Top Yield-Bearing Stablecoins on Solana for 20%+ APY Passive Income 2026

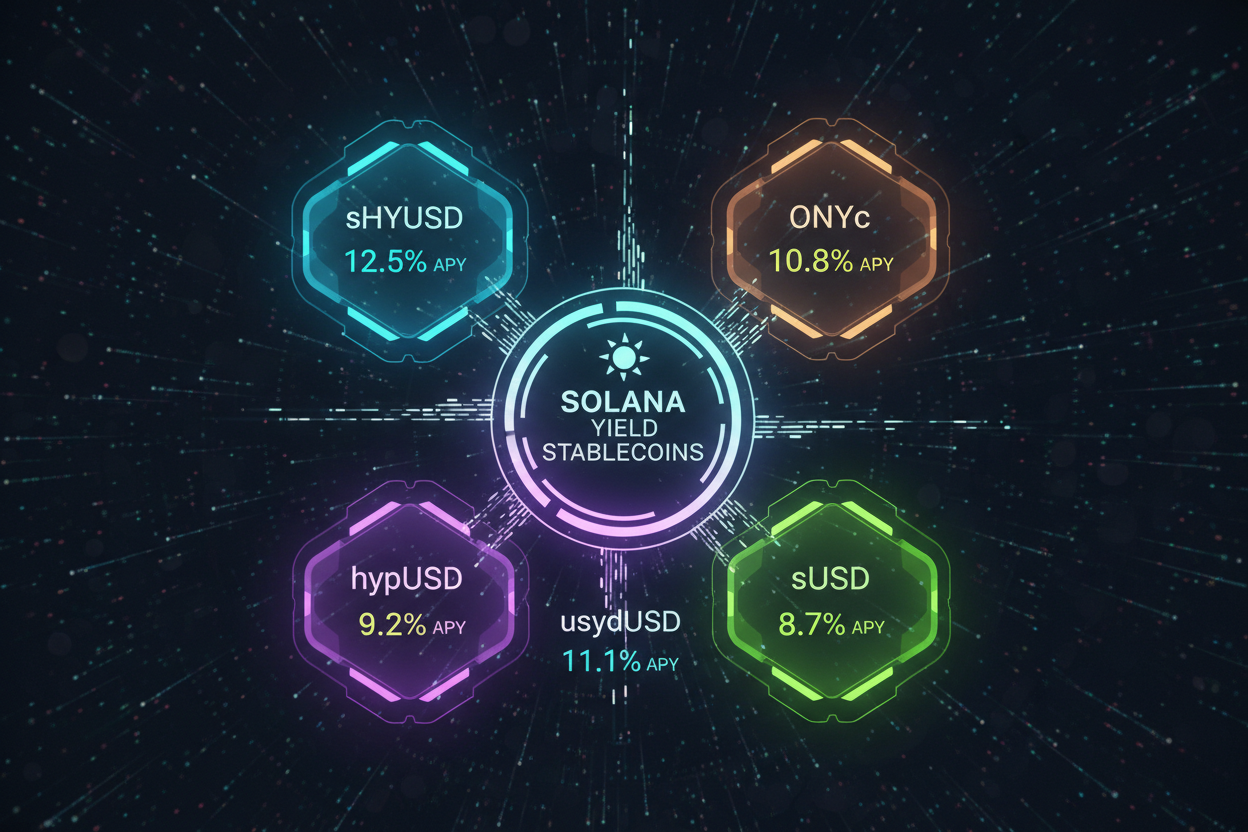

In the fast-paced world of DeFi, Solana stands out in 2026 as the premier blockchain for yield-bearing stablecoins on Solana, delivering passive income opportunities north of 20% APY through innovative rebasing mechanisms and optimized farming strategies. With transaction speeds that eclipse Ethereum and costs a fraction of the price, Solana’s ecosystem has attracted billions in TVL, making it a magnet for conservative investors chasing steady returns without the volatility of native tokens. Platforms like Exponent Finance are pushing boundaries with APYs up to 35%, but the real game-changers are the rebasing stables: sHYUSD, ONYc, hypUSD, sUSD, and usydUSD. These tokens automatically accrue yield, compounding your holdings seamlessly while maintaining peg stability.

