still, for those who thrive on volatility and have a taste for complex DeFi mechanics, USDe is the go-to for higher-risk, higher-reward passive income. For a deeper dive into how these new breeds of stablecoins are reshaping DeFi, check out this analysis.

sDAI vs USDe: Yield, Risk, and Everything In Between

Let’s break down how these two stack up in the trenches of 2024’s yield-bearing stablecoin landscape:

Pros & Cons: sDAI vs USDe for Passive Income

-

sDAI: Stability & SimplicityPro: sDAI offers a stable 3.25% annual yield via MakerDAO’s DAI Savings Rate (DSR), making it ideal for risk-averse investors seeking predictable passive income.

-

sDAI: Lower Yield CeilingCon: While safe, sDAI’s yield is typically lower than USDe, potentially missing out on higher returns in bullish markets.

-

USDe: High Yield PotentialPro: USDe, through Ethena’s delta-neutral strategy, has delivered yields around 5%—and sometimes higher—enticing those who crave bigger rewards.

-

USDe: Increased Risk & ComplexityCon: USDe’s returns depend on derivatives markets and complex hedging, exposing holders to greater risk and volatility than sDAI.

-

Both: DeFi Integration & LiquidityPro: sDAI and USDe are widely supported across DeFi platforms, making them easy to use for further yield strategies or liquidity provision.

On the surface, USDe is the clear winner for raw APY potential, especially when market conditions align. But sDAI’s predictability and protocol maturity make it a favorite for those who’d rather avoid the drama of derivatives. Both coins are deeply integrated across DeFi platforms, so liquidity isn’t an issue, what matters is your personal risk tolerance and your appetite for adventure.

Curious how these compare to other top stablecoin plays? Don’t miss our full breakdown: Top Yield-Bearing Stablecoins in 2024.

Navigating Volatility: Which Stablecoin Suits Your Strategy?

The real question isn’t just about chasing the fattest yield – it’s about matching your risk profile to the right vehicle. sDAI is the equivalent of clipping coupons in a bear market: slow, steady, and (almost) drama-free. If your DeFi strategy is built on predictability and you’re allergic to sudden APY drops, sDAI’s 3.25% annual yield is a fortress. You won’t wake up to wild protocol drama or black swan derivatives events. The tradeoff? You’ll watch from the sidelines as others ride the USDe rollercoaster to double-digit yields – or sudden reversals.

USDe, on the other hand, is for the bold. Its delta-neutral strategy is like juggling chainsaws: when you get it right, the returns are spectacular. With staking rates around 5% and historical spikes hitting 19% in 2024, USDe is DeFi’s answer to high-octane passive income. But don’t forget: this yield is paid for with exposure to derivatives funding rates, market volatility, and the ever-present risk of strategy breakdowns. If you’re comfortable monitoring funding rates, hedging mechanics, and protocol health, USDe can supercharge your portfolio – just don’t expect a smooth ride.

What About Integration, Liquidity, and Real-World Use?