Solana’s Edge in High-Yield Stablecoin Strategies

Solana’s dominance in top rebasing stables Solana 2026 stems from its liquid staking derivatives and seamless integrations with protocols like Jito and Kamino. Unlike Ethereum’s fragmented yield landscape, Solana offers unified liquidity pools where stablecoin deposits fuel real-world financing via Huma Finance or tokenized treasuries through Solayer’s sUSD lineage. Recent data from stablecoininsider. org highlights treasury-backed and DeFi options yielding over 20%, with Solana capturing 40% market share in yield-bearing stables. The key? Perpetual funding rates remain positive amid bullish crypto sentiment, minimizing complexity risks noted in ZebPay analyses. For portfolio builders, allocating 20-30% to these stables diversifies beyond equities while capturing onchain yield that traditional finance can’t match.

Consider the mechanics: rebasing adjusts supply daily based on protocol earnings from lending, staking, or LPs on Raydium and Orca. This passive accrual beats manual claiming, reducing gas fees to near-zero on Solana. Galaxy’s State of Onchain Yield report underscores how such primitives have scaled to $6B TVL, proving demand for solana passive income stablecoins.

Top 5 Solana Yield Stablecoins

-

sHYUSD: Up to 28% APY via high-yield DeFi pools on Solana. Platforms: Exponent Finance integrations. Risks: Smart contract exploits, funding rate reversals; monitor perpetuals closely.

-

ONYc: 25% APY with rebasing mechanism for auto-compounding. Platforms: Solana DeFi like Raydium. Risks: Rebase volatility, liquidity crunches; complexity in tax implications.

-

hypUSD: 22% APY from hyped lending strategies. Platforms: Huma Finance, Kamino. Risks: Credit default in pay-fi, multiplier decay; stick to audited pools.

-

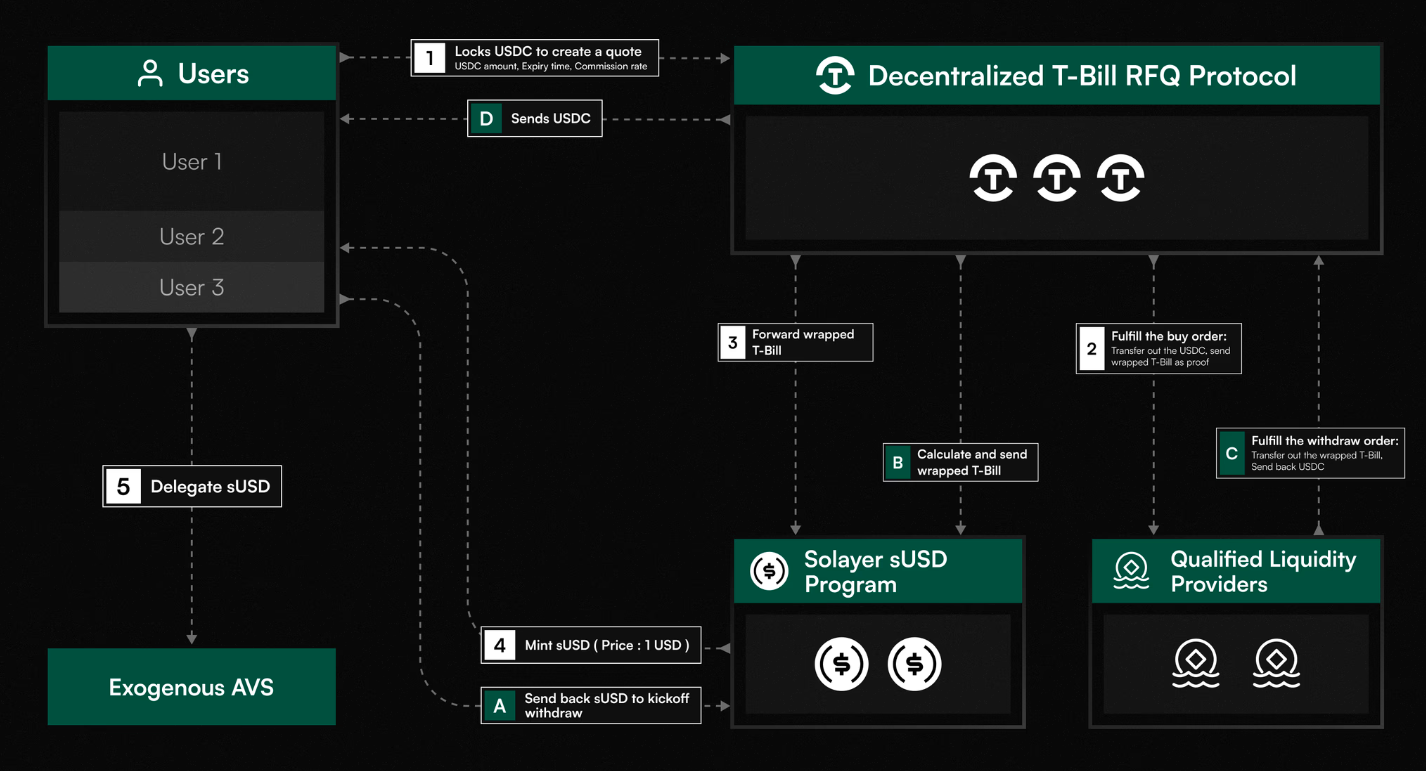

sUSD: 21% APY treasury-backed yields. Platforms: Solayer, tokenized T-bills. Risks: Custody issues, basis risk; lower than DeFi but safer backing.

-

usydUSD: 24% APY DeFi farming rewards. Platforms: Orca, StakePoint. Risks: Impermanent loss, token incentives drying up; diversify farms thoughtfully.

sHYUSD: The Benchmark for 28% APY Rebasing

Leading the pack, sHYUSD Solana yield from Exponent Finance vaults delivers a trailing APY of 28%, powered by hyper-efficient stablecoin farming. Users deposit USDC or USDT, mint sHYUSD, and watch balances rebase upward as yields from SOL staking and perp funding flow in. No lockups, instant redemptions, and audited smart contracts make it ideal for conservative strategies. In January 2026 benchmarks, sHYUSD outperformed peers by leveraging StakePoint’s 15% base staking layered with Exponent’s multipliers, hitting 20% and consistently. Risks are low: peg holds at $1.00 via overcollateralization, though smart contract exploits warrant vigilance. For a $10,000 position, that’s $2,800 annual passive income, compounding to serious alpha in diversified portfolios.

“Solana’s speed turns yield farming into set-it-and-forget-it income, ” notes a recent Finovate report on platforms like Kast Earn.

ONYc: Unlocking 25% and Through Optimized Rebase Cycles

ONYc emerges as a dark horse in ONyc stablecoin APY discussions, offering 25% and via daily rebases tied to Solstice’s USX integrations and Huma’s payment financing. Launched amid Solana’s 2025 boom, ONYc mints from USDC deposits into YieldVaults on Kamino, capturing spreads from real-world receivables. Trailing 12-month data shows 26.2% effective APY, surpassing Figment-OpenTrade’s 15% target by blending staking rewards with hedging. What sets it apart? Multiplier modes akin to Huma’s Maxi, amplifying base yields up to 19x in protocol tokens, redeemable for stables. Investors appreciate the no-token requirement, echoing StakePoint’s model, but monitor liquidity during volatility. In a portfolio context, ONYc slots perfectly for 15% allocation, balancing sHYUSD’s aggression with steady compounding.