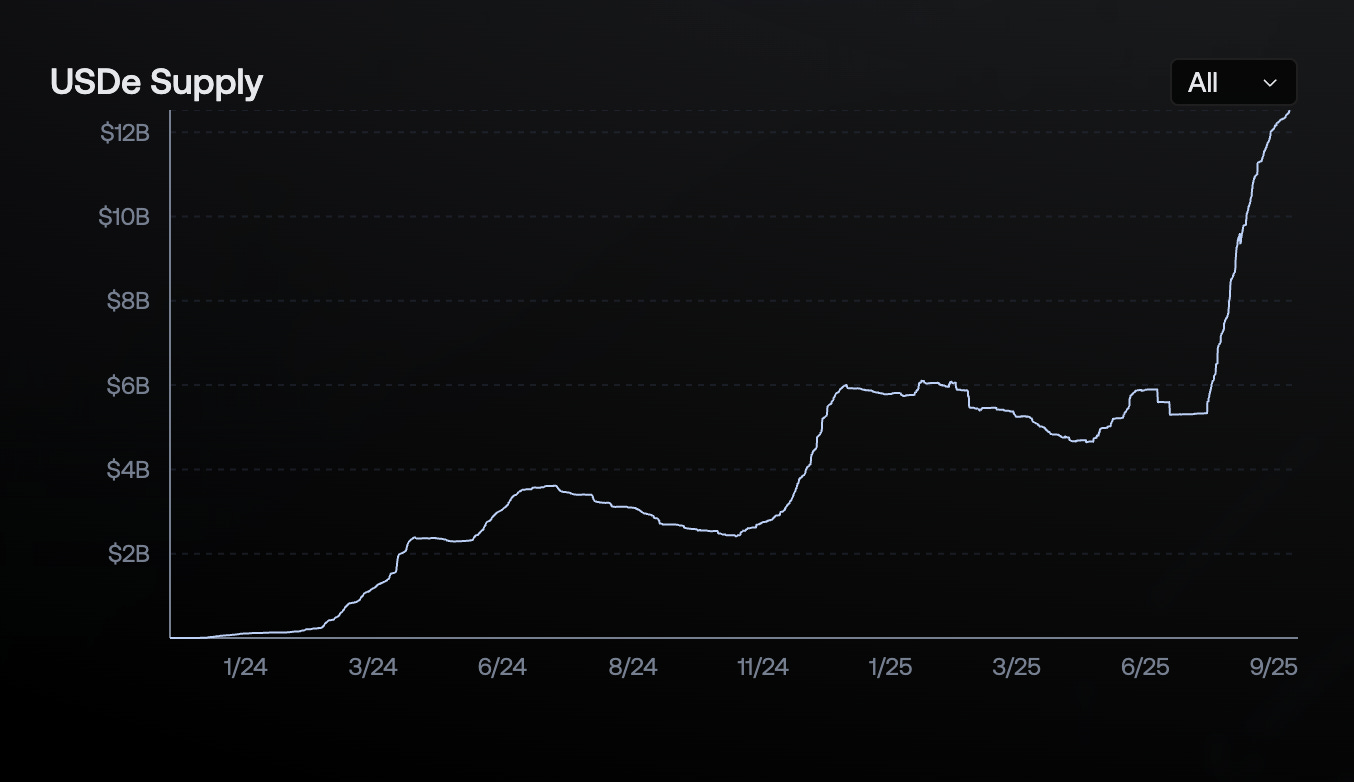

Both sDAI and USDe aren’t just theoretical yield machines – they’re woven into the fabric of DeFi. sDAI’s longstanding relationships across lending protocols, DEXs, and aggregators mean you can use it as collateral or swap it with minimal slippage almost anywhere. USDe, despite being the new kid on the block, has quickly ramped up cross-chain volume to $5.7B, with deep liquidity pools and integrations with major DeFi venues. That means whether you’re yield stacking or just parking stablecoins, both assets are highly accessible.

Still unsure which yield-bearing stablecoin fits your portfolio? Ask yourself: do you want to sleep soundly with sDAI’s slow-and-steady returns, or are you ready to embrace the chaos for a shot at USDe’s turbocharged rewards? For a hands-on breakdown of how these strategies work in practice, watch this in-depth explainer:

Key Takeaways for 2024: Building Your DeFi Passive Income Playbook

- sDAI offers a predictable 3.25% yield via MakerDAO’s DSR – ideal for risk-averse investors.

- USDe delivers higher, variable yields (5% to 19% in 2024) using complex derivatives strategies – best for advanced DeFi users.

- Both coins are liquid and well-integrated across DeFi, but differ wildly in risk profile.

- Choosing between them comes down to your risk appetite, technical comfort, and desire for passive versus active management.

In this new era of rebasing stablecoins and yield innovation, there’s no one-size-fits-all winner. sDAI and USDe represent two ends of the DeFi spectrum – stability versus speculation, predictability versus potential. As always in crypto, fortune favors the bold. . . but only the prepared survive.