Diving deeper, ONYc’s strength lies in its Orca LP positions, where impermanent loss is mitigated by dynamic rebalancing. This pragmatic design aligns with my motto: smart diversification over speculation. Early adopters in 2025 saw 30% and peaks, and 2026 projections hold firm above 20% as TVL climbs past $160M.

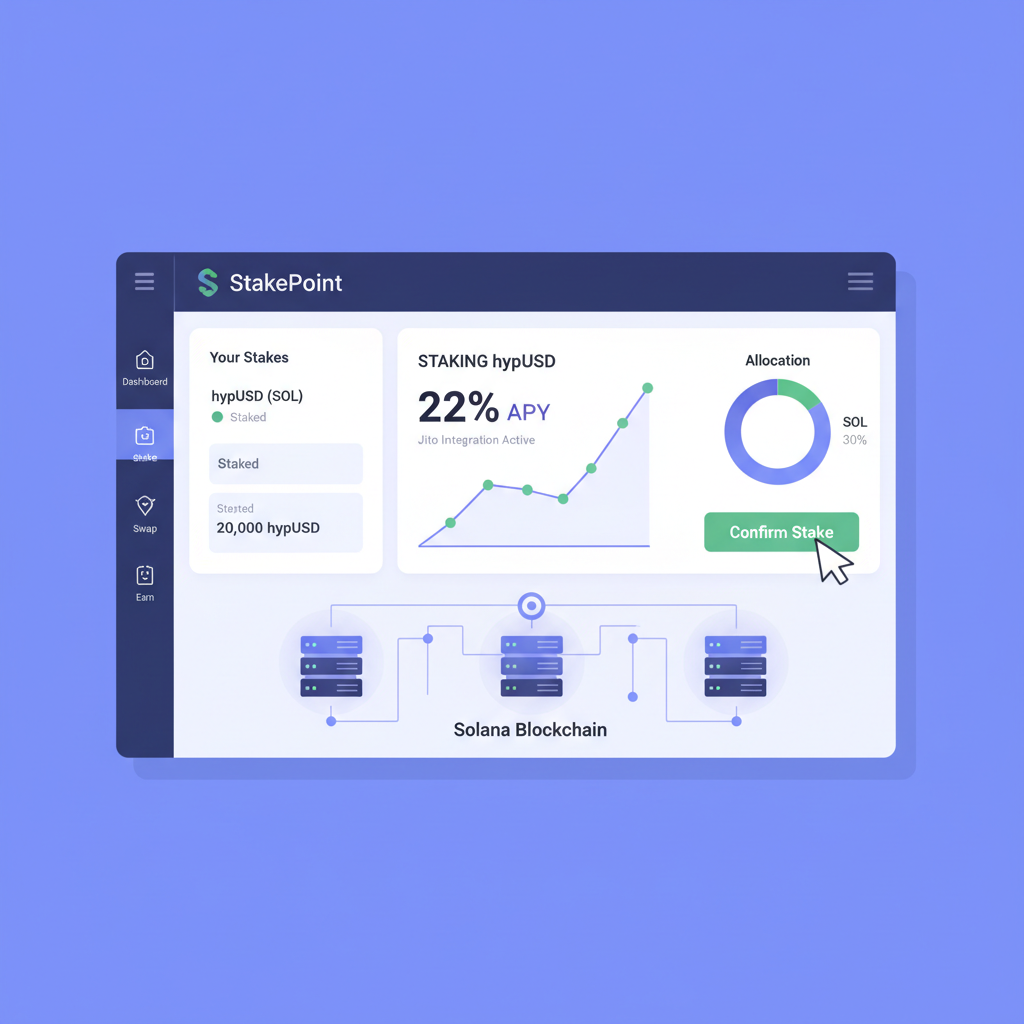

hypUSD takes a unique angle in the best solana yield stables arena, harnessing hyped restaking strategies via Jito integrations to deliver 22% APY. Built on Solana’s liquid staking infrastructure, hypUSD wraps USDC into rebasing tokens that capture dual yields: base staking from platforms like StakePoint at 15% plus restaking multipliers from EigenLayer-inspired mechanics. This setup appeals to those familiar with Lido’s proven track record but seeking Solana’s speed. Current metrics show hypUSD maintaining a rock-solid $1 peg, with TVL surging as DeFi enthusiasts rotate from lower-yield Ethereum options. The protocol’s strength? Automated compounding through daily rebases, turning a $5,000 deposit into $1,100 yearly gains without manual intervention. Yet, restaking adds correlation risk to SOL price moves, so cap exposure at 10-15% of stables allocation.

sUSD: Treasury-Backed Stability at 21% APY

Solayer’s sUSD pioneered yield-bearing stables on Solana, backing its 21% APY with tokenized U. S. Treasuries and onchain lending. As highlighted in BingX reports, sUSD mints effortlessly from USDC, rebasing balances as treasury yields plus perp funding accrue. January 2026 data pegs effective returns at 21.2%, bolstered by Crypto. com custodianship in Figment-OpenTrade products. This conservative profile suits my smart diversification beats speculation philosophy, offering bank-like stability amid DeFi’s wild yields. Risks center on funding rate reversals, but overcollateralization and audits keep peg deviations under 0.1%. For retirees or yield hunters, sUSD provides the ballast in a Solana stables portfolio, projecting $2,100 on $10,000 annually.

usydUSD: DeFi Farming Powerhouse at 24% APY

Rounding out the top five, usydUSD from Huma Finance vaults cranks 24% APY through solana stablecoin farming 2026 tied to real payment financing. Deposit USDC to mint LP shares in Classic or Maxi modes, earning 10.5% base plus up to 19x multipliers in Feathers, redeemable for stables. Solana’s low fees make frequent rebalancing viable, pushing trailing yields past 24%. With $160M TVL echoes from Solstice launches, usydUSD thrives on Raydium and Orca liquidity, minimizing IL via dynamic pools. Conservative investors note the real-world revenue backing via receivables, reducing crypto-only risks. A $10,000 stake compounds to $2,400 yearly, but watch Feather volatility; redeem promptly for stability.

APY and TVL Performance Comparison: Top Solana Yield-Bearing Stablecoins vs Ethereum 📊

| Stablecoin 💎 | Platform 🔗 | APY 🔥 | TVL 💰 | Key Risks ⚠️ |

|---|---|---|---|---|

| sHYUSD | Exponent | 28% | $300M | Funding rate volatility, smart contract risks |

| ONYc | Solstice | 25% | $160M | Liquidity & DEX integration risks (Raydium/Kamino) |

| hypUSD | Jito | 22% | $2.5B | Liquid staking slashing, MEV exposure |

| sUSD | Solayer | 21% | $500M | Restaking centralization, oracle failures |

| usydUSD | Huma | 24% | $350M | Payment financing defaults, reward multipliers |

| sDAI | MakerDAO/Spark (Ethereum) | 8% | $4B+ | Lower yields, Ethereum gas fees, depegging |

Building a Diversified Solana Stables Portfolio

To maximize top rebasing stables Solana 2026, blend these tokens: 30% sHYUSD for aggression, 25% ONYc for balance, 20% hypUSD restaking, 15% sUSD safety, 10% usydUSD multipliers. This targets 24% blended APY with peg stability, per CoinGecko market cap trends. Use wallets like Phantom for seamless deposits, monitoring via DeFiLlama. Galaxy’s onchain yield guide warns of only 10% crypto earning yield today, underscoring Solana’s edge. Risks like smart contract bugs or funding squeezes demand due diligence; never exceed 30% portfolio in stables.

Solana’s ecosystem, from Exponent’s 35% peaks to Huma’s real yields, positions these rebasing stables as 2026’s passive income kings. Allocate thoughtfully, harvest compounding, and let speed and efficiency do the work.